|

市场调查报告书

商品编码

1698327

胰岛素市场机会、成长动力、产业趋势分析及 2025-2034 年预测Insulin Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

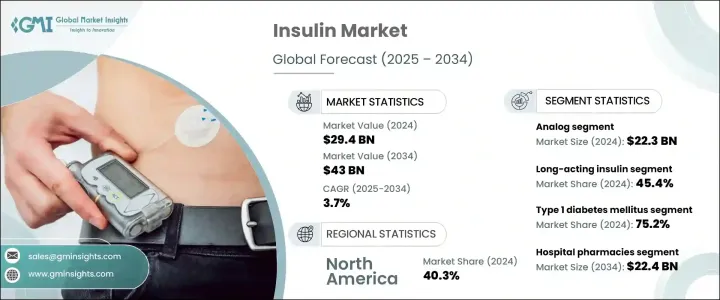

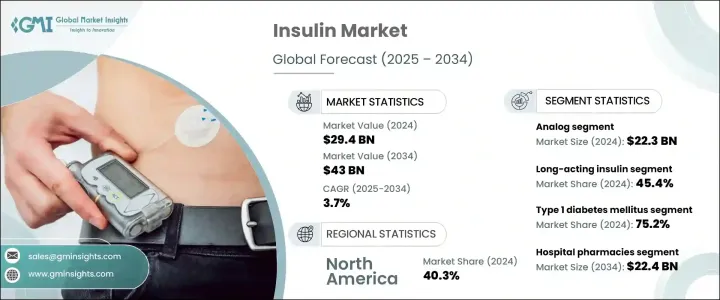

2024 年全球胰岛素市值为 294 亿美元,预计 2025 年至 2034 年的复合年增长率为 3.7%。糖尿病(尤其是第 2 型糖尿病)盛行率的不断上升正在推动市场扩张。久坐不动的生活方式、肥胖率上升以及人口老化等因素是造成这种成长的主要原因。其他风险因素,包括高热量饮食、遗传倾向和压力,也在糖尿病盛行率中发挥至关重要的作用。

不断增强的认识和早期的医疗干预增加了对胰岛素治疗的需求,这对糖尿病管理仍然至关重要。胰岛素製剂的进步,包括超速效、长效和生物相似药胰岛素,提高了治疗顺从性和患者的治疗效果。此外,政府和非政府组织对发展中地区的投资增加扩大了胰岛素的取得管道,进一步增强了市场。已开发经济体的优惠报销政策也促进了市场扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 294亿美元 |

| 预测值 | 430亿美元 |

| 复合年增长率 | 3.7% |

胰岛素对于调节血糖水平、确保有效的能量利用至关重要。市场包括各种胰岛素製剂,包括速效、短效、中效、长效和预混剂以及生物相似药。

市场分为人类胰岛素和胰岛素类似物。胰岛素类似物占据市场主导地位,2024 年市场规模达 223 亿美元。与传统人类胰岛素相比,胰岛素类似物因其卓越的疗效、更低的低血糖风险以及更好的患者依从性而被广泛采用。胰岛素类似物提供了更大的剂量灵活性,减少了餐后血糖峰值,并提供了更可预测的反应。与常规胰岛素相比,长效胰岛素类似物(例如地特胰岛素)也能最大限度地减少体重增加。生物相似药胰岛素类似物的出现进一步扩大了其可近性和可负担性。

根据产品类型,市场分为长效胰岛素、速效胰岛素、组合胰岛素、生物相似药和其他产品。长效胰岛素在2024年占最大份额,为45.4%。其缓释机制可确保稳定的胰岛素水平,减少注射频率并增强患者的依从性。这些配方有效模拟基础胰岛素分泌,降低了低血糖的风险。先进的长效胰岛素产品的开发和胰岛素输送装置的改进继续支撑市场主导地位。

根据应用,市场分为第 1 型糖尿病、2 型糖尿病和妊娠期糖尿病。 2024 年,1 型糖尿病占了 75.2% 的市场份额,预计复合年增长率为 3.6%。 1 型糖尿病患者依赖每日註射胰岛素来维持血糖值。与第 2 型糖尿病不同,改变生活型态和口服药物可能有效,而第 1 型糖尿病则需要持续注射胰岛素。

在分销管道方面,医院药房在 2024 年引领市场,预计到 2034 年将达到 224 亿美元。糖尿病相关住院人数高、胰岛素产品种类繁多以及先进的医疗保健系统促成了该领域的主导地位。

从地区来看,北美在 2023 年占据 40.3% 的市场份额,占据市场主导地位。美国市场规模从 2022 年的 96 亿美元成长到 2023 年的 102 亿美元。该国糖尿病患病率高、医疗保健基础设施健全以及对胰岛素研发的大力投资继续推动市场成长。领先胰岛素製造商的存在进一步支持了市场扩张。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 糖尿病盛行率不断上升

