|

市场调查报告书

商品编码

1698528

环境光感测器市场机会、成长动力、产业趋势分析及 2025-2034 年预测Ambient Light Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

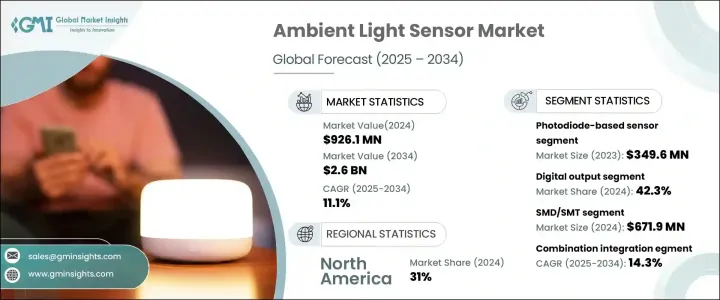

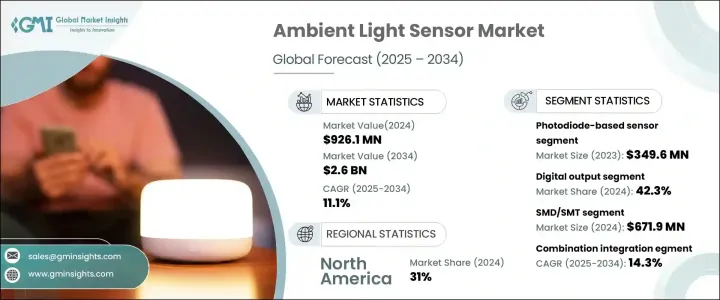

全球环境光感测器市场规模在 2024 年将达到 9.261 亿美元,预计在 2025 年至 2034 年期间将以 11.1% 的强劲复合年增长率扩张,这主要得益于消费性电子、汽车和智慧基础设施领域不断增长的需求。随着各行各业越来越重视自动化、能源效率和以使用者为中心的技术,环境光感测器正成为现代设备和系统的重要组成部分。这些感测器增强了自适应显示,优化了功耗,并提高了整体能源效率,使其成为最新技术进步中不可或缺的一部分。

消费性电子产品仍然是市场扩张的主要驱动力,智慧型手机、平板电脑、笔记型电脑和智慧家庭设备都整合了环境光感测器,可实现自动亮度调节。随着消费者对节能解决方案和无缝用户体验的偏好日益增加,製造商正在采用先进的传感器来增强萤幕的可读性并延长电池寿命。此外,随着企业和家庭寻求根据环境光条件动态调节照明的智慧解决方案,智慧照明系统的出现正在促进市场成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9.261亿美元 |

| 预测值 | 26亿美元 |

| 复合年增长率 | 11.1% |

汽车产业是推动市场扩张的另一个主要因素,环境光感测器被整合到高级驾驶辅助系统(ADAS)中,以提高安全性和使用者舒适度。这些感测器在自动大灯调节、仪表板照明控制和室内照明优化中发挥着至关重要的作用。随着汽车製造商投资尖端技术以提高可视性和节约能源,对高性能环境光感测器的需求持续激增。政府推动节能解决方案的法规和智慧城市计画的快速采用正在进一步加速市场渗透,为感测器製造商创造新的机会。

市场根据感测器类型分为基于光电二极体的感测器、基于CMOS的感测器和基于红外线的感测器。基于光电二极体的感测器在 2023 年创造了 3.496 亿美元的收入,由于其能够高效地将光转换为电讯号的卓越能力而越来越受到关注。这些感测器广泛应用于消费性电子和汽车应用,具有增强的性能和耐用性。同时,基于红外线的环境光感测器由于其高灵敏度和可靠性,在智慧建筑、温室和假冒检测系统等应用中的应用越来越广泛。

根据输出类型,市场分为类比和数位环境光感测器。数位感测器在 2024 年占据 42.3% 的份额,由于技术的快速进步和智慧型装置的日益普及,其需求正在增长。随着以人为本的照明解决方案在工作场所越来越受欢迎,数位环境光感测器正在部署以优化亮度、提高生产力并降低能耗。随着对智慧环境的日益重视,预计数位感测器将在整个预测期内保持强劲成长。

从地理位置来看,受成熟的汽车产业、严格的能源效率法规和不断扩大的智慧城市计画的推动,北美将在 2024 年以 31% 的份额占据市场主导地位。美国仍然是主要贡献者,这得益于对智慧消费电子产品、创新照明解决方案的需求不断增长以及汽车技术的不断发展。随着对智慧基础设施和节能解决方案的投资不断增加,北美环境光感测器市场将持续扩张。

目录

第一章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 消费性电子产品的整合度不断提高

- 智慧家庭科技的进步

- 医疗保健应用领域的扩展

- 能源效率意识不断提高

- 产业陷阱与挑战

- 先进感测器技术成本高昂

- 新兴经济体的认知有限

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按感测器类型,2021-2034

- 主要趋势

- 基于光电二极体

- 基于CMOS

- 基于红外线

第六章:市场估计与预测:依输出类型,2021-2034

- 主要趋势

- 模拟

- 数位的

第七章:市场估计与预测:按安装方式,2021-2034

- 主要趋势

- 贴片/表面贴装

- 通孔

- 其他的

第八章:市场估计与预测:依整合,2021-2034

- 主要趋势

- 离散的

- 组合

第九章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 消费性电子产品

- 汽车

- 工业的

- 家庭自动化

- 卫生保健

- 娱乐

- 安全

- 其他的

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Analog Devices (Maxim Integrated)

- ams-OSRAM AG

- Broadcom Inc.

