|

市场调查报告书

商品编码

1698296

表观遗传学诊断市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Epigenetics Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

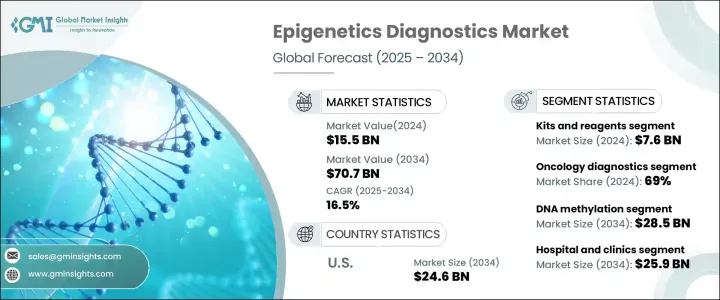

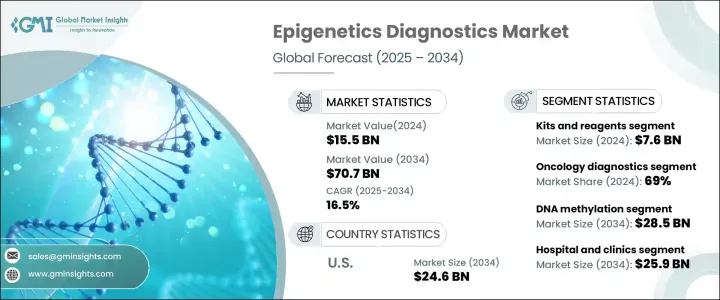

2024 年全球表观遗传学诊断市场价值为 155 亿美元,预计 2025 年至 2034 年期间的复合年增长率将达到 16.5%。这一快速扩张很大程度上是由于人们越来越认识到表观遗传修饰是疾病发展和进展的关键因素。随着对 DNA 甲基化、组蛋白修饰和非编码 RNA 在各种健康状况中的作用的研究不断深入,对先进诊断工具的需求呈指数级增长。

近年来,精准医疗的广泛应用,加上分子诊断技术的进步,大大加速了市场扩张。人工智慧和机器学习在表观遗传分析中的融合,进一步提高了诊断解决方案的准确性和效率。此外,大型製药和生物技术公司正在大力投资研发新型表观遗传生物标记物,进一步推动该产业的发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 155亿美元 |

| 预测值 | 707亿美元 |

| 复合年增长率 | 16.5% |

研究机构和医疗保健提供者之间日益密切的合作也在将科学发现转化为现实世界的临床应用方面发挥关键作用。旨在改善早期疾病检测和个人化医疗的资金和政府措施的增加正在推动该领域的创新。随着癌症和神经退化性疾病等慢性疾病的增加,表观遗传学诊断的重要性不断增加,为未来十年市场持续扩张奠定了基础。

市场分为主要产品类别,包括试剂盒和试剂、仪器、软体和服务。 2024 年,全球此类产品市场规模将达到 134 亿美元,其中试剂盒和试剂部分占据主导地位,规模达 76 亿美元。这些诊断工具已成为临床应用、学术研究和药物开发中不可或缺的工具。它们越来越受欢迎,源自于其用户友好的设计、增强的检测灵敏度、自动化能力以及与下一代定序 (NGS) 和聚合酶炼式反应 (PCR) 等尖端平台的兼容性。随着业界向更高通量和更具成本效益的解决方案迈进,对可靠、高效的试剂盒的需求持续增长。

表观遗传学诊断的应用领域分为肿瘤学和非肿瘤学领域,其中肿瘤学在 2024 年将占 69% 的份额。该领域的主导地位主要归因于对早期癌症检测的需求日益增长,以及表观遗传生物标记在诊断和治疗各种恶性肿瘤中的重要性日益增加。 DNA甲基化模式、组蛋白修饰和染色质重塑的变化已成为癌症发展的关键指标,从而可以实现更精确和个人化的治疗方法。随着全球癌症负担的增加和生物标记研究的不断进步,肿瘤学领域仍然是市场成长的主要驱动力。

预计到 2034 年,美国表观遗传学诊断市场将以 16.5% 的复合年增长率成长,在预测期结束时达到 246 亿美元。由于其强大的医疗保健基础设施、广泛的研发计划以及精准医疗的早期采用,该国仍然是该行业的领导者。包括美国国立卫生研究院 (NIH) 在内的政府机构继续资助表观遗传学的突破性研究,进一步加速创新和商业化。慢性病盛行率的上升、生物技术公司的投资增加以及有利的监管政策进一步巩固了美国在全球表观遗传学诊断领域的主导地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 癌症和慢性病发生率不断上升

