|

市场调查报告书

商品编码

1698562

卫星雷射通讯市场机会、成长动力、产业趋势分析及2025-2034年预测Satellite Laser Communication Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

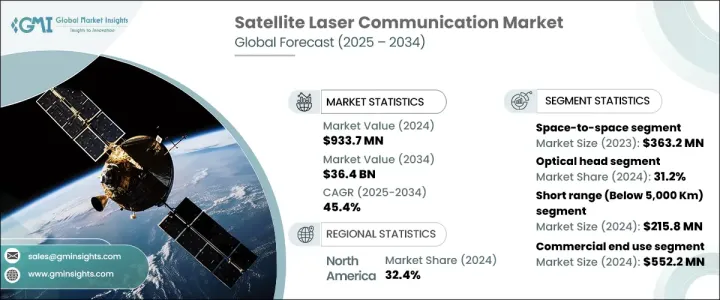

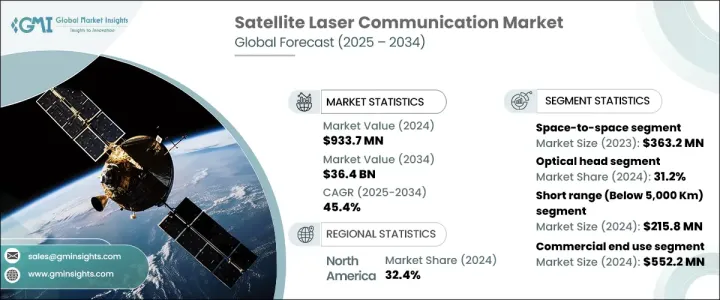

2024 年全球卫星雷射通讯市场价值为 9.337 亿美元,预计 2025 年至 2034 年期间的复合年增长率将达到 45.4%。这一成长是由对高速资料传输、增强频宽和复杂光纤系统广泛部署的需求不断增长所推动的。随着载波频率的发展,调变技术不断改进,提高了资料承载能力,实现了高效率的点对点传输。全球各地的企业都优先考虑快速可靠的连接,以提高生产力和增强客户服务,从而推动对高速资料传输的需求。卫星雷射通讯可实现卓越的资料速率,最大限度地减少讯号损失并确保无缝传输。该技术比射频系统提供更高的频宽,并且需要更低的重量、体积和功率,使其成为卫星星座和太空探索的理想选择。随着低地球轨道(LEO)卫星数量的增加,卫星雷射通讯的应用范围不断扩大。公司正在投资先进的调製技术来优化资料可靠性和传输效率。

根据解决方案,市场可细分为空间对空间、空间对地面站和空间对其他应用。太空对太空通信,2023 年价值 3.632 亿美元,支援高速卫星间资料传输,增强即时连接。太空对地面站部分预计到 2022 年价值 1.96 亿美元,可为科学研究、全球宽频和天气预报服务提供高效的资料传输。太空对其他应用在 2021 年创造了 4,650 万美元的收入,其中包括深空探索和行星任务,需要延迟最小的长距离光通讯。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9.337亿美元 |

| 预测值 | 364亿美元 |

| 复合年增长率 | 45.4% |

市场还按组件进行分类,包括光学头、调製解调器、雷射接收器和发射器以及调製器。到 2024 年,光学头部分将占据 31.2% 的市场份额,这对于使用先进光学元件实现精确的雷射光束传输至关重要。雷射接收器和发射器预计将占据 24.8% 的市场份额,可确保安全、高速的资料交换。调变解调器占 20.4% 的市场份额,可将数资料转换为光讯号,实现无缝传输;而调变器占据 17.2% 的市场份额,可提高频谱效率和资料吞吐量。

按范围细分包括短距离、中距离和长距离通讯。短距离部分价值 2024 年为 2.158 亿美元,涵盖用于地球观测和即时宽频网路的低地球轨道卫星链路。中程通讯连接不同轨道的卫星,2023 年价值 1.233 亿美元。远程部分的价值在 2022 年达到 3.259 亿美元,用于支援深空任务和行星际探测。

最终用途类别包括商业、政府和军事应用。商业领域规模最大,预计到 2024 年将达到 5.522 亿美元,由于全球宽频和资料中继服务需求的增加,该领域正在扩大。政府部门利用雷射通讯进行气候监测、灾害管理和安全资料交换,2024 年价值 2.008 亿美元。军事领域预计将在 2025 年至 2034 年期间以 46.7% 的复合年增长率成长,该领域将投资于国防和监视行动的安全高速通讯。

受电信基础设施大量投资的推动,北美将在 2024 年占据市场主导地位,占有 32.4% 的份额。美国市场价值 2024 年将达到 2.558 亿美元,由于政府和私营部门对卫星通讯系统的大力投资,该市场正在快速发展。

目录

第一章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 高速资料传输的需求不断增加

- 太空探索与卫星星座

- 越来越多地采用基于空间的服务

- 雷射通讯技术的进步

- 政府措施和投资

- 产业陷阱与挑战

- 开发和部署成本高

- 航太级组件供应有限

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依解,2021-2034 年

- 主要趋势

- 空对空

- 空对地站

- 空间对其他应用

第六章:市场估计与预测:依组件,2021-2034

- 主要趋势

- 光学头

- 雷射接收器和发射器

- 数据机

- 调节剂

- 其他的

第七章:市场估计与预测:依范围,2021-2034

- 主要趋势

- 短距离(5,000 公里以下)

- 中距离(5,000-35,000 公里)

- 长距离(35,000 公里以上)

第八章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 商业的

- 政府

- 军队

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Airbus SE

- Axelspace Corporation

- Ball Aerospace & Technologies Corp.

