|

市场调查报告书

商品编码

1698323

无线感测器网路市场机会、成长动力、产业趋势分析及 2025-2034 年预测Wireless Sensor Network Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

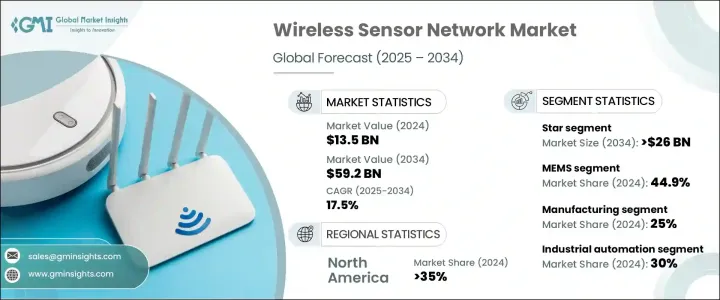

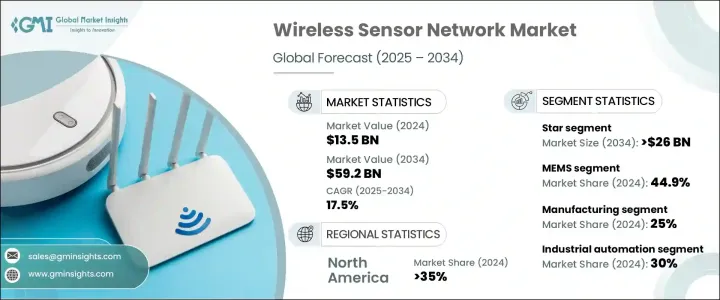

全球无线感测器网路市场规模在 2024 年将达到 135 亿美元,预计在 2025 年至 2034 年期间的复合年增长率将达到 17.5%,这得益于各行各业对物联网和智慧技术的日益普及。随着企业和消费者不断将连网设备融入日常营运中,对高效可靠的基于感测器的网路的需求正在激增。无线感测器网路对于实现工业流程自动化、优化即时资料收集以及增强不同应用之间的连接性至关重要。从智慧家庭和工业自动化到医疗保健和环境监测,这些网路正在简化营运并提高效率。

随着全球各地的组织加速数位转型,各行各业都在加大对先进感测器网路的投资,以增强数据驱动的决策能力。工业 4.0 技术的广泛应用正在推动对无线感测器网路的需求,尤其是在即时监控和自动化至关重要的製造业和物流业。这些网路能够提供无缝连接,而不受传统有线系统的限制,从而推动市场成长。政府和企业也正在投资智慧城市计划,进一步推动基于感测器的网路在交通管理、空气品质监测和安全等应用领域的应用。随着低功耗通讯协定和边缘运算的进步,无线感测器网路正在不断发展,为各个行业提供更高的效率、可靠性和可扩展性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 135亿美元 |

| 预测值 | 592亿美元 |

| 复合年增长率 | 17.5% |

市场按网路拓朴细分,包括汇流排型、星型、树型和网状配置。 2024 年,星型拓朴结构占据了 40% 的市场份额,预计到 2034 年将创造 260 亿美元的市场价值。企业之所以青睐星型拓扑结构,是因为它的结构简单,所有感测器节点都连接到中央集线器,从而降低了通讯复杂性并提高了系统可靠性。这种设计最大限度地减少了资料传输延迟,并确保了高速、安全的无线通信,使其成为需要高效和易于部署的应用的理想选择。星型拓朴结构的低维护要求和成本效益进一步促进了其在各行业的广泛应用。

无线感测器网路也按感测器类型分类,其中 MEMS、基于 CMOS 的感测器、LED 感测器和其他感测器在市场中发挥重要作用。 MEMS感测器在2024年占据主导地位,占据44.9%的市场份额。它们体积小、能源效率高,并且能够无缝整合到电子设备中,因此成为工业自动化、医疗保健和环境监测应用的首选。随着各行各业越来越依赖数据驱动的洞察力,MEMS 感测器在增强即时监控和营运效率方面发挥着不可估量的价值。

美国引领无线感测器网路市场,2024 年占有 35% 的份额。该国仍处于工业物联网应用的前沿,企业利用无线感测器网路来提高生产力、简化物流并推动自动化。成熟的感测器技术产业与强大的无线基础设施相结合,正在加速市场扩张。随着连接技术的进步和智慧解决方案的普及,无线感测器网路将在塑造多个领域的自动化、即时分析和智慧决策的未来方面发挥变革性作用。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 解决方案提供者

