|

市场调查报告书

商品编码

1699266

快速流感诊断测试(RIDT)市场机会、成长动力、产业趋势分析及2025-2034年预测Rapid Influenza Diagnostic Tests (RIDT) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

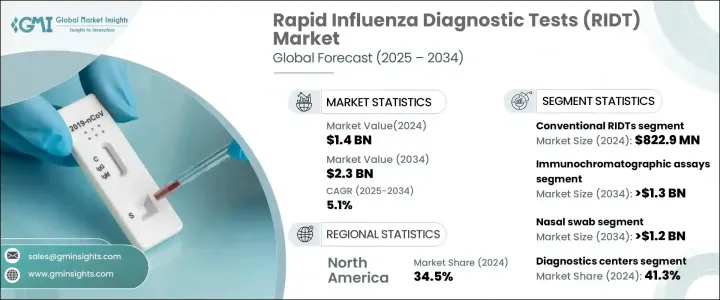

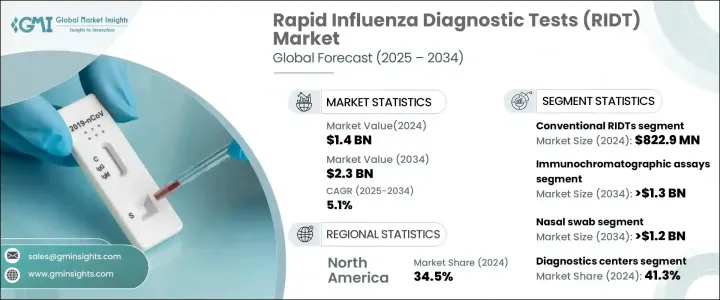

2024 年全球快速流感诊断检测市场规模达到 14 亿美元,预计 2025 年至 2034 年的复合年增长率为 5.1%。季节性流感盛行率的上升、即时检测的进步以及诊断方法的不断创新正在推动市场成长。世界各国政府正在加强流感监测并进行宣传活动,进一步扩大 RIDT 的采用。技术进步显着提高了测试准确性,数位 RIDT 提供了更高的灵敏度和特异性。

从定性到半定量 RIDT 的转变增加了它们的临床相关性,并且能够检测多种呼吸道病原体的多重测试变得越来越普遍。人工智慧 (AI) 和机器学习正在优化测试解释、减少错误并使诊断更容易获得。医疗保健基础设施方面不断增加的投资也提高了这些测试的可用性。监管机构正在透过简化审批和对公共卫生计划的财务支持来支持快速流感诊断。增加诊断测试的资金有助于提高公众意识,鼓励早期发现和治疗,并推动市场向前发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 14亿美元 |

| 预测值 | 23亿美元 |

| 复合年增长率 | 5.1% |

RIDT 市场根据产品类型、技术、样品类型、最终用途和地区进行细分。传统 RIDT 领域在 2024 年创造了 8.229 亿美元的收入。这些测试由于其价格实惠且易于取得而仍然被广泛使用,特别是在医疗保健基础设施有限的地区。它们设计简单、生产成本低,非常适合用于公共卫生项目,确保广泛普及。由于易于使用且只需极少的培训要求,这些测试可以在各种环境中实施,包括诊所、工作场所和学校。快速的结果可以实现快速决策,从而在管理季节性流感爆发方面非常有效。

从技术角度来看,免疫层析检测预计将引领市场成长,预计复合年增长率为 5.9%,到 2034 年将达到 13 亿美元以上。这些测试具有高灵敏度和特异性,对于检测儿童和老年人等弱势群体中的流感特别有价值。分散的医疗保健环境(包括药局和紧急护理中心)对免疫层析检测的需求正在增加。其紧凑的设计和最低限度的设备要求使其非常适合此类场所。持续的技术进步进一步提高了它们的速度和准确性,使其成为医疗保健专业人士的首选。

根据样本类型,鼻拭子市场预计将以 5.9% 的复合年增长率成长,到 2034 年将超过 12 亿美元。鼻拭子因其易于使用且在检测流感方面具有高准确度而被广泛使用。它们比其他样本采集方法侵入性更小,适合儿童和成人。它们能够捕获高病毒量,从而有效地进行早期流感诊断,使医疗服务提供者在护理点和实验室检测环境中受益。

2024 年,诊断中心占据了最高的最终用途收入份额,为 41.3%。这些设施提供先进的诊断技术并僱用训练有素的专业人员,确保准确且有效率的测试。对综合诊断服务(包括多种呼吸道感染的多重检测)的需求不断增长,导致诊断中心对 RIDT 的依赖性不断增强。这些设施在大规模流感监测计画中发挥着至关重要的作用,巩固了其市场主导地位。

2024 年,北美占据了 34.5% 的最大市场份额,这得益于完善的医疗保健系统、快速检测试剂盒的广泛普及以及即时检测的日益普及。 2021 年美国市场价值为 3.31 亿美元,2022 年将增至 3.658 亿美元,2023 年将增至 4.013 亿美元,反映出其在该地区的主导地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 流感流行率不断上升

