|

市场调查报告书

商品编码

1699263

高效能活性药物成分市场机会、成长动力、产业趋势分析及 2025-2034 年预测High Potency Active Pharmaceutical Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

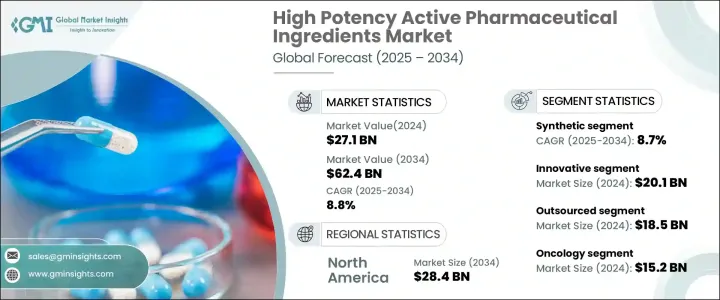

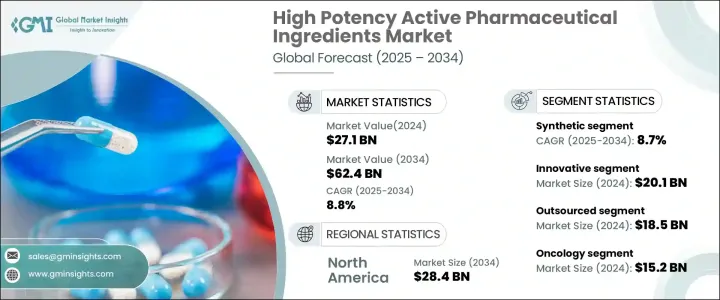

2024 年全球高效活性药物成分市场价值为 271 亿美元,预计 2025 年至 2034 年的复合年增长率为 8.8%。 HPAPI 是一种特殊的药物化合物,以最小剂量产生强大的生物效应,由于其效力,需要严格的处理和製造过程。这些成分在现代标靶治疗,特别是癌症治疗中发挥着至关重要的作用,因为它们能够更有效地传递药物,同时降低全身毒性。随着精准医疗需求的不断增长,製药公司正专注于扩大 HPAPI 的生产能力,以满足日益增长的先进疗法需求。

市场分为合成和生物技术 HPAPI,其中合成部分在 2024 年将创造 180 亿美元的收入,预计复合年增长率为 8.7%。合成 HPAPI 因其可扩展的製造流程而受到广泛青睐,使其更适合大规模生产。与需要细胞培养和发酵等复杂过程的生物技术 HPAPI 不同,合成替代品是使用完善的化学程序生产的,从而加快了药物开发时间表。随着全球慢性病盛行率的不断上升,合成HPAPI因其能够透过精确的剂量控制提供有针对性的治疗效果而继续占据市场主导地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 271亿美元 |

| 预测值 | 624亿美元 |

| 复合年增长率 | 8.8% |

根据药物类型,HPAPI 市场分为创新药和仿製药。到 2024 年,创新领域的规模将达到 201 亿美元,占市场份额的 74.3%。对癌症、自体免疫疾病和其他复杂疾病的先进治疗的需求不断增长,导致对高效 HPAPI 的投资增加。遏制系统和连续製造流程的持续技术进步正在简化生产流程,同时确保遵守严格的监管要求。此外,采用永续製造技术可降低生产成本并提高 HPAPI 开发的安全性。

市场还根据製造商类型进行细分,包括内部生产和外包生产。外包部分在 2024 年以 185 亿美元的收入领先市场。与专门的密封设施相关的高成本迫使许多製药公司依赖合约製造组织 (CMO) 来生产 HPAPI。这使得製药公司能够专注于药物研究、开发和商业化,同时利用 CMO 的专业知识来满足严格的行业标准。因此,外包已成为提高生产效率和维持成本效益的策略措施。

在应用方面,肿瘤学仍然是主导领域,2024 年贡献了 152 亿美元的收入。 HPAPI 在癌症治疗中发挥着至关重要的作用,特别是在化疗和标靶治疗中,因为它们能够攻击癌细胞,同时对健康组织的影响最小。它们在抗体-药物偶联物和免疫疗法等先进药物製剂中的应用进一步推动了市场需求。

从地理上看,北美在 2024 年的收入为 124 亿美元,预计到 2034 年将达到 284 亿美元。美国以 113 亿美元的收入领先该地区,这得益于癌症病例的增加和支持高效药物开发的严格监管要求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 癌症发生率上升

- 标靶治疗的采用日益增多

- 高效活性药物成分的应用日益广泛

- 产业陷阱与挑战

- 开发和製造成本高

- 严格的监管要求

- 成长动力

- 成长潜力分析

- 差距分析

- 专利分析

- 未来市场趋势

- 监管格局

- 技术格局

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 合成的

- 生物技术

第六章:市场估计与预测:依药物类型,2021 年至 2034 年

- 主要趋势

- 创新的

- 通用的

第七章:市场估计与预测:按製造商类型,2021 年至 2034 年

- 主要趋势

- 内部

- 外包

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 肿瘤学

- 荷尔蒙失调

- 青光眼

- 其他应用

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Albany Molecular Research

- Agilent Technologies

- Axplora

- BASF

- Boehringer Ingelheim International

- Bristol-Myers Squibb Company

- CARBOGEN AMCIS

- Cipla

- CordenPharma

- Dr. Reddy's Laboratories

- F. Hoffmann-La Roche

- Lonza

- Merck & Co.