- 表观基因组学研究和技术的进展

- 非侵入性诊断的需求不断增长

- 产业陷阱与挑战

- 表观遗传诊断技术成本高昂

- 测验方法标准化程度有限

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021-2034

- 主要趋势

- 试剂盒和试剂

- 仪器

- 软体和服务

第六章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 肿瘤诊断

- 非肿瘤诊断

第七章:市场估计与预测:按技术,2021-2034 年

- 主要趋势

- DNA甲基化

- 组蛋白甲基化

- MicroRNA修饰

- 染色质结构

- 其他技术

第八章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 医院和诊所

- 製药和生物技术公司

- 诊断实验室

- 其他最终用途

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Abcam

- Agilent Technologies

- Diagenode

- Dovetail Genomics

- Element Biosciences

- Illumina

- Merck

- New England Biolabs

- PacBio

- Promega

- QIAGEN

- Roche Diagnostics

- Thermo Fisher Scientific

- Zymo Research

The Global Epigenetics Diagnostics Market was valued at USD 15.5 billion in 2024 and is poised to register a CAGR of 16.5% from 2025 to 2034. This rapid expansion is largely fueled by the increasing recognition of epigenetic modifications as key contributors to disease development and progression. As research deepens into the role of DNA methylation, histone modifications, and non-coding RNAs in various health conditions, the demand for advanced diagnostic tools is rising exponentially.

In recent years, the widespread adoption of precision medicine, coupled with technological advancements in molecular diagnostics, has significantly accelerated market expansion. The integration of artificial intelligence and machine learning in epigenetic analysis has further enhanced the accuracy and efficiency of diagnostic solutions. Additionally, major pharmaceutical and biotechnology companies are investing heavily in R&D to develop novel epigenetic biomarkers, further propelling the industry forward.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.5 Billion |

| Forecast Value | $70.7 Billion |

| CAGR | 16.5% |

Growing collaborations between research institutions and healthcare providers are also playing a pivotal role in translating scientific discoveries into real-world clinical applications. The increased availability of funding and government initiatives aimed at improving early disease detection and personalized medicine is driving innovation in the field. With the rise in chronic diseases, including cancer and neurodegenerative disorders, the relevance of epigenetic diagnostics continues to grow, positioning the market for sustained expansion over the next decade.

The market is segmented into key product categories, including kits and reagents, instruments, software, and services. In 2024, the global market for these products reached USD 13.4 billion, with the kits and reagents segment dominating at USD 7.6 billion. These diagnostic tools have become indispensable in clinical applications, academic research, and pharmaceutical development. Their growing popularity stems from their user-friendly designs, enhanced assay sensitivity, automation capabilities, and compatibility with cutting-edge platforms like next-generation sequencing (NGS) and polymerase chain reaction (PCR). As the industry moves toward more high-throughput and cost-effective solutions, the demand for reliable and efficient kits continues to escalate.

The application landscape of epigenetics diagnostics is categorized into oncology and non-oncology segments, with oncology commanding a substantial 69% share in 2024. The dominance of this segment is largely attributed to the growing need for early cancer detection and the rising importance of epigenetic biomarkers in diagnosing and treating various malignancies. Changes in DNA methylation patterns, histone modifications, and chromatin remodeling have emerged as crucial indicators of cancer development, enabling more precise and personalized treatment approaches. With the increasing global burden of cancer and continued advancements in biomarker research, the oncology segment remains a major driver of market growth.

The U.S. Epigenetics Diagnostics Market is projected to grow at a CAGR of 16.5% through 2034, reaching USD 24.6 billion by the end of the forecast period. The country remains a frontrunner in this industry, thanks to its robust healthcare infrastructure, extensive research and development initiatives, and early adoption of precision medicine. Government agencies, including the National Institutes of Health (NIH), continue to fund breakthrough research in epigenetics, further accelerating innovation and commercialization. The rising prevalence of chronic diseases, increasing investments from biotech firms, and favorable regulatory policies are further cementing the U.S. as a dominant player in the global epigenetics diagnostics landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cancer and chronic diseases

- 3.2.1.2 Advancements in epigenomics research and technology

- 3.2.1.3 Growing demand for non-invasive diagnostics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of epigenetic diagnostics technologies

- 3.2.2.2 Limited standardization of testing methods

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 ($ Mn)

- 5.1 Key trends

- 5.2 Kits and reagents

- 5.3 Instruments

- 5.4 Software and services

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oncology diagnostics

- 6.3 Non-oncology diagnostics

Chapter 7 Market Estimates and Forecast, By Technology, 2021-2034 ($ Mn)

- 7.1 Key trends

- 7.2 DNA methylation

- 7.3 Histone methylation

- 7.4 MicroRNA modification

- 7.5 Chromatin structures

- 7.6 Other technologies

Chapter 8 Market Estimates and Forecast, By End Use, 2021-2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital and clinics

- 8.3 Pharmaceutical and biotechnology companies

- 8.4 Diagnostic laboratories

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abcam

- 10.2 Agilent Technologies

- 10.3 Diagenode

- 10.4 Dovetail Genomics

- 10.5 Element Biosciences

- 10.6 Illumina

- 10.7 Merck

- 10.8 New England Biolabs

- 10.9 PacBio

- 10.10 Promega

- 10.11 QIAGEN

- 10.12 Roche Diagnostics

- 10.13 Thermo Fisher Scientific

- 10.14 Zymo Research