|

市场调查报告书

商品编码

1699295

无线接取网路市场机会、成长动力、产业趋势分析及 2025-2034 年预测Radio Access Network Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

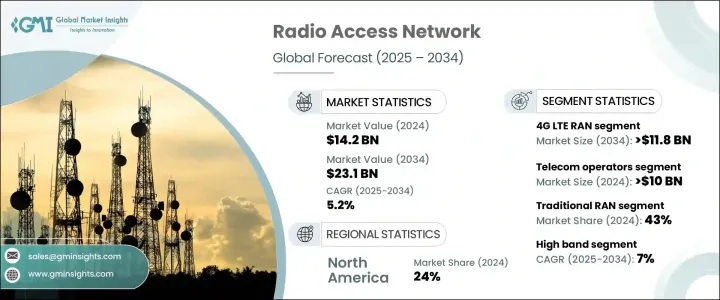

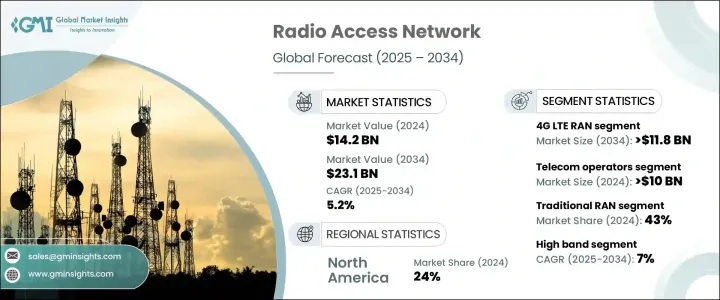

2024 年全球无线接取网路市场价值为 142 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.2%。对无缝连接的需求不断增长、行动网路的快速扩张以及对电信基础设施的持续投资正在推动市场成长。随着全球行动资料消费激增,网路供应商优先考虑覆盖范围、容量和效率,以支援越来越多的行动用户。数位转型、智慧城市计画的兴起以及基于物联网的应用的激增,正在推动电信公司升级其网路能力并部署尖端技术。

5G技术的广泛应用虽然仍处于早期阶段,但正在加速网路基础设施的进步。然而,4G LTE 仍然是主导技术,确保数十亿用户的持续连线。对高速互联网、低延迟通讯和卓越网路可靠性的需求正在推动电信巨头透过战略合作伙伴关係和投资来扩展其基础设施。世界各国政府和监管机构正在透过优惠政策、频谱分配和资金措施支持网路扩张,进一步推动市场扩张。此外,人工智慧 (AI) 和机器学习 (ML) 融入网路营运正在提高效率并减少延迟,使现代 RAN 解决方案更加稳健和适应性更强。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 142亿美元 |

| 预测值 | 231亿美元 |

| 复合年增长率 | 5.2% |

4G LTE RAN 领域在 2024 年占据了 54% 的市场份额,预计到 2034 年将创造 118 亿美元的市场价值。这种主导地位归功于 4G 网路的广泛覆盖和可靠性,该网路已经运作了十多年。儘管已经部署了 5G,但由于 4G LTE 的可访问性和稳定性,大多数行动用户仍然依赖 4G LTE。行动网路营运商正在大力投资优化和扩展 4G 基础设施,以确保在城乡地区提供卓越的效能。鑑于许多地区的 5G 覆盖范围仍然有限,4G LTE 仍然是行动连线最广泛使用和最可靠的选择。

电信营运商部门在 2024 年创造了 100 亿美元的收入,由于对 RAN 基础设施的大量投资而保持领先地位。这些营运商在建造、升级和维护蜂窝网路方面发挥关键作用,构成了电信业的支柱。对频谱获取、基地台和网路扩展的投资继续推动行业成长。随着对高速连接的需求不断增长,电信公司正在分配大量资源来提高网路效能,确保低延迟通信,并支援向 5G 的过渡。行动技术的持续进步将进一步维持对 RAN 基础设施的投资,营运商将专注于长期网路可靠性和可扩展性。

北美接取网路市场占24%的份额,2024年创造29.2亿美元的收入。该地区仍然处于电信基础设施投资的前沿,特别是在5G网路的扩展方面。独立 5G 和固定无线接入技术的持续发展正在巩固北美在全球 RAN 市场的领先地位。随着主要电信营运商专注于下一代网路的创新和大规模部署,北美继续在先进的连接解决方案方面树立标竿。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 製造商

- 技术提供者

- 最终用途

- 利润率分析

- 技术与创新格局

- 专利分析

- 监管格局

- 用例

- 衝击力

- 成长动力

- 5G网路的普及率不断提高

- 行动资料流量不断增长和物联网扩展

- 政府措施和5G频谱分配

- 开放式 RAN 和虚拟化 RAN 的采用率不断提高

- 企业私有5G网路的成长

- 产业陷阱与挑战

- 基础设施成本高

- 频谱分配和监管问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 2G 无线存取网

- 3G 无线存取网

- 4G LTE 无线接取网

- 5G 无线存取网

第六章:市场估计与预测:依基础设施,2021 - 2034 年

- 主要趋势

- 传统 RAN

- 云端 RAN

- 开放式 RAN

- 虚拟化RAN

第七章:市场估计与预测:按频段,2021 - 2034 年

- 主要趋势

- 低频段(低于 1 GHz)

