|

市场调查报告书

商品编码

1699313

冷链监控市场机会、成长动力、产业趋势分析及 2025-2034 年预测Cold Chain Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

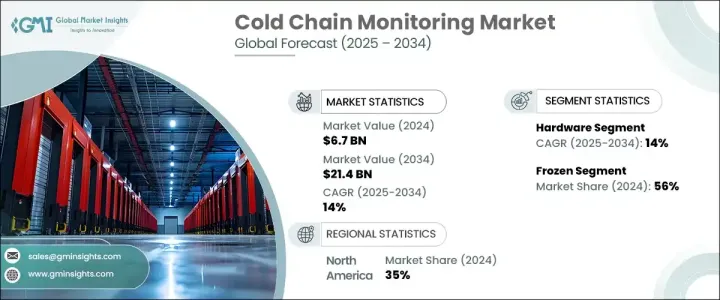

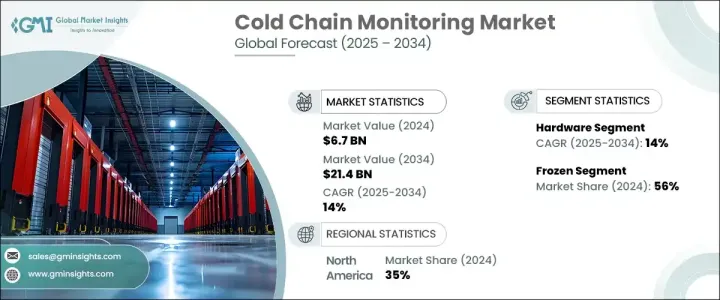

2024 年全球冷链监控市场规模达 67 亿美元,预计 2025 年至 2034 年的复合年增长率为 14%。这一增长是由各行各业对温度敏感商品的需求不断增长所推动的。由于製药、食品和饮料行业严重依赖冷藏和运输,企业越来越多地采用先进的监控解决方案来确保产品完整性和法规遵循。随着公司不断扩大其全球供应链,对即时追踪技术的需求变得比以往任何时候都更加重要。

物联网感测器、RFID 设备和远端资讯处理解决方案的整合正在改变整个行业,为企业提供无与伦比的物流网路可视性和控制力。世界各地的监管机构正在实施严格的指导方针,以维持最佳的储存和运输条件,进一步推动对尖端监控系统的投资。随着公司专注于降低风险、防止损坏和提高营运效率,市场可望继续扩张。人工智慧分析和基于云端的监控平台的采用正在重塑产业,实现即时决策和预测性维护,以防止与温度相关的中断。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 67亿美元 |

| 预测值 | 214亿美元 |

| 复合年增长率 | 14% |

对温控物流的日益依赖正在推动市场扩张,企业认识到保持产品安全和遵守不断发展的监管标准的重要性。公司优先实施强大的监控解决方案,以即时追踪环境条件,确保易腐货物保持在规定的温度阈值内。采用智慧监控系统不仅提高了供应链透明度,而且还减少了与产品损坏和召回相关的财务损失。

按组件细分,市场由硬体和软体解决方案组成。硬体部门在 2024 年创造了 45 亿美元的收入,并预计在整个预测期内以 14% 的复合年增长率成长。对温度敏感物流的需求不断增长,推动了先进硬体解决方案的采用,包括感测器、RFID 追踪器和远端资讯处理设备。这些技术提供即时环境资料,使企业能够主动应对潜在风险并维持遵守品质和安全标准。随着冷链产业的发展,公司正在利用创新的硬体组件来优化效率和可靠性,确保整个储存和运输网路的无缝运作。

根据温度范围,市场分为冷冻和冷藏部分。 2024 年,冷冻食品占了 56% 的市场份额,预计到 2034 年复合年增长率将达到 14%。对超低温储存解决方案日益增长的需求正在加速製药和生物技术等需要严格热调节的行业的采用。先进的监测技术在维持温度敏感产品的功效和稳定性方面发挥着至关重要的作用。企业为了努力遵守严格的储存要求,正在投资智慧解决方案,以增强可追溯性并最大限度地减少因温度偏差造成的损失。

2024 年,北美将以 35% 的份额引领全球冷链监控市场,其中美国的收入为 21 亿美元。该地区强大的市场影响力归功于製药业越来越依赖冷藏解决方案来确保运输过程中的产品安全。美国严格的监管准则强调了维持温度控制的重要性,促使公司投资先进的监控技术。此外,透过电子商务平台运送新鲜和冷冻食品的需求不断增长,也加速了对强大的冷链基础设施的需求。随着企业寻求满足不断变化的消费者期望和监管要求,对创新监控解决方案的投资预计将激增,从而增强温度敏感供应链的可靠性和安全性。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 硬体提供者

