|

市场调查报告书

商品编码

1698579

可重复使用运输包装 (RTP) 市场机会、成长动力、产业趋势分析及 2025-2034 年预测Reusable Transport Packaging (RTP) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

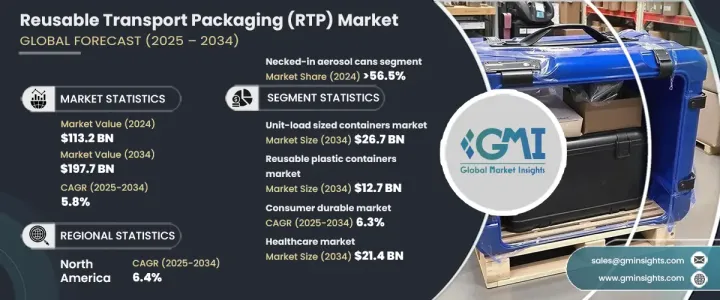

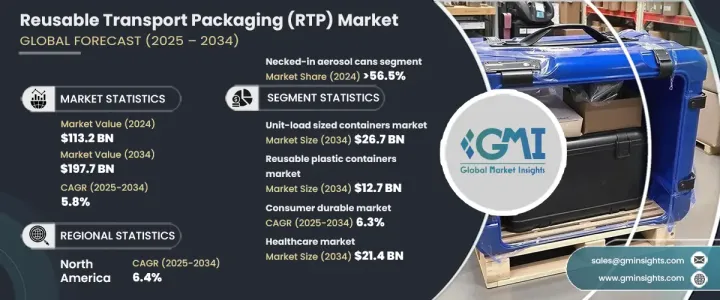

2024 年全球可重复使用运输包装市场规模达到 1,132 亿美元,预估 2025 年至 2034 年的复合年增长率为 5.8%。人们对温室气体排放日益增长的担忧正在推动人们转向永续包装解决方案。企业正专注于具有成本效益的物流,而可重复使用的运输包装 (RTP) 因其能够降低包装和废物处理成本而越来越受到关注。 RFID 和物联网追踪等先进技术正在进一步提高效率。各国政府和产业利益相关者正在推广可重复使用的包装以应对气候变化,努力的重点是减少碳排放。

可重复使用的运输包装包括手提箱、托盘、垫料和货物保护装置、可重复使用的塑胶容器、单位负载大小的容器、罐、桶和桶。托盘市场规模预计在 2024 年达到 683 亿美元,目前正在进行创新以改善运输条件。手持式板条箱预计到 2034 年将达到 256 亿美元,并被零售商广泛采用以实现高效的产品处理。垫料和货物保护领域价值 2024 年为 33 亿美元,越来越多地用于保护易碎物品。预计到 2034 年,单位载重量货柜的价值将达到 267 亿美元,这对于优化空间和减少浪费至关重要。预计到 2034 年,可重复使用的塑胶容器市场规模将达到 127 亿美元,感测器整合将增强即时追踪。预计到 2034 年,储罐、桶和桶的市场价值将达到 62 亿美元,对于运输散装液体和危险材料的行业仍然至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1132亿美元 |

| 预测值 | 1977亿美元 |

| 复合年增长率 | 5.8% |

根据材料类型,市场分为塑胶、金属和木材。 2024 年,塑胶占据了 26.4% 的市场份额,这得益于对高密度聚乙烯 (HDPE) 板条箱等轻质耐用解决方案的需求。预计到 2034 年金属包装市场规模将达到 261 亿美元,为重型应用提供强大的解决方案。预计到 2034 年木质包装的价值将达到 1,252 亿美元,对于运输需求来说,它仍然是一种经济高效且可生物降解的选择。製造商正在透过可重复使用的材料扩大其产品范围,以确保永续性和效率。

市场进一步按最终用途行业分类,包括食品和饮料、耐用消费品、汽车和医疗保健。食品和饮料行业的价值到 2024 年将达到 364 亿美元,该行业对可重复使用的容器以防止变质的需求正在增加。随着电子产品和家用电器越来越多地采用永续物流解决方案,耐用消费品领域预计将以 6.3% 的复合年增长率成长。预计到 2034 年,汽车市场规模将达到 429 亿美元,製造商将依赖高强度可重复使用的托盘。预计到 2034 年,医疗保健产业的规模将达到 214 亿美元,该产业正从使用一次性塑胶转向使用可重复使用的容器来运输精密医疗设备。

预测期内,北美可重复使用运输包装市场预计将以 6.4% 的复合年增长率成长。该地区对永续包装解决方案的需求激增,企业和消费者都优先考虑环保物流。公司正在采用可重复使用的运输包装来降低成本并减少对环境的影响。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 全球温室气体排放量增加导致可重复使用的运输包装解决方案的需求

- 从一次性包装到可重复使用包装容器的转变日益明显

- 消费者对可重复使用包装的可持续选择的偏好日益增加

- 政府对实施可重复使用包装的支持日益增加

- 不断开发创新的可重复使用包装设计,以实现高效的运输和物流处理

- 产业陷阱与挑战

- 缺乏对可重复使用容器状态的即时透明度跟踪

- 製造和设计成本高

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依包装类型,2021 年至 2034 年

- 主要趋势

- 托盘

- 手持式板条箱

- 垫料和货物保护

- 单元装载尺寸的货柜

- 可重复使用的塑胶容器

- 罐、桶和桶

- 其他的

第六章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 塑胶

- 金属

- 木头

第七章:市场估计与预测:依最终用途产业,2021 年至 2034 年

- 主要趋势

- 食品和饮料

- 耐久性消费品

- 汽车

- 卫生保健

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Auer Packaging

- Borealis AG

- CABKA

- CDF Corporation

- DS Smith

- DW Reusables

- Georg Utz Holding AG

- Greif Inc.

