|

市场调查报告书

商品编码

1698556

汽车音响市场机会、成长动力、产业趋势分析及2025-2034年预测Car Audio Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

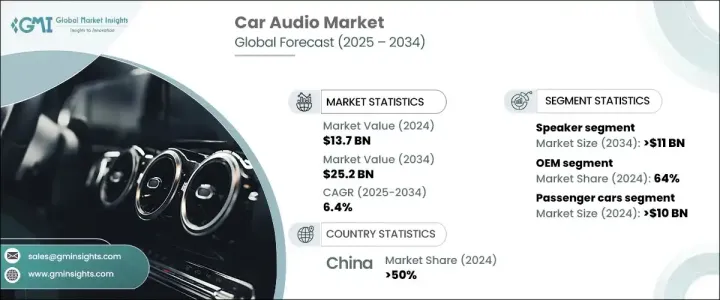

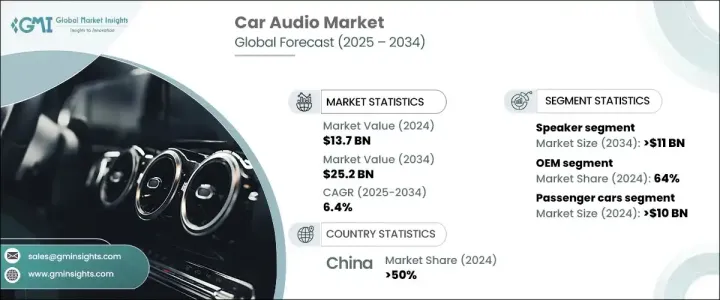

2024 年全球汽车音响市场价值为 137 亿美元,预计 2025 年至 2034 年的复合年增长率为 6.4%。电动车 (EV) 的日益普及为该行业创造了新的机会。由于电动车降低了引擎噪音,它们提供了独特的声学环境,为创新音频技术打开了大门。製造商正在开发解决方案来取代传统的引擎声音并增强车内的听觉体验。

受家庭和个人音响系统进步的影响,消费者越来越重视高品质的声音。因此,购车者正在寻找能够提供类似家庭设置的沉浸式、戏院式体验的音响系统。对许多人来说,音讯品质已成为购买汽车的决定性因素,尤其是千禧世代和 Z 世代等年轻一代。空间音讯、高解析度串流媒体和可自订的声学设定等功能正在成为汽车音响系统的重要组成部分。为了满足这些需求,汽车和售后市场製造商都在大力投资这些技术,将车辆转变为优质的声音环境。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 137 亿美元 |

| 预测值 | 252亿美元 |

| 复合年增长率 | 6.4% |

汽车音响市场按组件细分,包括扬声器、扩大机、数位讯号处理器 (DSP)、麦克风和调谐器。 2024 年,扬声器占 45% 的份额,预计到 2034 年该细分市场将创造 110 亿美元的产值。製造商正在使用碳纤维、芳纶和陶瓷注入聚合物等创新材料来提高扬声器的性能。这些材料具有更高的刚性、更轻的重量和更优异的声音传输性能,确保了车辆在温度波动和振动等苛刻条件下的使用寿命和可靠性。

汽车音响市场的销售管道分为OEM (原始设备製造商)和售后市场两类。预计到 2034 年, OEM部门将创造 160 亿美元的收入。汽车公司正专注于打造先进的音响系统,以提升车内音响体验。这些系统采用尖端的音讯处理技术,包括基于物件的声音,可产生 3D 音景,适应乘客位置和车辆的动态。这些系统中的先进演算法可以实现精确的声音分级,在车厢内提供类似音乐厅的声学沉浸式环境。

2024年,中国汽车音响市场将占50%的份额。中国製造商正在客製化音响系统,以符合当地的喜好和聆听习惯。机器学习等技术用于客製化声音设定文件,而区域语言语音助理和文化相关内容使这些系统有别于全球竞争对手。声学设计也经过优化,以适应中国城市独特的城市声音环境,为当地消费者提供增强的聆听体验。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 零件製造商

- 汽车音响系统製造商

- 软体供应商

- 技术整合商

- 最终用途

- 利润率分析

- 技术差异化因素

- 高解析度音讯技术

- 无线音讯解决方案

- 智慧连线

- 先进的放大系统

- 其他的

- 重要新闻和倡议

- 成本細項分析

- 专利分析

- 监管格局

- 衝击力

- 成长动力

- 消费者对优质音讯体验的需求不断增长

- 音讯设备与车辆的整合连接

- 消费者对个人化音讯体验的需求

- 声音技术的进步

- 产业陷阱与挑战

- 消费者价格敏感度不断提高

- 网路安全和资料隐私问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 扬声器

- 双向

- 三通

- 四通

- 扩大机

- 数位讯号处理器

- 麦克风

- 调谐器

第六章:市场估计与预测:按健全管理,2021 - 2034 年

- 主要趋势

- 语音辨识

- 手动的

第七章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车(LCV)

- 重型商用车(HCV)

