|

市场调查报告书

商品编码

1699281

黏液补充剂市场机会、成长动力、产业趋势分析及 2025-2034 年预测Viscosupplementation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

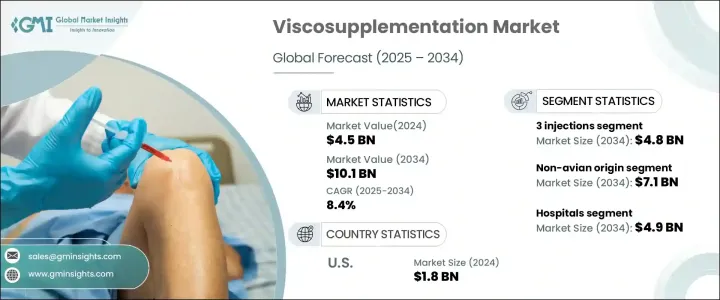

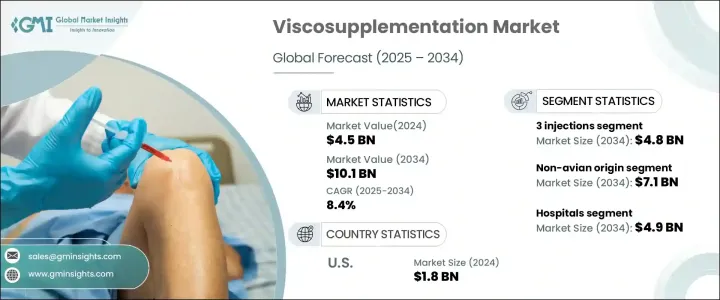

2024 年全球黏液补充剂市场规模达到 45 亿美元,预计 2025 年至 2034 年的复合年增长率为 8.4%。骨关节炎(尤其是膝关节骨性关节炎)盛行率的上升继续推动对先进治疗方案的需求。作为一种非手术干预措施,黏弹性补充疗法因其改善关节活动性、缓解疼痛和延缓侵入性手术需求的能力而获得广泛认可。由于人口老化,市场正在快速扩张,因为老年人更容易受到关节退化和骨关节炎相关併发症的影响。

随着全球骨关节炎病例激增,医疗保健提供者和患者越来越多地转向黏液补充剂进行长期症状管理。该手术包括将透明质酸注射到受影响的关节中,以恢復润滑、减少僵硬并增强活动性。患者更喜欢这种治疗方法,因为它的恢復时间最短,并且减少了对止痛药的依赖。同时,配方技术和产品纯度的不断进步正在扩大不同患者群体的采用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 45亿美元 |

| 预测值 | 101亿美元 |

| 复合年增长率 | 8.4% |

具有更强功效和更好生物相容性的下一代黏液补充剂的推出进一步推动了市场的成长。製造商不断创新以提高产品性能,确保黏液补充剂仍然是骨关节炎管理的首选。此外,政府的支持措施、不断增加的医疗支出以及对非手术治疗替代方案的认识不断提高,正在加速市场的发展轨迹。

黏液补充剂市场根据产品类型分为单次注射、三次注射和五次注射。其中,三联注射剂市场占据主导地位,2024 年收入达 21 亿美元,预计到 2034 年将达到 48 亿美元,复合年增长率为 8.5%。它在控制骨关节炎症状和恢復关节功能方面的有效性使其成为标准治疗方法。医生之所以青睐这种疗法,是因为其结构化的给药方案,可以持续缓解症状,同时最大限度地减少频繁就医的需要。由于其易于管理、治疗时间均衡、临床结果一致,该领域的受欢迎程度持续上升。

根据来源,市场分为禽源性和非禽源性黏液补充剂,其中非禽源性产品在 2024 年占据 71.6% 的市场份额。由于人们对过敏反应、道德考量和产品一致性提高的担忧日益增加,预计到 2034 年,这一细分市场的规模将达到 71 亿美元。非禽源性黏液补充剂具有更高的纯度和更低的免疫反应风险,因此越来越受到患者和医疗保健提供者的青睐。随着製造商专注于开发无过敏原、高纯度配方,向合成和生物工程替代品的转变正在进一步塑造市场。

随着北美骨关节炎病例持续增加,北美黏液补充剂市场规模将于 2024 年达到 18 亿美元。研究表明,关节炎仍然是最常见的关节疾病,影响数百万人,而骨关节炎是老年人残疾的主要原因。研究表明,65岁及以上的人中有43%患有骨关节炎,主要由于软骨退化、关节恶化和弹性降低。随着对有效、微创解决方案的需求不断增长,黏弹性补充疗法继续巩固其作为骨关节炎护理关键治疗选择的地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 老年人口日益增长,易患骨关节炎