- Everlight Electronics Co., Ltd.

- Honeywell International Inc.

- Melexis NV

- Microchip Technology Inc.

- OmniVision Technologies, Inc.

- ON Semiconductor Corporation

- Panasonic Corporation

- Renesas Electronics Corporation

- ROHM Semiconductor

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- Silicon Labs

- Sony Semiconductor Solutions Corporation

- STMicroelectronics

- Texas Instruments Incorporated

- Vishay Intertechnology

The Global Ambient Light Sensor Market, valued at USD 926.1 million in 2024, is projected to expand at a robust CAGR of 11.1% from 2025 to 2034, driven by rising demand across consumer electronics, automotive, and smart infrastructure sectors. As industries increasingly prioritize automation, energy efficiency, and user-centric technologies, ambient light sensors are becoming an essential component in modern devices and systems. These sensors enhance adaptive displays, optimize power consumption, and improve overall energy efficiency, making them indispensable in the latest technological advancements.

Consumer electronics remain a key driver of market expansion, with smartphones, tablets, laptops, and smart home devices integrating ambient light sensors to enable automatic brightness adjustment. With increasing consumer preference for energy-saving solutions and seamless user experiences, manufacturers are incorporating advanced sensors to enhance screen readability and extend battery life. Additionally, the emergence of smart lighting systems is contributing to market growth as businesses and households seek intelligent solutions that dynamically adjust illumination based on ambient light conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $926.1 Million |

| Forecast Value | $2.6 Billion |

| CAGR | 11.1% |

The automotive industry is another major factor fueling market expansion, with ambient light sensors being integrated into advanced driver-assistance systems (ADAS) to enhance safety and user comfort. These sensors play a crucial role in automatic headlight adjustment, dashboard illumination control, and interior lighting optimization. As automakers invest in cutting-edge technologies for improved visibility and energy conservation, the demand for high-performance ambient light sensors continues to surge. Government regulations promoting energy-efficient solutions and the rapid adoption of smart city initiatives are further accelerating market penetration, creating new opportunities for sensor manufacturers.

The market is segmented by sensor type into photodiode-based, CMOS-based, and infrared-based sensors. Photodiode-based sensors, which generated USD 349.6 million in 2023, are gaining traction due to their superior ability to convert light into electrical signals efficiently. These sensors are extensively used in consumer electronics and automotive applications, offering enhanced performance and durability. Meanwhile, infrared-based ambient light sensors are witnessing increased adoption in applications such as smart buildings, greenhouses, and counterfeit detection systems, benefiting from their high sensitivity and reliability.

Based on output type, the market is categorized into analog and digital ambient light sensors. Digital sensors, which held a 42.3% share in 2024, are seeing heightened demand due to rapid technological advancements and the growing adoption of smart devices. As human-centric lighting solutions gain momentum in workplaces, digital ambient light sensors are being deployed to optimize brightness, improve productivity, and reduce energy consumption. With the rising emphasis on smart environments, digital sensors are expected to maintain strong growth throughout the forecast period.

Geographically, North America led the market with a 31% share in 2024, propelled by a well-established automotive sector, stringent energy efficiency regulations, and expanding smart city initiatives. The United States remains a dominant contributor, driven by increasing demand for smart consumer electronics, innovative lighting solutions, and the continuous evolution of automotive technologies. As investments in intelligent infrastructure and energy-efficient solutions escalate, the North American ambient light sensor market is set for sustained expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing integration in consumer electronics

- 3.6.1.2 Advancements in smart home technologies

- 3.6.1.3 Expansion in healthcare applications

- 3.6.1.4 Rising awareness of energy efficiency

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High costs of advanced sensor technologies

- 3.6.2.2 Limited awareness in emerging economies

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Sensor Type, 2021-2034 (USD Million & Unit)

- 5.1 Key trends

- 5.2 Photodiode-based

- 5.3 CMOS-based

- 5.4 Infrared-based

Chapter 6 Market Estimates & Forecast, By Output Type, 2021-2034 (USD Million & Unit)

- 6.1 Key trends

- 6.2 Analog

- 6.3 Digital

Chapter 7 Market Estimates & Forecast, By Mounting Style, 2021-2034 (USD Million & Unit)

- 7.1 Key trends

- 7.2 SMD/SMT

- 7.3 Through hole

- 7.4 Others

Chapter 8 Market Estimates & Forecast, By Integration, 2021-2034 (USD Million & Unit)

- 8.1 Key trends

- 8.2 Discrete

- 8.3 Combination

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Unit)

- 9.1 Key trends

- 9.2 Consumer electronics

- 9.3 Automotive

- 9.4 Industrial

- 9.5 Home automation

- 9.6 Healthcare

- 9.7 Entertainment

- 9.8 Security

- 9.9 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Unit)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Analog Devices (Maxim Integrated)

- 11.2 ams-OSRAM AG

- 11.3 Broadcom Inc.

- 11.4 Everlight Electronics Co., Ltd.

- 11.5 Honeywell International Inc.

- 11.6 Melexis NV

- 11.7 Microchip Technology Inc.

- 11.8 OmniVision Technologies, Inc.

- 11.9 ON Semiconductor Corporation

- 11.10 Panasonic Corporation

- 11.11 Renesas Electronics Corporation

- 11.12 ROHM Semiconductor

- 11.13 Samsung Electronics Co., Ltd.

- 11.14 Sharp Corporation

- 11.15 Silicon Labs

- 11.16 Sony Semiconductor Solutions Corporation

- 11.17 STMicroelectronics

- 11.18 Texas Instruments Incorporated

- 11.19 Vishay Intertechnology