|

市场调查报告书

商品编码

1698311

讯号情报 (SIGINT) 市场机会、成长动力、产业趋势分析与 2025-2034 年预测Signals Intelligence (SIGINT) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

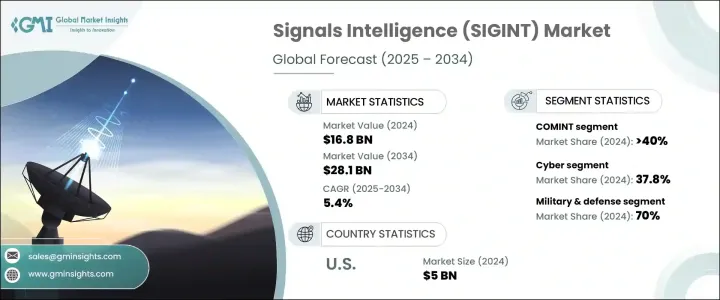

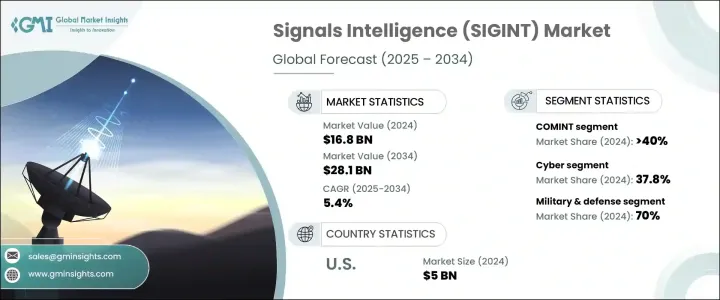

2024 年全球讯号情报市场规模达到 168 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.4%。这一成长主要得益于人工智慧 (AI) 和感测器技术的快速进步。人工智慧演算法增强了快速处理大量资料的能力,从而可以更快地识别威胁。结合机器学习,这些系统变得更擅长识别通讯和电子讯号中的模式和异常。增强的感测器功能(例如提高的灵敏度和过滤能力)显着增加了 SIGINT 平台的范围和精度,从而实现了更高效、更准确的情报收集。这些进步减少了对人类操作员的依赖,同时提高了战术和战略情报行动的有效性。

全球地缘政治紧张局势和军事对抗不断加剧,对信号情报系统的需求也随之增加,各国越来越依赖这些技术来监视对手并确保国防安全。由于对电子战 (EW) 的担忧,市场也在不断扩大,SIGINT 在对抗干扰、欺骗和其他电子威胁方面发挥着至关重要的作用。各国正在将 SIGINT 纳入其军事战略,以在现代战争中保持竞争优势,尤其是在东欧、印度-太平洋和中东等地区的威胁不断演变的情况下。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 168亿美元 |

| 预测值 | 281亿美元 |

| 复合年增长率 | 5.4% |

市场主要按类型细分,包括通讯情报 (COMINT)、电子情报 (ELINT) 和外国仪器讯号情报 (FISINT)。其中,COMINT 引领市场,占 2024 年总份额的 40% 以上。军事和安全机构越来越多地使用 COMINT 解决方案来拦截和分析语音、文字和加密讯息,这在即时威胁侦测和网路防御中发挥关键作用。

在应用方面,网路领域正在经历快速成长,占据了相当大的市场份额。随着网路间谍和数位战争威胁的日益增加,用于保护关键基础设施的网路讯号情报技术的资金激增。政府和国防机构正在大力投资自动化、人工智慧驱动的系统,以增强即时威胁侦测能力。

军事和国防部门继续主导 SIGINT 市场,到 2024 年将占据总市场份额的近 70%。对电子战和威胁检测解决方案的不断增长的需求正在推动该领域的显着增长。此外,各国政府也利用 SIGINT 进行间谍活动、反恐和边境安全行动。商业领域也采用 SIGINT 技术来防范网路威胁并确保安全通讯。

北美引领全球讯号情报市场,其中美国在 2024 年贡献了 50 亿美元的相当可观的份额。美国正大力投资人工智慧讯号处理和资料分析,以加强其国防和情报能力,确保强大的国家安全。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 远端资讯处理硬体供应商

- 软体开发者

- 无线电操作商

- 系统整合商

- 车队管理服务提供者

- 利润率分析

- 技术与创新格局

- 专利分析

- 用例

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 远端资讯处理和物联网需求不断增长

- 严格的安全和排放法规

- 电子商务和最后一哩配送的成长

- 电动和自动驾驶汽车的普及率不断提高

- 产业陷阱与挑战

- 数据过载和管理问题

- 驾驶员管理与安全问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- COMINT(通信情报)

- ELINT(电子情报)

- FISINT(外国仪器讯号情报)

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 网路

- 地面

- 空降

- 战斗机

- 特殊任务飞机

- 运输飞机

- 无人驾驶飞行器(UAV)

- 海军

- 船舶

- 潜水艇

- 无人驾驶船舶(UMV)

