|

市场调查报告书

商品编码

1698606

太阳能追踪器市场机会、成长动力、产业趋势分析及 2025-2034 年预测Solar Tracker Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

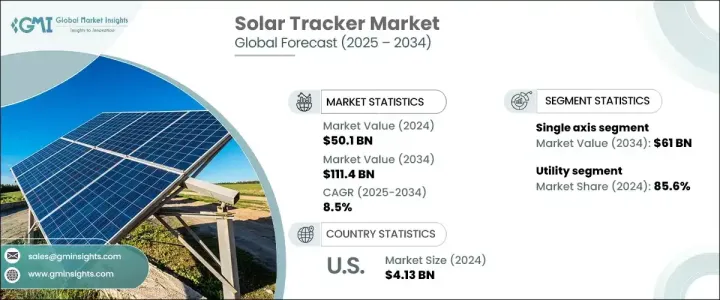

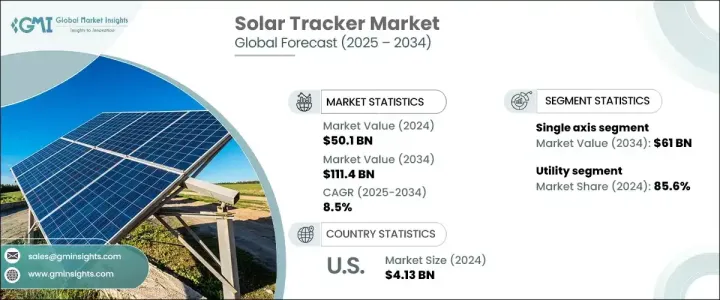

2024 年全球太阳能追踪器市场价值为 501 亿美元,预计 2025 年至 2034 年的复合年增长率为 8.5%。太阳能发电系统效率的提高,加上太阳能追踪器成本的下降,正在推动产业成长。这些系统提高了太阳能电池板的性能,与固定倾斜装置相比,单轴追踪器可将能量输出提高 10-25%,双轴追踪器可将能量输出提高高达 40%。智慧电网技术与物联网的整合可以改善能源生产的监控、控制和最佳化,从而加速市场扩张。与传统单面系统相比,配备单轴追踪器的双面太阳能组件的采用预计将使平准化电力成本降低约 16%,从而进一步刺激产品需求。太阳能追踪器技术的不断进步正在透过降低成本、提高效率和增加太阳能在多种应用中的可及性来重塑产业。

市场还受益于能源储存解决方案的整合、混合太阳能追踪系统的出现以及环保材料的使用以最大限度地减少对环境的影响。支持性监管政策、激励计画以及美国《通膨削减法案》和澳洲的Solar Sunshot计画等政府措施预计将增强商业前景。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 501亿美元 |

| 预测值 | 1114亿美元 |

| 复合年增长率 | 8.5% |

根据产品,市场分为单轴追踪器和双轴追踪器。预计到 2034 年,单轴追踪器的收入将超过 610 亿美元,与固定倾斜系统相比,效率将提高 25-35%。材料和设计的进步提高了可靠性,降低了维护成本并延长了使用寿命,从而提高了产品的采用率。此外,更高的能源产量和效率的提高可以带来更好的投资回报,从而改善产业格局。

市场分为住宅、商业和工业以及公用事业应用。 2024年,公用事业部门占据85.6%的市占率。社区太阳能计画日益普及,多个家庭受益于共享的太阳能追踪系统,这有助于该领域的扩张。与智慧家庭技术的日益融合也使房主能够更有效地监控和优化能源消耗,从而促进市场成长。

在区域分析中,美国太阳能追踪器市场在 2022 年的价值为 26 亿美元,2023 年为 41 亿美元,2024 年为 41.3 亿美元。受优惠政策、丰富的太阳能资源和大型公用事业项目扩张的推动,北美在 2024 年将占据全球 8.5% 以上的市场份额。预计联邦和州的激励措施以及旨在使追踪器更经济实惠、更适合住宅应用的持续创新将增强产业前景。持续开发具有成本效益的追踪解决方案,以及增加对太阳能基础设施的投资,将继续为整个地区创造巨大的成长机会。

目录

第一章:方法论与范围

- 研究设计

- 基础估算与计算

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 价格趋势分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与技术格局