- 胰岛素输送系统的进展

- 政府措施和政策

- 关注儿童糖尿病

- 产业陷阱与挑战

- 胰岛素成本高昂

- 替代疗法的可用性

- 成长动力

- 成长潜力分析

- 监管格局

- 管道分析

- 糖尿病概况

- 2023年全球各地区糖尿病患者数

- 2023年糖尿病患者最多的国家

- 2023年全球各地区糖尿病死亡人数

- 预计 2045 年全球糖尿病患者数量最多的国家

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 人类胰岛素

- 胰岛素类似物

第六章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 速效胰岛素

- 长效胰岛素

- 复合胰岛素

- 生物相似药

- 其他产品

第七章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 1 型糖尿病

- 2型糖尿病

- 妊娠糖尿病

第八章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 网路药局

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Adocia

- Biocon

- Boehringer Ingelheim International

- Eli Lilly and Company

- Gan & Lee Pharmaceuticals

- Gland Pharma

- Julphar

- MannKind Corporation

- Novo Nordisk

- Pfizer

- Sanofi

- Shanghai Fosun Pharmaceutical

- Tonghua Dongbao Pharmaceutical

- United Laboratories International

- Wockhardt

The Global Insulin Market was valued at USD 29.4 billion in 2024 and is projected to grow at a CAGR of 3.7% from 2025 to 2034. The increasing prevalence of diabetes, especially type 2, is driving market expansion. Factors such as a sedentary lifestyle, rising obesity rates, and an aging population significantly contribute to this growth. Other risk factors, including high-calorie diets, genetic predisposition, and stress, also play a crucial role in diabetes prevalence.

Growing awareness and early medical interventions have increased the demand for insulin therapy, which remains essential for diabetes management. Advances in insulin formulations, including ultra-rapid-acting, long-acting, and biosimilar insulins, have improved treatment adherence and patient outcomes. Additionally, increased government and NGO investments in developing regions have expanded insulin access, further strengthening the market. Favorable reimbursement policies in developed economies have also contributed to market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.4 Billion |

| Forecast Value | $43 Billion |

| CAGR | 3.7% |

Insulin is essential in regulating blood glucose levels, ensuring efficient energy utilization. The market includes various insulin formulations, including rapid-acting, short-acting, intermediate-acting, long-acting, and premixed options, as well as biosimilars.

The market is segmented into human insulin and insulin analogs. Insulin analogs dominated the market, accounting for USD 22.3 billion in 2024. Their widespread adoption stems from superior efficacy, lower risk of hypoglycemia, and better patient adherence compared to traditional human insulin. Insulin analogs provide greater dosing flexibility, reduce postprandial glucose spikes, and offer a more predictable response. Long-acting insulin analogs, such as insulin detemir, also minimize weight gain compared to regular insulin. The availability of biosimilar insulin analogs has further expanded accessibility and affordability.

By product type, the market is divided into long-acting insulin, rapid-acting insulin, combination insulin, biosimilars, and other products. Long-acting insulin held the largest share at 45.4% in 2024. Its slow-release mechanism ensures stable insulin levels, reducing the frequency of injections and enhancing patient adherence. These formulations effectively mimic basal insulin secretion, lowering the risk of hypoglycemia. The development of advanced long-acting insulin products and improvements in insulin delivery devices continue to support market dominance.

The market is categorized by application into type 1 diabetes, type 2 diabetes, and gestational diabetes. Type 1 diabetes accounted for 75.2% of the market in 2024 and is expected to grow at a CAGR of 3.6%. Patients with type 1 diabetes rely on daily insulin injections to maintain blood glucose levels. Unlike type 2 diabetes, where lifestyle modifications and oral medications may be effective, type 1 diabetes necessitates consistent insulin administration.

In terms of distribution channels, hospital pharmacies led the market in 2024, projected to reach USD 22.4 billion by 2034. High diabetes-related hospital admissions, access to a wide range of insulin products, and advanced healthcare systems contribute to this segment's dominance.

Regionally, North America led the market with a 40.3% share in 2023. The US market grew from USD 9.6 billion in 2022 to USD 10.2 billion in 2023. The country's high diabetes prevalence, robust healthcare infrastructure, and strong investments in insulin research and development continue to drive market growth. The presence of leading insulin manufacturers further supports market expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of diabetes

- 3.2.1.2 Advancements in insulin delivery systems

- 3.2.1.3 Government initiatives and policies

- 3.2.1.4 Focus on pediatric diabetes

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of insulin

- 3.2.2.2 Availability of alternative therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pipeline analysis

- 3.6 Diabetes landscape

- 3.6.1 Number of diabetics worldwide, by region, 2023

- 3.6.2 Countries with the highest number of diabetics, 2023

- 3.6.3 Number of diabetes deaths worldwide, by region, 2023

- 3.6.4 Countries with the highest projected number of diabetics worldwide in 2045

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Human insulin

- 5.3 Insulin analog

Chapter 6 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Rapid-acting insulin

- 6.3 Long-acting insulin

- 6.4 Combination insulin

- 6.5 Biosimilar

- 6.6 Other products

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Type 1 diabetes mellitus

- 7.3 Type 2 diabetes mellitus

- 7.4 Gestational diabetes

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Adocia

- 10.2 Biocon

- 10.3 Boehringer Ingelheim International

- 10.4 Eli Lilly and Company

- 10.5 Gan & Lee Pharmaceuticals

- 10.6 Gland Pharma

- 10.7 Julphar

- 10.8 MannKind Corporation

- 10.9 Novo Nordisk

- 10.10 Pfizer

- 10.11 Sanofi

- 10.12 Shanghai Fosun Pharmaceutical

- 10.13 Tonghua Dongbao Pharmaceutical

- 10.14 United Laboratories International

- 10.15 Wockhardt