- Blue Canyon Technologies LLC

- BridgeComm, Inc.

- EnduroSat AD

- General Atomics Electromagnetic Systems Inc.

- Infostellar Inc.

- Kongsberg Satellite Services AS

- L3 Harris Technologies, Inc.

- Laser Light Communications, LLC

- Lockheed Martin Corporation

- Mynaric AG

- NEC Corporation

- Thales Group

The Global Satellite Laser Communication Market, valued at USD 933.7 million in 2024, is projected to surge at a CAGR of 45.4% from 2025 to 2034. This growth is driven by escalating demand for high-speed data transmission, enhanced bandwidth, and widespread deployment in complex fiber systems. As carrier frequencies evolve, modulation techniques improve, increasing data-carrying capacity for efficient point-to-point transmission. Businesses worldwide are prioritizing fast and reliable connectivity to boost productivity and enhance customer service, driving demand for high-speed data transmission. Satellite laser communication enables superior data rates, minimizing signal loss and ensuring seamless transmission. The technology offers higher bandwidth than radio frequency systems and requires lower weight, volume, and power, making it ideal for satellite constellations and space exploration. With the rising number of low Earth orbit (LEO) satellites, the adoption of satellite laser communication continues to expand. Companies are investing in advanced modulation techniques to optimize data reliability and transmission efficiency.

The market is segmented based on solutions into space-to-space, space-to-ground station, and space-to-other applications. Space-to-space communication, valued at USD 363.2 million in 2023, supports high-speed inter-satellite data transfer, enhancing real-time connectivity. The space-to-ground station segment, worth USD 196 million in 2022, enables efficient data transmission for scientific research, global broadband, and weather forecasting services. Space-to-other applications, which generated USD 46.5 million in 2021, include deep-space exploration and planetary missions, necessitating long-range optical communication with minimal latency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $933.7 Million |

| Forecast Value | $36.4 Billion |

| CAGR | 45.4% |

The market is also classified by components, including optical heads, modems, laser receivers and transmitters, and modulators. The optical head segment is set to account for 31.2% of the market in 2024, crucial for precise laser beam transmission using advanced optics. Laser receivers and transmitters, projected to hold 24.8% of the market, ensure secure, high-speed data exchange. Modems, with a 20.4% share, convert digital data into optical signals for seamless transmission, while modulators, representing 17.2% of the market, enhance spectral efficiency and data throughput.

Segmentation by range includes short, medium, and long-range communication. The short-range segment, valued at USD 215.8 million in 2024, covers LEO satellite links for Earth observation and real-time broadband networks. Medium-range communication, worth USD 123.3 million in 2023, connects satellites in different orbits. The long-range segment, valued at USD 325.9 million in 2022, supports deep-space missions and interplanetary probes.

End-use categories include commercial, government, and military applications. The commercial segment, the largest at USD 552.2 million in 2024, is expanding due to increased demand for global broadband and data relay services. The government sector, valued at USD 200.8 million in 2024, leverages laser communication for climate monitoring, disaster management, and secure data exchange. The military sector, expected to grow at a 46.7% CAGR from 2025 to 2034, invests in secure, high-speed communication for defense and surveillance operations.

North America dominates the market with a 32.4% share in 2024, driven by significant investments in telecommunication infrastructure. The US market, valued at USD 255.8 million in 2024, is advancing rapidly due to strong government and private sector investments in satellite-based communication systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for high-speed data transmission

- 3.6.1.2 Space exploration and satellite constellations

- 3.6.1.3 Increasing adoption of space-based services

- 3.6.1.4 Advancements in laser communication technology

- 3.6.1.5 Government initiatives and investments

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High development and deployment costs

- 3.6.2.2 Limited availability of space-qualified components

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Solution, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Space-to-Space

- 5.3 Space-to-Ground station

- 5.4 Space-to-Other applications

Chapter 6 Market Estimates & Forecast, By Component, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Optical head

- 6.3 Laser receivers and transmitters

- 6.4 Modems

- 6.5 Modulators

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Range, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Short range (Below 5,000 Km)

- 7.3 Medium range (5,000-35,000 Km)

- 7.4 Long range (Above 35,000 Km)

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Commercial

- 8.3 Government

- 8.4 Military

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Airbus SE

- 10.2 Axelspace Corporation

- 10.3 Ball Aerospace & Technologies Corp.

- 10.4 Blue Canyon Technologies LLC

- 10.5 BridgeComm, Inc.

- 10.6 EnduroSat AD

- 10.7 General Atomics Electromagnetic Systems Inc.

- 10.8 Infostellar Inc.

- 10.9 Kongsberg Satellite Services AS

- 10.10. L3 Harris Technologies, Inc.

- 10.11 Laser Light Communications, LLC

- 10.12 Lockheed Martin Corporation

- 10.13 Mynaric AG

- 10.14 NEC Corporation

- 10.15 Thales Group