|

市场调查报告书

商品编码

1698532

GaN LED 晶片市场机会、成长动力、产业趋势分析及 2025-2034 年预测GaN LED Chips Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

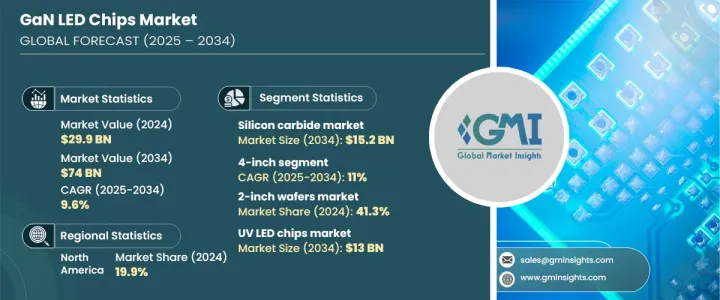

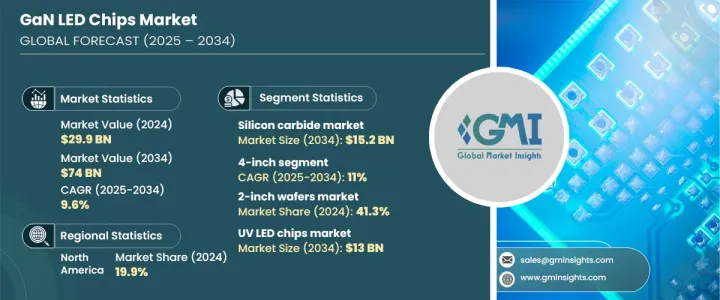

2024 年全球 GaN LED 晶片市值为 299 亿美元,预计 2025 年至 2034 年的复合年增长率为 9.6%。消费性电子、汽车和航太等各领域对微型 LED 显示器的需求不断增长,推动了市场成长。 GaN LED 晶片具有卓越的亮度、能源效率和耐用性,使其成为微型 LED 技术不可或缺的一部分。预计到 2027 年全球微型 LED 显示器市场规模将达到 718 亿美元,凸显了对 GaN 基 LED 的依赖日益增加。这些晶片因其高解析度、低功耗和增强的色彩性能而被广泛应用于智慧手錶、高阶电视、AR/VR设备和商业显示器。它们的热稳定性和高光输出使其成为微型 LED 製造的首选材料,从而推动了持续的需求。此外,体育场、机场和零售场所的大面积显示器正在整合微型 LED 技术,进一步推动 GaN LED 晶片市场的发展。

製造商优先考虑用于电子产品和大型显示器的高性能微型 LED 解决方案。增强的亮度、色彩精度和能源效率是推动智慧型手机、电视和其他显示应用程式采用的关键因素。市场按晶圆尺寸细分为2吋、4吋、6吋和8吋。 2024年,2吋晶圆市场占有41.3%的份额,受惠于成熟、经济高效的生产流程。预计到 2034 年,在高亮度应用的推动下,4 吋市场的复合年增长率将达到 11.1%。预计到 2034 年,6 吋晶圆市场规模将达到 123 亿美元,而 8 吋晶圆市场将占据 2024 年 8.9% 的市场份额,因其在高需求应用中的效率而获得关注。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 299亿美元 |

| 预测值 | 740亿美元 |

| 复合年增长率 | 9.6% |

根据基板类型,市场分为碳化硅 (SiC)、蓝宝石、硅 (Si)、氮化镓 (GaN) 等。蓝宝石凭藉其高温稳定性、透明度和耐化学性,在 2024 年占据 61.4% 的份额,成为高品质 LED 生产的理想选择。预计到 2034 年,SiC 的市值将达到 152 亿美元,因其优异的导热性而受到青睐。硅基 LED 的复合年增长率为 8.5%,而受微型 LED 和 UV LED 需求推动的 GaN 基板的年增长率预计将超过 13%。

