|

市场调查报告书

商品编码

1699323

石油和天然气基础设施市场机会、成长动力、产业趋势分析及 2025-2034 年预测Oil and Gas Infrastructure Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

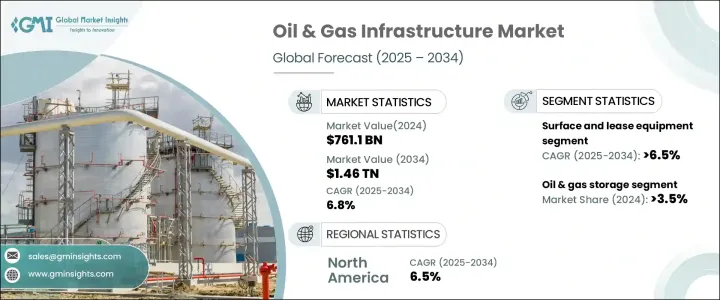

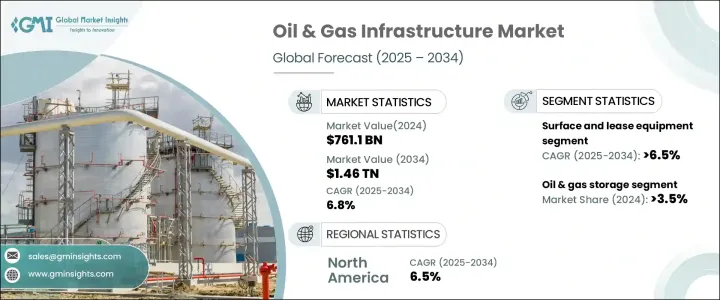

2024 年全球石油和天然气基础设施市场规模达到 7,611 亿美元,预计 2025 年至 2034 年的复合年增长率为 6.8%。石油和天然气需求的不断增长,尤其是新兴经济体的需求,加上大型基础设施项目投资的激增,将推动产业扩张。随着能源产业的快速转型,各国正投入大量资源来加强基础建设和提高营运效率。能源消耗的增加,加上技术的进步,正在加速高效率运输、储存和加工设施的发展。

该行业分为几个部分,包括地面和租赁设备、收集和加工、管道、储存、精炼和运输以及出口终端。受勘探和生产活动扩张的推动,预计到 2034 年,地面和租赁设备的复合年增长率将达到 6.5%。緻密气和页岩气开采等非常规钻井技术的日益普及,进一步刺激了对支援作业的先进设备的需求。随着能源生产商寻求提高效率和优化生产,对地面基础设施的投资仍然至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7611亿美元 |

| 预测值 | 1.46兆美元 |

| 复合年增长率 | 6.8% |

到 2024 年,石油和天然气储存行业的份额将达到 3.5%,由于向天然气为基础的经济转变和全球贸易的不断扩大,需求将不断增加。对大规模储存解决方案日益增长的需求源于石化和炼油活动的加强,这些活动需要大量容量来容纳原油、原料和精炼石油产品,包括航空燃料、柴油和汽油。推动供应灵活性和增强储存基础设施正在促进市场成长,确保稳定的能源供应以满足波动的需求。

2024 年美国石油和天然气基础设施市场价值为 804 亿美元,预计到 2034 年将达到 1,500 亿美元。对能源基础设施的策略性投资正在加强国家能源安全,最大限度地减少供应链漏洞,并确保燃料分配不间断。该国正致力于液化工厂和炼油终端的现代化和扩建,加速业界采用尖端技术。管道网路、储存扩建和先进炼油设施的资本支出增加正在促进产业成长,使美国能够保持其在石油和天然气基础设施领域的主导地位。

