|

市场调查报告书

商品编码

1698299

下一代网路市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Next Generation Networking Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

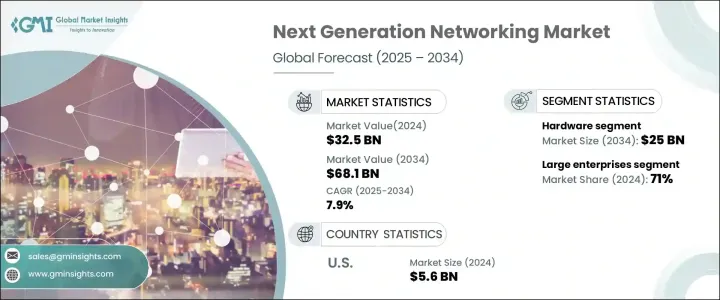

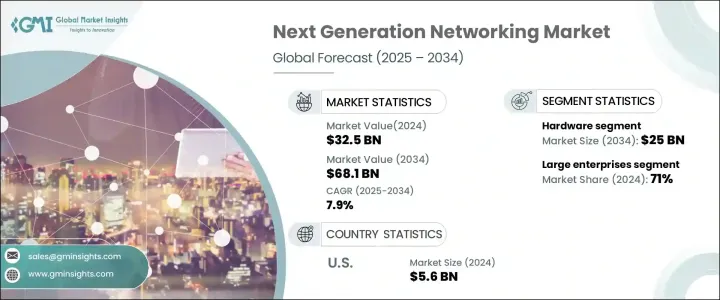

2024 年全球新一代网路市场价值为 325 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 7.9%。随着对云端运算、云端储存服务的依赖日益增加以及全球数位基础设施的扩张,该市场正在经历快速转型。随着企业将其营运和资料迁移到云端,对提供无缝连接、高频宽和低延迟的先进网路解决方案的需求变得比以往任何时候都更加重要。随着企业寻求尖端技术来提高营运效率和即时资料处理,人工智慧 (AI)、物联网 (IoT) 和 5G 网路的日益普及进一步推动了需求。

向软体定义网路 (SDN) 和网路功能虚拟化 (NFV) 的转变正在重塑市场格局,使组织能够在管理其网路方面实现更大的灵活性、自动化和成本效率。网路安全威胁和监管合规要求也促使企业采用强大的安全措施升级其网路框架,确保资料完整性和弹性。此外,智慧城市、自动驾驶汽车和边缘运算解决方案的普及也扩大了对能够支援复杂、数据密集型应用的下一代网路系统的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 325亿美元 |

| 预测值 | 681亿美元 |

| 复合年增长率 | 7.9% |

市场分为硬体、软体和服务,其中硬体占最大份额。 2024 年,硬体部分占了 40% 的市场份额,预计到 2034 年将达到 250 亿美元。路由器、交换器、伺服器和网路处理器等基本网路元件在实现高效能基础设施方面发挥关键作用,尤其是在部署 5G、SDN 和 NFV 技术的情况下。企业优先投资可扩展的高速网路设备,以满足云端运算、企业资料中心和电信网路不断变化的需求。

企业规模在市场动态中也发挥着重要作用,大型企业在采用方面处于领先地位。 2024年,大型企业将占据下一代网路市场71%的份额,利用其财务能力实施先进、安全的网路解决方案。这些组织依靠高效能网路来支援大规模营运、劳动力协作和数据驱动的决策。同时,中小型企业 (SME) 正在逐步增加对下一代网路技术的投资,并认识到需要可扩展、经济高效的解决方案才能保持竞争力。

2024 年,北美占据全球新一代网路市场的 34%,其中美国为该地区的估值贡献了 56 亿美元。主要电信公司的参与,加上对 5G 部署和数位转型计画的积极投资,使该地区成为网路创新的领导者。医疗保健、金融和製造业等各行各业对高速、低延迟连线的需求不断增长,并持续推动市场成长。北美高度重视下一代无线基础设施和新兴网路技术,将继续在塑造全球网路解决方案的未来方面发挥关键作用。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 网路基础设施供应商

- 电信服务供应商

- 网路技术和解决方案供应商

- 最终用途

- 利润率分析

- 技术与创新格局

- 专利分析

- 成本細項分析

- 重要新闻和倡议

- 用例

- 监管格局

- 衝击力

- 成长动力

- 采用云端运算和存储

- 低延迟和即时应用的需求

- 物联网(IoT)的兴起

- 5G普及率不断提高

- 提高成本效率和可扩展性

- 产业陷阱与挑战

- 基础设施成本高

- 安全和隐私问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 硬体

- 路由器

- 开关

- 防火墙

- 伺服器

- 其他的

- 软体

- 网路管理系统

- 网路安全软体

- SDN控制器

- 网路虚拟化

- 其他的

- 服务

- 专业服务

- 託管服务

第六章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 安全定义网络

- 网路功能虚拟化

- 5G 网路

- 边缘运算

- 其他的

第七章:市场估计与预测:依企业规模,2021 - 2034 年

- 主要趋势

- 中小企业

- 大型企业

第八章:市场估计与预测:按部署,2021 - 2034 年

- 主要趋势

- 本地

- 基于云端

- 杂交种

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 电信

- 卫生保健

- 政府

- 汽车

- 製造业

- 其他的

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- A10 Networks

- Adtran

- AT&T

- Check Point Software Technologies

- Ciena Corporation

- Cisco

- Commverge Solutions

- Ericsson

- Forcepoint

- Fortinet

- Huawei

- IBM

- Juniper Networks

- Keysight Technologies

- NEC

- Nokia

- Samsung

- TelcoBridges

- VMware (Broadcom)

