|

市场调查报告书

商品编码

1698548

智慧家庭自动化市场机会、成长动力、产业趋势分析及 2025-2034 年预测Smart Home Automation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

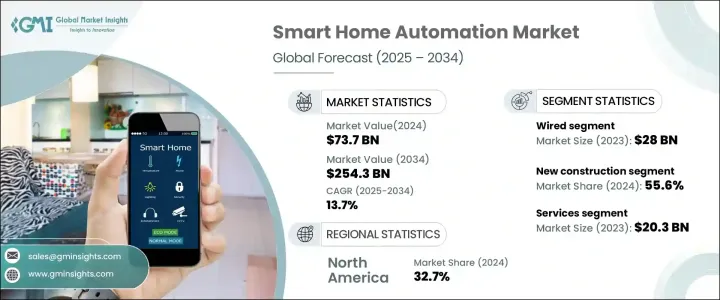

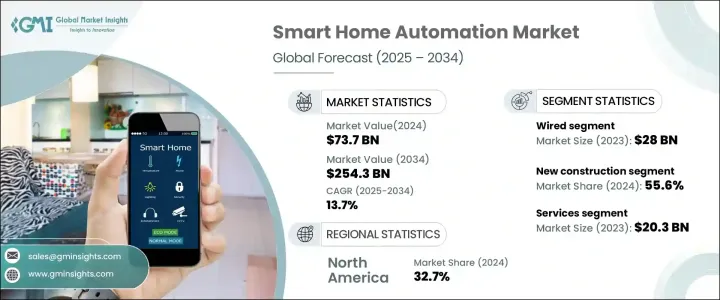

2024 年全球智慧家庭自动化市场价值为 737 亿美元,预计 2025 年至 2034 年的复合年增长率为 13.7%。人工智慧 (AI) 和物联网 (IoT) 的快速普及正在推动需求,因为这些技术提高了家庭自动化的便利性和效率。消费者越来越多地选择与智慧家庭设备整合的人工智慧虚拟助手,实现对照明、安全系统、恆温器和家用电器的无缝语音控制。免持操作和个人化自动化的日益普及正在推动市场扩张。

安全性仍然是影响智慧家庭解决方案采用的关键因素。人工智慧驱动的监视摄影机、智慧锁和警报系统利用脸部和模式识别来识别个人并即时通知房主。随着人们对家庭安全的关注度日益增加,消费者正在投资能够提供远端监控和增强保护的智慧安全系统。此外,领先的电子公司正在将人工智慧融入其产品中,使智慧家庭设备能够学习使用者行为、自动执行任务并创造更个人化的生活体验。 2023 年智慧家庭数量将达到 3 亿,预计到 2028 年将超过 4.25 亿,这表明全球智慧家庭的应用将显着增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 737亿美元 |

| 预测值 | 2543亿美元 |

| 复合年增长率 | 13.7% |

根据技术,市场分为有线系统和无线系统。 2023 年,有线网路市场规模达 280 亿美元,透过实体电缆提供可靠的连接。虽然安装需要专业知识,但这些系统提供了稳定性,非常适合大型住宅和商业空间。同时,无线领域在 2022 年的价值为 383 亿美元,由于其易于安装以及与 Wi-Fi、Zigbee 和 Z-Wave 技术的兼容性而受到关注。无线解决方案特别适用于改造现有住宅,从而在升级自动化功能的同时最大限度地减少干扰。

按装修类型细分的市场包括新建和改造解决方案。到 2024 年,新建筑领域预计将占据 55.6% 的市场份额,这得益于自动照明、先进的安全系统和智慧能源管理解决方案等节能智慧家庭功能的整合。永续性方面,包括再生能源收集和节水功能,进一步促进了采用。同时,改造领域预计将占据 44.4% 的市场份额,因为使用自动化解决方案升级现有住宅可以提高能源效率、舒适度和整体功能。

根据产品类型,市场分为硬体和服务。硬体领域涵盖照明控制、安全系统、暖通空调控制和娱乐自动化,2024 年市场规模达 517 亿美元,占据主导地位。成长归因于智慧恆温器、锁、摄影机和照明设备的广泛采用。到 2023 年,服务业的价值将达到 203 亿美元,随着语音控制虚拟助理在家庭管理中的应用越来越多,该领域正在不断扩大。

从地理位置来看,受消费者对增强便利性、能源效率和远端家庭管理的需求推动,北美将在 2024 年以 32.7% 的份额占据市场主导地位。光是美国市场就达到了 209 亿美元,反映出智慧技术在家庭自动化领域的应用日益广泛。

目录

第一章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 无线技术和物联网连接的进步

- 政府措施和支持

- 对能源效率的需求不断增加

- 可支配所得增加和都市化

- 产业陷阱与挑战

- 快速的技术变革

- 网路连线的可靠性和依赖性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品,2021-2034

- 主要趋势

- 硬体

- 照明控制

- 安全和访问

- HVAC控制

- 娱乐控制及其他

- 其他的

- 服务

第六章:市场估计与预测:依技术,2021-2034 年

- 主要趋势

- 有线

- 无线的

第七章:市场估计与预测:依装配,2021-2034

- 主要趋势

- 新建筑

- 改造

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- ABB Ltd.

