|

市场调查报告书

商品编码

1698607

自我监测血糖设备市场机会、成长动力、产业趋势分析及 2025-2034 年预测Self-Monitoring Blood Glucose Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

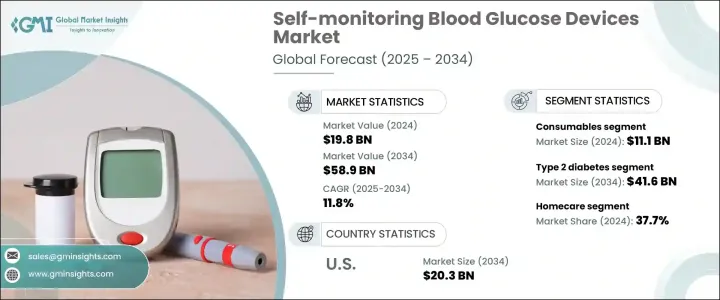

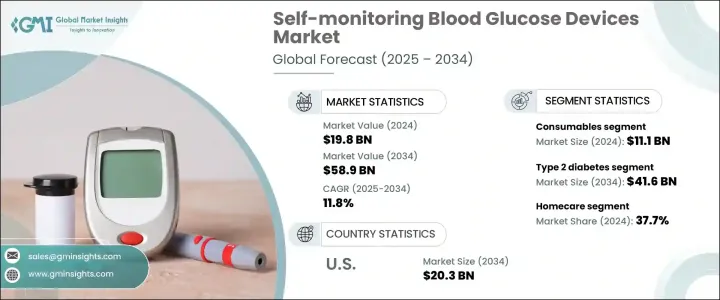

2024 年全球自我监测血糖设备市场价值为 198 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 11.8%。全球糖尿病盛行率的不断上升是市场成长的主要驱动力,数百万人需要持续血糖监测才能有效管理疾病。各国政府和医疗保健组织正在加强提高人们对糖尿病的认识,促进早期发现并鼓励采用 SMBG 设备。在欧盟,针对高风险族群设计了有针对性的筛检计划,导致对糖尿病相关治疗的需求不断增长。对频繁血糖监测的需求,特别是对于被诊断患有第 1 型和第 2 型糖尿病的个体而言,进一步加速了市场扩张。设备准确性和易用性的不断提高正在增强患者和医疗保健提供者对其的采用。

市场根据产品、应用和最终用途进行细分。根据产品,SMBG 设备市场分为自我监测血糖仪和耗材。耗材领域引领市场,2024 年产值达 111 亿美元。这些设备依赖试纸和采血针等消耗性组件,这些组件对于日常血糖监测至关重要。一次性使用的测试条由于体积小巧、使用方便,仍然是最受欢迎的组件。这些试纸的准确性对糖尿病管理有显着影响,现代版本与相容的血糖仪一起使用时可以提供精确的读数。製造商也正在改进采血针的设计,以减少采血时的痛苦,提高使用者的舒适度,并鼓励经常监测血糖。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 198亿美元 |

| 预测值 | 589亿美元 |

| 复合年增长率 | 11.8% |

根据应用,SMBG 设备市场分为第 1 型糖尿病、2 型糖尿病和妊娠期糖尿病。 2 型糖尿病占了最大的收入份额,占 2024 年市场的 69.3%,预计到 2034 年将达到 416 亿美元。 2 型糖尿病盛行率的不断上升是其占据市场主导地位的关键因素,因为患有这种疾病的人会出现胰岛素分泌受损和细胞对胰岛素反应降低的情况。肥胖和久坐习惯等与生活方式相关的风险因素的发生率不断上升,进一步促进了该领域对 SMBG 设备的需求不断增加。

根据最终用途,SMBG 设备市场分为医院、门诊手术中心、诊断中心、家庭护理和其他使用者。家庭护理成为最大的细分市场,到 2024 年占据 37.7% 的市场。独立监测血糖水平的能力减少了频繁就诊的需要,尤其有利于老年患者和行动不便的患者。这些设备在家庭中的广泛使用可以让人们即时调整饮食、运动和用药习惯,从而改善糖尿病管理。

在美国,SMBG 设备市场在 2023 年的价值为 64 亿美元,预计到 2034 年将达到 203 亿美元。该国因糖尿病而面临沉重的经济负担,与该疾病相关的医疗保健费用在 2022 年超过 4,129 亿美元,较 2017 年的 3,270 亿美元大幅增加。美国高昂的医疗保健支出促进了 SMBG 设备的广泛采用,鼓励了创新和先进的糖尿病管理解决方案。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 全球糖尿病盛行率不断上升

