|

市场调查报告书

商品编码

1699335

癫痫治疗药物市场机会、成长动力、产业趋势分析及预测(2025-2034)Epilepsy Treatment Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

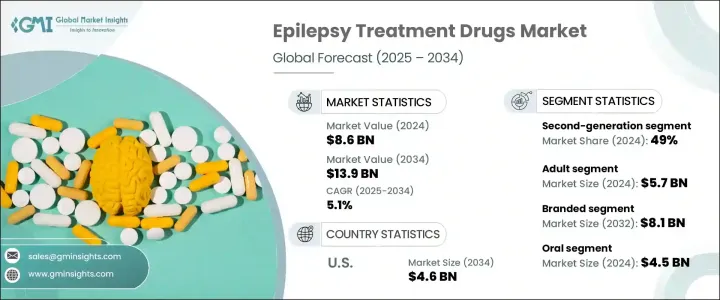

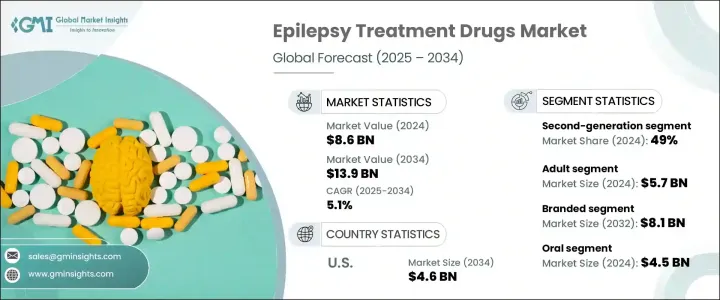

2024 年全球癫痫治疗药物市场规模达到 86 亿美元,预计 2025 年至 2034 年的复合年增长率为 5.1%。推动这一增长的因素包括癫痫盛行率的上升、药物研究的进步以及政府和私人组织投资的增加。全球范围内癫痫病例数量的不断增加推动了对有效药物的需求,而药物研发的突破则带来了疗效更强、副作用更少的创新治疗方案的推出。正在进行的研究和开发计划正在为下一代癫痫药物铺平道路,这些药物可以改善患者的治疗效果并提供更大的治疗益处。

製药公司正在大力投资临床试验和监管快速通道,以便更快地将先进的抗癫痫药物推向市场。老年人口的不断增长更容易患神经系统疾病,这进一步增加了对癫痫药物的需求。此外,加强宣传活动、改善医疗保健基础设施以及更便捷的药物取得方式正在加强市场扩张。精准医疗和个人化治疗方法的引入也在重塑癫痫治疗格局中发挥关键作用。随着药品製造商继续优先考虑安全性和有效性,市场正在见证大量具有优化剂量和最小副作用的新配方的涌入。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 86亿美元 |

| 预测值 | 139亿美元 |

| 复合年增长率 | 5.1% |

市场根据药物类别细分为第一代、第二代和第三代药物。第二代药物在 2024 年占据主导地位,占据总市场份额的 49%,预计到 2034 年将以 5.2% 的复合年增长率增长。与第一代药物相比,第二代药物的广泛采用主要归因于患者依从性较好、药物交互作用风险较低、副作用较少。由于这些药物在治疗癫痫以外的多种神经系统疾病方面有效,监管机构正在加速批准这些药物。随着製药公司不断增强其产品组合,对第二代癫痫药物的需求预计将大幅上升。

根据药物类型,市场也分为品牌癫痫治疗药物和仿製癫痫治疗药物。 2024 年,品牌药物领域占据市场主导地位,占总收入的 59.1%,预计到 2034 年将达到 81 亿美元。製药公司正专注于开发安全性更高、治疗效果更好的品牌癫痫药物,从而推动对优质治疗解决方案的需求。由于品牌药物可靠、有效且副作用风险较低,患者和医疗保健提供者越来越青睐品牌药物。随着向下一代品牌疗法的不断转变,市场有望实现持续成长。

美国仍然是癫痫治疗药物销售的主要贡献者,预计到 2034 年市场规模将达到 46 亿美元。癫痫病例数量的增加推动了对抗癫痫药物的强劲需求,而政府措施和研究资金正在加速药物开发。旨在提高治疗可及性和治疗策略进步的联邦计划正在进一步加强市场扩张。随着製药公司不断创新并获得监管部门的批准,美国市场预计将在全球癫痫治疗药物产业中保持主导地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 癫痫盛行率上升