- 微创治疗需求不断成长

- 技术进步

- 运动相关伤害增加

- 产业陷阱与挑战

- 治疗费用高

- 替代疗法的可用性

- 成长动力

- 成长潜力分析

- 监管格局

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 单次注射

- 3次注射

- 5次注射

第六章:市场估计与预测:依原产地,2021 年至 2034 年

- 主要趋势

- 禽类起源

- 非禽类来源

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 骨科诊所

- 门诊手术中心(ASC)

- 其他最终用途

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Anika Therapeutics

- APTISSEN

- Avanos

- Biotech Healthcare

- Bioventus

- Ferring Pharmaceuticals

- Fidia Pharma

- Premier Surgical

- Sanofi

- Seikagaku Corporation

- Stellar Pharmaceuticals

- TRB Pharma

- Zimmer Biomet

The Global Viscosupplementation Market reached USD 4.5 billion in 2024 and is projected to grow at a CAGR of 8.4% from 2025 to 2034. The rising prevalence of osteoarthritis, particularly knee osteoarthritis, continues to drive the demand for advanced treatment solutions. As a non-surgical intervention, viscosupplementation is gaining widespread recognition for its ability to improve joint mobility, alleviate pain, and delay the need for invasive procedures. The market is witnessing rapid expansion due to the aging population, as older individuals are more susceptible to joint degeneration and osteoarthritis-related complications.

With osteoarthritis cases surging globally, healthcare providers and patients alike are increasingly turning to viscosupplementation for long-term symptom management. The procedure involves injecting hyaluronic acid into the affected joints to restore lubrication, reduce stiffness, and enhance mobility. Patients prefer this treatment for its minimal recovery time and reduced dependence on pain medication. Meanwhile, ongoing advancements in formulation technologies and product purity are expanding adoption across diverse patient groups.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.5 Billion |

| Forecast Value | $10.1 Billion |

| CAGR | 8.4% |

The introduction of next-generation viscosupplements with extended efficacy and improved biocompatibility is further fueling market growth. Manufacturers are continuously innovating to enhance product performance, ensuring that viscosupplementation remains a preferred choice for osteoarthritis management. Additionally, supportive government initiatives, rising healthcare expenditure, and increasing awareness about non-surgical treatment alternatives are accelerating the market's trajectory.

The viscosupplementation market is segmented by product type into single injection, three injections, and five injections. Among these, the three-injection segment dominated the market with USD 2.1 billion in revenue in 2024 and is expected to reach USD 4.8 billion by 2034, registering a CAGR of 8.5%. Its effectiveness in managing osteoarthritis symptoms and restoring joint function has made it the standard treatment approach. Physicians favor this regimen due to its structured dosing schedule, which provides sustained symptom relief while minimizing the need for frequent medical visits. The segment's popularity continues to rise due to its ease of administration, balanced treatment duration, and consistent clinical outcomes.

By source, the market is categorized into avian-origin and non-avian-origin viscosupplements, with non-avian-origin products accounting for 71.6% of the market share in 2024. This segment is projected to reach USD 7.1 billion by 2034, driven by growing concerns over allergic reactions, ethical considerations, and improved product consistency. Non-avian-origin viscosupplements offer enhanced purity and a lower risk of immune response, making them increasingly preferred by both patients and healthcare providers. The transition toward synthetic and bioengineered alternatives is further shaping the market as manufacturers focus on developing allergen-free, high-purity formulations.

North America viscosupplementation market reached USD 1.8 billion in 2024, as osteoarthritis cases continue to rise across the region. Studies indicate that arthritis remains the most common joint disorder, affecting millions of individuals, with osteoarthritis being the leading cause of disability among aging populations. Research shows that 43% of individuals aged 65 and above suffer from osteoarthritis, primarily due to cartilage degeneration, joint deterioration, and reduced resilience. As demand for effective, minimally invasive solutions grows, viscosupplementation continues to cement its position as a key treatment option in osteoarthritis care.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing geriatric population prone to osteoarthritis

- 3.2.1.2 Rising demand for minimally invasive treatments

- 3.2.1.3 Technological advancements

- 3.2.1.4 Increasing sport-related injuries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment cost

- 3.2.2.2 Availability of alternative treatments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Single injection

- 5.3 3 injections

- 5.4 5 injections

Chapter 6 Market Estimates and Forecast, By Source of Origin, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Avian origin

- 6.3 Non-avian origin

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Orthopedic clinics

- 7.4 Ambulatory surgical centers (ASCs)

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Anika Therapeutics

- 9.2 APTISSEN

- 9.3 Avanos

- 9.4 Biotech Healthcare

- 9.5 Bioventus

- 9.6 Ferring Pharmaceuticals

- 9.7 Fidia Pharma

- 9.8 Premier Surgical

- 9.9 Sanofi

- 9.10 Seikagaku Corporation

- 9.11 Stellar Pharmaceuticals

- 9.12 TRB Pharma

- 9.13 Zimmer Biomet