- 服务提供者

- 技术提供者

- 最终用途

- 供应商格局

- 利润率分析

- 技术与创新格局

- 专利分析

- 监管格局

- 衝击力

- 成长动力

- 对物联网和智慧型设备的需求不断增长

- 在工业自动化和智慧城市的应用日益广泛

- 与人工智慧和机器学习的集成

- 产业陷阱与挑战

- 安装和维护成本高

- 能源消耗挑战

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按拓朴结构,2021 - 2034 年

- 主要趋势

- 公车

- 星星

- 树

- 网

第六章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 陆地

- 地下

- 水下

- 多媒体

- 移动的

第七章:市场估计与预测:按感测器,2021 - 2034 年

- 主要趋势

- 微机电系统

- 基于CMOS的感测器

- LED 感应器

- 其他的

第八章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 无线HART

- 无线网

- 无线上网

- IPv6

- 蓝牙

- Dash 7

- Z-Wave

第九章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 家庭和楼宇自动化

- 工业自动化

- 军事监视

- 智慧交通

- 病患监护

- 机器监控

- 其他的

第十章:市场估计与预测:依产业,2021 - 2034 年

- 主要趋势

- 汽车

- 卫生保健

- 能源与公用事业

- IT和电信

- 製造业

- 零售

- 航太与国防

- 其他的

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十二章:公司简介

- ABB

- Advantech

- Analog Devices

- Broadcom

- Butlr Technologies

- Cisco

- Digi International

- Emerson Electric

- FreeWave Technologies

- Honeywell

- Intel

- Libelium

- Link Labs

- NXP Semiconductors

- Qualcomm

- Schneider Electric

- Siemens

- STMicroelectronics

- TE Connectivity

- Texas Instruments

The Global Wireless Sensor Network Market, valued at USD 13.5 billion in 2024, is projected to expand at a CAGR of 17.5% between 2025 and 2034, driven by the increasing adoption of IoT and smart technology across industries. As businesses and consumers continue to integrate connected devices into their daily operations, the demand for efficient and reliable sensor-based networks is surging. Wireless sensor networks are becoming essential for automating industrial processes, optimizing real-time data collection, and enhancing connectivity across diverse applications. From smart homes and industrial automation to healthcare and environmental monitoring, these networks are streamlining operations and improving efficiency.

As organizations worldwide accelerate digital transformation efforts, industries are increasingly investing in advanced sensor networks to enhance data-driven decision-making. The widespread adoption of Industry 4.0 technologies is fueling the demand for wireless sensor networks, particularly in manufacturing and logistics, where real-time monitoring and automation are critical. The ability of these networks to provide seamless connectivity without the limitations of traditional wired systems is propelling market growth. Governments and enterprises are also investing in smart city initiatives, further driving the adoption of sensor-based networks for applications such as traffic management, air quality monitoring, and security. With advancements in low-power communication protocols and edge computing, wireless sensor networks are evolving to deliver greater efficiency, reliability, and scalability across industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.5 billion |

| Forecast Value | $59.2 billion |

| CAGR | 17.5% |

The market is segmented by network topology, including bus, star, tree, and mesh configurations. In 2024, the star topology segment held a 40% market share and is expected to generate USD 26 billion by 2034. Businesses prefer star topology due to its straightforward structure, where all sensor nodes connect to a central hub, reducing communication complexity and enhancing system reliability. This design minimizes data transfer delays and ensures high-speed, secure wireless communication, making it ideal for applications that require efficiency and ease of deployment. The low maintenance requirements and cost-effectiveness of star topology further contribute to its growing adoption across various industries.

Wireless sensor networks are also categorized by sensor type, with MEMS, CMOS-based sensors, LED sensors, and others playing a significant role in the market. MEMS sensors dominated in 2024, accounting for a 44.9% market share. Their compact size, energy efficiency, and ability to integrate seamlessly into electronic devices make them a preferred choice for industrial automation, healthcare, and environmental monitoring applications. With industries increasingly relying on data-driven insights, MEMS sensors are proving invaluable in enhancing real-time monitoring and operational efficiency.

The U.S. leads the wireless sensor network market, holding a 35% share in 2024. The country remains at the forefront of Industrial IoT adoption, with businesses leveraging wireless sensor networks to enhance productivity, streamline logistics, and drive automation. A well-established sensor technology industry, combined with robust wireless infrastructure, is accelerating market expansion. As connectivity technologies advance and smart solutions gain traction, wireless sensor networks are set to play a transformative role in shaping the future of automation, real-time analytics, and intelligent decision-making across multiple sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Solution provider

- 3.1.2 Services provider

- 3.1.3 Technology provider

- 3.1.4 End Use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing demand for IoT and smart devices

- 3.7.1.2 Growing adoption in industrial automation and smart cities

- 3.7.1.3 Integration with AI and machine learning

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High costs of installation and maintenance

- 3.7.2.2 Energy consumption challenges

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Topology, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Bus

- 5.3 Star

- 5.4 Tree

- 5.5 Mesh

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Terrestrial

- 6.3 Underground

- 6.4 Underwater

- 6.5 Multimedia

- 6.6 Mobile

Chapter 7 Market Estimates & Forecast, By Sensors, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 MEMS

- 7.3 CMOS-based sensors

- 7.4 LED sensors

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Wireless HART

- 8.3 ZigBee

- 8.4 Wi-Fi

- 8.5 IPv6

- 8.6 Bluetooth

- 8.7 Dash 7

- 8.8 Z-Wave

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Home and building automation

- 9.3 Industrial automation

- 9.4 Military surveillance

- 9.5 Smart transportation

- 9.6 Patient monitoring

- 9.7 Machine monitoring

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By Industry, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 Automotive

- 10.3 Healthcare

- 10.4 Energy & utilities

- 10.5 IT & telecom

- 10.6 Manufacturing

- 10.7 Retail

- 10.8 Aerospace & defense

- 10.9 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 ABB

- 12.2 Advantech

- 12.3 Analog Devices

- 12.4 Broadcom

- 12.5 Butlr Technologies

- 12.6 Cisco

- 12.7 Digi International

- 12.8 Emerson Electric

- 12.9 FreeWave Technologies

- 12.10 Honeywell

- 12.11 Intel

- 12.12 Libelium

- 12.13 Link Labs

- 12.14 NXP Semiconductors

- 12.15 Qualcomm

- 12.16 Schneider Electric

- 12.17 Siemens

- 12.18 STMicroelectronics

- 12.19 TE Connectivity

- 12.20 Texas Instruments