- 增加对研发活动的投资

- 对新型癫痫治疗方法的需求日益增长

- 提高认识和早期诊断

- 产业陷阱与挑战

- 与抗癫痫药物相关的不良反应

- 专利到期

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按药物类别,2021 年至 2034 年

- 主要趋势

- 第一代

- 第二代

- 第三代

第六章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 品牌

- 泛型

第七章:市场估计与预测:依管理路线,2021 年至 2034 年

- 主要趋势

- 口服

- 鼻腔

- 注射剂

- 直肠

第八章:市场估计与预测:按年龄组,2021 年至 2034 年

- 主要趋势

- 儿科

- 成人

第九章:市场估计与预测:按扣押类型,2021 年至 2034 年

- 主要趋势

- 局部性癫痫

- 全身性癫痫

- 合併发作

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 网路药局

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- Bausch Health Companies

- Dr. Reddy's Laboratories

- Eisai

- GlaxoSmithKline

- Jazz Pharmaceuticals

- Neurelis

- Novartis

- Novel Laboratories

- Pfizer

- Sanofi

- SK Biopharmaceuticals

- SUMITOMO PHARMA

- Sun Pharmaceutical Industries

- UCB Pharma

The Global Epilepsy Treatment Drugs Market reached USD 8.6 billion in 2024 and is projected to expand at a CAGR of 5.1% from 2025 to 2034. The growth is driven by an increasing prevalence of epilepsy, advancements in pharmaceutical research, and rising investments from government and private organizations. The rising number of epilepsy cases worldwide is fueling demand for effective medications, while breakthroughs in drug development are leading to the introduction of innovative treatment options with enhanced efficacy and fewer side effects. Ongoing research and development initiatives are paving the way for next-generation epilepsy medications that offer improved patient outcomes and greater therapeutic benefits.

Pharmaceutical companies are investing heavily in clinical trials and regulatory fast-tracking to bring advanced anti-epileptic drugs to market faster. The growing elderly population, which is more susceptible to neurological disorders, is further contributing to the demand for epilepsy medications. Additionally, increased awareness campaigns, improved healthcare infrastructure, and better access to medications are strengthening market expansion. The introduction of precision medicine and personalized treatment approaches is also playing a pivotal role in reshaping the epilepsy treatment landscape. As drug manufacturers continue prioritizing safety and efficacy, the market is witnessing an influx of new formulations with optimized dosing and minimal adverse effects.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.6 Billion |

| Forecast Value | $13.9 Billion |

| CAGR | 5.1% |

The market is segmented based on drug class into first-generation, second-generation, and third-generation drugs. Second-generation drugs dominated in 2024, accounting for 49% of the total market share, and are anticipated to grow at a CAGR of 5.2% through 2034. Their widespread adoption is primarily attributed to better patient compliance, lower risk of drug interactions, and fewer side effects compared to first-generation alternatives. Regulatory bodies are increasingly expediting approvals for these medications due to their effectiveness in treating multiple neurological disorders beyond epilepsy. As pharmaceutical companies continue to enhance their portfolios, the demand for second-generation epilepsy drugs is expected to rise significantly.

The market is also categorized by drug type into branded and generic epilepsy treatment medications. In 2024, the branded segment led the market, capturing 59.1% of total revenue, and is projected to reach USD 8.1 billion by 2034. Pharmaceutical firms are focusing on the development of branded epilepsy drugs with enhanced safety profiles and improved therapeutic performance, fueling demand for premium treatment solutions. Patients and healthcare providers increasingly prefer branded medications due to their reliability, effectiveness, and reduced risk of side effects. With the ongoing shift toward next-generation branded therapies, the market is poised for sustained growth.

The United States remains a key contributor to epilepsy treatment drug sales, with the market projected to generate USD 4.6 billion by 2034. The rising number of epilepsy cases is driving strong demand for anti-epileptic medications, while government initiatives and research funding are accelerating drug development. Federal programs aimed at improving treatment accessibility and advancements in therapeutic strategies are further strengthening market expansion. As pharmaceutical companies continue innovating and securing regulatory approvals, the U.S. market is expected to maintain its dominant position in the global epilepsy treatment drugs industry.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° Synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of epilepsy

- 3.2.1.2 Increasing investments in research and development activities

- 3.2.1.3 Increasing demand for novel treatment for epilepsy

- 3.2.1.4 Growing awareness and early diagnosis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse effects associated with the antiepileptic drugs

- 3.2.2.2 Patent expiration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 First-generation

- 5.3 Second-generation

- 5.4 Third-generation

Chapter 6 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Branded

- 6.3 Generics

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Nasal

- 7.4 Injectable

- 7.5 Rectal

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pediatric

- 8.3 Adult

Chapter 9 Market Estimates and Forecast, By Seizure Type, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Focal seizure

- 9.3 Generalized seizure

- 9.4 Combined seizure

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospital pharmacies

- 10.3 Retail pharmacies

- 10.4 Online pharmacies

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Bausch Health Companies

- 12.2 Dr. Reddy's Laboratories

- 12.3 Eisai

- 12.4 GlaxoSmithKline

- 12.5 Jazz Pharmaceuticals

- 12.6 Neurelis

- 12.7 Novartis

- 12.8 Novel Laboratories

- 12.9 Pfizer

- 12.10 Sanofi

- 12.11 SK Biopharmaceuticals

- 12.12 SUMITOMO PHARMA

- 12.13 Sun Pharmaceutical Industries

- 12.14 UCB Pharma