|

市场调查报告书

商品编码

1699260

穿戴式心臟设备市场机会、成长动力、产业趋势分析及 2025-2034 年预测Wearable Cardiac Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

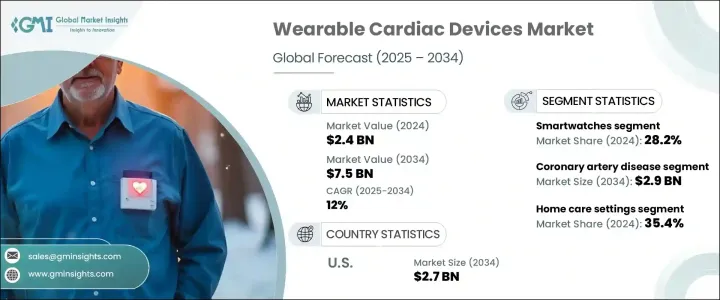

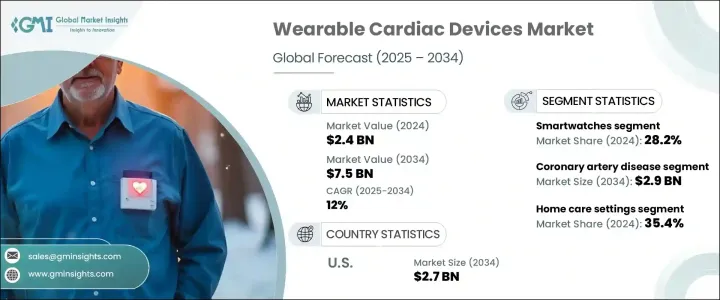

2024 年全球穿戴式心臟设备市场价值为 24 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 12%。这些便携式医疗设备允许个人每天监测他们的心臟健康,收集和分析基于心率、节律、身体活动和睡眠模式的长期资料。透过实现远端监控,他们无需频繁就诊,从而提高了患者的便利性和医疗效率。这些设备配备了先进的感测器和人工智慧分析功能,可提供即时洞察,帮助医疗保健专业人员做出明智的决策。预防性医疗保健意识的增强、心血管疾病病例的增加以及远端病人监控需求的增加正在推动市场成长。穿戴式心臟设备广泛用于心律不整监测和管理心臟衰竭和周边动脉疾病等病症。

市场按产品细分为智慧手錶、动态心电图监测仪、贴片、脉搏血氧仪、除颤器和其他穿戴式装置。智慧手錶引领了这一领域,占了 2024 年总收入的 28.2%。其用户友好的设计允许无缝追踪心臟健康,无需专业协助,使其可以被广泛的受众所接受。人工智慧演算法有助于检测心律不整并提供即时健康见解。由于这些手錶可以监测心电图、心率和氧气水平等各种生命体征,因此它们可以提供心血管健康状况的全面视图。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 24亿美元 |

| 预测值 | 75亿美元 |

| 复合年增长率 | 12% |

根据应用,市场分为冠状动脉疾病、心肌病变、心肌梗塞后、先天性心臟病、术后心臟护理和其他相关疾病。冠状动脉疾病领域在 2024 年占据了 37.4% 的市场份额,预计到 2034 年将达到 29 亿美元。缺乏运动、肥胖和吸烟等与生活方式相关的风险因素的激增,正在推动该领域对穿戴式心臟设备的需求。随着冠状动脉疾病病例的增加,医疗保健提供者越来越依赖穿戴式技术进行早期发现和疾病管理。

根据最终用途,市场进一步分为医院、专科中心、家庭护理机构和其他设施。 2024 年,居家照护环境占 35.4%,反映出人们越来越倾向于在舒适的环境中进行持续的心臟监测。这些设备使人们能够在家中追踪自己的心血管健康状况,并减少对医疗机构的依赖。法规遵从性确保了穿戴式装置在护理点环境中的有效性,进一步推动了该领域的应用。

从地区来看,受心血管疾病高发病率和医疗保健体系发达的推动,美国穿戴式心臟设备市场规模预计到 2034 年将达到 27 亿美元。消费者意识的提高和穿戴式健康设备的技术进步进一步增强了市场的成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 心血管疾病患者数量不断增加

- 穿戴式心臟设备的技术快速进步

- 微创设备日益受到青睐

- 健康意识和预防保健意识不断提高

- 产业陷阱与挑战

- 资料隐私问题

- 严格的监理政策

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 动态心电图监测仪

- 智慧手錶

- 修补

- 除颤器

- 脉搏血氧仪

- 其他产品

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 冠状动脉疾病(CAD)

