|

市场调查报告书

商品编码

1698506

Wi-Fi 晶片组市场机会、成长动力、产业趋势分析及 2025-2034 年预测Wi-Fi Chipset Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

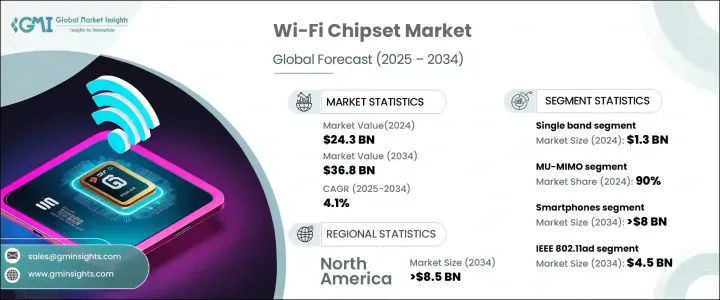

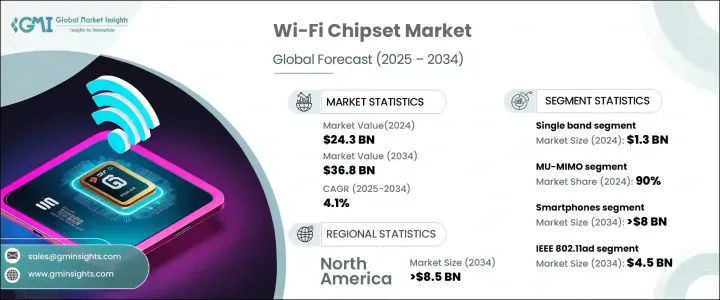

2024 年全球 Wi-Fi 晶片组市场规模达 243 亿美元,预估 2025 年至 2034 年的复合年增长率为 4.1%。物联网和连网设备的日益普及,以及公共 Wi-Fi 的持续部署,正在推动需求的成长。随着数位转型的加速,对高速连线的需求不断上升。消费者依靠无缝无线通讯来实现串流媒体、游戏和智慧家居技术等应用,从而推动了该行业的扩张。

Wi-Fi 晶片组市场依频段分为单频、双频和三频。双频 Wi-Fi 晶片组因其支援高清串流、游戏和新兴数位应用的能力而受到广泛需求。单频 Wi-Fi 晶片组因其价格实惠且节能,到 2024 年价值将达到 13 亿美元。物联网和智慧家庭设备的日益普及推动了对单频晶片组的需求,因为它们为安全摄影机、智慧照明和工业感测器等应用提供了可靠的连接。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 243亿美元 |

| 预测值 | 368亿美元 |

| 复合年增长率 | 4.1% |

市场进一步按应用分类,包括智慧型手机、平板电脑、桌上型电脑、笔记型电脑和连网家用设备。随着全球智慧型手机普及率和高速网路存取的不断提高,预计到 2034 年,智慧型手机中的 Wi-Fi 晶片组将产生 80 亿美元的市场价值。消费者要求日常任务具有更快、更稳定的连接,这加强了行动装置对先进 Wi-Fi 技术的需求。随着新兴经济体智慧型手机用户数量的激增,对 Wi-Fi 网路上网的依赖也日益增加。

受高速互联网和数位转型需求不断增长的推动,北美 Wi-Fi 晶片组市场规模预计到 2034 年将达到 85 亿美元。该地区完善的 5G 基础设施支援采用 Wi-Fi 6 和 Wi-Fi 6E 晶片组,从而改善整体无线连接。智慧家庭技术和企业数位化的快速发展正在推动产业扩张。主要晶片组製造商的存在正在加速创新,确保下一代 Wi-Fi 解决方案在消费者和商业应用中的稳定采用。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 物联网采用率不断提高

- Wi-Fi技术的进步

- 智慧型装置的扩展

- 智慧城市计画兴起

- 5G融合趋势日益增强

- 产业陷阱与挑战

- 生产成本高

- 安全问题

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按品牌,2021 年至 2034 年

- 主要趋势

- 单身的

- 双重的

- 三频

第六章:市场估计与预测:依 MIMO 配置,2021 年至 2034 年

- 主要趋势

- SU-MIMO

- 多用户多输入多输出

- 1x1 MU-MIMO

- 2x2 MU-MIMO

- 3x3 MU-MIMO

- 4x4 MU-MIMO

- 8x8 MU-MIMO

第七章:市场估计与预测:依标准,2021 年至 2034 年

- 主要趋势

- IEEE 802.11ay

- IEEE 802.11ad

- IEEE 802.11ax(Wi-Fi 6 和 Wi-Fi 6E)

- IEEE 802.11ac

- IEEE 802.11n(SB 和 DB)

- 电气和电子工程师协会 802.11b/G

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 智慧型手机

- 药片

- 桌上型电脑

- 笔记型电脑

- 连网家居设备

- 其他的

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Broadcom

- ESPRESSIF SYSTEMS (SHANGHAI) CO., LTD

- HiSilicon

- I&C Technology

- Infineon Technologies

- Intel Corporation

- MediaTek, Inc.