产品细分包括蓝色、绿色和紫外线 LED 晶片。受背光和通用照明应用的推动,蓝色 LED 晶片将在 2024 年占据 40.3% 的市场份额。由于绿色 LED 晶片在 AR/VR 和高解析度显示器中的应用,其复合年增长率预计将达到 10.7%。预计到2034年,紫外线LED晶片市场规模将达130亿美元,在杀菌和医疗消毒领域的应用将日益增加。

按技术分類的市场包括标准、薄膜、垂直和倒装晶片 GaN LED。由于发光效率的提高,标准 GaN LED 将在 2024 年占据 32.8% 的市场份额。预计到 2034 年薄膜 GaN LED 的市场规模将达到 226 亿美元,在高性能照明领域越来越受欢迎。受微型 LED 显示器进步的推动,垂直 GaN LED 的复合年增长率为 13.4%。预计到 2034 年,倒装晶片 GaN LED 的市场规模将达到 167 亿美元,受益于热阻的提高和亮度的提高。

最终用途产业包括汽车、消费性电子、国防、工业和资讯通讯技术。由于 GaN LED 为新一代显示器提供卓越的亮度和效率,预计到 2034 年消费性电子产品的复合年增长率将达到 11.4%。汽车产业在 2024 年占据 30.3% 的市场份额,并且越来越多地采用基于 GaN 的照明解决方案。国防部门占18.7%,受益于GaN LED在极端条件下的可靠性。在仓库和工厂节能照明的推动下,工业应用预计到 2034 年将达到 83 亿美元。受资料中心和网路基础设施照明需求不断增长的推动,ICT 的复合年增长率预计将达到 6.9%。

从应用角度来看,在向节能解决方案转型的支持下,通用照明将在 2024 年占据 34% 的市场份额。受电视和显示器中 mini-LED 的采用推动,背光市场正以 8.6% 的复合年增长率扩张。随着电动车越来越多地整合基于 GaN 的解决方案以提高能源效率,汽车照明占据了 16.6% 的份额。预计到 2034 年,显示和标牌应用将达到 106 亿美元,而包括医疗和园艺用途在内的特种照明预计将以 11.4% 的复合年增长率增长。

从地区来看,北美在 2024 年占据 19.9% 的市场份额,对智慧照明和消费性电子产品的需求强劲。受汽车和国防应用领域采用率提高的推动,美国市场规模预计到 2034 年将达到 107 亿美元。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 汽车和智慧型设备领域的新兴应用

- 电动车(EV)市场的扩张

- 转向永续和绿色技术

- GaN LED 在消费性电子产品的应用日益广泛

- 微型LED显示器市场不断成长

- 产业陷阱与挑战

- 製造成本高、生产流程复杂

- 与现有显示基础设施整合的挑战

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 蓝色LED晶片

- 绿色LED晶片

- 紫外线 LED 晶片

- 其他的

第六章:市场估计与预测:按技术,2021 年至 2034 年

- 主要趋势

- 标准GaN LED

- 薄膜GaN LED

- 垂直GaN LED

- 倒装晶片GaN LED

- 其他的

第七章:市场预估与预测:依晶圆尺寸,2021 – 2034

- 主要趋势

- 2英吋

- 4吋

- 6吋

- 8吋

第八章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 汽车

- 消费性电子产品

- 国防与航太

- 工业和电力

- 资讯与通讯技术

- 其他的

第九章:市场估计与预测:依基材类型,2021 年至 2034 年

- 主要趋势

- 蓝宝石

- 碳化硅(SiC)

- 硅(Si)

- 氮化镓(GaN)

- 其他的

第 10 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 普通照明

- 住宅照明

- 商业照明

- 工业照明

- 户外照明

- 背光

- 电视背光

- 智慧型手机和平板电脑显示幕

- 笔记型电脑和显示器显示器

- 汽车照明

- 头灯

- 尾灯

- 室内照明

- 日间行车灯(DRL)

