|

市场调查报告书

商品编码

1699289

眼外伤设备市场机会、成长动力、产业趋势分析及 2025-2034 年预测Ocular Trauma Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

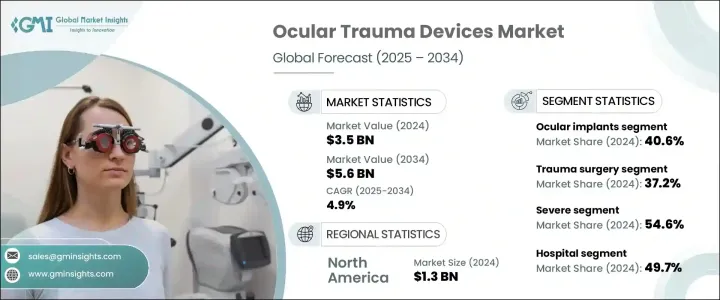

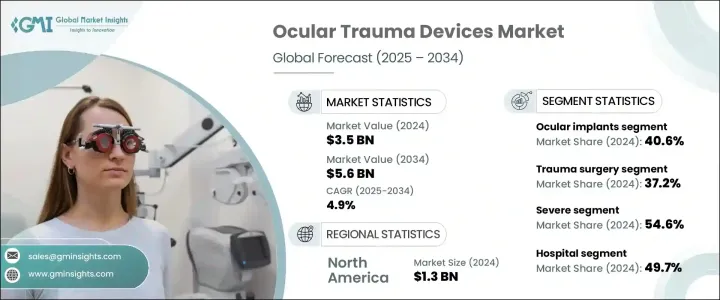

2024 年全球眼部外伤设备市场规模达到 35 亿美元,预计 2025 年至 2034 年期间的复合年增长率将达到 4.9%,这主要得益于眼外伤患病率的上升以及对专门治疗解决方案的需求不断增长。眼睛创伤仍然是一个重大的公共卫生问题,其伤害范围从轻微擦伤到需要立即进行医疗干预的严重穿透伤。早期诊断的进步、对可用治疗方案的认识的提高以及尖端手术技术的采用正在推动市场扩张。由于医疗保健提供者优先考虑对眼部创伤病例进行快速有效的干预,对高精度创伤设备的需求持续攀升。

微创手术和技术先进的设备在改善患者预后、缩短恢復时间和提高整体手术效率方面发挥着至关重要的作用。生物工程眼部植入物、机器人辅助眼科手术和眼科黏弹性装置(OVD)等创新正在获得关注,进一步促进了市场的积极发展。此外,全球各国政府的措施和医疗保健投资的增加正在加强眼科研究和开发力度,从而带来更有效的创伤管理解决方案。人工智慧与诊断工具和手术系统的整合进一步简化了治疗方案,提高了治疗精确度和效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 35亿美元 |

| 预测值 | 56亿美元 |

| 复合年增长率 | 4.9% |

医院、专科诊所和门诊手术中心越来越多地采用眼部外伤设备,在推动这一上升趋势中发挥关键作用。随着全球创伤相关手术数量的不断增加,医疗机构正在积极升级其眼科设备,从而更广泛地采用创新解决方案。

根据产品类型,眼外伤设备市场分为手术器械、人工水晶体 (IOL)、眼部植入物、眼科黏弹性装置 (OVD) 和其他相关设备。 2024 年,眼部植入物占据了 40.6% 的市场份额,这得益于需要人工水晶体和视网膜假体等辅助解决方案的严重创伤病例数量的增加。这些植入物在因事故、钝力伤害或穿透性创伤造成的结构性损伤后,对于恢復视力和维持眼部完整性起着至关重要的作用。复杂性眼部损伤的发生率不断上升,推动了对专门用于有效治疗严重病例的植入物的需求。

根据应用,市场还分为创伤手术、视网膜剥离、白内障手术、青光眼管理和其他手术。 2024 年,创伤外科占据了 37.2% 的市场份额,这主要是由于钝力创伤、穿透性伤口和需要高级外科手术干预的化学烧伤发生率不断上升。严重眼外伤的治疗涉及止血、结构修復和视功能恢復,需要使用高精度手术工具。对复杂的创伤管理解决方案的需求不断增长,正在促进市场的扩张。

美国仍然是眼外伤设备产业的主导力量,2024 年市场价值为 12.3 亿美元,预计到 2032 年将达到 18 亿美元。作为医疗技术的全球领导者,美国处于眼科创新的前沿,包括机器人眼科手术、生物工程植入物和微创手术工具。来自私营和公共部门的投资正在推动突破性研究,使製造商能够开发治疗眼外伤的下一代解决方案。随着眼部外伤护理的不断进步,未来几年市场将持续成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 眼外伤盛行率上升

- 技术进步

- 提高认识和早期诊断

- 有利的政府措施和保险覆盖

- 产业陷阱与挑战

- 治疗费用高昂

- 缺乏熟练的医疗保健专业人员

- 成长动力

- 成长潜力分析

- 监管格局

- 报销场景

- 未来市场趋势

- 差距分析

- 技术格局

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 竞争定位矩阵

- 供应商矩阵分析

- 策略仪表板

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 手术器械

- 人工水晶体(IOL)

- 眼部植入物

- 眼科黏弹装置(OVD)

