|

市场调查报告书

商品编码

1698557

嵌入式系统市场机会、成长动力、产业趋势分析及 2025-2034 年预测Embedded Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

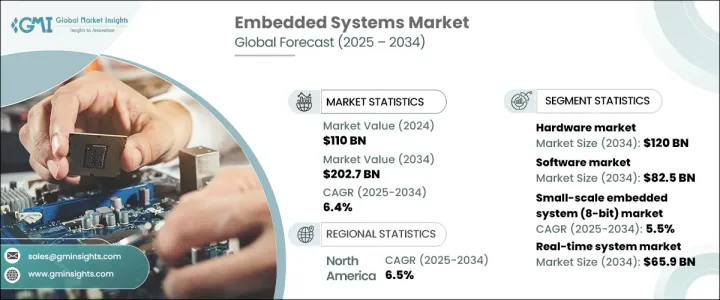

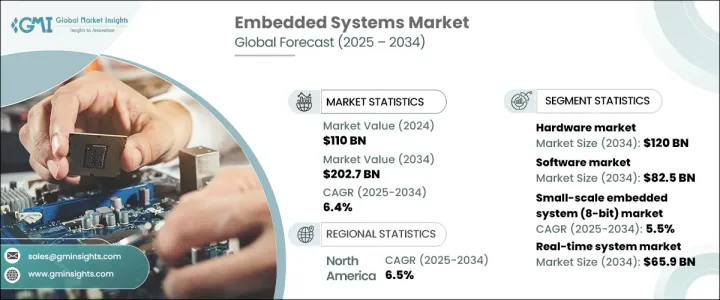

2024 年全球嵌入式系统市场规模达到 1,100 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 6.4%。汽车产业发展的激增是该市场成长的主要驱动力,尤其是嵌入式系统对于车辆安全、性能和自动化变得至关重要。配备多个微控制器的智慧车辆的需求不断增长,显示嵌入式系统的采用率正在稳步上升。电动和连网汽车的持续发展趋势进一步强调了这些系统无缝整合和运作的必要性。

嵌入式系统本质上是电脑硬体和软体的组合,旨在在更大的系统中执行特定功能。它们包括微控制器、记忆体、微处理器和输入/输出设备,可在汽车、医疗设备、消费性电子产品和家用电器等各行各业执行预先定义的任务。在这个生态系统中,硬体和软体市场都发挥关键作用。值得注意的是,各公司正在开发整合解决方案,以满足人工智慧和自动化日益普及所推动的对先进设备日益增长的需求。例如,嵌入式系统硬体领域预计到 2034 年将达到 1,200 亿美元,汽车、云端和资料中心等产业对高性能设备的需求将会增加。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1100亿美元 |

| 预测值 | 2027亿美元 |

| 复合年增长率 | 6.4% |

从细分角度来看,嵌入式系统市场根据处理能力分为小型、中型和大型系统。小规模系统(8 位元)在家庭自动化和消费性电子产品等低复杂度应用中特别突出,成长率为 5.5%。中型和大型嵌入式系统有望支援向自主系统和物联网的转变。受製造业和医疗保健等领域对快速、准确资料处理的需求日益增长的推动,即时系统领域预计到 2034 年将达到 659 亿美元。

在应用方面,包括连网汽车和自动化系统在内的汽车市场预计将以 6.6% 的复合年增长率成长。消费性电子产业是另一个关键领域,随着嵌入式系统增强智慧型手机和家用电器等智慧型设备,该产业规模到 2034 年预计将达到 513 亿美元。此外,製造业对嵌入式系统的需求庞大,以提高效率,预计到 2034 年市场规模将达到 264 亿美元。

从地理上看,美国预计将显着成长,嵌入式系统市场规模预计到 2034 年将达到 512 亿美元。机器人和电子产品在汽车和工业自动化等各个行业的渗透率不断提高,在扩大市场覆盖范围方面发挥着至关重要的作用。美国继续在创新方面处于领先地位,各公司积极开发新的解决方案,以加速各行业嵌入式系统的成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 汽车产业蓬勃发展

- 新技术的采用率上升

- 更加重视自动化和机器人技术

- 嵌入式系统在医疗保健领域的整合度不断提高

- 产业陷阱与挑战

- 开发成本高

- 嵌入式系统的复杂设计

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按系统,2021 年至 2034 年

- 主要趋势

- 硬体

- 软体

第六章:市场估计与预测:依系统规模,2021 年至 2034 年

- 主要趋势

- 小型嵌入式系统(8位元)

- 中型嵌入式系统(16-32位元)

- 大型嵌入式系统(32位元以上)

第七章:市场估计与预测:按功能,2021 年至 2034 年

- 主要趋势

- 独立系统

- 即时系统

- 网路系统

- 移动系统

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 汽车

- 消费性电子产品

- 製造机器

- 零售

- 媒体和娱乐

- 军事与国防

- 电信

- 活力

- 其他的

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Advanced Micro Devices, Inc.