- ZTE

The Global Next-Generation Networking Market was valued at USD 32.5 billion in 2024 and is projected to grow at a CAGR of 7.9% between 2025 and 2034. The market is witnessing a rapid transformation driven by the increasing reliance on cloud computing, cloud storage services, and the expansion of digital infrastructures worldwide. As businesses migrate their operations and data to the cloud, the need for advanced networking solutions that offer seamless connectivity, high bandwidth, and low latency is becoming more critical than ever. The growing adoption of artificial intelligence (AI), the Internet of Things (IoT), and 5G networks further fuels the demand as companies seek cutting-edge technologies to enhance operational efficiency and real-time data processing.

The shift toward software-defined networking (SDN) and network function virtualization (NFV) is reshaping the market landscape, enabling organizations to achieve greater flexibility, automation, and cost efficiency in managing their networks. Cybersecurity threats and regulatory compliance requirements are also pushing enterprises to upgrade their networking frameworks with robust security measures, ensuring data integrity and resilience. Additionally, the proliferation of smart cities, autonomous vehicles, and edge computing solutions is amplifying the demand for next-generation networking systems that can support complex, data-intensive applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $32.5 Billion |

| Forecast Value | $68.1 Billion |

| CAGR | 7.9% |

The market is segmented into hardware, software, and services, with hardware accounting for the largest share. In 2024, the hardware segment held a 40% market share and is expected to reach USD 25 billion by 2034. Essential networking components such as routers, switches, servers, and network processors play a pivotal role in enabling high-performance infrastructure, particularly with the deployment of 5G, SDN, and NFV technologies. Businesses are prioritizing investments in scalable, high-speed networking equipment to meet evolving demands in cloud computing, enterprise data centers, and telecommunication networks.

Enterprise size also plays a significant role in market dynamics, with large enterprises leading adoption. In 2024, large enterprises dominated the next-generation networking market with a 71% share, leveraging their financial capabilities to implement advanced, secure networking solutions. These organizations rely on high-performance networks to support large-scale operations, workforce collaboration, and data-driven decision-making. Meanwhile, small and medium-sized enterprises (SME) are gradually increasing their investments in next-generation networking technologies, recognizing the need for scalable, cost-effective solutions to stay competitive.

North America held a 34% share of the global next-generation networking market in 2024, with the United States contributing USD 5.6 billion to the regional valuation. The presence of major telecom players, coupled with aggressive investments in 5G deployment and digital transformation initiatives, has positioned the region as a frontrunner in network innovation. The increasing demand for high-speed, low-latency connectivity across industries, including healthcare, finance, and manufacturing, continues to drive market growth. With a strong focus on next-gen wireless infrastructure and emerging networking technologies, North America is set to remain a key player in shaping the future of global networking solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Network infrastructure providers

- 3.2.2 Telecommunication service providers

- 3.2.3 Network technology and solutions vendors

- 3.2.4 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Cost breakdown analysis

- 3.7 Key news & initiatives

- 3.8 Use cases

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Adoption of cloud computing and storage

- 3.10.1.2 Demand for low latency and real-time applications

- 3.10.1.3 Rise of the Internet of Things (IoT)

- 3.10.1.4 Growing 5G adoption

- 3.10.1.5 Increased cost efficiency and scalability

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High infrastructure costs

- 3.10.2.2 Security and privacy concerns

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Routers

- 5.2.2 Switches

- 5.2.3 Firewalls

- 5.2.4 Servers

- 5.2.5 Others

- 5.3 Software

- 5.3.1 Network management systems

- 5.3.2 Network security software

- 5.3.3 SDN controllers

- 5.3.4 Network virtualization

- 5.3.5 Others

- 5.4 Services

- 5.4.1 Professional services

- 5.4.2 Managed services

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 SDN

- 6.3 NFV

- 6.4 5G networks

- 6.5 Edge computing

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 SME

- 7.3 Large enterprises

Chapter 8 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 On-premises

- 8.3 Cloud-based

- 8.4 Hybrid

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Telecommunication

- 9.3 Healthcare

- 9.4 Government

- 9.5 Automotive

- 9.6 Manufacturing

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 A10 Networks

- 11.2 Adtran

- 11.3 AT&T

- 11.4 Check Point Software Technologies

- 11.5 Ciena Corporation

- 11.6 Cisco

- 11.7 Commverge Solutions

- 11.8 Ericsson

- 11.9 Forcepoint

- 11.10 Fortinet

- 11.11 Huawei

- 11.12 IBM

- 11.13 Juniper Networks

- 11.14 Keysight Technologies

- 11.15 NEC

- 11.16 Nokia

- 11.17 Samsung

- 11.18 TelcoBridges

- 11.19 VMware (Broadcom)

- 11.20 ZTE