|

市场调查报告书

商品编码

1698600

番茄加工市场机会、成长动力、产业趋势分析及2025-2034年预测Tomato Processing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

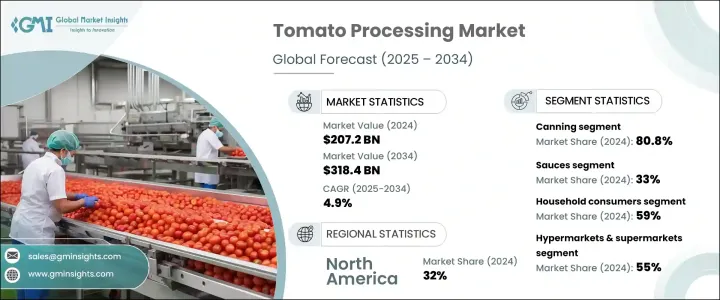

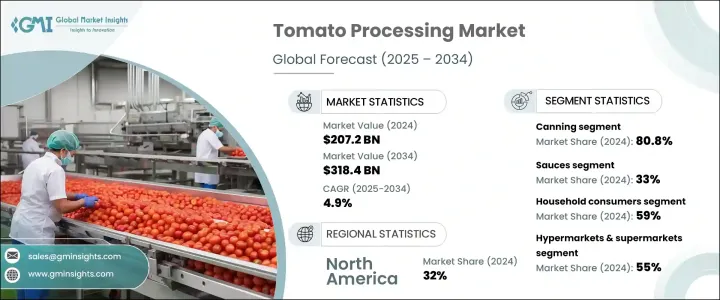

2024 年全球番茄加工市场价值为 2,072 亿美元,预计 2025 年至 2034 年的复合年增长率为 4.9%。对方便食品的需求不断增长和食品供应链的全球化是推动这一增长的关键因素。加工番茄製品已成为现代家庭和食品服务行业的必需品,推动了生产和市场扩张。消费者对快速简便的膳食解决方案的偏好导致对酱料、酱汁和罐装番茄等产品的需求激增,因为这些是即食和即煮食品的主要原料。此外,超市、大卖场和电子商务平台等现代零售业的扩张使得加工番茄产品更容易获得,进一步推动了市场成长。城市化和不断变化的饮食习惯继续增强市场的发展势头,消费者行为转向包装和预製食品。

番茄加工产业包括义大利麵、番茄罐头、番茄丁、酱汁、番茄酱、果汁、果泥、浓缩液和粉末等多种产品。其中,酱料因其在各种菜系中的广泛使用,在2024年占据了33%的市场份额。随着方便食品越来越受欢迎,即食酱料的需求也越来越大。製造商正在利用消费者偏好的变化,推出有机和低钠产品来吸引註重健康的买家。餐饮服务业(包括快餐店和休閒餐厅)仍然是市场扩张的重要贡献者,因为这些机构依靠预先准备好的番茄製品来有效率地准备餐点。食品加工和配料配方的创新进一步增强了这一领域的吸引力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2072亿美元 |

| 预测值 | 3184亿美元 |

| 复合年增长率 | 4.9% |

市面上的加工方法包括浓缩、罐装、榨汁、干燥、酱汁生产、冷冻和发酵。 2024 年,罐头占据市场主导地位,占有 80.8% 的份额,预计复合年增长率为 4.9%。罐装番茄产品的便利性和较长的保质期推动了消费者和食品服务提供者对其的需求。干燥和冷冻等其他方法吸引了寻求延长产品保质期的消费者,而榨汁则吸引了注重健康的消费者。浓缩过程可生产出番茄酱,它是一种用途广泛的烹饪原料。随着专门食品应用的利基市场的发展,发酵番茄产品也越来越受欢迎。

市场按最终用户细分,包括家庭消费者、工业食品加工商和餐厅。受便利性和可负担性的推动,家庭消费者将在 2024 年占据 59% 的市场。由于对稳定、高品质加工番茄产品的大量订单仍然至关重要,工业部门和食品服务业继续扩张。饮料和製药业也将番茄萃取物纳入新产品创新中。透过有机和优质产品实现差异化在市场竞争中发挥着至关重要的作用。

分销管道包括大卖场、超市、专卖店和便利商店,其中大卖场和超市占据主导地位,到 2024 年市场份额将达到 55%。具有竞争力的定价和广泛的产品种类使其成为主导地位。专卖店透过提供有机和优质产品来满足小众市场的需求,而便利商店则专注于即食番茄产品。网路销售和直接面向消费者的选项持续增加,提供了更广泛的选择和送货上门的便利性。

受加工番茄产品强劲需求的推动,北美在 2024 年将引领市场,占全球营收的 32%。然而,受城市化进程加快和可支配收入增加的推动,亚太地区预计将实现最高成长。永续发展措施、有机产品需求以及更严格的食品安全法规推动了欧洲市场的扩张。随着食品技术和分销的不断进步,全球番茄加工产业有望持续成长。

目录

第一章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

- 初步研究和验证

- 主要来源

- 资料探勘来源

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 方便食品需求不断成长

- 食品供应链全球化

- 增加食品零售通路

- 产业陷阱与挑战

- 番茄供应的季节性变化

- 原物料价格波动

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 酱汁

- 义大利麵

- 番茄罐头

- 番茄酱

- 汁

- 花椰菜泥

- 切丁

- 集中

- 酱

- 粉末

- 其他的

第六章:市场估计与预测:按加工方法,2021 年至 2034 年

- 主要趋势

- 罐头

- 酱料製作

- 榨汁

- 专注

- 烘干

- 冷冻

- 发酵

- 其他的

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 家庭消费者

- 工业食品加工机

- 饮料业

- 製药业

- 其他的

- 餐厅及餐饮服务

第八章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 大型超市和超市

- 食品专卖店

- 便利商店

- 其他的

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- JG Boswell Tomato Company

- Campbell Soup Company

- CFT Group

- ConAgra Brands, Inc

- CONESA Group

- Del Monte Foods, Inc

- Food & Biotech Engineers (India) Pvt. Ltd.