- 指示灯

- 展示和标牌

- 数位广告看板

- 室内数位看板

- 户外显示器

- 交通号誌

- 特种照明

- 园艺照明

- 紫外线(UV)固化

- 医疗器材及设备

- 舞台和演播室灯光

- 其他的

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十二章:公司简介

- Aixtron

- Aledia

- Allegro Microsystems

- Bridgelux

- Cree

- Efficient Power Conversion

- Epileds Technologies

- Epistar

- Fujitsu

- Ganpower International

- Infineon Technologies

- Lumileds Holding

- Navitas Semiconductor

- Qorvo

- SemiLEDs

- Sumitomo Electric Industries

- Veeco Instruments

The Global GaN LED Chips Market was valued at USD 29.9 billion in 2024 and is projected to expand at a CAGR of 9.6% from 2025 to 2034. Rising demand for micro-LED displays across various sectors, including consumer electronics, automotive, and aerospace, is fueling market growth. GaN LED chips offer superior brightness, energy efficiency, and durability, making them indispensable for micro-LED technology. The global micro-LED display market is expected to reach USD 71.8 billion by 2027, underscoring the increasing reliance on GaN-based LEDs. These chips are widely used in smartwatches, premium TVs, AR/VR devices, and commercial displays due to their high resolution, low power consumption, and enhanced color performance. Their thermal stability and high light output make them the preferred material for micro-LED fabrication, driving consistent demand. Additionally, large-area displays in stadiums, airports, and retail settings are integrating micro-LED technology, further propelling the GaN LED chips market.

Manufacturers are prioritizing high-performance micro-LED solutions for electronics and large-scale displays. Enhanced brightness, color accuracy, and energy efficiency are key factors driving adoption in smartphones, TVs, and other display applications. The market is segmented by wafer size into 2-inch, 4-inch, 6-inch, and 8-inch. In 2024, the 2-inch wafer segment held a 41.3% market share, benefiting from an established, cost-effective production process. The 4-inch segment is forecast to grow at an 11.1% CAGR by 2034, driven by high-brightness applications. The 6-inch wafer market is expected to reach USD 12.3 billion by 2034, while the 8-inch segment, accounting for 8.9% market share in 2024, is gaining traction due to its efficiency in high-demand applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.9 Billion |

| Forecast Value | $74 Billion |

| CAGR | 9.6% |

By substrate type, the market is categorized into silicon carbide (SiC), sapphire, silicon (Si), gallium nitride (GaN), and others. Sapphire dominated with a 61.4% share in 2024 due to its high-temperature stability, transparency, and chemical resistance, making it ideal for high-quality LED production. SiC is projected to reach USD 15.2 billion by 2034, favored for its superior thermal conductivity. Silicon-based LEDs are expanding at an 8.5% CAGR, while GaN substrates, driven by demand for micro-LEDs and UV LEDs, are set to grow at over 13% annually.

The product segmentation includes blue, green, and UV LED chips. Blue LED chips captured 40.3% of the market in 2024, driven by applications in backlighting and general lighting. Green LED chips are set to grow at a 10.7% CAGR due to their use in AR/VR and high-resolution displays. UV LED chips are projected to reach USD 13 billion by 2034, with increasing applications in sterilization and medical disinfection.

Market segmentation by technology includes standard, thin-film, vertical, and flip-chip GaN LEDs. Standard GaN LEDs led with a 32.8% market share in 2024, supported by advancements in luminous efficacy. Thin-film GaN LEDs are projected to reach USD 22.6 billion by 2034, gaining popularity in high-performance lighting. Vertical GaN LEDs are growing at a 13.4% CAGR, driven by micro-LED display advancements. Flip-chip GaN LEDs are expected to hit USD 16.7 billion by 2034, benefiting from improved thermal resistance and higher brightness.

End-use industries include automotive, consumer electronics, defense, industrial, and ICT. Consumer electronics are projected to expand at an 11.4% CAGR by 2034, as GaN LEDs offer superior brightness and efficiency for next-generation displays. The automotive sector held a 30.3% market share in 2024, with increasing adoption of GaN-based lighting solutions. The defense sector accounted for 18.7%, benefiting from GaN LEDs' reliability in extreme conditions. Industrial applications are expected to reach USD 8.3 billion by 2034, driven by energy-efficient lighting in warehouses and factories. ICT is set to grow at a 6.9% CAGR, fueled by rising demand for data centers and network infrastructure lighting.

