|

市场调查报告书

商品编码

1698583

C 臂市场机会、成长动力、产业趋势分析及 2025-2034 年预测C-arm Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

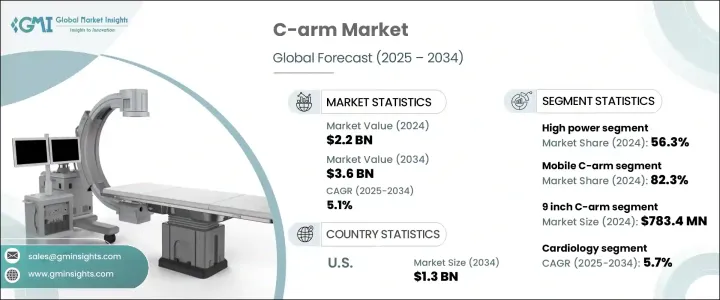

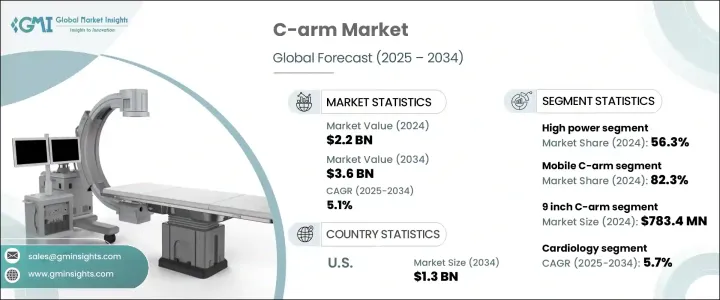

全球 C 臂市场价值 2024 年为 22 亿美元,预计 2025 年至 2034 年的复合年增长率为 5.1%。 C 臂是一种先进的成像设备,有移动和固定两种配置,旨在为医疗程序提供即时 X 光成像。这些设备在骨科、心臟病学和肿瘤学等各个专业的手术、诊断和介入放射学中发挥关键作用。由于人口老化、久坐不动的生活方式和不良的饮食习惯,慢性病发病率不断上升,推动了对先进影像解决方案的需求。

随着慢性病变得越来越普遍,诊断、治疗和外科手术对高解析度影像的需求不断增加。 C 臂系统透过提供清晰的即时视觉效果来提高手术精确度和患者治疗效果,从而促进血管成形术、整形外科手术和肿瘤切除等复杂手术的进行。成像品质、易用性和便携性的进步进一步促进了市场扩张。医院和外科中心越来越多地整合这些设备,以提高诊断准确性和治疗效率,从而加强市场稳定的成长轨迹。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 22亿美元 |

| 预测值 | 36亿美元 |

| 复合年增长率 | 5.1% |

就产品类型而言,移动式 C 臂在 2024 年占据全球市场主导地位,占有 82.3% 的份额。其便携性使其能够在医院各部门之间无缝运输,使其成为空间受限且在不同地点进行多项手术的设施的理想选择。增强的成像品质、改进的可操作性和用户友好的设计促进了它们的广泛应用。这些系统还为各种应用提供即时成像,例如创伤病例、骨科手术和透视手术,从而刺激需求并巩固其市场主导地位。

根据发电机功率,市场分为高功率和低功率部分。高功率 C 臂在 2024 年占据了 56.3% 的份额,因其能够提供对准确诊断和治疗至关重要的高解析度影像而成为外科、骨科和创伤应用的首选。这些系统在对緻密组织和复杂解剖结构进行成像时特别有价值,可确保复杂医疗程序的精确度。慢性病病例的增加、全球人口老化以及微创手术的进步继续推动对高功率 C 臂设备的需求。它们能够提供即时成像,同时最大限度地减少辐射暴露,使其成为现代医疗保健环境中的首选。

市场也按影像增强器类型进行细分,其中 9 吋 C 臂类别领先,2024 年市场规模达 7.834 亿美元。这些系统在便携性和成像解析度之间实现了最佳平衡,非常适合手术室和门诊中心的手术。它们在支持骨科手术、血管介入和疼痛管理应用方面的多功能性进一步促进了它们的广泛应用。

在各种医疗应用中,心臟病学预计到 2034 年将以 5.7% 的复合年增长率增长最快。心血管疾病的盛行率不断上升,推动了对先进影像系统的需求,以促进复杂的干预。即时成像对于血管造影和支架置入等手术至关重要,推动了该领域对 C 臂的需求不断增长。全球向微创心臟病治疗的转变正在进一步加速市场扩张。

按最终用途划分,医院占据市场主导地位,2024 年的收入为 12 亿美元。作为各种诊断和外科手术的主要医疗保健提供者,医院是 C 臂系统的主要消费者。他们拥有更高的预算和先进的医疗技术,因此能够更快地采用和整合这些成像设备。患者数量的增加,尤其是急诊和重症监护室的患者数量,继续推动需求,使医院成为市场领先地位。

受骨科、心臟病学和神经病学领域对微创手术的需求不断增长的推动,美国 C 臂市场规模预计将在 2034 年达到 13 亿美元。即时影像技术的广泛应用在提高手术精度和改善医疗机构患者预后方面发挥着至关重要的作用。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 外科手术数量不断增加