- Novartis

- Pfizer

- Sanofi

- Sun Pharmaceutical Industries

- Teva Pharmaceutical Industries

The Global High Potency Active Pharmaceutical Ingredients Market was valued at USD 27.1 billion in 2024 and is projected to grow at a CAGR of 8.8% from 2025 to 2034. HPAPIs are specialized pharmaceutical compounds that produce strong biological effects at minimal doses, necessitating strict handling and manufacturing processes due to their potency. These ingredients play a crucial role in modern targeted therapies, particularly cancer treatments, as they enable more effective drug delivery while reducing systemic toxicity. With the rising demand for precision medicine, pharmaceutical companies are focusing on expanding HPAPI production capabilities to cater to the growing need for advanced therapies.

The market is divided into synthetic and biotech HPAPIs, with the synthetic segment generating USD 18 billion in revenue in 2024 and expected to grow at a CAGR of 8.7%. Synthetic HPAPIs are widely preferred due to their scalable manufacturing processes, making them more efficient for large-scale production. Unlike biotech HPAPIs, which require complex processes like cell culture and fermentation, synthetic alternatives are produced using well-established chemical procedures, accelerating drug development timelines. With an increasing global prevalence of chronic diseases, synthetic HPAPIs continue to dominate the market due to their ability to deliver targeted therapeutic effects with precise dosage control.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $27.1 Billion |

| Forecast Value | $62.4 Billion |

| CAGR | 8.8% |

Based on drug type, the HPAPI market is categorized into innovative and generic drugs. The innovative segment accounted for USD 20.1 billion in 2024, representing 74.3% of the market. The growing demand for advanced treatments for cancer, autoimmune diseases, and other complex conditions has led to increased investment in high-efficacy HPAPIs. Ongoing technological advancements in containment systems and continuous manufacturing processes are streamlining production while ensuring compliance with stringent regulatory requirements. Additionally, the adoption of sustainable manufacturing techniques is reducing production costs and enhancing safety in HPAPI development.

The market is also segmented by manufacturer type, with in-house and outsourced production. The outsourced segment led the market with USD 18.5 billion in revenue in 2024. The high costs associated with specialized containment facilities have driven many pharmaceutical companies to rely on contract manufacturing organizations (CMOs) for HPAPI production. This allows pharmaceutical firms to focus on drug research, development, and commercialization while leveraging the expertise of CMOs to meet stringent industry standards. As a result, outsourcing has become a strategic move to enhance production efficiency and maintain cost-effectiveness.

In terms of applications, oncology remained the dominant segment, contributing USD 15.2 billion in revenue in 2024. HPAPIs play a vital role in cancer treatments, particularly in chemotherapy and targeted therapies, due to their ability to attack cancer cells with minimal impact on healthy tissues. Their application in advanced drug formulations, including antibody-drug conjugates and immunotherapy, is further driving market demand.

Geographically, North America accounted for USD 12.4 billion in 2024 and is projected to reach USD 28.4 billion by 2034. The U.S. led the region with USD 11.3 billion in revenue, driven by increasing cancer cases and stringent regulatory requirements that support the development of high-potency pharmaceuticals.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of cancer

- 3.2.1.2 Growing adoption of targeted therapies

- 3.2.1.3 Growing application of high potency active pharmaceutical ingredients

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and manufacturing cost

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Gap analysis

- 3.5 Patent analysis

- 3.6 Future market trends

- 3.7 Regulatory landscape

- 3.8 Technological landscape

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Synthetic

- 5.3 Biotech

Chapter 6 Market Estimates and Forecast, By Drug Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Innovative

- 6.3 Generic

Chapter 7 Market Estimates and Forecast, By Manufacturer Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 In-house

- 7.3 Outsourced

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oncology

- 8.3 Hormonal imbalance

- 8.4 Glaucoma

- 8.5 Other applications

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Albany Molecular Research

- 10.2 Agilent Technologies

- 10.3 Axplora

- 10.4 BASF

- 10.5 Boehringer Ingelheim International

- 10.6 Bristol-Myers Squibb Company

- 10.7 CARBOGEN AMCIS

- 10.8 Cipla

- 10.9 CordenPharma

- 10.10 Dr. Reddy’s Laboratories

- 10.11 F. Hoffmann-La Roche

- 10.12 Lonza

- 10.13 Merck & Co.

- 10.14 Novartis

- 10.15 Pfizer

- 10.16 Sanofi

- 10.17 Sun Pharmaceutical Industries

- 10.18 Teva Pharmaceutical Industries