|

市场调查报告书

商品编码

1699319

直接晶片液冷市场机会、成长动力、产业趋势分析及 2025-2034 年预测Direct-to-chip Liquid Cooling Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

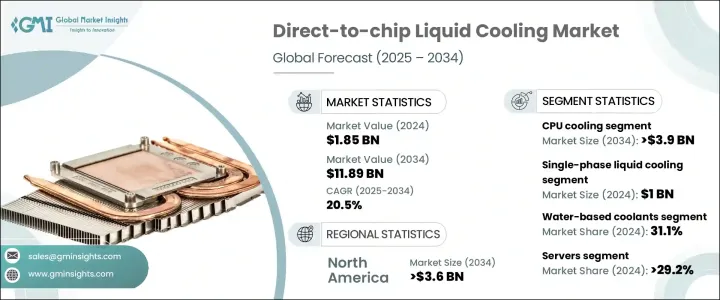

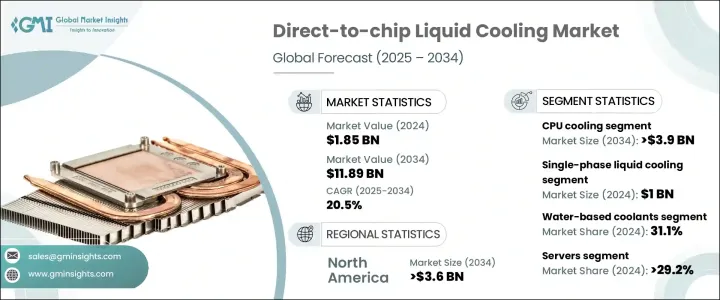

全球直接晶片液体冷却市场预计在 2024 年达到 18.5 亿美元,随着企业越来越重视高效能运算、能源效率和永续资料中心解决方案,该市场预计将在 2025 年至 2034 年间以 20.5% 的复合年增长率扩张。人工智慧 (AI)、机器学习 (ML) 和云端运算的快速普及正在推动资料处理需求的空前激增,使得传统的冷却方法在管理先进处理器不断上升的热负荷方面变得不那么有效。世界各地的组织正在转向直接晶片液体冷却解决方案,以提高系统可靠性、防止热节流并优化功耗。人们对绿色资料中心和减少碳足迹的日益重视进一步加速了液体冷却的采用,使其成为下一代运算基础设施的重要创新。

随着高效能运算 (HPC) 环境不断突破处理能力的界限,传统的空气冷却难以满足 CPU、GPU 和记忆体模组的散热需求。直接晶片液体冷却透过将热量直接从晶片转移到液体冷却剂来实现精确的热管理,正在成为资料中心优化领域的变革者。云端服务供应商、超大规模资料中心和部署人工智慧驱动工作负载的企业正在整合液体冷却技术,以最大限度地提高效率并最大限度地降低营运成本。对即时资料分析、高密度运算集群和5G基础设施部署的需求进一步加强了市场的扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 18.5亿美元 |

| 预测值 | 118.9亿美元 |

| 复合年增长率 | 20.5% |

按组件冷却细分,市场涵盖 GPU 冷却、CPU 冷却、记忆体冷却、ASIC 冷却和其他特定于组件的解决方案。预计到 2034 年,CPU 冷却领域的规模将达到 39 亿美元,这得益于人工智慧和基于云端的应用程式的广泛采用,这些应用程式将显着增加处理器的功耗。先进的 CPU 会产生大量的热负荷,需要先进的热管理解决方案来维持系统稳定性并防止效能下降。直接晶片液体冷却可提供卓越的散热效果,即使在极端运算工作负载下也能确保持续的效能。

市场还根据液体冷却剂类型进行分类,包括水性冷却剂、介电流体、矿物油和工程流体。水性冷却剂在 2024 年占据了 31.1% 的市场份额,因其出色的导热性和成本效益而越来越受欢迎。随着企业注重永续性,这些冷却剂正在成为降低能源消耗同时保持高性能标准的首选。其卓越的传热性能使其成为致力于平衡效率和环境责任的现代资料中心的理想解决方案。

