|

市场调查报告书

商品编码

1699320

检视机器人市场机会、成长动力、产业趋势分析及 2025-2034 年预测Inspection Robots Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

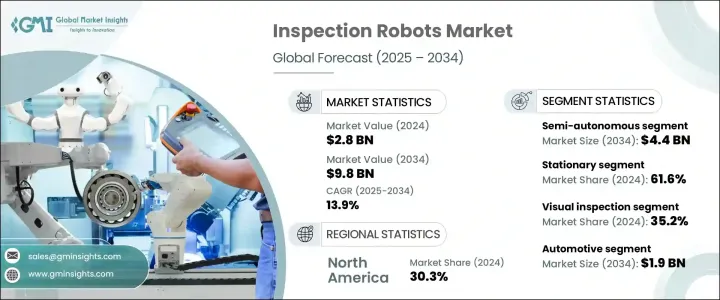

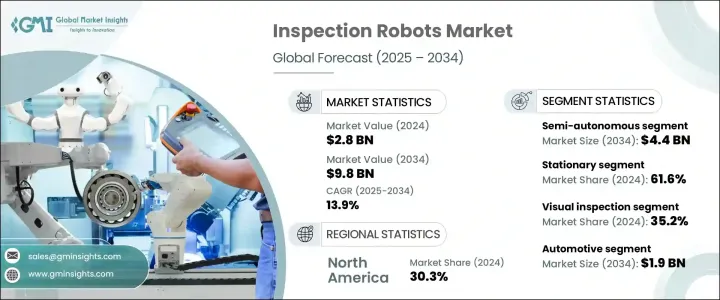

全球检查机器人市场规模在 2024 年将达到 28 亿美元,预计在 2025 年至 2034 年期间的复合年增长率将达到 13.9%。推动这一成长的动力来自各行各业对机器人的应用日益增多,这些行业旨在提高效率、降低营运风险并遵守不断发展的安全法规。製造业、能源业和基础设施行业的企业正在将检查机器人整合到其营运中,以简化工作流程、最大限度地减少停机时间并确保遵守严格的行业标准。

随着各行各业对自动化和精确度的重视,检查机器人在维护和品质控制中发挥关键作用。这些先进的系统提供了更高的准确性和可靠性,消除了与人工检查相关的限制。各组织正在利用机器人技术来满足对无损检测、即时分析和预测性维护日益增长的需求。对人工智慧 (AI) 和机器学习 (ML) 技术的投资不断增加,进一步推动了机器人检测系统的创新,实现了自主决策和自适应学习。随着公司致力于提高工作场所的安全性并优化营运绩效,对危险和难以到达的环境中持续监控的需求正在加速成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 28亿美元 |

| 预测值 | 98亿美元 |

| 复合年增长率 | 13.9% |

按类型分類的市场包括非自主机器人、半自主机器人和全自动机器人。预计到 2034 年,半自动驾驶领域的市场规模将达到 44 亿美元,由于其能够在自动化和人工监督之间取得平衡,因此将广泛应用。这些系统在高风险行业中尤其有价值,在这些行业中,人工智慧辅助决策允许人类操作员仅在必要时进行干预。它们能够在复杂的环境中运作而无需持续监督,这使得它们成为寻求提高效率同时保持对关键操作控制的企业的有吸引力的选择。

根据技术,市场分为固定式和移动式检查机器人。 2024 年,固定式系统占据了 61.6% 的市场份额,由于其高精度和与自动化製造环境的无缝整合而获得了发展动力。这些机器人在需要精细品质控制的行业中发挥重要作用,提供高精度缺陷检测和即时性能监控。对无损检测和高速评估技术的日益重视进一步推动了其应用。製造商优先考虑减少错误和提高操作效率,使得固定式检测机器人成为现代生产线中不可或缺的一部分。

美国检测机器人市场预计将大幅成长,预计到 2034 年将达到 28 亿美元。製造业对自动化的依赖程度不断提高,加上对缺陷检测和品质保证的高度重视,正在加速机器人检测系统的部署。该公司正在投资先进的机器人技术,以提高生产力、最大限度地减少停机时间并优化营运效率。随着自动化不断改变工业工作流程,机器人检测系统正在成为确保始终如一的品质和卓越营运的重要组成部分。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 服务机器人的销售量和采用率增加