- 慢性病盛行率上升

- C臂机器的技术进步

- 微创手术的需求不断增长

- 产业陷阱与挑战

- C 臂机器成本高昂

- 缺乏熟练的医疗保健专业人员

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 固定C臂

- 移动式C臂

第六章:市场估计与预测:按发电机功率,2021 年至 2034 年

- 主要趋势

- 高功率

- 低功耗

第七章:市场估计与预测:按影像增强器类型,2021 年至 2034 年

- 主要趋势

- 9吋C臂

- 12吋C臂

- 4/6吋C型臂

- 其他类型的影像增强器

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 骨科和创伤

- 心臟病学

- 神经病学

- 胃肠病学

- 肿瘤学

- 牙科

- 其他应用

第九章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 诊断中心

- 其他最终用途

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- Canon

- Fujifilm

- GE Healthcare

- Genoray

- Hologic

- Philips

- Perlove Medical

- Shimadzu Corporation

- Siemens Healthineers

- StrenMed

- Trivitron Healthcare

- Turner Imaging Systems

- UMG/DEL Medical

- Villa Sistemi Medicali

- Ziehm Imaging

The Global C-Arm Market, valued at USD 2.2 billion in 2024, is set to grow at a CAGR of 5.1% from 2025 to 2034. A C-arm is an advanced imaging device, available in both mobile and fixed configurations, designed to deliver real-time X-ray imaging for medical procedures. These devices play a critical role in surgeries, diagnostics, and interventional radiology across various specialties, including orthopedics, cardiology, and oncology. The rising incidence of chronic diseases, fueled by aging populations, sedentary lifestyles, and poor dietary habits, is driving demand for advanced imaging solutions.

As chronic conditions become more prevalent, the need for high-resolution imaging in diagnosis, treatment, and surgical interventions continues to expand. C-arm systems facilitate complex procedures such as angioplasty, orthopedic surgeries, and tumor removals by providing clear, real-time visuals that enhance surgical precision and patient outcomes. Advances in imaging quality, ease of use, and portability further contribute to market expansion. Hospitals and surgical centers are increasingly integrating these devices to enhance diagnostic accuracy and treatment efficiency, reinforcing the market's steady growth trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $3.6 Billion |

| CAGR | 5.1% |

In terms of product type, mobile C-arms dominated the global market with an 82.3% share in 2024. Their portability enables seamless transport across various hospital departments, making them ideal for facilities where space is constrained and multiple procedures occur in different locations. Enhanced imaging quality, improved maneuverability, and user-friendly designs have contributed to their widespread adoption. These systems also provide real-time imaging for a variety of applications, such as trauma cases, orthopedic surgeries, and fluoroscopic procedures, boosting demand and solidifying their market dominance.

Based on generator power, the market is categorized into high-power and low-power segments. High-power C-arms, which captured a 56.3% share in 2024, are preferred in surgical, orthopedic, and trauma applications due to their ability to deliver high-resolution images critical for accurate diagnoses and treatments. These systems are particularly valuable in imaging dense tissues and complex anatomical structures, ensuring precision during intricate medical procedures. Growing cases of chronic diseases, an aging global population, and advancements in minimally invasive surgeries continue to propel demand for high-power C-arm devices. Their ability to deliver real-time imaging while minimizing radiation exposure makes them a preferred choice in modern healthcare settings.

The market is also segmented by image intensifier type, with the 9-inch C-arm category leading at USD 783.4 million in 2024. These systems offer an optimal balance between portability and imaging resolution, making them highly suitable for procedures in operating rooms and outpatient centers. Their versatility in supporting orthopedic surgeries, vascular interventions, and pain management applications further contributes to their widespread adoption.

Among various medical applications, cardiology is projected to grow at the fastest CAGR of 5.7% through 2034. The increasing prevalence of cardiovascular conditions is fueling the need for advanced imaging systems to facilitate complex interventions. Real-time imaging is essential in procedures like angiography and stent placement, driving the growing demand for C-arms in this segment. The global shift toward minimally invasive cardiology treatments is further accelerating market expansion.

By end use, hospitals dominated the market with USD 1.2 billion in revenue in 2024. As the primary healthcare providers for a vast range of diagnostic and surgical procedures, hospitals are major consumers of C-arm systems. Their higher budgets and access to advanced medical technologies enable faster adoption and integration of these imaging devices. Increasing patient volumes, particularly in emergency departments and critical care units, continue to drive demand, positioning hospitals as the leading segment in the market.

The U.S. C-arm market is on track to reach USD 1.3 billion by 2034, driven by the rising demand for minimally invasive procedures across orthopedic, cardiology, and neurology fields. The widespread adoption of real-time imaging technology is playing a crucial role in enhancing surgical precision and improving patient outcomes across healthcare facilities.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing number of surgical procedures

- 3.2.1.2 Rising prevalence of chronic diseases

- 3.2.1.3 Technological advancements of C-arm machines

- 3.2.1.4 Growing demand for minimally invasive procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with C-arm machines

- 3.2.2.2 Dearth of skilled healthcare professionals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Fixed C-arm

- 5.3 Mobile C-arm

Chapter 6 Market Estimates and Forecast, By Generator Power, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 High power

- 6.3 Low power

Chapter 7 Market Estimates and Forecast, By Image Intensifier Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 9 inch C-arm

- 7.3 12 inch C-arm

- 7.4 4/6 inch C-arm

- 7.5 Other image intensifier types

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Orthopedics and trauma

- 8.3 Cardiology

- 8.4 Neurology

- 8.5 Gastroenterology

- 8.6 Oncology

- 8.7 Dental

- 8.8 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Diagnostic centers

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Canon

- 11.2 Fujifilm

- 11.3 GE Healthcare

- 11.4 Genoray

- 11.5 Hologic

- 11.6 Philips

- 11.7 Perlove Medical

- 11.8 Shimadzu Corporation

- 11.9 Siemens Healthineers

- 11.10 StrenMed

- 11.11 Trivitron Healthcare

- 11.12 Turner Imaging Systems

- 11.13 UMG/DEL Medical

- 11.14 Villa Sistemi Medicali

- 11.15 Ziehm Imaging