- GWP Group

- IFCO SYSTEMS

- IPL, Inc.

- Mauser Packaging Solutions

- Myers Industries

- Nefab Group

- ORBIS Corporation

- Rotovia Deventer bv

- Schoeller Allibert

- Schutz GmbH & Co. KGaA

- SSI SCHAEFER

- Werit

The Global Reusable Transport Packaging Market reached USD 113.2 billion in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2034. Rising concerns over greenhouse gas emissions are driving a shift towards sustainable packaging solutions. Businesses are focusing on cost-efficient logistics, and reusable transport packaging (RTP) is gaining traction due to its ability to reduce packaging and waste disposal costs. Advanced technologies such as RFID and IoT tracking are further enhancing efficiency. Governments and industry stakeholders are promoting reusable packaging to combat climate change, with efforts centered on reducing carbon emissions.

Reusable transport packaging includes handheld crates, pallets, dunnage and cargo protection, reusable plastic containers, unit-load-sized containers, tanks, drums, and barrels. The pallet market, valued at USD 68.3 billion in 2024, is undergoing innovations for improved shipment conditions. Handheld crates, expected to reach USD 25.6 billion by 2034, are widely adopted by retailers for efficient product handling. The dunnage and cargo protection segment, valued at USD 3.3 billion in 2024, is increasingly used for safeguarding fragile items. Unit-load-sized containers, estimated to reach USD 26.7 billion by 2034, are critical for space optimization and waste reduction. The reusable plastic container market is forecasted to reach USD 12.7 billion by 2034, with sensor integration enhancing real-time tracking. Tanks, drums, and barrels, projected to hit USD 6.2 billion by 2034, remain essential for industries transporting bulk liquids and hazardous materials.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $113.2 Billion |

| Forecast Value | $197.7 Billion |

| CAGR | 5.8% |

By material type, the market is segmented into plastic, metal, and wood. In 2024, plastic held a 26.4% market share, driven by the demand for lightweight and durable solutions such as high-density polyethylene (HDPE) crates. The metal packaging market is expected to reach USD 26.1 billion by 2034, offering robust solutions for heavy-duty applications. Wood-based packaging, anticipated to reach USD 125.2 billion by 2034, remains a cost-effective and biodegradable option for transportation needs. Manufacturers are expanding their offerings with reusable materials to ensure sustainability and efficiency.

The market is further categorized by end-use industries, including food and beverages, consumer durables, automotive, and healthcare. The food and beverage sector, valued at USD 36.4 billion in 2024, is witnessing an increase in demand for reusable containers to prevent spoilage. The consumer durables segment is expected to grow at a CAGR of 6.3% as sustainable logistics solutions are increasingly adopted for electronics and home appliances. The automotive market is projected to reach USD 42.9 billion by 2034, with manufacturers relying on high-strength reusable pallets. The healthcare sector, forecasted to reach USD 21.4 billion by 2034, is shifting from single-use plastics to reusable containers for transporting delicate medical equipment.

North America's reusable transport packaging market is expected to grow at a CAGR of 6.4% during the forecast period. The region is experiencing a surge in demand for sustainable packaging solutions, with businesses and consumers prioritizing eco-friendly logistics. Companies are adopting reusable transport packaging to lower costs while reducing environmental impact.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global greenhouse gas emissions leading to demand of reuseable transport packaging solutions

- 3.2.1.2 Growing shift from single-use packages to reusable packaging containers

- 3.2.1.3 Rising preferences towards the sustainable options of reusable packages

- 3.2.1.4 Growing support from the government in implementing reusable packaging

- 3.2.1.5 Increasing development of innovative reusable packaging design for efficient transport and logistic handling

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of real-time transparency in tracking the status of reusable containers

- 3.2.2.2 High cost associated with manufacturing and design

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Packaging Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Pallets

- 5.3 Handheld crates

- 5.4 Dunnage & cargo protection

- 5.5 Unit-load sized containers

- 5.6 Reusable plastic containers

- 5.7 Tanks, drums, & barrels

- 5.8 Others

Chapter 6 Market Estimates and Forecast, By Material, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Metal

- 6.4 Wood

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Consumer durables

- 7.4 Automotive

- 7.5 Healthcare

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Auer Packaging

- 9.2 Borealis AG

- 9.3 CABKA

- 9.4 CDF Corporation

- 9.5 DS Smith

- 9.6 DW Reusables

- 9.7 Georg Utz Holding AG

- 9.8 Greif Inc.

- 9.9 GWP Group

- 9.10 IFCO SYSTEMS

- 9.11 IPL, Inc.

- 9.12 Mauser Packaging Solutions

- 9.13 Myers Industries

- 9.14 Nefab Group

- 9.15 ORBIS Corporation

- 9.16 Rotovia Deventer bv

- 9.17 Schoeller Allibert

- 9.18 Schutz GmbH & Co. KGaA

- 9.19 SSI SCHAEFER

- 9.20 Werit