|

市场调查报告书

商品编码

1698591

上游石油与天然气分析市场机会、成长动力、产业趋势分析及 2025-2034 年预测Upstream Oil and Gas Analytics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

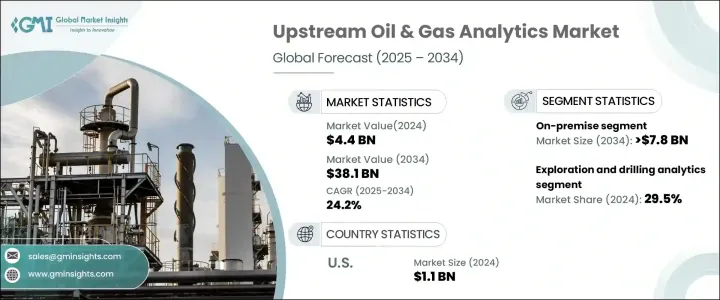

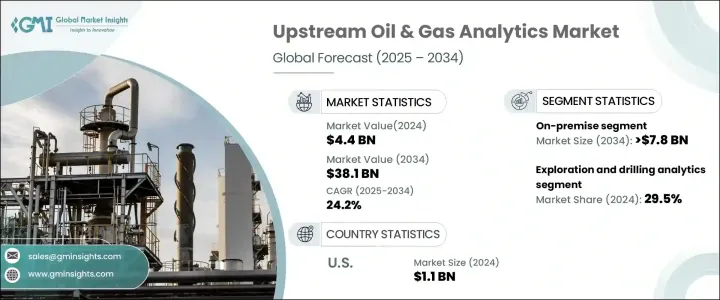

2024 年全球上游石油和天然气分析市值为 44 亿美元,预计 2025 年至 2034 年的复合年增长率为 24.2%。这一增长得益于对基础设施的大量投资和能源开发的进步,尤其是在石油和天然气领域。随着全球电力需求的不断增长,能源资源的开采也随之激增,人们更加重视石油和天然气的勘探,以满足住宅、商业和工业领域日益增长的需求。

经济成长和城市化也推动能源需求稳定上升,促使政府和能源公司加强勘探和生产力。人工智慧 (AI) 与石油和天然气营运的整合正变得越来越普遍,旨在提高生产力和效率,许多公司都在投资人工智慧驱动的工具和分析。随着越来越多的组织转向云端平台进行人工智慧应用,先进技术的采用将推动上游分析市场的进一步成长。此外,即时监控和供应链管理等上游流程的日益复杂,也推动了对优化营运和降低风险的分析的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 44亿美元 |

| 预测值 | 381亿美元 |

| 复合年增长率 | 24.2% |

在部署方面,预计到 2034 年,内部部署部分规模将超过 78 亿美元,这主要归因于对石油和天然气的需求不断增长。随着能源公司越来越依赖基于云端的解决方案,託管分析平台正在提供更具成本效益的替代方案,从而无需对内部部署基础设施进行大量投资。云端部署实现了更灵活的运营,允许公司根据市场活动扩展其资源。随着业界越来越多地采用基于云端的分析来增强营运洞察力,预计这一趋势将会持续下去。

从应用角度来看,勘探和钻井分析占据市场主导地位,到 2024 年将占据 29.5% 的市场份额。用于地震资料分析和油藏建模的人工智慧工具正在帮助公司提高勘探精度并优化钻井效率。随着越来越多的物联网感测器和边缘运算设备被整合到钻井作业中,对这些分析的需求预计会增加,从而实现即时设备监控并减少停机时间。现场监控和监控分析也至关重要,2024 年的市场价值将达到 9 亿美元。人工智慧驱动的分析可帮助公司在潜在问题出现之前发现它们,从而减少停机时间和维护成本。远端监控功能越来越受到关注,因为操作员现在无需亲自检查现场即可管理资产,从而提高了安全性和营运效率。

