|

市场调查报告书

商品编码

1699325

商业电线电缆市场机会、成长动力、产业趋势分析及2025-2034年预测Commercial Wire and Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

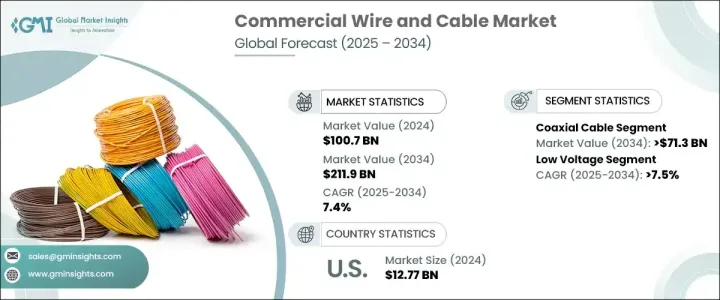

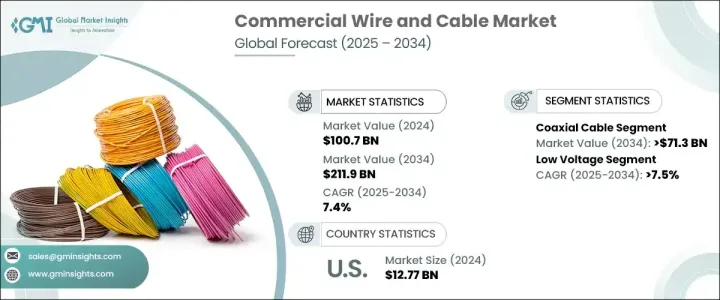

2024 年,全球商业电线电缆市场规模达到 1,007 亿美元,并有望大幅成长,预计 2025 年至 2034 年期间的复合年增长率为 7.4%。这一扩张是由各行各业的快速商业化推动的,从而刺激了对高品质电线电缆解决方案的需求。随着城市化和工业化的加速,企业正在大力投资电力基础设施以支持其营运。对先进连接解决方案的日益依赖、不断增加的基础设施开发项目以及严格的监管标准,促使市场参与者提高生产能力并创新新产品,以在竞争中保持领先地位。

电信业持续成为商业电线电缆市场需求的重要推手。受电信和商业领域对可靠高速连接的需求不断增长的推动,预计到 2034 年,仅光纤电缆领域就将创造 400 亿美元的产值。过去十年,电信业每年平均投资 500 亿美元用于网路升级,这进一步凸显了商业电线电缆解决方案的重要性。该领域的公司正在投入大量资源来提高生产能力并满足不断增长的行业需求,从而进一步巩固未来几年的市场扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1007亿美元 |

| 预测值 | 2119亿美元 |

| 复合年增长率 | 7.4% |

根据电压,预计到 2034 年低压部分将以 7.5% 的复合年增长率增长,这主要受到基础设施开发项目对电线电缆需求不断增长的推动。世界各国政府和私人企业正大力投资电网现代化,促进市场扩张。 2023年,光是中国就为电网建设项目拨款590亿美元,凸显了商业电线电缆在未来城镇化和工业进步中所扮演的关键角色。

美国商业电线电缆市场价值预计在 2024 年达到 127.7 亿美元,由于对电力基础设施的大量投资,该市场预计将实现稳步增长。 2022年,美国在电力网路上的投资约890亿美元,是近年来最高的支出之一。该国大力推动再生能源的应用进一步推动了对先进电线电缆解决方案的需求。北美正将自己定位为能源转型的领导者,增强商业电线电缆製造商的市场潜力。

目录

第一章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依产品,2021 年至 2034 年

- 主要趋势

- 同轴电缆/电子线

- 光纤电缆

- 讯号和控制电缆

- 电信和资料电缆

- 其他的

第六章:市场规模及预测:按电压 2021 – 2034

- 主要趋势

- 低的

- 中等的

第七章:市场规模与预测:按应用划分 2021 年至 2034 年

- 主要趋势

- 物料搬运/物流

- 娱乐/休閒

- 消费性电子产品

- 建设基础设施

- 其他的

第八章:市场规模及预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 荷兰

- 义大利

- 西班牙

- 德国

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 科威特

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

- 秘鲁

第九章:公司简介

- Bergen Cable Technology

- Belden Inc.