- 中频段(1-6 GHz)

- 高频段(毫米波,24 GHz 以上)

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 电信营运商

- 企业

- 智慧城市和公共部门

- 国防和安全

- 工业和製造业

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Airspan Networks

- Altiostar Networks

- ASOCS

- AT&T

- Cisco

- CommScope

- Ericsson

- Fujitsu Limited

- Huawei

- Intel

- Juniper Networks

- Mavenir

- NEC

- Nokia

- Parallel Wireless

- Radisys

- Rakuten Symphony

- Samsung Electronics

- Verizon Communications

- ZTE

The Global Radio Access Network Market was valued at USD 14.2 billion in 2024 and is projected to grow at a CAGR of 5.2% between 2025 and 2034. Increasing demand for seamless connectivity, rapid expansion of mobile networks, and continuous investments in telecommunications infrastructure are fueling market growth. As mobile data consumption surges worldwide, network providers are prioritizing coverage, capacity, and efficiency to support a growing number of mobile users. The rise of digital transformation, smart city initiatives, and the proliferation of IoT-based applications are pushing telecom companies to upgrade their network capabilities and deploy cutting-edge technologies.

The widespread adoption of 5G technology, though still in its early stages, is accelerating advancements in network infrastructure. However, 4G LTE remains the dominant technology, ensuring consistent connectivity for billions of users. The demand for high-speed internet, low-latency communication, and superior network reliability is pushing telecom giants to expand their infrastructure through strategic partnerships and investments. Governments and regulatory bodies worldwide are supporting network expansion with favorable policies, spectrum allocation, and funding initiatives, further driving market expansion. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) into network operations is improving efficiency and reducing latency, making modern RAN solutions more robust and adaptive.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.2 Billion |

| Forecast Value | $23.1 Billion |

| CAGR | 5.2% |

The 4G LTE RAN segment held a 54% market share in 2024 and is expected to generate USD 11.8 billion by 2034. This dominance is attributed to the extensive coverage and reliability of 4G networks, which have been operational for over a decade. Despite 5G deployment, the majority of mobile users continue to rely on 4G LTE due to its accessibility and stability. Mobile network operators are heavily investing in optimizing and expanding 4G infrastructure to ensure superior performance across urban and rural areas. Given that 5G coverage is still limited in many regions, 4G LTE remains the most widely used and dependable option for mobile connectivity.

The telecom operators segment generated USD 10 billion in 2024, maintaining a leading position due to massive investments in RAN infrastructure. These operators play a critical role in building, upgrading, and maintaining cellular networks, forming the backbone of the telecommunications industry. Investments in spectrum acquisition, base stations, and network expansion continue to drive industry growth. As demand for high-speed connectivity rises, telecom companies are allocating substantial resources to enhance network performance, ensure low-latency communication, and support the transition toward 5G. Ongoing advancements in mobile technology will further sustain investment in RAN infrastructure, with operators focusing on long-term network reliability and scalability.

North America's access network market accounted for a 24% share, generating USD 2.92 billion in 2024. The region remains at the forefront of telecommunications infrastructure investments, particularly in the expansion of 5G networks. Ongoing developments in standalone 5G and fixed wireless access technologies are reinforcing North America's position as a leader in the global RAN market. With major telecom players focusing on innovation and large-scale deployment of next-generation networks, North America continues to set benchmarks in advanced connectivity solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Manufacturers

- 3.1.3 Technology providers

- 3.1.4 End Use

- 3.1.5 Profit margin analysis

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Use cases

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing adoption of 5G networks

- 3.6.1.2 Rising mobile data traffic and IoT expansion

- 3.6.1.3 Government initiatives and 5G spectrum allocation

- 3.6.1.4 Increasing adoption of open RAN and virtualized RAN

- 3.6.1.5 Growth in private 5G networks for enterprises

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High infrastructure costs

- 3.6.2.2 Spectrum allocation and regulatory issues

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 2G RAN

- 5.3 3G RAN

- 5.4 4G LTE RAN

- 5.5 5G RAN

Chapter 6 Market Estimates & Forecast, By Infrastructure, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Traditional RAN

- 6.3 Cloud RAN

- 6.4 Open RAN

- 6.5 Virtualized RAN

Chapter 7 Market Estimates & Forecast, By Frequency Band, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Low band (Below 1 GHz)

- 7.3 Mid band (1-6 GHz)

- 7.4 High band (mmWave, 24 GHz and above)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Telecom operators

- 8.3 Enterprises

- 8.4 Smart cities & public sector

- 8.5 Defense & security

- 8.6 Industrial & manufacturing

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Airspan Networks

- 10.2 Altiostar Networks

- 10.3 ASOCS

- 10.4 AT&T

- 10.5 Cisco

- 10.6 CommScope

- 10.7 Ericsson

- 10.8 Fujitsu Limited

- 10.9 Huawei

- 10.10 Intel

- 10.11 Juniper Networks

- 10.12 Mavenir

- 10.13 NEC

- 10.14 Nokia

- 10.15 Parallel Wireless

- 10.16 Radisys

- 10.17 Rakuten Symphony

- 10.18 Samsung Electronics

- 10.19 Verizon Communications

- 10.20 ZTE