|

市场调查报告书

商品编码

1698328

资产绩效管理市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Asset Performance Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

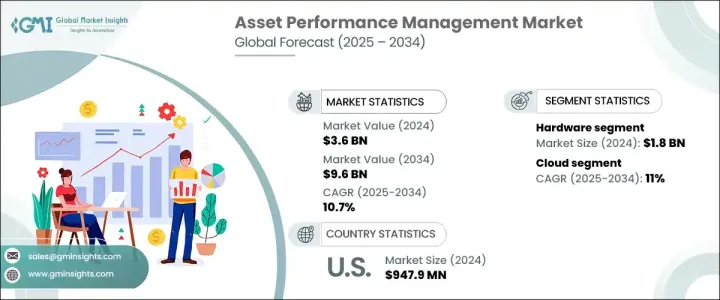

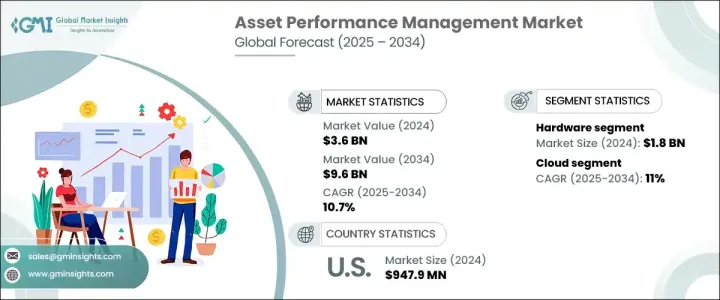

2024 年全球资产绩效管理市场价值为 36 亿美元,预计 2025 年至 2034 年期间的复合年成长率将达到 10.7%。预测性维护和物联网技术的日益普及正在推动这一成长。组织正在利用预测性维护来即时监控资产状况,从而能够在故障发生之前检测到潜在故障。物联网与资产管理解决方案的结合使企业能够收集和分析即时资料,从而帮助提高效率、降低营运成本并延长资产寿命。

企业优先考虑营运效率和降低成本,这促使他们最佳化生产模式,同时保持最低的开支。先进的资产管理解决方案提供即时监控和分析,以识别效率低和表现不佳的资产。公司可以采取主动措施减少停机时间和维护成本,最终提高资产可靠性和资源配置。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 36亿美元 |

| 预测值 | 96亿美元 |

| 复合年成长率 | 10.7% |

市场依组件分为硬体、软体和服务。 2024 年,硬体收入为 18 亿美元,而预计到 2034 年软体的复合年成长率将达到约 12%。先进感测器技术的日益普及正在推动硬体需求。各行业的行业都致力于延长资产生命週期,因此需要即时监控和预测性维护。高品质的感测器对于追踪温度、振动和压力等关键性能参数变得至关重要。支援物联网的感测器透过实现无缝资料收集和即时诊断进一步增强资产监控。此外,5G 等无线通讯技术的进步正在透过促进长距离资料传输来提高感测器效率。

根据部署模式,市场还可分为内部部署和基于云端的解决方案。 2024 年,云端运算领域占据了约 60% 的市场占有率,预计 2025 年至 2034 年的复合年成长率为 11%。基于云端的解决方案提供即时资料分析和预测性维护,而无需大量的内部部署基础架构。它们降低了传统软体安装成本,同时提供了可扩展性。企业受益于协作监控和远端访问,这使得云端解决方案对于地理位置分散的企业特别有价值。这些解决方案还提供管理大量资产资料所需的安全资料储存和分析功能,使产业能够提高营运效率、最大限度地减少停机时间并降低成本。

根据最终用途,市场分为製造业、运输业、化学和製药业、石油和天然气业、能源和公用事业、采矿业和其他行业。由于对营运效率和资产最佳化的需求日益成长,製造业引领市场。製造商依赖复杂的机械,因此即时监控和预测分析对于最大限度地减少停机时间和保持平稳运行至关重要。工业 4.0 正在推动自动化、物联网整合和数位化,增加了对 APM 解决方案的需求,以增强资产可见性和控制力。随着製造流程变得越来越复杂,智慧数据驱动的解决方案对于提高生产力和降低营运成本至关重要。

北美占据全球资产绩效管理市场的 35% 占有率,其中美国在 2024 年的收入为 9.479 亿美元。随着企业扩大投资于物联网、自动化和高级资料分析,工业 4.0 的广泛采用是成长的重要驱动力。资产绩效管理解决方案可实现即时状态监控、维护预测和减少计划外停机时间,这对于製造业、石油天然气和公用事业等设备可靠性直接影响盈利能力的行业至关重要。

目录

第1章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第2章:执行摘要

第3章:行业洞察

- 产业生态系统分析

- 解决方案提供者

- 服务提供者

- 技术提供者

- 最终用途

- 供应商格局

- 利润率分析

- 专利格局

- 亲子市场分析

- 技术与创新格局

- 重要新闻和举措

- 监管格局

- 衝击力

- 成长动力

- 预测性维护需求不断成长,以最大程度减少停机时间

- 更加重视营运效率和降低成本

- 采用物联网感测器和智慧型装置进行即时监控

- 人工智慧与机器学习的整合,实现高阶分析与洞察

- 产业陷阱与挑战

- 初始实施成本高且资源需求大

- 跨遗留系统的资料整合挑战

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第4章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第5章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 解决方案

- 服务

- 专业服务

- 託管服务

第6章:市场估计与预测:依部署模型,2021 - 2034 年

- 主要趋势

- 本地

- 基于云端

第7章:市场估计与预测:依组织规模,2021 - 2034 年

- 主要趋势

- 中小企业(SME)

