|

市场调查报告书

商品编码

1698573

无线麦克风市场机会、成长动力、产业趋势分析及 2025-2034 年预测Wireless Microphone Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

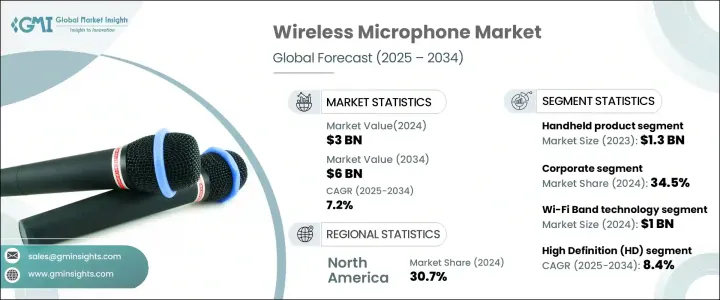

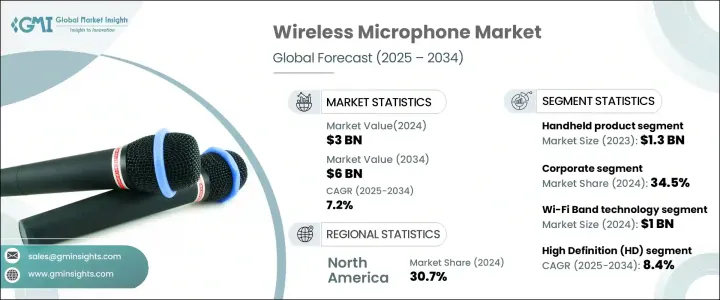

2024 年全球无线麦克风市场价值为 30 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 7.2%。这一增长受到娱乐、企业和教育领域日益增长的需求的推动。娱乐和活动产业仍然是一个主要推动力,因为无线麦克风使表演者、演讲者和广播员能够不受限制地移动。媒体和娱乐产业持续扩张,全球现场活动收入大幅成长,尤其是在疫情后。

现场表演、公开演讲和专业活动的增加加速了无线麦克风的采用。企业界也见证了无线麦克风在商务会议、研讨会和培训课程中的广泛应用。这些设备提供无缝通讯和高品质音频,不受物理限制,使其成为专业环境中的必备设备。教育机构正在将无线麦克风用于讲座、演示和课外活动,促进了市场的稳定扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 30亿美元 |

| 预测值 | 60亿美元 |

| 复合年增长率 | 7.2% |

无线麦克风有手持式和夹式两种。由于与数位无线系统和智慧技术的融合,手持设备市场在 2023 年创造了 13 亿美元的收入。夹式无线麦克风越来越受欢迎,预计到 2034 年其市场规模将达到 21 亿美元,这得益于其轻巧易携的特性,提高了演讲者和表演者的移动性。最终用途行业包括企业、教育、酒店和体育赛事。

2024 年,企业部门将占据 34.5% 的市场份额,受益于与会议工具整合的增强音讯解决方案。教育产业占了 24.2% 的份额,这得益于学术机构对无线麦克风的需求增加。 2024 年,饭店相关应用的规模将达到 4.736 亿美元,会议和娱乐活动对这些麦克风的需求也将持续成长。体育赛事也促进了市场成长,预计到 2034 年将创造 8.045 亿美元的市场规模,因为无线麦克风可以轻鬆地进行评论、指导和比赛日公告。

从技术角度来看,市场分为 Wi-Fi 频段和射频 (RF) 频段。 Wi-Fi 频段因其易于整合和支援远端监控的能力而引领市场,到 2024 年将创造 10 亿美元的收入。预计到 2034 年,射频频段部分将达到 37 亿美元,得益于其与现有音讯装置的兼容性和改进的频率管理。替代频率的使用范围不断扩大,支援跨行业的可靠音讯传输。

市场根据射频通道进一步细分,包括单通道、双通道和多通道系统。单通道部分预计将以 7.3% 的复合年增长率成长,提供可靠且经济高效的解决方案。受双人演示对高品质音讯的需求推动,双通道部分将以 7.6% 的复合年增长率扩张。多通道部分的复合年增长率为 6.7%,支援需要无干扰麦克风操作的大型活动。

2024 年,北美占全球市场份额的 30.7%,各行各业均大力采用此技术,且监管政策有利。由于现场活动和企业应用对无线麦克风的需求增加,美国市场规模达到 7.658 亿美元。

目录

第一章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 娱乐和活动产业的快速成长

- 企业和教育领域的新兴用途

- 无线音讯装置需求激增

- 日益发展的技术

- 产业陷阱与挑战

- 与干扰和频谱可用性相关的复杂性

- 先进麦克风技术成本高昂

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品,2021-2034

- 主要趋势

- 手持式

- 夹式

- 其他的

第六章:市场估计与预测:依技术,2021-2034 年

- 主要趋势

- Wi-Fi频段

- 2.4 GHz

- 3.6 GHz

- 5 GHz

- 无线电频段

- 540兆赫 - 680兆赫

- 721兆赫 - 750兆赫

- 823兆赫 - 865兆赫

第七章:市场估计与预测:按无线电频率频道,2021-2034 年

- 主要趋势

- 单通道

- 双通道

- 多通道

第八章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 公司的

- 教育

- 饭店业

- 体育赛事

- 其他的

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AKG Acoustics

- Audio-Technica Corporation

- Azden Corporation

- Beyerdynamic GmbH & Co. KG

- Countryman Associates, Inc.