北美将主导直接晶片液体冷却市场,预计到 2034 年估值将达到 36 亿美元。该地区资料中心的快速扩张、不断增长的云端运算生态系统以及对 HPC 解决方案不断增长的需求正在推动其广泛采用。美国在 2024 年占据了 78.4% 的市场份额,其资料基础设施投资正在飙升,这推动了对先进冷却系统的需求。随着人工智慧驱动的应用程式和超大规模云端服务突破运算能力的极限,对高效热管理解决方案的需求持续激增,巩固了美国市场在不断发展的资料中心领域的领导地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 对高效能运算(HPC)的需求不断增长

- 提高资料中心密度

- 更加重视永续性

- 高效能运算的需求不断增长

- 越来越关注资料中心的能源效率和永续性

- 产业陷阱与挑战

- 初期投资成本高

- 维护和操作的复杂性

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按冷却解决方案类型,2021 年至 2034 年

- 主要趋势

- 单相液体冷却

- 双相液体冷却

第六章:市场估计与预测:依冷却组件划分,2021 年至 2034 年

- 主要趋势

- CPU凉

- GPU冷却

- ASIC冷却

- 记忆体冷却

- 其他部件冷却

第七章:市场估计与预测:依液体冷却剂类型,2021 年至 2034 年

- 主要趋势

- 水性冷却液

- 介电流体

- 矿物油

- 工程流体

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 伺服器

- 工作站

- 边缘运算设备

- 超电脑

- 游戏电脑

- 其他的

第九章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 资料中心

- 高效能运算 (HPC)

- 人工智慧/机器学习系统

- 游戏和电子竞技

- 电信

- 金融服务

- 医疗保健和生命科学

- 石油和天然气

- 汽车(用于电动车电池)

- 航太和国防

- 其他的

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳新银行

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- Asetek

- Alfa Laval

- Castrol

- Cisco Systems, Inc.

- CoolIT Systems

- DCX The Liquid Cooling Company

- Danfoss A/S

- DUG Technology

- Equinix, Inc.

- Fujitsu Limited

- Green Revolution Cooling (GRC)

- Huawei Technologies Co., Ltd.

- Iceotope Technologies Ltd.

- Inspur Systems

- LiquidCool Solutions

- LiquidStack

- Rittal GmbH & Co. KG

- Schneider Electric

- STULZ GmbH

- Submer Technologies

- Super Micro Computer, Inc.

- Vertiv Group Corp.

- ZutaCore

The Global Direct-To-Chip Liquid Cooling Market, valued at USD 1.85 billion in 2024, is on track to expand at a CAGR of 20.5% from 2025 to 2034 as enterprises increasingly prioritize high-performance computing, energy efficiency, and sustainable data center solutions. The rapid proliferation of artificial intelligence (AI), machine learning (ML), and cloud computing is driving an unprecedented surge in data processing demands, making conventional cooling methods less effective in managing the rising thermal loads of advanced processors. Organizations worldwide are shifting toward direct-to-chip liquid cooling solutions to enhance system reliability, prevent thermal throttling, and optimize power consumption. The growing emphasis on green data centers and carbon footprint reduction further accelerates adoption, positioning liquid cooling as an essential innovation in next-generation computing infrastructure.

As high-performance computing (HPC) environments push the boundaries of processing power, traditional air-based cooling struggles to keep pace with the heat dissipation needs of CPUs, GPUs, and memory modules. Direct-to-chip liquid cooling, which enables precise thermal management by transferring heat directly from the chip to a liquid coolant, is emerging as a game-changer in data center optimization. Cloud service providers, hyperscale data centers, and enterprises deploying AI-driven workloads are integrating liquid cooling technologies to maximize efficiency and minimize operational costs. The demand for real-time data analytics, high-density computing clusters, and 5G infrastructure deployment is further reinforcing the market's expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.85 Billion |

| Forecast Value | $11.89 Billion |

| CAGR | 20.5% |

Segmented by component cooling, the market encompasses GPU cooling, CPU cooling, memory cooling, ASIC cooling, and other component-specific solutions. The CPU cooling segment is projected to reach USD 3.9 billion by 2034, driven by the widespread adoption of AI and cloud-based applications that significantly increase processor power consumption. Advanced CPUs generate substantial heat loads, requiring cutting-edge thermal management solutions to maintain system stability and prevent performance degradation. Direct-to-chip liquid cooling delivers superior heat dissipation, ensuring sustained performance even under extreme computational workloads.