- 软体和平台开发人员

- 系统整合商

- 连接提供者

- 服务提供者

- 利润率分析

- 技术与创新格局

- 专利分析

- 用例

- 冷链物流统计

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 易腐商品需求不断增加

- 对温度敏感产品的运输和储存施加严格的监管要求

- 技术、物联网和资料分析的进步

- 更加重视食品安全与品质

- 产业陷阱与挑战

- 发展中地区的基础建设挑战

- 实施成本高且复杂

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 硬体

- 感应器

- RFID设备

- 远端资讯处理

- 网路装置

- 其他的

- 软体

- 即时监控

- 分析和报告

第六章:市场估计与预测:按温度,2021 - 2034 年

- 主要趋势

- 《冰雪奇缘》

- 冷藏

第七章:市场估计与预测:按物流,2021 - 2034 年

- 主要趋势

- 贮存

- 运输

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 製药和医疗保健

- 食品和饮料

- 物流与配送

- 化学

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Berlinger & Co

- CargoSense

- Cold Chain Technologies

- Controlant

- Descartes Systems Group

- Digi International

- ELPRO-BUCHS

- Emerson Electric

- Honeywell International

- Infratab

- Intelleflex

- Monnit

- ORBCOMM

- Roambee

- Sensaphone

- Sensitech

- Swisslog Holding

- Testo SE & Co

- Tive

- Zebra Technologies

The Global Cold Chain Monitoring Market reached USD 6.7 billion in 2024 and is anticipated to grow at a CAGR of 14% from 2025 to 2034. The growth is driven by the rising demand for temperature-sensitive goods across various industries. With pharmaceuticals, food, and beverage sectors relying heavily on cold storage and transportation, businesses are increasingly adopting advanced monitoring solutions to ensure product integrity and regulatory compliance. As companies continue to expand their global supply chains, the need for real-time tracking technologies is becoming more critical than ever.

The integration of IoT-enabled sensors, RFID devices, and telematics solutions is transforming the industry, offering businesses unparalleled visibility and control over their logistics networks. Regulatory authorities worldwide are imposing stringent guidelines to maintain optimal storage and transportation conditions, further propelling investments in cutting-edge monitoring systems. The market is poised for continued expansion as companies focus on mitigating risks, preventing spoilage, and enhancing operational efficiency. The adoption of AI-powered analytics and cloud-based monitoring platforms is reshaping the industry, enabling real-time decision-making and predictive maintenance to prevent temperature-related disruptions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.7 Billion |

| Forecast Value | $21.4 Billion |

| CAGR | 14% |

The increasing reliance on temperature-controlled logistics is fueling market expansion, with businesses recognizing the importance of maintaining product safety and compliance with evolving regulatory standards. Companies are prioritizing the implementation of robust monitoring solutions to track environmental conditions in real time, ensuring that perishable goods remain within prescribed temperature thresholds. The adoption of smart monitoring systems is not only enhancing supply chain transparency but also reducing financial losses associated with product spoilage and recalls.

Segmented by components, the market consists of hardware and software solutions. The hardware segment generated USD 4.5 billion in 2024 and is set to grow at a CAGR of 14% throughout the forecast period. The increasing demand for temperature-sensitive logistics is driving the adoption of advanced hardware solutions, including sensors, RFID trackers, and telematics devices. These technologies provide real-time environmental data, enabling businesses to proactively address potential risks and maintain adherence to quality and safety standards. As the cold chain industry advances, companies are leveraging innovative hardware components to optimize efficiency and reliability, ensuring seamless operations across storage and transportation networks.

By temperature range, the market is categorized into frozen and chilled segments. The frozen segment accounted for 56% of the market share in 2024 and is expected to register a CAGR of 14% through 2034. The growing demand for ultra-low temperature storage solutions is accelerating adoption across industries that require strict thermal regulation, such as pharmaceuticals and biotechnology. Advanced monitoring technologies are playing a crucial role in preserving the efficacy and stability of temperature-sensitive products. As businesses strive to comply with rigorous storage requirements, they are investing in smart solutions that enhance traceability and minimize losses caused by temperature deviations.

North America led the global cold chain monitoring market with a 35% share in 2024, with the U.S. accounting for USD 2.1 billion in revenue. The region's strong market presence is attributed to the pharmaceutical sector's growing reliance on cold storage solutions to ensure product safety during transit. Strict regulatory guidelines in the U.S. emphasize the importance of maintaining temperature control, prompting companies to invest in advanced monitoring technologies. Additionally, the rising demand for fresh and frozen food deliveries through e-commerce platforms is accelerating the need for robust cold chain infrastructure. As businesses seek to meet evolving consumer expectations and regulatory mandates, investments in innovative monitoring solutions are expected to surge, reinforcing the reliability and security of temperature-sensitive supply chains.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Hardware providers

- 3.2.2 Software & platform developers

- 3.2.3 System integrators

- 3.2.4 Connectivity providers

- 3.2.5 Service providers

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Use cases

- 3.7 Cold chain logistics statistics

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing demand for perishable goods

- 3.10.1.2 Stringent regulatory requirements imposed on the transportation and storage of temperature-sensitive products

- 3.10.1.3 Advancements in technology, IoT, and data analytics

- 3.10.1.4 Increasing focus on food safety and quality

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Infrastructure challenges in developing regions

- 3.10.2.2 High implementation costs and complexity

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensors

- 5.2.2 RFID devices

- 5.2.3 Telematics

- 5.2.4 Networking devices

- 5.2.5 Others

- 5.3 Software

- 5.3.1 Real-time monitoring

- 5.3.2 Analytics and reporting

Chapter 6 Market Estimates & Forecast, By Temperature, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Frozen

- 6.3 Chilled

Chapter 7 Market Estimates & Forecast, By Logistics, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Storage

- 7.3 Transportation

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Pharmaceutical & healthcare

- 8.3 Food & beverage

- 8.4 Logistics & distribution

- 8.5 Chemical

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Berlinger & Co

- 10.2 CargoSense

- 10.3 Cold Chain Technologies

- 10.4 Controlant

- 10.5 Descartes Systems Group

- 10.6 Digi International

- 10.7 ELPRO-BUCHS

- 10.8 Emerson Electric

- 10.9 Honeywell International

- 10.10 Infratab

- 10.11 Intelleflex

- 10.12 Monnit

- 10.13 ORBCOMM

- 10.14 Roambee

- 10.15 Sensaphone

- 10.16 Sensitech

- 10.17 Swisslog Holding

- 10.18 Testo SE & Co

- 10.19 Tive

- 10.20 Zebra Technologies