- Microchip Technology Inc.

- MORSE MICRO

- Newracom

- NXP Semiconductors

- ON Semiconductors

- PERASO TECHNOLOGIES INC.

- Qualcomm Technologies, Inc.

- Realtek Semiconductor Corp.

- Renesas Electronics Corporation

- Samsung Electronics Co., Ltd.

- Silicon Laboratories

- STMicroelectronics NV

- Telit

- Texas Instruments Incorporated.

The Global Wi-Fi Chipset Market reached USD 24.3 billion in 2024 and is projected to grow at a CAGR of 4.1% from 2025 to 2034. The increasing adoption of IoT and connected devices, along with the growing deployment of public Wi-Fi, is driving demand. As digital transformation accelerates, the need for high-speed connectivity continues to rise. Consumers rely on seamless wireless communication for applications like streaming, gaming, and smart home technologies, fueling the expansion of the industry.

The Wi-Fi chipset market is segmented by band into single, dual, and tri-band. Dual-band Wi-Fi chipsets are witnessing significant demand due to their ability to support high-definition streaming, gaming, and emerging digital applications. Single-band Wi-Fi chipsets were valued at USD 1.3 billion in 2024 due to their affordability and energy efficiency. The rising adoption of IoT and smart home devices drives demand for single-band chipsets, as they provide reliable connectivity for applications like security cameras, smart lighting, and industrial sensors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.3 Billion |

| Forecast Value | $36.8 Billion |

| CAGR | 4.1% |

The market is further categorized by applications, including smartphones, tablets, desktops, laptops, and connected home devices. Wi-Fi chipsets in smartphones are projected to generate USD 8 billion by 2034, driven by increasing smartphone adoption and high-speed internet access worldwide. Consumers demand faster and more stable connections for everyday tasks, reinforcing the need for advanced Wi-Fi technology in mobile devices. As emerging economies witness a surge in smartphone users, reliance on Wi-Fi networks for internet access is expanding.

North American Wi-Fi chipset market is expected to reach USD 8.5 billion by 2034, driven by increasing demand for high-speed internet and digital transformation. The region's well-established 5G infrastructure supports the adoption of Wi-Fi 6 and Wi-Fi 6E chipsets, improving overall wireless connectivity. Rapid advancements in smart home technologies and enterprise digitalization are fueling industry expansion. The presence of key chipset manufacturers is accelerating innovation, ensuring the steady adoption of next-generation Wi-Fi solutions across consumer and business applications.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing IoT adoption

- 3.2.1.2 Advancements in Wi-Fi technology

- 3.2.1.3 Expansion of smart devices

- 3.2.1.4 Rise in smart city initiatives

- 3.2.1.5 Growing trend of 5G integration

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production cost

- 3.2.2.2 Security concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Band, 2021 – 2034 (USD Mn & Units)

- 5.1 Key trends

- 5.2 Single

- 5.3 Dual

- 5.4 Tri band

Chapter 6 Market Estimates and Forecast, By MIMO Configuration, 2021 – 2034 (USD Mn & Units)

- 6.1 Key trends

- 6.2 SU-MIMO

- 6.3 MU-MIMO

- 6.3.1 1x1 MU-MIMO

- 6.3.2 2x2 MU-MIMO

- 6.3.3 3x3 MU-MIMO

- 6.3.4 4x4 MU-MIMO

- 6.3.5 8x8 MU-MIMO

Chapter 7 Market Estimates and Forecast, By Standards, 2021 – 2034 (USD Mn & Units)

- 7.1 Key trends

- 7.2 IEEE 802.11ay

- 7.3 IEEE 802.11ad

- 7.4 IEEE 802.11ax (Wi-Fi 6 & Wi-Fi 6E)

- 7.5 IEEE 802.11ac

- 7.6 IEEE 802.11n (SB and DB)

- 7.7 EEE 802.11b/G

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Mn & Units)

- 8.1 Key trends

- 8.2 Smartphones

- 8.3 Tablet

- 8.4 Desktop PC

- 8.5 Laptop

- 8.6 Connected home devices

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Mn & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Broadcom

- 10.2 ESPRESSIF SYSTEMS (SHANGHAI) CO., LTD

- 10.3 HiSilicon

- 10.4 I&C Technology

- 10.5 Infineon Technologies

- 10.6 Intel Corporation

- 10.7 MediaTek, Inc.

- 10.8 Microchip Technology Inc.

- 10.9 MORSE MICRO

- 10.10 Newracom

- 10.11 NXP Semiconductors

- 10.12 ON Semiconductors

- 10.13 PERASO TECHNOLOGIES INC.

- 10.14 Qualcomm Technologies, Inc.

- 10.15 Realtek Semiconductor Corp.

- 10.16 Renesas Electronics Corporation

- 10.17 Samsung Electronics Co., Ltd.

- 10.18 Silicon Laboratories

- 10.19 STMicroelectronics N.V.

- 10.20 Telit

- 10.21 Texas Instruments Incorporated.