- 心肌病变

- 心肌梗塞后

- 先天性心臟病

- 术后心臟护理

- 其他应用

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 专业中心

- 居家照护环境

- 其他最终用途

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Abbott Laboratories

- Boston Scientific

- Cardiac Insight

- CardiacSense

- Cardiac Rhythm

- iRhythm Technologies

- Integra LifeSciences

- Koninklijke Philips

- Medtronic

- Proteus Digital Health

- Qardio

- ZOLL Medical Corporation

- Welch Allyn

- VitalConnect

- Zimmer Biomet

The Global Wearable Cardiac Devices Market was valued at USD 2.4 billion in 2024 and is expected to expand at a CAGR of 12% from 2025 to 2034. These portable medical devices allow individuals to monitor their heart health daily, collecting and analyzing long-term data based on heart rate, rhythm, physical activity, and sleep patterns. By enabling remote monitoring, they eliminate the need for frequent clinical visits, improving patient convenience and medical efficiency. Equipped with advanced sensors and AI-powered analytics, these devices provide real-time insights, helping healthcare professionals make informed decisions. Growing awareness about preventive healthcare, rising cases of cardiovascular diseases, and increasing demand for remote patient monitoring are driving market growth. Wearable cardiac devices are widely used for cardiac arrhythmia monitoring and managing conditions such as heart failure and peripheral artery disease.

The market is segmented by product into smartwatches, Holter monitors, patches, pulse oximeters, defibrillators, and other wearable devices. Smartwatches led the segment, capturing 28.2% of total revenue in 2024. Their user-friendly design allows seamless heart health tracking without professional assistance, making them accessible to a broad audience. AI-powered algorithms help detect irregular heart rhythms and provide real-time health insights. As these watches monitor various vitals, including ECG, heart rate, and oxygen levels, they offer a comprehensive view of cardiovascular health.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $7.5 Billion |

| CAGR | 12% |

By application, the market is divided into coronary artery disease, cardiomyopathies, post-myocardial infarction, congenital heart diseases, post-surgical cardiac care, and other related conditions. The coronary artery disease segment held a 37.4% market share in 2024 and is projected to reach USD 2.9 billion by 2034. A surge in lifestyle-related risk factors such as physical inactivity, obesity, and smoking is fueling the demand for wearable cardiac devices in this segment. With rising cases of coronary artery disease, healthcare providers are increasingly relying on wearable technology for early detection and disease management.

The market is further categorized by end use into hospitals, specialty centers, home care settings, and other facilities. Home care settings accounted for a 35.4% share in 2024, reflecting a growing preference for continuous heart monitoring in comfortable environments. These devices enable individuals to track their cardiovascular health at home, reducing dependency on healthcare facilities. Regulatory compliance ensures the effectiveness of wearable devices in point-of-care settings, further driving adoption in this segment.

Regionally, the U.S. wearable cardiac devices market is anticipated to reach USD 2.7 billion by 2034, fueled by a high prevalence of cardiovascular diseases and a well-developed healthcare system. Increasing consumer awareness and technological advancements in wearable health devices are further strengthening market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of patients suffering from cardiovascular diseases

- 3.2.1.2 Rapid technological advancements in wearable cardiac devices

- 3.2.1.3 Growing preference of minimally invasive devices

- 3.2.1.4 Rising health consciousness and preventive care

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data privacy issues

- 3.2.2.2 Stringent regulatory policies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Holter monitors

- 5.3 Smartwatches

- 5.4 Patch

- 5.5 Defibrillators

- 5.6 Pulse oximeters

- 5.7 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Coronary artery disease (CAD)

- 6.3 Cardiomyopathies

- 6.4 Post-myocardial infarction

- 6.5 Congenital heart diseases

- 6.6 Post-surgical cardiac care

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Specialty centers

- 7.4 Home care settings

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Boston Scientific

- 9.3 Cardiac Insight

- 9.4 CardiacSense

- 9.5 Cardiac Rhythm

- 9.6 iRhythm Technologies

- 9.7 Integra LifeSciences

- 9.8 Koninklijke Philips

- 9.9 Medtronic

- 9.10 Proteus Digital Health

- 9.11 Qardio

- 9.12 ZOLL Medical Corporation

- 9.13 Welch Allyn

- 9.14 VitalConnect

- 9.15 Zimmer Biomet