- 其他产品

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 创伤外科

- 视网膜剥离

- 白内障手术

- 青光眼管理

- 其他应用

第七章:市场估计与预测:依创伤严重程度,2021 年至 2034 年

- 主要趋势

- 轻微

- 缓和

- 剧烈

第八章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 眼科诊所

- 门诊手术中心

- 其他最终用途

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 亚太地区

- 日本

- 中国

- 印度

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Alcon

- Bausch + Lomb

- Carl Zeiss Meditec

- CooperVision

- Essilor Instruments

- Haag-Streit Group

- Innovative Optics

- IRIDEX Corporation

- Johnson & Johnson Vision

- Leica Microsystems

- Optos

- Sonomed Escalon

- Topcon Corporation

The Global Ocular Trauma Devices Market reached USD 3.5 billion in 2024 and is projected to expand at a CAGR of 4.9% from 2025 to 2034, driven by the rising prevalence of eye injuries and the growing need for specialized treatment solutions. Ocular trauma remains a significant public health concern, with incidents ranging from minor abrasions to severe penetrating injuries that require immediate medical intervention. Advancements in early diagnosis, increased awareness of available treatment options, and the adoption of cutting-edge surgical techniques are fueling market expansion. As healthcare providers prioritize rapid and effective intervention for eye trauma cases, the demand for high-precision trauma devices continues to climb.

Minimally invasive procedures and technologically advanced devices are playing a crucial role in improving patient outcomes, reducing recovery time, and enhancing overall surgical efficiency. Innovations such as bioengineered ocular implants, robotic-assisted eye surgeries, and ophthalmic viscoelastic devices (OVDs) are gaining traction, further contributing to the market's positive trajectory. Moreover, government initiatives and increased healthcare investments worldwide are strengthening ophthalmic research and development efforts, leading to the introduction of more effective trauma management solutions. The integration of artificial intelligence in diagnostic tools and surgical systems is further streamlining treatment protocols, offering enhanced precision and efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $5.6 Billion |

| CAGR | 4.9% |

The increasing adoption of ocular trauma devices across hospitals, specialty clinics, and ambulatory surgical centers is playing a pivotal role in driving this upward trend. With a growing number of trauma-related surgeries performed globally, healthcare facilities are actively upgrading their ophthalmic equipment, leading to higher adoption of innovative solutions.

By product type, the ocular trauma devices market is segmented into surgical instruments, intraocular lenses (IOLs), ocular implants, ophthalmic viscoelastic devices (OVDs), and other related devices. Ocular implants captured a 40.6% market share in 2024, propelled by the rising number of severe trauma cases necessitating secondary solutions such as artificial lenses and retinal prostheses. These implants play a vital role in restoring vision and maintaining ocular integrity following structural damage caused by accidents, blunt force injuries, or penetrating trauma. The increasing prevalence of complex ocular injuries is fueling demand for specialized implants designed to address severe cases effectively.

The market is also categorized by application into trauma surgery, retinal detachment, cataract surgery, glaucoma management, and other procedures. Trauma surgery accounted for a 37.2% market share in 2024, driven by the rising incidence of blunt force trauma, penetrating wounds, and chemical burns requiring advanced surgical interventions. Managing severe ocular trauma involves hemorrhage control, structural repairs, and visual function restoration, necessitating the use of high-precision surgical tools. The growing demand for sophisticated trauma management solutions is reinforcing the market's expansion.

The United States remains a dominant force in the ocular trauma devices industry, with the market valued at USD 1.23 billion in 2024 and expected to generate USD 1.8 billion by 2032. As a global leader in medical technology, the country is at the forefront of ophthalmic innovations, including robotic eye surgeries, bioengineered implants, and minimally invasive surgical tools. Investments from both private and public sectors are fueling groundbreaking research, enabling manufacturers to develop next-generation solutions for treating traumatic eye injuries. With continuous advancements in ocular trauma care, the market is set to witness sustained growth in the coming years.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of ocular trauma

- 3.2.1.2 Technological advancements

- 3.2.1.3 Increasing awareness and early diagnosis

- 3.2.1.4 Favorable government initiatives and insurance coverage

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of treatment

- 3.2.2.2 Lack of skilled healthcare professionals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Reimbursement scenario

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Technology landscape

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive positioning matrix

- 4.5 Vendor matrix analysis

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Surgical instruments

- 5.3 Intraocular lenses (IOLs)

- 5.4 Ocular implants

- 5.5 Ophthalmic viscoelastic devices (OVDs)

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Trauma surgery

- 6.3 Retinal detachment

- 6.4 Cataract surgery

- 6.5 Glaucoma management

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By Trauma Severity, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Mild

- 7.3 Moderate

- 7.4 Severe

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ophthalmic clinics

- 8.4 Ambulatory surgical centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 Japan

- 9.4.2 China

- 9.4.3 India

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Argentina

- 9.5.3 Mexico

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alcon

- 10.2 Bausch + Lomb

- 10.3 Carl Zeiss Meditec

- 10.4 CooperVision

- 10.5 Essilor Instruments

- 10.6 Haag-Streit Group

- 10.7 Innovative Optics

- 10.8 IRIDEX Corporation

- 10.9 Johnson & Johnson Vision

- 10.10 Leica Microsystems

- 10.11 Optos

- 10.12 Sonomed Escalon

- 10.13 Topcon Corporation