|

市场调查报告书

商品编码

1698587

静脉注射解决方案市场机会、成长动力、产业趋势分析及 2025-2034 年预测Intravenous Solutions Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

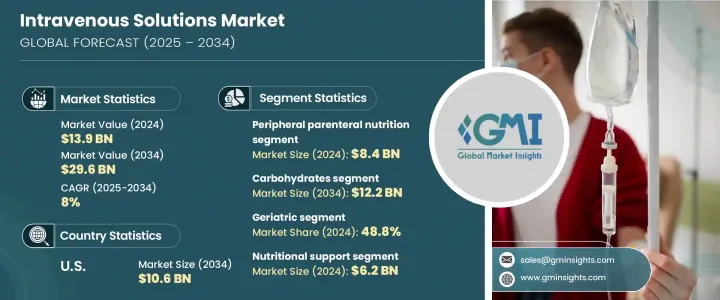

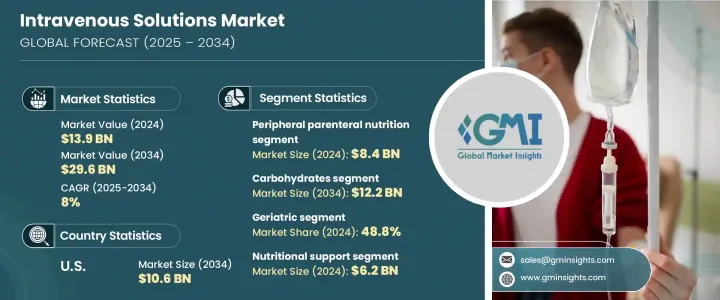

全球静脉注射溶液市场价值为 139 亿美元,预计 2025 年至 2034 年的复合年增长率为 8%。静脉 (IV) 溶液是直接注射到患者血液中的无菌液体,用于维持水分、输送药物和提供必需的营养素。由于营养不良现像日益严重、慢性病盛行以及粮食不安全,静脉注射溶液的需求正在上升。全球相当一部分人口面临营养不良的问题,加剧了对静脉注射治疗的需求。此外,新生儿和儿科护理中静脉输液的使用日益增多与早产的高发生率有关,而早产需要专门的营养支持。世界各地的医院和医疗机构继续将静脉注射解决方案融入患者护理中,用于补液疗法、营养补充和术后恢復。

市场依类型分为全肠外营养及週边肠外营养(PPN)。 2024 年,PPN 领域占据市场主导地位,营收达 84 亿美元。 PPN 是短期营养支持的首选方法,透过週边静脉提供葡萄糖、胺基酸和脂质等重要营养素。它有助于维持营养平衡,预防营养缺陷,并为口服摄取有限的患者提供支持。研究表明,及时进行 PPN 治疗可降低感染和代谢併发症的风险,使其成为现代医疗治疗的重要组成部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 139亿美元 |

| 预测值 | 296亿美元 |

| 复合年增长率 | 8% |

按成分细分,市场包括维生素和矿物质、碳水化合物、单剂量胺基酸、肠外脂肪乳剂和其他必需化合物。碳水化合物部分占 2024 年市场总收入的 40.6%,预计到 2034 年将达到 122 亿美元。葡萄糖基静脉注射溶液被广泛用于为无法透过常规方式获得营养的重症患者提供热量支持。这些解决方案在维持代谢稳定、防止肌肉分解和帮助恢復方面发挥关键作用。临床研究支持碳水化合物类静脉注射溶液在改善患者预后的有效性,尤其是在术后和创伤照护方面。

按年龄组别划分,老年人口占据最高的市场份额,占 2024 年总收入的 48.8%。老年人由于口渴感减弱、行动不便和各种健康状况,很容易脱水。静脉注射溶液可确保有效补水和营养输送,预防与慢性疾病相关的併发症。全球人口老化进一步推动了需求,医疗保健提供者越来越依赖静脉注射疗法来治疗吞嚥困难或胃肠道疾病的老年患者。

在应用方面,市场分为营养支持、输血以及液体和电解质平衡。 2024 年,营养支持领域引领市场,创造 62 亿美元的收入。营养不良、慢性病和术后恢復需求的发生率不断上升,导致了这种增长。患有胃肠道疾病或影响营养吸收的疾病的患者可以从静脉注射营养中受益匪浅,确保获得足够的营养以进行康復。

按最终用途划分,医院和诊所占据市场主导地位,2024 年的收入份额为 58.8%。这些机构严重依赖静脉注射液进行重症监护、手术、创伤管理和水合疗法。慢性病盛行率的不断上升和医疗基础设施的进步进一步促进了采用。此外,诊所也扩大了静脉注射疗法在治疗慢性病和短期治疗的应用。

在北美,静脉注射溶液市场正在快速扩张,预计到 2034 年美国市场规模将达到 106 亿美元。不断增长的医疗保健需求、确保产品品质的严格 FDA 法规以及先进静脉注射溶液的高采用率促进了市场成长。随着静脉注射疗法的不断进步和人们日益认识到其益处,未来几年市场将迎来大幅扩张。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 营养不良病例不断增加