- Analog Devices, Inc.

- ARM Holdings

- Broadcom Limited

- Fujitsu Limited

- Infineon Technologies

- Intel Corporation

- Lattice Semiconductor

- Marvell Technology Group Ltd.

- Microchip Technology Inc.

- NXP Semiconductor NV

- Qualcomm Technologies Inc.

- Renesas Electronics Corporation

- Samsung

- STMicroelectronics

- Texas Instruments, Inc.

- Toshiba Corporation

The Global Embedded Systems Market reached USD 110 billion in 2024 and is estimated to grow at a CAGR of 6.4% between 2025 and 2034. The surge in automotive sector developments is a major driver of this market's growth, particularly as embedded systems become crucial for vehicle safety, performance, and automation. The increasing demand for smarter vehicles, which are equipped with multiple microcontrollers, indicates a steady rise in the adoption of embedded systems. The ongoing trend toward electric and connected vehicles further emphasizes the necessity of these systems for seamless integration and operation.

Embedded systems are essentially a combination of computer hardware and software designed to perform specific functions within larger systems. They include microcontrollers, memory, microprocessors, and input/output devices that perform predefined tasks across a range of industries, including automobiles, medical devices, consumer electronics, and household appliances. Within this ecosystem, both hardware and software markets play pivotal roles. Notably, companies are developing integrated solutions to meet the rising demand for advanced devices driven by the increasing popularity of AI and automation. For example, the hardware sector of embedded systems is expected to reach USD 120 billion by 2034, with the demand for high-performance devices used in industries such as automotive, cloud, and data centers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $110 Billion |

| Forecast Value | $202.7 Billion |

| CAGR | 6.4% |

Segment-wise, the embedded systems market is divided into small-scale, medium-scale, and large-scale systems based on processing power. Small-scale systems (8-bit) are particularly prominent in low-complexity applications like home automation and consumer electronics, with a growth rate of 5.5% CAGR. Medium and large-scale embedded systems are expected to support the shift toward autonomous systems and IoT. The real-time system segment is projected to reach USD 65.9 billion by 2034, driven by the growing need for fast, accurate data processing in sectors like manufacturing and healthcare.

In terms of applications, the automotive market, which includes systems for connected cars and automation, is predicted to grow at a CAGR of 6.6%. The consumer electronics sector is another key area, set to reach USD 51.3 billion by 2034, as embedded systems enhance smart devices such as smartphones and home appliances. Additionally, the manufacturing sector is experiencing substantial demand for embedded systems to improve efficiency, with the market expected to reach USD 26.4 billion by 2034.

Geographically, the U.S. is anticipated to see significant growth, with the embedded systems market expected to hit USD 51.2 billion by 2034. The increasing penetration of robotics and electronics within various industries, such as automotive and industrial automation, plays a crucial role in expanding the market's reach. The U.S. continues to lead in innovation, with companies actively developing new solutions to accelerate the growth of embedded systems across sectors.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing automobile sector

- 3.2.1.2 Rise in adoption of newer technologies

- 3.2.1.3 Increasing focus towards automation and robotics

- 3.2.1.4 Rising integration of embedded systems in healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development cost

- 3.2.2.2 Complex design of embedded systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By System, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

Chapter 6 Market Estimates and Forecast, By System Size, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Small-scale Embedded System (8-bit)

- 6.3 Medium-scale Embedded System (16-32-bit)

- 6.4 Large-scale Embedded System(Above 32-bit)

Chapter 7 Market Estimates and Forecast, By Function, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Standalone system

- 7.3 Real-time system

- 7.4 Network system

- 7.5 Mobile system

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Consumer electronics

- 8.4 Manufacturing machines

- 8.5 Retail

- 8.6 Media & entertainment

- 8.7 Military & defense

- 8.8 Telecommunications

- 8.9 Energy

- 8.10 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Advanced Micro Devices, Inc.

- 10.2 Analog Devices, Inc.

- 10.3 ARM Holdings

- 10.4 Broadcom Limited

- 10.5 Fujitsu Limited

- 10.6 Infineon Technologies

- 10.7 Intel Corporation

- 10.8 Lattice Semiconductor

- 10.9 Marvell Technology Group Ltd.

- 10.10 Microchip Technology Inc.

- 10.11 NXP Semiconductor N.V.

- 10.12 Qualcomm Technologies Inc.

- 10.13 Renesas Electronics Corporation

- 10.14 Samsung

- 10.15 STMicroelectronics

- 10.16 Texas Instruments, Inc.

- 10.17 Toshiba Corporation