- JBT Corporation

- Kagome Co., Ltd.

- Los Gatos Tomato Products

- Morning Star Company

The Global Tomato Processing Market was valued at USD 207.2 billion in 2024 and is estimated to grow at a CAGR of 4.9% from 2025 to 2034. The increasing demand for convenience foods and the globalization of food supply chains are key factors driving this growth. Processed tomato products have become essential in modern households and the food service industry, fueling production and market expansion. Consumer preference for quick and easy meal solutions has led to a surge in demand for products like pastes, sauces, and canned tomatoes, as these are primary ingredients in ready-to-eat and ready-to-cook meals. Additionally, modern retail expansion, including supermarkets, hypermarkets, and e-commerce platforms, has made processed tomato products more accessible, further driving market growth. Urbanization and evolving dietary habits continue to reinforce the market's momentum, with consumer behavior shifting toward packaged and pre-prepared food options.

The tomato processing industry includes a wide range of products such as pasta, canned tomatoes, diced tomatoes, sauces, ketchup, juice, puree, concentrate, and powder. Among these, sauces held 33% of the market share in 2024 due to their extensive use in various cuisines. As convenience foods gain popularity, ready-to-eat sauces are experiencing heightened demand. Manufacturers are capitalizing on shifting consumer preferences by introducing organic and low-sodium options to appeal to health-conscious buyers. The foodservice industry, including quick-service and casual dining restaurants, remains a significant contributor to market expansion, as these establishments rely on pre-prepared tomato-based products for efficient meal preparation. Innovations in food processing and ingredient formulation further enhance the appeal of this segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $207.2 Billion |

| Forecast Value | $318.4 Billion |

| CAGR | 4.9% |

Processing methods in the market include concentration, canning, juice extraction, drying, sauce production, freezing, and fermentation. Canning dominated the market in 2024, accounting for 80.8% of the share, and is expected to grow at a 4.9% CAGR. The convenience and long shelf life of canned tomato products drive their demand among consumers and food service providers. Other methods, such as drying and freezing, attract customers looking for extended product durability, while juice extraction appeals to health-conscious consumers. Concentration processes produce tomato paste, which serves as a versatile cooking ingredient. Fermented tomato products are also gaining traction as niche markets develop for specialized food applications.

The market is segmented by end users, including household consumers, industrial food processors, and restaurants. Household consumers accounted for 59% of the market share in 2024, driven by accessibility and affordability. The industrial sector and food service industry continue to expand, as bulk orders for consistent, high-quality processed tomato products remain essential. The beverage and pharmaceutical sectors are also incorporating tomato extracts into new product innovations. Differentiation through organic and premium offerings plays a crucial role in market competition.

Distribution channels include hypermarkets, supermarkets, specialty stores, and convenience stores, with hypermarkets and supermarkets leading the segment at 55% of the market share in 2024. Competitive pricing and a wide product range contribute to their dominance. Specialty stores cater to niche markets with organic and premium selections, while convenience stores focus on ready-to-eat tomato products. Online sales and direct-to-consumer options continue to rise, offering a broader selection and home delivery convenience.

North America led the market in 2024, accounting for 32% of global revenue, driven by a strong demand for processed tomato products. However, the Asia-Pacific region is expected to witness the highest growth, supported by rising urbanization and increasing disposable incomes. Europe's market expansion is fueled by sustainability initiatives, organic product demand, and stricter food safety regulations. With ongoing advancements in food technology and distribution, the global tomato processing industry is poised for sustained growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for convenience foods

- 3.6.1.2 Globalization of food supply chains

- 3.6.1.3 Increasing food retail channels

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Seasonal variability in tomato supply

- 3.6.2.2 Price volatility of raw materials

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Sauces

- 5.3 Pasta

- 5.4 Canned tomatoes

- 5.5 Ketchup

- 5.6 Juice

- 5.7 Puree

- 5.8 Diced & chopped

- 5.9 Concentrate

- 5.10 Sauce

- 5.11 Powder

- 5.12 Others

Chapter 6 Market Estimates and Forecast, By Processing Method, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Canning

- 6.3 Sauce production

- 6.4 Juice extraction

- 6.5 Concentration

- 6.6 Drying

- 6.7 Freezing

- 6.8 Fermentation

- 6.9 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Household consumers

- 7.3 Industrial food processors

- 7.3.1 Beverage industry

- 7.3.2 Pharmaceutical industry

- 7.3.3 Others

- 7.4 Restaurants & foodservice

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Hypermarkets & supermarkets

- 8.3 Food specialty stores

- 8.4 Convenience stores

- 8.5 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 J.G. Boswell Tomato Company

- 10.2 Campbell Soup Company

- 10.3 CFT Group

- 10.4 ConAgra Brands, Inc

- 10.5 CONESA Group

- 10.6 Del Monte Foods, Inc

- 10.7 Food & Biotech Engineers (India) Pvt. Ltd.

- 10.8 JBT Corporation

- 10.9 Kagome Co., Ltd.

- 10.10 Los Gatos Tomato Products

- 10.11 Morning Star Company