- 大型企业

第8章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 製造业

- 运输

- 化学和製药

- 石油和天然气

- 能源与公用事业

- 矿业

- 其他

第9章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 资产策略管理

- 效能监控

- 风险管理

- 维护管理

- 资产生命週期管理

第10章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿拉伯联合大公国

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- ABB

- Applied Materials

- AVEVA Group

- Bentley Systems

- CGI Group

- Emerson Electric

- General Electric (GE)

- Honeywell International

- IBM

- Infosys

- Ivalua

- Mitsubishi Electric

- Oracle

- Rockwell Automation

- SAP

- SAS Institute

- Schneider Electric

- Siemens

- Toshiba

- Uptake Technologies

The Global Asset Performance Management Market, valued at USD 3.6 billion in 2024, is anticipated to expand at a CAGR of 10.7% from 2025 to 2034. The increasing adoption of predictive maintenance and IoT technologies is fueling this growth. Organizations are leveraging predictive maintenance to monitor asset conditions in real time, enabling them to detect potential failures before they occur. The integration of IoT with asset management solutions allows businesses to collect and analyze real-time data, helping improve efficiency, reduce operational costs, and extend asset lifespan.

Businesses are prioritizing operational efficiency and cost reduction, prompting them to optimize production models while maintaining minimal expenses. Advanced asset management solutions provide real-time monitoring and analytics to identify inefficiencies and underperforming assets. Companies can take proactive steps to reduce downtime and maintenance costs, ultimately improving asset reliability and resource allocation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.6 Billion |

| Forecast Value | $9.6 Billion |

| CAGR | 10.7% |

The market is segmented by components into hardware, software, and services. In 2024, hardware accounted for USD 1.8 billion in revenue, while software is projected to grow at a CAGR of approximately 12% by 2034. The rising adoption of advanced sensor technologies is driving hardware demand. Industries across various sectors are focused on extending asset life cycles, necessitating real-time monitoring and predictive maintenance. High-quality sensors are becoming crucial for tracking key performance parameters such as temperature, vibration, and pressure. IoT-enabled sensors further enhance asset monitoring by enabling seamless data collection and real-time diagnostics. Additionally, the advancement of wireless communication technologies, such as 5G, is improving sensor efficiency by facilitating data transmission over long distances.

The market is also categorized by deployment model into on-premises and cloud-based solutions. The cloud segment accounted for approximately 60% of the market share in 2024 and is expected to grow at a CAGR of 11% from 2025 to 2034. Cloud-based solutions offer real-time data analytics and predictive maintenance without requiring extensive on-premises infrastructure. They lower traditional software installation costs while providing scalability. Businesses benefit from collaborative monitoring and remote access, making cloud solutions particularly valuable for enterprises with geographically dispersed operations. These solutions also provide secure data storage and analytics capabilities essential for managing large volumes of asset data, enabling industries to improve operational efficiency, minimize downtime, and lower costs.

By end use, the market is segmented into manufacturing, transportation, chemical and pharmaceutical, oil & gas, energy & utility, mining, and others. Manufacturing leads the market due to the growing need for operational efficiency and asset optimization. Manufacturers rely on complex machinery, making real-time monitoring and predictive analytics crucial for minimizing downtime and maintaining smooth operations. Industry 4.0 is driving automation, IoT integration, and digitalization, increasing demand for APM solutions to enhance asset visibility and control. As manufacturing processes become more sophisticated, intelligent data-driven solutions are critical for improving productivity and reducing operational costs.

North America dominates the global asset performance management market with a 35% share, with the United States generating USD 947.9 million in revenue in 2024. The widespread adoption of Industry 4.0 is a significant driver of growth, as companies increasingly invest in IoT, automation, and advanced data analytics. Asset performance management solutions enable real-time condition monitoring, maintenance forecasting, and reduced unplanned downtime, making them vital in industries like manufacturing, oil & gas, and utilities, where equipment reliability directly impacts profitability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Solution providers

- 3.1.2 Service providers

- 3.1.3 Technology providers

- 3.1.4 End Use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Patent landscape

- 3.5 Parent & child market analysis

- 3.6 Technology & innovation landscape

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Growing demand for predictive maintenance to minimize downtime

- 3.9.1.2 Increased focus on operational efficiency and cost reduction

- 3.9.1.3 Adoption of IoT sensors and smart devices for real-time monitoring

- 3.9.1.4 Integration of AI and machine learning for advanced analytics and insights

- 3.9.2 Industry pitfalls & challenges

- 3.9.3 High initial implementation costs and resource requirements

- 3.9.4 Data integration challenges across legacy systems

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.3 Services

- 5.3.1 Professional services

- 5.3.2 Managed services

Chapter 6 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-Premises

- 6.3 Cloud-Based

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Small and Medium-Sized Enterprises (SME)

- 7.3 Large enterprises

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Manufacturing

- 8.3 Transportation

- 8.4 Chemical and pharmaceutical

- 8.5 Oil & Gas

- 8.6 Energy & Utility

- 8.7 Mining

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Asset strategy management

- 9.3 Performance monitoring

- 9.4 Risk management

- 9.5 Maintenance management

- 9.6 Asset lifecycle management

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 Applied Materials

- 11.3 AVEVA Group

- 11.4 Bentley Systems

- 11.5 CGI Group

- 11.6 Emerson Electric

- 11.7 General Electric (GE)

- 11.8 Honeywell International

- 11.9 IBM

- 11.10 Infosys

- 11.11 Ivalua

- 11.12 Mitsubishi Electric

- 11.13 Oracle

- 11.14 Rockwell Automation

- 11.15 SAP

- 11.16 SAS Institute

- 11.17 Schneider Electric

- 11.18 Siemens

- 11.19 Toshiba

- 11.20 Uptake Technologies