受能源需求成长和工业化推动,美国上游石油和天然气分析市场预计将继续成长,到 2024 年将超过 11 亿美元,并在未来几年大幅扩张。

目录

第一章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依部署,2021 年至 2034 年

- 主要趋势

- 本地

- 託管

第六章:市场规模及预测:依服务,2021 年至 2034 年

- 主要趋势

- 专业的

- 云

- 一体化

第七章:市场规模及预测:依应用,2021 年至 2034 年

- 主要趋势

- 勘探和钻探

- 现场监测和监控

- 生产计划和预测

- 设备维护管理

- 资产表现

- 劳动力管理

第八章:市场规模及预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第九章:公司简介

- Accenture

- Capgemini

- Cisco Systems

- Cognizant

- Deloitte

- Hewlett Packard Enterprise

- Hitachi

- IBM

- Microsoft

- Oracle

- SAP

- SAS Institute

- Tableau Software

- Teradata

- TIBCO Software

The Global Upstream Oil And Gas Analytics Market was valued at USD 4.4 billion in 2024 and is projected to grow at a CAGR of 24.2% from 2025 to 2034. This growth is driven by significant investments in infrastructure and advancements in energy source development, particularly within the oil and gas sector. With increasing global demand for electricity, there is a surge in the extraction of energy resources, leading to a heightened focus on oil and gas exploration to meet the growing needs across residential, commercial, and industrial sectors.

Economic growth and urbanization have also contributed to a steady rise in energy demand, prompting governments and energy companies to enhance exploration and production efforts. The integration of artificial intelligence (AI) within oil and gas operations, aimed at improving productivity and efficiency, is becoming more widespread, with many companies investing in AI-driven tools and analytics. As more organizations turn to cloud platforms for AI applications, the adoption of advanced technologies is set to drive further growth in the upstream analytics market. Additionally, the increasing complexity of upstream processes, such as real-time monitoring and supply chain management, is fueling the demand for analytics to optimize operations and mitigate risks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Billion |

| Forecast Value | $38.1 Billion |

| CAGR | 24.2% |

In terms of deployment, the on-premise segment is expected to surpass USD 7.8 billion by 2034, largely due to the rising demand for oil and gas. As energy companies increasingly rely on cloud-based solutions, hosted analytics platforms are providing more cost-effective alternatives, eliminating the need for significant investments in on-premise infrastructure. Cloud deployment enables more flexible operations, allowing companies to scale their resources according to market activity. This trend is expected to continue as the industry increasingly adopts cloud-based analytics for enhanced operational insights.

By application, exploration and drilling analytics dominate the market, accounting for 29.5% of the market share in 2024. AI-powered tools for seismic data analysis and reservoir modeling are helping companies improve exploration accuracy and optimize drilling efficiency. The demand for these analytics is expected to increase as more IoT sensors and edge computing devices are integrated into drilling operations, allowing for real-time equipment monitoring and reducing operational downtime. Field surveillance and monitoring analytics are also vital, with a market value of USD 900 million in 2024. AI-driven analytics help companies identify potential issues before they arise, reducing downtime and maintenance costs. Remote monitoring capabilities are gaining traction as operators can now manage assets without physically inspecting sites, which enhances security and operational efficiency.

The U.S. upstream oil & gas analytics market is expected to continue its growth, surpassing USD 1.1 billion in 2024 and expanding significantly in the years to come, driven by rising energy demands and industrialization.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Deployment, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 On premise

- 5.3 Hosted

Chapter 6 Market Size and Forecast, By Service, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Professional

- 6.3 Cloud

- 6.4 Integration

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Exploration and drilling

- 7.3 Field surveillance and monitoring

- 7.4 Production planning and forecasting

- 7.5 Equipment maintenance management

- 7.6 Asset performance

- 7.7 Workforce management

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Italy

- 8.3.5 Russia

- 8.3.6 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Turkey

- 8.5.4 South Africa

- 8.5.5 Egypt

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 Accenture

- 9.2 Capgemini

- 9.3 Cisco Systems

- 9.4 Cognizant

- 9.5 Deloitte

- 9.6 Hewlett Packard Enterprise

- 9.7 Hitachi

- 9.8 IBM

- 9.9 Microsoft

- 9.10 Oracle

- 9.11 SAP

- 9.12 SAS Institute

- 9.13 Tableau Software

- 9.14 Teradata

- 9.15 TIBCO Software