- 政府为提高民众意识所采取的倡议

- 已开发国家的技术进步

- 产业陷阱与挑战

- 发展中国家先进设备和配件成本高昂

- 严格的监管要求

- 成长动力

- 成长潜力分析

- 监管格局

- 未来市场趋势

- 技术格局

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 自我监测血糖仪

- 耗材

- 测试条

- 刺血针

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 1型糖尿病

- 2 型糖尿病

- 妊娠糖尿病

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 门诊手术中心(ASC)

- 诊断中心

- 居家护理

- 其他最终用途

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Abbott Laboratories

- AgaMatrix

- All Medicus

- Arkray

- Ascensia Diabetes Care Holdings

- B. Braun Melsungen

- Bionime Corporation

- DarioHealth

- F. Hoffmann-La Roche

- LifeScan

- Nova Biomedical

- Omnis Health

- Sanofi

- Sinocare

- Ypsomed Holding

The Global Self-Monitoring Blood Glucose Devices Market was valued at USD 19.8 billion in 2024 and is projected to expand at a CAGR of 11.8% from 2025 to 2034. The increasing prevalence of diabetes worldwide is the primary driver of market growth, with millions of individuals requiring continuous glucose monitoring for effective disease management. Governments and healthcare organizations are intensifying efforts to raise awareness about diabetes, promoting early detection and encouraging the adoption of SMBG devices. In the European Union, targeted screening programs are designed for high-risk populations, leading to a growing demand for diabetes-related treatments. The need for frequent blood sugar monitoring, particularly among individuals diagnosed with type 1 and type 2 diabetes, further accelerates market expansion. Continuous improvements in device accuracy and ease of use are enhancing their adoption among both patients and healthcare providers.

The market is segmented based on product, application, and end use. By product, the SMBG devices market is divided into self-monitoring blood glucose meters and consumables. The consumables segment led the market, generating USD 11.1 billion in 2024. These devices rely on consumable components such as test strips and lancets, which are critical for daily glucose monitoring. Test strips, designed for single use, remain the most in-demand component due to their compact size and convenience. The accuracy of these strips significantly impacts diabetes management, with modern versions delivering precise readings when used with compatible glucose meters. Manufacturers are also refining lancet designs to make blood sampling less painful, enhancing user comfort and encouraging frequent glucose monitoring.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.8 Billion |

| Forecast Value | $58.9 Billion |

| CAGR | 11.8% |

By application, the SMBG devices market is categorized into type 1 diabetes, type 2 diabetes, and gestational diabetes. Type 2 diabetes accounted for the largest revenue share, representing 69.3% of the market in 2024, and is projected to reach USD 41.6 billion by 2034. The growing prevalence of type 2 diabetes is a key factor behind its market dominance, as individuals with this condition experience impaired insulin production and reduced cellular response to insulin. The rising incidence of lifestyle-related risk factors, such as obesity and sedentary habits, further contributes to the increasing demand for SMBG devices in this segment.

By end use, the SMBG devices market is segmented into hospitals, ambulatory surgery centers, diagnostic centers, home care, and other users. Homecare emerged as the largest segment, holding 37.7% of the market share in 2024. The ability to monitor blood glucose levels independently reduces the need for frequent clinical visits, particularly benefiting elderly patients and those with mobility challenges. The widespread use of these devices at home allows individuals to make real-time adjustments to their diet, exercise, and medication routines, leading to improved diabetes management.

In the United States, the SMBG devices market was valued at USD 6.4 billion in 2023 and is expected to reach USD 20.3 billion by 2034. The country faces a significant economic burden due to diabetes, with healthcare costs associated with the disease exceeding USD 412.9 billion in 2022, a sharp increase from USD 327 billion in 2017. The high healthcare spending in the U.S. fosters the widespread adoption of SMBG devices, encouraging innovation and advanced diabetes management solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of diabetes worldwide

- 3.2.1.2 Government initiatives for increasing awareness among people

- 3.2.1.3 Technological advancements in developed countries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced devices and accessories in developing countries

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Technology landscape

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Self-monitoring blood glucose meters

- 5.3 Consumables

- 5.3.1 Testing strips

- 5.3.2 Lancets

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Type 1 diabetes

- 6.3 Type 2 diabetes

- 6.4 Gestational diabetes

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory Surgery Centers (ASCs)

- 7.4 Diagnostic centers

- 7.5 Home care

- 7.6 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 AgaMatrix

- 9.3 All Medicus

- 9.4 Arkray

- 9.5 Ascensia Diabetes Care Holdings

- 9.6 B. Braun Melsungen

- 9.7 Bionime Corporation

- 9.8 DarioHealth

- 9.9 F. Hoffmann-La Roche

- 9.10 LifeScan

- 9.11 Nova Biomedical

- 9.12 Omnis Health

- 9.13 Sanofi

- 9.14 Sinocare

- 9.15 Ypsomed Holding