- Acuity Brands

- Amazon (Ring)

- Apple Inc. (HomeKit)

- Control4 Corporation

- Crestron Electronics, Inc.

- Ecobee Inc.

- Google (Nest Labs)

- Honeywell International, Inc.

- Johnson Controls

- Koninklijke Philips NV

- Legrand SA

- Leviton Manufacturing Company, Inc.

- Lutron Electronics Co., Inc.

- Resideo Technologies

- Samsung Electronics

- Savant Systems LLC

- Schneider Electric

- Siemens AG

The Global Smart Home Automation Market was valued at USD 73.7 billion in 2024 and is projected to grow at a CAGR of 13.7% from 2025 to 2034. The rapid adoption of artificial intelligence (AI) and the Internet of Things (IoT) is fueling demand as these technologies enhance convenience and efficiency in home automation. Consumers are increasingly opting for AI-powered virtual assistants that integrate with smart home devices, enabling seamless voice control of lighting, security systems, thermostats, and household appliances. The rising popularity of hands-free operation and personalized automation is driving market expansion.

Security remains a key factor influencing the adoption of smart home solutions. AI-driven surveillance cameras, smart locks, and alarm systems utilize facial and pattern recognition to identify individuals and notify homeowners in real time. With growing concerns about home security, consumers are investing in intelligent security systems that offer remote monitoring and enhanced protection. Additionally, leading electronics companies are incorporating AI into their product offerings, enabling smart home devices to learn user behavior, automate tasks, and create a more personalized living experience. The number of smart homes reached 300 million in 2023 and is projected to surpass 425 million by 2028, indicating significant growth in adoption worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $73.7 billion |

| Forecast Value | $254.3 billion |

| CAGR | 13.7% |

Based on technology, the market is categorized into wired and wireless systems. In 2023, the wired segment accounted for USD 28 billion, offering reliable connectivity through physical cables. Although installation requires professional expertise, these systems provide stability and are ideal for large residences and commercial spaces. Meanwhile, the wireless segment was valued at USD 38.3 billion in 2022, gaining traction due to its ease of installation and compatibility with Wi-Fi, Zigbee, and Z-Wave technologies. Wireless solutions are particularly favored for retrofitting existing homes, thus minimizing disruptions while upgrading automation capabilities.

Market segmentation by fitment includes new construction and retrofit solutions. In 2024, the new construction segment is anticipated to capture 55.6% of the market share, driven by the integration of energy-efficient smart home features such as automated lighting, advanced security systems, and intelligent energy management solutions. The sustainability aspect, including renewable energy harvesting and water conservation features, further boosts adoption. Meanwhile, the retrofit segment is expected to hold 44.4% of the market share, as upgrading existing homes with automation solutions enhances energy efficiency, comfort, and overall functionality.

By product type, the market is divided into hardware and services. The hardware segment, encompassing lighting control, security systems, HVAC control, and entertainment automation, dominated the market with USD 51.7 billion in 2024. Growth is attributed to the widespread adoption of smart thermostats, locks, cameras, and lighting fixtures. The services segment, valued at USD 20.3 billion in 2023, is expanding due to the rising use of voice-controlled virtual assistants for home management.

Geographically, North America led the market with a 32.7% share in 2024, driven by consumer demand for enhanced convenience, energy efficiency, and remote home management. The US market alone accounted for USD 20.9 billion, reflecting increasing adoption of smart technologies for home automation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Advancements in wireless technologies and IoT connectivity

- 3.6.1.2 Government initiatives and support

- 3.6.1.3 Increasing demand for energy efficiency

- 3.6.1.4 Rising disposable incomes and urbanization

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Rapid technological changes

- 3.6.2.2 Reliability and dependence on internet connectivity

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Lighting control

- 5.2.2 Security & access

- 5.2.3 HVAC control

- 5.2.4 Entertainment control & others

- 5.2.5 Others

- 5.3 Services

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Wired

- 6.3 Wireless

Chapter 7 Market Estimates & Forecast, By Fitment, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 New construction

- 7.3 Retrofit

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ABB Ltd.

- 9.2 Acuity Brands

- 9.3 Amazon (Ring)

- 9.4 Apple Inc. (HomeKit)

- 9.5 Control4 Corporation

- 9.6 Crestron Electronics, Inc.

- 9.7 Ecobee Inc.

- 9.8 Google (Nest Labs)

- 9.9 Honeywell International, Inc.

- 9.10 Johnson Controls

- 9.11 Koninklijke Philips N.V

- 9.12 Legrand SA

- 9.13 Leviton Manufacturing Company, Inc.

- 9.14 Lutron Electronics Co., Inc.

- 9.15 Resideo Technologies

- 9.16 Samsung Electronics

- 9.17 Savant Systems LLC

- 9.18 Schneider Electric

- 9.19 Siemens AG