第五章:市场规模及预测:依产品,2021 年至 2034 年

- 主要趋势

- 单轴

- 水平的

- 垂直的

- 双轴

第六章:市场规模及预测:依技术分类,2021 年至 2034 年

- 主要趋势

- 光电

- 云端服务供应商

第七章:市场规模及预测:依应用,2021 年至 2034 年

- 主要趋势

- 住宅

- 商业和工业

- 公用事业

第八章:市场规模及预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 荷兰

- 德国

- 瑞典

- 西班牙

- 奥地利

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 印尼

- 马来西亚

- 新加坡

- 泰国

- 纽西兰

- 菲律宾

- 越南

- 中东

- 沙乌地阿拉伯

- 阿联酋

- 约旦

- 以色列

- 非洲

- 南非

- 埃及

- 阿尔及利亚

- 奈及利亚

- 摩洛哥

- 拉丁美洲

- 巴西

- 智利

第九章:公司简介

- ArcelorMittal

- Array Technologies

- Arctech

- All Earth Renewables

- Convert Italia

- Degerenergie

- GameChange Solar

- Gonvarri Solar Steel

- Haosolar

- Ideematec

- Mecasolar

- Nclave

- Nextracker

- Powerway Renewable Energy

- PVHardware

- Scorpius Trackers

- SmartTrak Solar Systems

- Soltec

- STI Norland

- SunPower Corporation

- Trina Solar

The Global Solar Tracker Market was valued at USD 50.1 billion in 2024 and is projected to grow at a CAGR of 8.5% from 2025 to 2034. The increasing efficiency of solar power systems, coupled with the declining costs of solar trackers, is driving industry growth. These systems enhance solar panel performance, with single-axis trackers boosting energy output by 10-25% and dual-axis trackers by up to 40% compared to fixed-tilt installations. The integration of smart grid technologies and IoT allows for improved monitoring, control, and optimization of energy production, accelerating market expansion. The rising adoption of bifacial solar modules with single-axis trackers is expected to reduce the levelized cost of electricity by around 16% compared to traditional monofacial systems, further fueling product demand. Ongoing advancements in solar tracker technology are reshaping the industry by lowering costs, enhancing efficiency, and increasing the accessibility of solar energy across multiple applications.

The market is also benefiting from the integration of energy storage solutions, the emergence of hybrid solar tracking systems, and the use of eco-friendly materials to minimize environmental impact. Supportive regulatory policies, incentive programs, and government initiatives such as the U.S. Inflation Reduction Act and Australia's Solar Sunshot program are expected to strengthen business prospects.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $50.1 Billion |

| Forecast Value | $111.4 Billion |

| CAGR | 8.5% |

By product, the market is categorized into single-axis and dual-axis trackers. Single-axis trackers are projected to generate over USD 61 billion by 2034, offering an efficiency increase of 25-35% compared to fixed-tilt systems. Advancements in materials and design have improved reliability, reducing maintenance costs and extending lifespan, which enhances product adoption. Additionally, higher energy yields and efficiency improvements lead to better returns on investment, strengthening the industry landscape.

The market is segmented into residential, commercial & industrial, and utility applications. In 2024, the utility sector held an 85.6% share of the market. The growing popularity of community solar projects, where multiple households benefit from shared solar tracking systems, is contributing to segment expansion. Increasing integration with smart home technologies is also enabling homeowners to monitor and optimize energy consumption more effectively, fostering market growth.

In regional analysis, the U.S. solar tracker market recorded values of USD 2.6 billion in 2022, USD 4.1 billion in 2023, and USD 4.13 billion in 2024. North America held over 8.5% of the global market share in 2024, driven by favorable policies, abundant solar resources, and the expansion of large-scale utility projects. Federal and state incentives, along with continuous innovations aimed at making trackers more affordable and user-friendly for residential applications, are expected to reinforce the industry outlook. The ongoing development of cost-effective tracking solutions, alongside increasing investments in solar infrastructure, will continue to create significant growth opportunities across the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research Design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Price trend analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Billion & MW)

- 5.1 Key trends

- 5.2 Single axis

- 5.2.1 Horizontal

- 5.2.2 Vertical

- 5.3 Dual axis

Chapter 6 Market Size and Forecast, By Technology, 2021 – 2034 (USD Billion & MW)

- 6.1 Key trends

- 6.2 PV

- 6.3 CSP

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (USD Billion & MW)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial & industrial

- 7.4 Utility

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Netherlands

- 8.3.4 Germany

- 8.3.5 Sweden

- 8.3.6 Spain

- 8.3.7 Austria

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 South Korea

- 8.4.4 India

- 8.4.5 Australia

- 8.4.6 Indonesia

- 8.4.7 Malaysia

- 8.4.8 Singapore

- 8.4.9 Thailand

- 8.4.10 New Zealand

- 8.4.11 Philippines

- 8.4.12 Vietnam

- 8.5 Middle East

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Jordan

- 8.5.4 Israel

- 8.6 Africa

- 8.6.1 South Africa

- 8.6.2 Egypt

- 8.6.3 Algeria

- 8.6.4 Nigeria

- 8.6.5 Morocco

- 8.7 Latin America

- 8.7.1 Brazil

- 8.7.2 Chile

Chapter 9 Company Profiles

- 9.1 ArcelorMittal

- 9.2 Array Technologies

- 9.3 Arctech

- 9.4 All Earth Renewables

- 9.5 Convert Italia

- 9.6 Degerenergie

- 9.7 GameChange Solar

- 9.8 Gonvarri Solar Steel

- 9.9 Haosolar

- 9.10 Ideematec

- 9.11 Mecasolar

- 9.12 Nclave

- 9.13 Nextracker

- 9.14 Powerway Renewable Energy

- 9.15 PVHardware

- 9.16 Scorpius Trackers

- 9.17 SmartTrak Solar Systems

- 9.18 Soltec

- 9.19 STI Norland

- 9.20 SunPower Corporation

- 9.21 Trina Solar