The market is also categorized by liquid coolant type, including water-based coolants, dielectric fluids, mineral oils, and engineered fluids. Water-based coolants, which held a 31.1% market share in 2024, are gaining traction due to their exceptional thermal conductivity and cost-effectiveness. As enterprises focus on sustainability, these coolants are becoming a preferred choice for reducing energy consumption while maintaining high-performance standards. Their superior heat transfer properties make them an ideal solution for modern data centers striving to balance efficiency and environmental responsibility.

North America is set to dominate the direct-to-chip liquid cooling market, with projections indicating a valuation of USD 3.6 billion by 2034. The region's rapid data center expansion, growing cloud computing ecosystem, and escalating demand for HPC solutions are driving widespread adoption. The United States, which held a commanding 78.4% market share in 2024, is witnessing soaring investments in data infrastructure, fueling the need for advanced cooling systems. With AI-driven applications and hyperscale cloud services pushing the limits of computing power, the demand for high-efficiency thermal management solutions continues to surge, reinforcing the U.S. market's leadership in the evolving data center landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for high-performance computing (HPC)

- 3.2.1.2 Increasing data center density

- 3.2.1.3 Increased focus on sustainability

- 3.2.1.4 Rising demand for high-performance computing

- 3.2.1.5 Growing focus on energy efficiency and sustainability in data centers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Complexity of maintenance and operations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Cooling Solution Type, 2021 – 2034 (USD Mn)

- 5.1 Key trends

- 5.2 Single-phase liquid cooling

- 5.3 Two-phase liquid cooling

Chapter 6 Market Estimates and Forecast, By Component Cooling, 2021 – 2034 (USD Mn)

- 6.1 Key trends

- 6.2 CPU cooling

- 6.3 GPU cooling

- 6.4 ASIC cooling

- 6.5 Memory cooling

- 6.6 Other component cooling

Chapter 7 Market Estimates and Forecast, By Liquid Coolant Type, 2021 – 2034 (USD Bn)

- 7.1 Key trends

- 7.2 Water-based coolants

- 7.3 Dielectric fluids

- 7.4 Mineral oils

- 7.5 Engineered fluids

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Bn)

- 8.1 Key trends

- 8.2 Servers

- 8.3 Workstations

- 8.4 Edge computing devices

- 8.5 Supercomputers

- 8.6 Gaming PCs

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Bn)

- 9.1 Key trends

- 9.2 Data centers

- 9.3 High-performance computing (HPC)

- 9.4 Artificial intelligence/machine learning systems

- 9.5 Gaming and eSports

- 9.6 Telecommunications

- 9.7 Financial services

- 9.8 Healthcare and life sciences

- 9.9 Oil and gas

- 9.10 Automotive (for electric vehicle batteries)

- 9.11 Aerospace and defense

- 9.12 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 ANZ

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Asetek

- 11.2 Alfa Laval

- 11.3 Castrol

- 11.4 Cisco Systems, Inc.

- 11.5 CoolIT Systems

- 11.6 DCX The Liquid Cooling Company

- 11.7 Danfoss A/S

- 11.8 DUG Technology

- 11.9 Equinix, Inc.

- 11.10 Fujitsu Limited

- 11.11 Green Revolution Cooling (GRC)

- 11.12 Huawei Technologies Co., Ltd.

- 11.13 Iceotope Technologies Ltd.

- 11.14 Inspur Systems

- 11.15 LiquidCool Solutions

- 11.16 LiquidStack

- 11.17 Rittal GmbH & Co. KG

- 11.18 Schneider Electric

- 11.19 STULZ GmbH

- 11.20 Submer Technologies

- 11.21 Super Micro Computer, Inc.

- 11.22 Vertiv Group Corp.

- 11.23 ZutaCore