- 越来越多地使用无人机和移动机器人进行远端检查

- 智慧製造和工业 4.0 计划的成长

- 石油天然气和能源产业的扩张

- 各行业严格的安全和品质法规

- 产业陷阱与挑战

- 中小企业部署成本高

- 复杂性和整合困难

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 非自治

- 半自主

- 完全自主

第六章:市场估计与预测:按技术,2021 年至 2034 年

- 主要趋势

- 固定式

- 移动的

第七章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 目视检查

- 超音波检查

- 雷射扫描检测

- 热检查

- 品质检验

第八章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 汽车

- 建造

- 食品和饮料

- 製造业

- 石油和天然气

- 力量

- 其他的

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- ABB

- Cognex

- Denso Wave

- DSI Robotics

- Energy Robotics

- Fanuc

- Honeybee Robotics

- Innok Robotics

- JH Robotics

- Kuka

- Mitsubishi Heavy Industries

- Nexxis

- Robotnik Automation

- Staubli

- Superdroid Robotics

- Universal Robots

The Global Inspection Robots Market, valued at USD 2.8 billion in 2024, is set to expand at a CAGR of 13.9% from 2025 to 2034. The growth is driven by increasing adoption across industries seeking to enhance efficiency, reduce operational risks, and comply with evolving safety regulations. Businesses across manufacturing, energy, and infrastructure sectors are integrating inspection robots into their operations to streamline workflows, minimize downtime, and ensure compliance with stringent industry standards.

With industries prioritizing automation and precision, inspection robots are playing a critical role in maintenance and quality control. These advanced systems offer enhanced accuracy and reliability, eliminating the limitations associated with manual inspections. Organizations are leveraging robotics to meet growing demands for non-destructive testing, real-time analytics, and predictive maintenance. Increasing investments in artificial intelligence (AI) and machine learning (ML) technologies are further driving innovation in robotic inspection systems, enabling autonomous decision-making and adaptive learning. The need for continuous monitoring in hazardous and hard-to-reach environments is accelerating demand as companies aim to improve workplace safety while optimizing operational performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $9.8 Billion |

| CAGR | 13.9% |

Market segmentation by type includes non-autonomous, semi-autonomous, and fully autonomous robots. The semi-autonomous segment is expected to reach USD 4.4 billion by 2034, witnessing significant adoption due to its ability to strike a balance between automation and human oversight. These systems are particularly valuable in high-risk industries, where AI-assisted decision-making allows human operators to intervene only when necessary. Their ability to function in complex environments without constant supervision makes them an attractive choice for businesses seeking to enhance efficiency while maintaining control over critical operations.

Based on technology, the market is segmented into stationary and mobile inspection robots. In 2024, stationary systems accounted for 61.6% of the market share, gaining traction due to their high precision and seamless integration into automated manufacturing environments. These robots play an essential role in industries that demand meticulous quality control, offering high-accuracy defect detection and real-time performance monitoring. The growing emphasis on non-destructive testing and high-speed evaluation techniques is further fueling adoption. Manufacturers are prioritizing error reduction and operational efficiency, making stationary inspection robots indispensable across modern production lines.

The US inspection robots market is poised for substantial growth, projected to reach USD 2.8 billion by 2034. Increasing reliance on automation in manufacturing, coupled with a strong focus on defect detection and quality assurance, is accelerating the deployment of robotic inspection systems. Companies are investing in advanced robotic technologies to enhance productivity, minimize downtime, and optimize operational efficiency. As automation continues to transform industrial workflows, robotic inspection systems are emerging as an essential component in ensuring consistent quality and operational excellence.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increased sales and adoption of service robots

- 3.2.1.2 Increasing use of drones and mobile robots for remote inspections

- 3.2.1.3 Growth in smart manufacturing and industry 4.0 initiatives

- 3.2.1.4 Expansion of the oil & gas and energy sectors

- 3.2.1.5 Stringent safety and quality regulations across industries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High deployment cost for SME

- 3.2.2.2 Complexity & integration difficulties

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Bn)

- 5.1 Key trends

- 5.2 Non-autonomous

- 5.3 Semi-autonomous

- 5.4 Fully autonomous

Chapter 6 Market Estimates and Forecast, By Technology , 2021 – 2034 (USD Bn)

- 6.1 Key trends

- 6.2 Stationary

- 6.3 Mobile

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Bn)

- 7.1 Key trends

- 7.2 Visual inspection

- 7.3 Ultrasonic inspection

- 7.4 Laser scanning inspection

- 7.5 Thermal inspection

- 7.6 Quality inspection

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Bn)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Construction

- 8.4 Food & beverages

- 8.5 Manufacturing

- 8.6 Oil & gas

- 8.7 Power

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Cognex

- 10.3 Denso Wave

- 10.4 DSI Robotics

- 10.5 Energy Robotics

- 10.6 Fanuc

- 10.7 Honeybee Robotics

- 10.8 Innok Robotics

- 10.9 JH Robotics

- 10.10 Kuka

- 10.11 Mitsubishi Heavy Industries

- 10.12 Nexxis

- 10.13 Robotnik Automation

- 10.14 Staubli

- 10.15 Superdroid Robotics

- 10.16 Universal Robots