第八章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 扬声器

- 扩大机

- 数位讯号处理器

- 麦克风

- 调谐器

- 售后市场

- 扬声器

- 扩大机

- 数位讯号处理器

- 麦克风

- 调谐器

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Alpine Electronics

- ASK Industries

- Bose

- Bowers & Wilkins

- Clarion

- Continental Aktiengesellschaft

- Dynaudio

- Focal JMLAB

- Harman

- JL Audio

- JVC KENWOOD

- KICKER (Stillwater Designs and Audio)

- Nippon Audiotronix

- NXP Semiconductors

- Panasonic

- Pioneer

- Premium Sound Solutions

- Rockford

- Sony

- ST Microelectronics

The Global Car Audio Market was valued at USD 13.7 billion in 2024 and is projected to grow at a CAGR of 6.4% from 2025 to 2034. The rising adoption of electric vehicles (EVs) creates new opportunities within this sector. As EVs reduce engine noise, they offer a unique acoustic environment that opens the door for innovative audio technologies. Manufacturers are developing solutions to replace traditional engine sounds and enhance the auditory experience within the vehicle.

Consumers are increasingly prioritizing high-quality sound, influenced by the advancements in home and personal audio systems. As a result, car buyers are looking for audio systems that offer immersive, theater-like experiences similar to their home setups. For many, audio quality has become a decisive factor when purchasing a vehicle, particularly among younger generations such as millennials and Gen Z. Features such as spatial audio, high-resolution streaming, and customizable acoustic settings are becoming vital components in car audio systems. To meet these demands, both automotive and aftermarket manufacturers are investing heavily in these technologies to transform vehicles into premium sound environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.7 billion |

| Forecast Value | $25.2 Billion |

| CAGR | 6.4% |

The car audio market is segmented by components, which include speakers, amplifiers, digital signal processors (DSP), microphones, and tuners. In 2024, speakers accounted for a 45% share, and this segment is expected to generate USD 11 billion by 2034. Manufacturers are enhancing speaker performance with innovative materials such as carbon fiber, aramid fiber, and ceramic-infused polymers. These materials provide increased rigidity, lighter weight, and superior sound transmission, ensuring longevity and reliability under demanding conditions within vehicles, such as temperature fluctuations and vibrations.

Sales channels in the car audio market are divided into OEM (original equipment manufacturer) and aftermarket categories. The OEM segment is projected to generate USD 16 billion by 2034. Automotive companies are focusing on creating advanced audio systems that elevate the in-vehicle sound experience. These systems use cutting-edge audio processing technologies, including object-based sound that generates 3D soundscapes, adapting to passenger positioning and the vehicle's dynamics. Advanced algorithms in these systems allow for precise sound staging, delivering an acoustically immersive environment similar to a concert hall within the vehicle cabin.

Chinese car audio market accounted for a 50% share in 2024. Manufacturers in China are customizing audio systems to align with local preferences and listening habits. Technologies such as machine learning are used to tailor sound profiles, while regional language voice assistants and culturally relevant content differentiate these systems from global competitors. Acoustic designs are also optimized to suit the unique urban sound environments in Chinese cities, offering an enhanced listening experience for local consumers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component manufacturers

- 3.2.2 Car audio system manufacturers

- 3.2.3 Software providers

- 3.2.4 Technology integrators

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology differentiators

- 3.4.1 High-resolution audio technology

- 3.4.2 Wireless audio solutions

- 3.4.3 Smart connectivity

- 3.4.4 Advanced amplification systems

- 3.4.5 Others

- 3.5 Key news & initiatives

- 3.6 Cost breakdown analysis

- 3.7 Patent analysis

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising consumer demand for premium audio experience

- 3.9.1.2 Integrated connectivity of audio devices with vehicles

- 3.9.1.3 Consumer demand for personalized audio experiences

- 3.9.1.4 Advancements in sound technologies

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Increasing consumer price sensitivity

- 3.9.2.2 Cybersecurity and data privacy concerns

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Speaker

- 5.2.1 2-way

- 5.2.2 3-way

- 5.2.3 4-way

- 5.3 Amplifiers

- 5.4 DSP

- 5.5 Microphone

- 5.6 Tuners

Chapter 6 Market Estimates & Forecast, By Sound Management, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Voice recognition

- 6.3 Manual

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.2.1 Speaker

- 8.2.2 Amplifier

- 8.2.3 DSP

- 8.2.4 Microphone

- 8.2.5 Tuners

- 8.3 Aftermarket

- 8.3.1 Speaker

- 8.3.2 Amplifier

- 8.3.3 DSP

- 8.3.4 Microphone

- 8.3.5 Tuners

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Alpine Electronics

- 10.2 ASK Industries

- 10.3 Bose

- 10.4 Bowers & Wilkins

- 10.5 Clarion

- 10.6 Continental Aktiengesellschaft

- 10.7 Dynaudio

- 10.8 Focal JMLAB

- 10.9 Harman

- 10.10 JL Audio

- 10.11 JVC KENWOOD

- 10.12 KICKER (Stillwater Designs and Audio)

- 10.13 Nippon Audiotronix

- 10.14 NXP Semiconductors

- 10.15 Panasonic

- 10.16 Pioneer

- 10.17 Premium Sound Solutions

- 10.18 Rockford

- 10.19 Sony

- 10.20 ST Microelectronics