- 空间

第七章:市场估计与预测:依出行方式,2021 - 2034 年

- 主要趋势

- 固定的

- 便携的

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 军事与国防

- 政府和执法部门

- 商业和私营部门

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Airbus

- BAE Systems

- Boeing

- Collins Aerospace

- DRS RADA Technologies

- Elbit Systems

- General Atomics

- General Dynamics

- Hensoldt

- Israel Aerospace Industries

- L3Harris

- Leonardo

- Lockheed Martin

- Mercury Systems

- Northrop Grumman

- Raytheon

- Rohde & Schwarz

- Saab

- SRC

- Thales

The Global Signals Intelligence Market reached USD 16.8 billion in 2024 and is expected to grow at a CAGR of 5.4% from 2025 to 2034. This growth is primarily fueled by rapid advancements in artificial intelligence (AI) and sensor technologies. AI algorithms enhance the ability to process vast amounts of data quickly, allowing for faster identification of threats. Coupled with machine learning, these systems are becoming more adept at recognizing patterns and anomalies in communications and electronic signals. Enhanced sensor capabilities, such as improved sensitivity and filtering, have significantly increased the range and precision of SIGINT platforms, enabling more efficient and accurate intelligence collection. These advancements are reducing the reliance on human operators while boosting the effectiveness of both tactical and strategic intelligence operations.

The rising geopolitical tensions and military confrontations worldwide have escalated the demand for SIGINT systems, as countries are increasingly relying on these technologies to monitor adversaries and secure national defense. The market is also expanding due to concerns over electronic warfare (EW), with SIGINT playing a crucial role in countering jamming, spoofing, and other electronic threats. Countries are integrating SIGINT into their military strategies to maintain a competitive edge in modern warfare, especially as threats continue to evolve in regions like Eastern Europe, the Indo-Pacific, and the Middle East.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.8 Billion |

| Forecast Value | $28.1 Billion |

| CAGR | 5.4% |

The market is primarily segmented by types, including Communications Intelligence (COMINT), Electronic Intelligence (ELINT), and Foreign Instrumentation Signals Intelligence (FISINT). Among these, COMINT leads the market, accounting for over 40% of the total share in 2024. COMINT solutions are increasingly used by military and security agencies for intercepting and analyzing voice, text, and encrypted messages, which play a critical role in real-time threat detection and cyber defense.

In terms of applications, the cyber segment is witnessing rapid growth, capturing a significant share of the market. With the increasing threats from cyber espionage and digital warfare, there has been a surge in funding for cyber SIGINT technologies aimed at protecting critical infrastructure. Governments and defense agencies are heavily investing in automated, AI-driven systems to enhance real-time threat detection capabilities.

The military and defense sector continues to dominate the SIGINT market, accounting for nearly 70% of the total market share in 2024. The increasing demand for electronic warfare and threat detection solutions is driving significant growth in this sector. Additionally, governments are leveraging SIGINT for espionage, counterterrorism, and border security operations. The commercial sector is also adopting SIGINT technologies to safeguard against cyber threats and ensure secure communication.

North America leads the global SIGINT market, with the United States contributing a substantial share of USD 5 billion in 2024. The U.S. is making significant investments in AI-powered signal processing and data analytics to strengthen its defense and intelligence capabilities, ensuring robust national security.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Telematics hardware providers

- 3.2.2 Software developers

- 3.2.3 Wireless carriers

- 3.2.4 System integrators

- 3.2.5 Fleet management service providers

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Use cases

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising Demand for telematics & IoT

- 3.9.1.2 Stringent safety & emission regulations

- 3.9.1.3 Growth in e-commerce & last-mile delivery

- 3.9.1.4 Growing adoption of electric & autonomous vehicles

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Data overload and management concerns

- 3.9.2.2 Driver management and safety issues

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 COMINT (Communications Intelligence)

- 5.3 ELINT (Electronic Intelligence)

- 5.4 FISINT (Foreign Instrumentation Signals Intelligence)

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cyber

- 6.3 Ground

- 6.4 Airborne

- 6.4.1 Fighter jets

- 6.4.2 Special mission aircraft

- 6.4.3 Transport aircraft

- 6.4.4 Unmanned Aerial Vehicles (UAVs)

- 6.5 Naval

- 6.5.1 Ships

- 6.5.2 Submarines

- 6.5.3 Unmanned Marine Vehicles (UMVs)

- 6.6 Space

Chapter 7 Market Estimates & Forecast, By Mobility, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Fixed

- 7.3 Portable

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Military & defense

- 8.3 Government & law enforcement

- 8.4 Commercial & private sector

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Airbus

- 10.2 BAE Systems

- 10.3 Boeing

- 10.4 Collins Aerospace

- 10.5 DRS RADA Technologies

- 10.6 Elbit Systems

- 10.7 General Atomics

- 10.8 General Dynamics

- 10.9 Hensoldt

- 10.10 Israel Aerospace Industries

- 10.11 L3Harris

- 10.12 Leonardo

- 10.13 Lockheed Martin

- 10.14 Mercury Systems

- 10.15 Northrop Grumman

- 10.16 Raytheon

- 10.17 Rohde & Schwarz

- 10.18 Saab

- 10.19 SRC

- 10.20 Thales