Application-wise, general lighting dominated with a 34% market share in 2024, supported by the transition to energy-efficient solutions. Backlighting is expanding at an 8.6% CAGR, driven by mini-LED adoption in TVs and monitors. Automotive lighting held a 16.6% share as electric vehicles increasingly integrate GaN-based solutions for energy efficiency. Display and signage applications are expected to reach USD 10.6 billion by 2034, while specialty lighting, including medical and horticultural uses, is projected to grow at an 11.4% CAGR.

Regionally, North America accounted for a 19.9% market share in 2024, with strong demand in smart lighting and consumer electronics. The U.S. market is expected to reach USD 10.7 billion by 2034, driven by increased adoption in automotive and defense applications.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising applications in automotive and smart devices

- 3.2.1.2 Expansion of electric vehicle (EV) market

- 3.2.1.3 Shift towards sustainable and green technologies

- 3.2.1.4 Increasing use of GaN LEDs in consumer electronics

- 3.2.1.5 Growing market for micro-LED displays

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing costs and complex production process

- 3.2.2.2 Challenges in integration with existing display infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 (USD Bn & Units)

- 5.1 Key trends

- 5.2 Blue LED chips

- 5.3 Green LED chips

- 5.4 UV LED chips

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Technology, 2021 – 2034 (USD Bn & Units)

- 6.1 Key trends

- 6.2 Standard GaN LEDs

- 6.3 Thin-Film GaN LEDs

- 6.4 Vertical GaN LEDs

- 6.5 Flip-Chip GaN LEDs

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Wafer Size, 2021 – 2034 (USD Bn & Units)

- 7.1 Key trends

- 7.2 2-inch

- 7.3 4-inch

- 7.4 6-inch

- 7.5 8-inch

Chapter 8 Market Estimates and Forecast, By End-Use, 2021 – 2034 (USD Bn & Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Consumer electronics

- 8.4 Defense & aerospace

- 8.5 Industrial & power

- 8.6 Information & communication technology

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Substrate Type, 2021 – 2034 (USD Bn & Units)

- 9.1 Key trends

- 9.2 Sapphire

- 9.3 Silicon Carbide (SiC)

- 9.4 Silicon (Si)

- 9.5 Gallium Nitride (GaN)

- 9.6 Others

Chapter 10 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Bn & Units)

- 10.1 Key trends

- 10.2 General lighting

- 10.2.1 Residential lighting

- 10.2.2 Commercial lighting

- 10.2.3 Industrial lighting

- 10.2.4 Outdoor lighting

- 10.3 Backlighting

- 10.3.1 Tv backlighting

- 10.3.2 Smartphone and tablet displays

- 10.3.3 Laptop and monitor displays

- 10.4 Automotive lighting

- 10.4.1 Headlights

- 10.4.2 Taillights

- 10.4.3 Interior lighting

- 10.4.4 Daytime running lights (drls)

- 10.4.5 Indicator lights

- 10.5 Display & signage

- 10.5.1 Digital billboards

- 10.5.2 Indoor digital signage

- 10.5.3 Outdoor displays

- 10.5.4 Traffic signals

- 10.6 Specialty lighting

- 10.6.1 Horticultural lighting

- 10.6.2 Ultraviolet (uv) curing

- 10.6.3 Medical devices and equipment

- 10.6.4 Stage and studio lighting

- 10.7 Others

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn & Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Aixtron

- 12.2 Aledia

- 12.3 Allegro Microsystems

- 12.4 Bridgelux

- 12.5 Cree

- 12.6 Efficient Power Conversion

- 12.7 Epileds Technologies

- 12.8 Epistar

- 12.9 Fujitsu

- 12.10 Ganpower International

- 12.11 Infineon Technologies

- 12.12 Lumileds Holding

- 12.13 Navitas Semiconductor

- 12.14 Qorvo

- 12.15 SemiLEDs

- 12.16 Sumitomo Electric Industries

- 12.17 Veeco Instruments