- 技术进步

- 早期流感诊断和管理的需求不断增长

- 快速诊断测试日益普及

- 产业陷阱与挑战

- 缺乏熟练的专业人员

- 严格的规定

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 定价分析

- 差距分析

- 波特的分析

- PESTEL分析

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 常规RIDT

- 数字RIDT

第六章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 免疫层析分析

- 横向流动试验

- 聚合酶连锁反应

- 其他技术

第七章:市场估计与预测:依样本类型,2021 - 2034 年

- 主要趋势

- 鼻拭子

- 咽拭子

- 其他样本类型

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 诊断中心

- 医院

- 研究实验室

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 3B BlackBio

- Abbott

- Access Bio

- BD

- bioMérieux

- CHEMBIO

- DiaSorin

- Meridian

- Quidel Corporation

- Roche

- SEKISUI

- Siemens HEALTHINEERS

- Thermo Fisher

The Global Rapid Influenza Diagnostic Tests Market reached USD 1.4 billion in 2024 and is projected to grow at a CAGR of 5.1% from 2025 to 2034. The rising prevalence of seasonal flu, advancements in point-of-care testing, and continuous innovations in diagnostic methods are driving market growth. Governments worldwide are strengthening influenza surveillance and running awareness campaigns, further expanding the adoption of RIDTs. Technological advancements have significantly improved test accuracy, with digital RIDTs offering enhanced sensitivity and specificity.

The shift from qualitative to semi-quantitative RIDTs has increased their clinical relevance, and multiplexed tests capable of detecting multiple respiratory pathogens are becoming more common. Artificial intelligence (AI) and machine learning are optimizing test interpretation, reducing errors, and making diagnostics more accessible. Growing investments in healthcare infrastructure are also improving the availability of these tests. Regulatory bodies are supporting rapid influenza diagnosis through streamlined approvals and financial support for public health initiatives. Increased funding for diagnostic testing is helping expand public awareness, encouraging early detection and treatment, and driving the market forward.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.3 Billion |

| CAGR | 5.1% |

The RIDTs market is segmented based on product type, technology, sample type, end-use, and region. The conventional RIDTs segment generated USD 822.9 million in 2024. These tests remain widely used due to their affordability and ease of access, particularly in regions with limited healthcare infrastructure. Their simple design and low production cost make them ideal for use in public health programs, ensuring broad availability. The ease of use and minimal training requirements allow these tests to be implemented in a variety of settings, including clinics, workplaces, and schools. Fast results enable quick decision-making, making them highly effective in managing seasonal flu outbreaks.

By technology, immunochromatographic assays are expected to lead market growth with a projected CAGR of 5.9%, reaching over USD 1.3 billion by 2034. These tests offer high sensitivity and specificity, making them particularly valuable for detecting influenza in vulnerable populations, such as children and the elderly. The demand for immunochromatographic assays is increasing in decentralized healthcare settings, including pharmacies and urgent care centers. Their compact design and minimal equipment requirements make them well-suited for such locations. Continued technological advancements have further improved their speed and accuracy, making them a preferred choice among healthcare professionals.

Based on sample type, the nasal swab segment is projected to grow at a CAGR of 5.9%, surpassing USD 1.2 billion by 2034. Nasal swabs are widely used due to their ease of application and high accuracy in detecting influenza. They are less invasive than other sample collection methods, making them suitable for both children and adults. Their ability to capture high viral loads makes them effective in early influenza diagnosis, benefiting healthcare providers in both point-of-care and laboratory testing environments.

Diagnostic centers accounted for the highest end-use revenue share of 41.3% in 2024. These facilities offer advanced diagnostic technologies and employ trained professionals, ensuring accurate and efficient testing. The increasing demand for comprehensive diagnostic services, including multiplex testing for multiple respiratory infections, has contributed to the growing reliance on RIDTs in diagnostic centers. These facilities play a crucial role in large-scale influenza monitoring programs, reinforcing their market dominance.

North America captured the largest market share of 34.5% in 2024, driven by a well-established healthcare system, the widespread availability of rapid test kits, and the increasing adoption of point-of-care testing. The US market was valued at USD 331 million in 2021, rising to USD 365.8 million in 2022 and USD 401.3 million in 2023, reflecting its dominant position within the region.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of influenza

- 3.2.1.2 Technological advancements

- 3.2.1.3 Rising demand for early influenza diagnosis and management

- 3.2.1.4 Increasing popularity of rapid diagnostic tests

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of skilled professionals

- 3.2.2.2 Stringent regulations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Pricing analysis

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Conventional RIDTs

- 5.3 Digital RIDTs

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Immunochromatographic assays

- 6.3 Lateral flow assays

- 6.4 PCR

- 6.5 Other technologies

Chapter 7 Market Estimates and Forecast, By Sample Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Nasal swab

- 7.3 Throat swab

- 7.4 Other sample types

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Diagnostic centers

- 8.3 Hospitals

- 8.4 Research laboratories

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 3B BlackBio

- 10.2 Abbott

- 10.3 Access Bio

- 10.4 BD

- 10.5 bioMérieux

- 10.6 CHEMBIO

- 10.7 DiaSorin

- 10.8 Meridian

- 10.9 Quidel Corporation

- 10.10 Roche

- 10.11 SEKISUI

- 10.12 Siemens HEALTHINEERS

- 10.13 Thermo Fisher