目录

第一章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:依类别,2021 年至 2034 年

- 主要趋势

- 地面和租赁设备

- 收集和加工

- 石油、天然气和天然气凝析液管道

- 石油和天然气储存

- 炼油及石油产品运输

- 出口码头

第六章:市场规模及预测:依地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 挪威

- 英国

- 法国

- 义大利

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 奈及利亚

- 阿联酋

- 阿曼

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

第七章:公司简介

- Baker Hughes Company

- BP

- Centrica

- Chevron Corporation

- ConocoPhillips

- Energy Transfer

- Enterprise Products Partners

- Exxon Mobil Corporation

- Hatch

- Halliburton

- Kinder Morgan

- Marathon Oil Company

- NGL Energy Partners

- Occidental Petroleum Corporation

- ONEOK

- Royal Vopak

- SLB

- Shell

- TotalEnergies

- WILLIAMS

The Global Oil and Gas Infrastructure Market reached USD 761.1 billion in 2024 and is projected to grow at a CAGR of 6.8% from 2025 to 2034. The increasing demand for oil and gas, especially in emerging economies, combined with surging investments in large-scale infrastructure projects, is set to drive industry expansion. With the energy sector undergoing rapid transformation, nations are allocating significant resources to strengthen their infrastructure and enhance operational efficiency. Rising energy consumption, coupled with advancements in technology, is accelerating the development of efficient transportation, storage, and processing facilities.

The industry is classified into several segments, including surface and lease equipment, gathering and processing, pipelines, storage, refining and transportation, and export terminals. Surface and lease equipment is expected to grow at a CAGR of 6.5% by 2034, driven by the expansion of exploration and production activities. The rising implementation of unconventional drilling techniques, such as tight gas and shale gas extraction, is further fueling demand for advanced equipment to support operations. As energy producers seek to enhance efficiency and optimize production, investment in surface infrastructure remains critical.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $761.1 Billion |

| Forecast Value | $1.46 Trillion |

| CAGR | 6.8% |

The oil & gas storage sector held a 3.5% share in 2024, with demand increasing due to a shift toward a natural gas-based economy and expanding global trade. The growing need for large-scale storage solutions stems from heightened petrochemical and refinery activities, where significant capacities are required to accommodate crude oil, feedstocks, and refined petroleum products, including jet fuel, diesel, and gasoline. The push for supply flexibility and enhanced storage infrastructure is reinforcing market growth, ensuring a stable energy supply to meet fluctuating demand.

United States oil & gas infrastructure market was valued at USD 80.4 billion in 2024, with projections expected to generate USD 150 billion by 2034. Strategic investments in energy infrastructure are reinforcing national energy security, minimizing supply chain vulnerabilities, and ensuring uninterrupted fuel distribution. The country is focusing on modernizing and expanding liquefaction plants and refining terminals, accelerating industry adoption of cutting-edge technologies. Increased capital expenditure in pipeline networks, storage expansions, and advanced refining facilities is fostering sectoral growth, allowing the US to maintain its position as a dominant player in the oil and gas infrastructure landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Category, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Surface and lease equipment

- 5.3 Gathering & processing

- 5.4 Oil, gas & NGL pipelines

- 5.5 Oil & gas storage

- 5.6 Refining & oil products transport

- 5.7 Export terminals

Chapter 6 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 Norway

- 6.3.2 UK

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Russia

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 South Korea

- 6.4.5 Australia

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 Qatar

- 6.5.3 Nigeria

- 6.5.4 UAE

- 6.5.5 Oman

- 6.5.6 Egypt

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

- 6.6.3 Mexico

Chapter 7 Company Profiles

- 7.1 Baker Hughes Company

- 7.2 BP

- 7.3 Centrica

- 7.4 Chevron Corporation

- 7.5 ConocoPhillips

- 7.6 Energy Transfer

- 7.7 Enterprise Products Partners

- 7.8 Exxon Mobil Corporation

- 7.9 Hatch

- 7.10 Halliburton

- 7.11 Kinder Morgan

- 7.12 Marathon Oil Company

- 7.13 NGL Energy Partners

- 7.14 Occidental Petroleum Corporation

- 7.15 ONEOK

- 7.16 Royal Vopak

- 7.17 SLB

- 7.18 Shell

- 7.19 TotalEnergies

- 7.20 WILLIAMS