- 早产率高

- 胃肠道疾病、神经系统疾病、癌症等疾病的发生率不断上升

- 外科手术数量不断增加

- 产业陷阱与挑战

- 严格的监管和品质要求

- 成长动力

- 成长潜力分析

- 监管格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 完全肠外营养

- 週边肠外营养

第六章:市场估计与预测:依构成,2021 年至 2034 年

- 主要趋势

- 碳水化合物

- 维生素和矿物质

- 单剂量胺基酸

- 肠外脂肪乳剂

- 其他作品

第七章:市场估计与预测:依年龄组,2021 年至 2034 年

- 主要趋势

- 儿科

- 成年人

- 老年

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 营养支持

- 输血

- 液体和电解质平衡

- 其他应用

第九章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院和诊所

- 门诊手术中心

- 居家照护环境

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- AdvaCare Pharma

- Amanta Healthcare

- Axa Parenterals

- B. Braun

- Baxter International

- Fresenius Kabi

- Grifols

- ICU Medical

- JW Life Science

- Otsuka Pharmaceutical

The Global Intravenous Solutions Market, valued at USD 13.9 billion in 2024, is projected to expand at a CAGR of 8% from 2025 to 2034. Intravenous (IV) solutions are sterile liquids administered directly into a patient's bloodstream to maintain hydration, deliver medications, and supply essential nutrients. Demand for IV solutions is rising due to increasing malnutrition, the prevalence of chronic diseases, and food insecurity. A significant portion of the global population struggles with inadequate nutrition, fueling the need for IV solutions. Additionally, the growing use of IV fluids in neonatal and pediatric care is linked to the high incidence of preterm births, which require specialized nutritional support. Hospitals and healthcare facilities worldwide continue to integrate IV solutions into patient care for hydration therapy, nutrient replenishment, and post-surgical recovery.

The market is divided by type into total parenteral nutrition and peripheral parenteral nutrition (PPN). In 2024, the PPN segment dominated the market, reaching USD 8.4 billion in revenue. PPN is a preferred method for short-term nutritional support, supplying vital nutrients such as dextrose, amino acids, and lipids through peripheral veins. It helps maintain nutritional balance, prevents deficiencies, and supports patients with limited oral intake. Research suggests that timely PPN administration reduces the risk of infections and metabolic complications, making it a crucial component in modern medical treatments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.9 Billion |

| Forecast Value | $29.6 Billion |

| CAGR | 8% |

Segmented by composition, the market includes vitamins and minerals, carbohydrates, single-dose amino acids, parenteral lipid emulsions, and other essential compounds. The carbohydrates segment accounted for 40.6% of total market revenue in 2024 and is expected to reach USD 12.2 billion by 2034. Dextrose-based IV solutions are widely used to provide caloric support to critically ill patients who cannot receive nutrition through conventional means. These solutions play a key role in maintaining metabolic stability, preventing muscle breakdown, and aiding recovery. Clinical studies support the effectiveness of carbohydrate-based IV solutions in improving patient outcomes, especially in postoperative and trauma care.

By age group, the geriatric population accounted for the highest market share, representing 48.8% of total revenue in 2024. Older adults are highly susceptible to dehydration due to reduced thirst sensation, mobility challenges, and various health conditions. IV solutions ensure effective hydration and nutrient delivery, preventing complications linked to chronic illnesses. The aging global population further drives demand, with healthcare providers increasingly relying on IV therapy for elderly patients with swallowing difficulties or gastrointestinal disorders.

In terms of application, the market is segmented into nutritional support, blood transfusion, and fluid and electrolyte balance. The nutritional support segment led the market in 2024, generating USD 6.2 billion in revenue. The rising incidence of malnutrition, chronic diseases, and post-surgical recovery needs, contribute to this growth. Patients with gastrointestinal disorders or conditions affecting nutrient absorption benefit significantly from IV-administered nutrition, ensuring adequate nourishment for recovery.

By end use, hospitals and clinics dominated the market, holding a 58.8% revenue share in 2024. These facilities rely heavily on IV solutions for critical care, surgeries, trauma management, and hydration therapy. The increasing prevalence of chronic diseases and advancements in healthcare infrastructure further boost adoption. Additionally, clinics have expanded their use of IV therapy for managing chronic conditions and short-term treatments.

In North America, the intravenous solutions market is witnessing rapid expansion, with the US projected to reach USD 10.6 billion by 2034. Rising healthcare demands, stringent FDA regulations ensuring product quality, and high adoption rates of advanced IV solutions contribute to market growth. With ongoing advancements and increasing awareness of IV therapy's benefits, the market is poised for significant expansion in the coming years.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 Synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing cases of malnutrition

- 3.2.1.2 High prevalence of pre-term births

- 3.2.1.3 Increasing prevalence of diseases, such as gastrointestinal disorder, neurological diseases, and cancer

- 3.2.1.4 Increasing number of surgical procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory and quality requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Total parenteral nutrition

- 5.3 Peripheral parenteral nutrition

Chapter 6 Market Estimates and Forecast, By Composition, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Carbohydrates

- 6.3 Vitamins and minerals

- 6.4 Single-dose amino acids

- 6.5 Parenteral lipid emulsion

- 6.6 Other compositions

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pediatric

- 7.3 Adults

- 7.4 Geriatric

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Nutritional support

- 8.3 Blood transfusion

- 8.4 Fluid and electrolyte balance

- 8.5 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals and clinics

- 9.3 Ambulatory surgery centers

- 9.4 Home care settings

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AdvaCare Pharma

- 11.2 Amanta Healthcare

- 11.3 Axa Parenterals

- 11.4 B. Braun

- 11.5 Baxter International

- 11.6 Fresenius Kabi

- 11.7 Grifols

- 11.8 ICU Medical

- 11.9 JW Life Science

- 11.10 Otsuka Pharmaceutical