- Electro-Voice (EV)

- Harman International Industries, Incorporated

- Hollyland Technology

- KLOTZ AIS GmbH

- Lectrosonics, Inc.

- Mipro Electronics Co., Ltd.

- Peavey Electronics Corporation

- Phonic Corporation

- RØDE Microphones

- Samson Technologies Corp.

- Sennheiser electronic GmbH & Co. KG

- Shure Inc.

- Sony Corporation

- Taiden Industrial Co., Ltd.

- Tascam

- TOA Corporation

- Yamaha Corporation

- Zoom Corporation

The Global Wireless Microphone Market, valued at USD 3 billion in 2024, is anticipated to grow at a 7.2% CAGR from 2025 to 2034. This growth is fueled by increasing demand across entertainment, corporate, and educational sectors. The entertainment and events industry remains a major driver, as wireless microphones enable unrestricted movement for performers, speakers, and broadcasters. The media and entertainment sector continues to expand, with global revenues from live events showing substantial growth, particularly after the pandemic.

An increase in live performances, public speaking engagements, and professional events has accelerated the adoption of wireless microphones. The corporate sector is also witnessing widespread integration of wireless microphones in business meetings, conferences, and training sessions. These devices provide seamless communication and high-quality audio without physical constraints, making them essential in professional environments. Educational institutions are incorporating wireless microphones for lectures, presentations, and extracurricular activities, contributing to the market's steady expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $6 Billion |

| CAGR | 7.2% |

Wireless microphones are available in handheld and clip-on variants. The handheld segment generated USD 1.3 billion in 2023 due to its integration with digital wireless systems and smart technologies. Clip-on wireless microphones are gaining popularity, expected to reach USD 2.1 billion by 2034, driven by their lightweight and portable nature, which enhances mobility for speakers and performers. End-use industries include corporate, education, hospitality, and sporting events.

The corporate sector accounted for 34.5% of the market in 2024, benefiting from enhanced audio solutions that integrate with conferencing tools. The education sector held a 24.2% share, propelled by increased demand for wireless microphones in academic institutions. Hospitality-related applications reached USD 473.6 million in 2024, with growing demand for these microphones in conferences and entertainment activities. Sporting events are also contributing to market growth, projected to generate USD 804.5 million by 2034, as wireless microphones facilitate commentary, coaching, and game-day announcements.

Technology-wise, the market is segmented into Wi-Fi band and radio frequency (RF) band. The Wi-Fi band segment led the market, generating USD 1 billion in 2024, owing to its ease of integration and ability to support remote monitoring. The RF band segment is projected to hit USD 3.7 billion by 2034, benefiting from its compatibility with existing audio equipment and improved frequency management. The use of alternative frequencies has expanded, supporting reliable audio transmission across industries.

The market is further segmented based on radio frequency channels, including single, dual, and multi-channel systems. The single-channel segment is set to grow at a 7.3% CAGR, offering reliable and cost-effective solutions. The dual-channel segment will expand at a 7.6% CAGR, driven by demand for high-quality audio in two-person presentations. The multi-channel segment, with a 6.7% CAGR, supports large-scale events requiring interference-free microphone operation.

North America accounted for 30.7% of the global market share in 2024, with strong adoption across industries and favorable regulatory policies. The US market reached USD 765.8 million, driven by increased demand for wireless microphones in live events and corporate applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rapid growth of the entertainment and event industry

- 3.6.1.2 Emerging use in corporate and educational sectors

- 3.6.1.3 Surge in demand for wireless audio equipment

- 3.6.1.4 Increasing technological developments

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Complexities associated with interference and spectrum availability

- 3.6.2.2 High cost of advanced microphone technology

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Handheld

- 5.3 Clip-on

- 5.4 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Wi-Fi Band

- 6.2.1 2.4 GHz

- 6.2.2 3.6 GHz

- 6.2.3 5 GHz

- 6.3 Radio Frequency band

- 6.3.1 540 MHz - 680 MHz

- 6.3.2 721 MHz - 750 MHz

- 6.3.3 823 MHz - 865 MHz

Chapter 7 Market Estimates & Forecast, By Radio Frequency Channel, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Single channel

- 7.3 Dual channel

- 7.4 Multi-channel

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Corporate

- 8.3 Education

- 8.4 Hospitality

- 8.5 Sporting events

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AKG Acoustics

- 10.2 Audio-Technica Corporation

- 10.3 Azden Corporation

- 10.4 Beyerdynamic GmbH & Co. KG

- 10.5 Countryman Associates, Inc.

- 10.6 Electro-Voice (EV)

- 10.7 Harman International Industries, Incorporated

- 10.8 Hollyland Technology

- 10.9 KLOTZ AIS GmbH

- 10.10 Lectrosonics, Inc.

- 10.11 Mipro Electronics Co., Ltd.

- 10.12 Peavey Electronics Corporation

- 10.13 Phonic Corporation

- 10.14 RØDE Microphones

- 10.15 Samson Technologies Corp.

- 10.16 Sennheiser electronic GmbH & Co. KG

- 10.17 Shure Inc.

- 10.18 Sony Corporation

- 10.19 Taiden Industrial Co., Ltd.

- 10.20 Tascam

- 10.21 TOA Corporation

- 10.22 Yamaha Corporation

- 10.23 Zoom Corporation