- FURUKAWA ELECTRIC CO., LTD.

- Havell India Ltd.

- KEI Industries Limited

- Klaus Faber AG

- LS Cables

- Leoni Cables

- NKT A/S

- Polycab

- Prysmian Group

- RR Kabel

- Riyadh Cables

- Sumitomo Electric Industries, Ltd.

- Southwire Company LLC

- Top Cables

- Thermo Cables

- ZM Cables

The Global Commercial Wire And Cable Market reached USD 100.7 billion in 2024 and is poised for significant growth, with projections indicating a CAGR of 7.4% between 2025 and 2034. This expansion is driven by rapid commercialization across industries, fueling the demand for high-quality wire and cable solutions. As urbanization and industrialization accelerate, businesses are investing heavily in electrical infrastructure to support their operations. The increasing reliance on advanced connectivity solutions, rising infrastructure development projects, and stringent regulatory standards are prompting market players to enhance their production capabilities and innovate new product offerings to stay ahead in the competitive landscape.

The telecommunications sector continues to be a significant driver of demand in the commercial wire and cable market. The fiber optics cable segment alone is expected to generate USD 40 billion by 2034, fueled by the rising need for reliable and high-speed connectivity in telecommunications and commercial sectors. Over the past decade, the telecom industry has invested an average of USD 50 billion annually in upgrading networks, reinforcing the importance of commercial wire and cable solutions. Companies operating in this sector are allocating substantial resources to enhance production capacity and meet growing industry requirements, further solidifying market expansion over the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $100.7 Billion |

| Forecast Value | $211.9 Billion |

| CAGR | 7.4% |

Based on voltage, the low voltage segment is projected to grow at a CAGR of 7.5% by 2034, primarily driven by the increasing demand for wire and cable in infrastructure development projects. Governments and private enterprises worldwide are investing heavily in electrical grid modernization, contributing to market expansion. In 2023, China alone allocated USD 59 billion for electric power grid construction projects, emphasizing the critical role of commercial wire and cable in powering the future of urbanization and industrial advancements.

The U.S. commercial wire and cable market, valued at USD 12.77 billion in 2024, is set to witness steady growth owing to substantial investments in electrical infrastructure. In 2022, the U.S. invested approximately USD 89 billion in electricity networks, marking one of the highest expenditures in recent years. The country's strong push towards renewable energy adoption further drives the demand for advanced wire and cable solutions. North America is positioning itself as a leader in energy transition, enhancing the market potential for commercial wire and cable manufacturers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Coaxial Cables/Electronic Wires

- 5.3 Fiber optics cables

- 5.4 Signal & Control cable

- 5.5 Telecom & data cables

- 5.6 Others

Chapter 6 Market Size and Forecast, By Voltage 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

Chapter 7 Market Size and Forecast, By Application 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Material Handling/Logistics

- 7.3 Entertainment/Leisure

- 7.4 Consumer electronics

- 7.5 Building infrastructure

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Netherlands

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Germany

- 8.3.7 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Kuwait

- 8.5.5 South Africa

- 8.5.6 Egypt

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Peru

Chapter 9 Company Profiles

- 9.1 Bergen Cable Technology

- 9.2 Belden Inc.

- 9.3 FURUKAWA ELECTRIC CO., LTD.

- 9.4 Havell India Ltd.

- 9.5 KEI Industries Limited

- 9.6 Klaus Faber AG

- 9.7 LS Cables

- 9.8 Leoni Cables

- 9.9 NKT A/S

- 9.10 Polycab

- 9.11 Prysmian Group

- 9.12 RR Kabel

- 9.13 Riyadh Cables

- 9.14 Sumitomo Electric Industries, Ltd.

- 9.15 Southwire Company LLC

- 9.16 Top Cables

- 9.17 Thermo Cables

- 9.18 ZM Cables