|

市场调查报告书

商品编码

1699345

皮下注射器及针头市场机会、成长动力、产业趋势分析及 2025-2034 年预测Hypodermic Syringes and Needles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

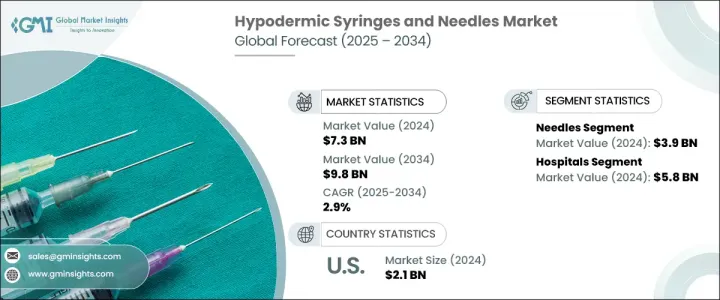

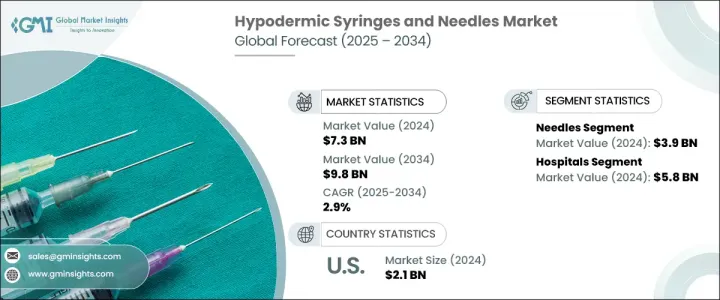

2024 年全球皮下注射器和针头市场价值为 73 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 2.9%。这一增长受到多种因素的推动,包括慢性病患病率上升、外科手术数量增加以及注射器和针头在采血中的使用率不断提高。随着医疗保健的进步不断影响现代医疗方法,预计未来十年对高效、精确注射设备的需求将激增。此外,药物管理技术的进步、对安全注射器的推动以及需要定期注射的老年人口的增加,进一步加强了市场扩张。

慢性病负担的恶化是导致注射器和针头需求增加的重要因素。全球数百万人需要频繁注射药物来治疗糖尿病、关节炎和心血管疾病等疾病,这更凸显了对可靠、精确的针头系统的需求。对预防保健的日益关注,加上对疫苗接种计划的认识不断提高,预计也将推动市场成长。政府推动免疫接种的倡议和对家庭医疗保健解决方案日益增长的偏好进一步推动了采用率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 73亿美元 |

| 预测值 | 98亿美元 |

| 复合年增长率 | 2.9% |

市场分为两个主要部分:注射器和针头。针头市场预计将成为整体市场扩张的主要贡献者,预计复合年增长率为 3.1%,到 2034 年将达到 54 亿美元。慢性病治疗的需求日益增长,特别是对于需要定期注射的患者而言,这推动了对先进针头技术的需求。随着自行注射数量的稳定增长以及对感染预防的日益重视,製造商正致力于创新针头设计,以提高患者的舒适度和安全性。

在应用方面,皮下注射器和针头市场涵盖多个类别,包括采血、药物输送、疫苗接种、胰岛素给药等。药物传输领域预计将经历显着成长,到 2034 年将达到 48 亿美元,复合年增长率为 2.8%。随着管理慢性病的人数不断增加,对有效的药物管理解决方案的需求也越来越大。该行业正在见证无针注射系统、智慧注射器和预充式註射器技术的进步,这些技术在提高药物输送效率和患者依从性方面发挥着至关重要的作用。

2024 年美国皮下注射器和针头市场价值为 21.3 亿美元,预计在 2025 年至 2034 年期间将以 1.8% 的速度成长。该国完善的医疗保健基础设施,加上慢性病的高发生率,继续推动对这些设备的需求。由于相当一部分人口需要注射治疗,对精确、高品质的注射器和针头的需求仍然强劲。此外,对医疗保健创新的投资不断增加以及确保产品安全和效率的严格监管政策正在进一步塑造美国的市场动态。随着对注射解决方案的需求不断增长,製造商正专注于可持续且用户友好的注射器和针头技术,以满足不断变化的医疗保健需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 慢性病发生率上升

- 手术数量增加

- 技术进步与产品创新

- 注射器和针头采血使用量激增

- 产业陷阱与挑战

- 针刺伤和感染的风险

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 新兴替代品

- 差距分析

- 波特的分析

- PESTEL分析

- 未来市场趋势

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 注射器

- 针

第六章:市场估计与预测:按可用性,2021 - 2034 年

- 主要趋势

- 一次性的

- 可重复使用的

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 血液收集

- 药物输送

- 疫苗接种

- 胰岛素给药

- 其他应用

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 诊断中心

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Abbott

- B. Braun

- BD (Becton, Dickinson and Company)

- Cardinal Health

- Catalent

- Connecticut Hypodermics

- DeRoyal

- EXEl

- HI-TECH MEDICS

- ICU medical

- Lifelong MEDITECH

- McKESSON

- Medline

- NIPRO

- RETRACTABLE TECHNOLOGIES

- TERUMO

- VITA NEEDLE

- VMG

The Global Hypodermic Syringes And Needles Market was valued at USD 7.3 billion in 2024 and is set to grow at a CAGR of 2.9% from 2025 to 2034. This growth is fueled by multiple factors, including the rising prevalence of chronic diseases, an increasing number of surgical procedures, and the expanding utilization of syringes and needles for blood collection. As healthcare advancements continue to shape modern medical treatments, the demand for efficient and precise injection devices is expected to surge over the next decade. Additionally, technological advancements in drug administration, the push for safety-engineered syringes, and the rising geriatric population requiring routine injections are further strengthening market expansion.

The growing burden of chronic illnesses is a significant driver behind the increasing demand for hypodermic syringes and needles. Millions of people worldwide require frequent injectable medications for conditions such as diabetes, arthritis, and cardiovascular diseases, amplifying the need for reliable and accurate needle systems. The increasing focus on preventive care, coupled with rising awareness of vaccination programs, is also expected to propel market growth. Government initiatives promoting immunization and the increasing preference for home healthcare solutions are further driving adoption rates.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.3 Billion |

| Forecast Value | $9.8 Billion |

| CAGR | 2.9% |

The market is divided into two key segments: syringes and needles. The needle segment is poised to be the primary contributor to overall market expansion, with a projected CAGR of 3.1%, reaching USD 5.4 billion by 2034. The growing necessity for chronic care treatments, particularly for patients who require regular injections, is fueling the demand for advanced needle technologies. With the steady increase in the number of self-administered injections and the growing emphasis on infection prevention, manufacturers are focusing on innovative needle designs that enhance patient comfort and safety.

In terms of application, the hypodermic syringes and needles market spans various categories, including blood collection, drug delivery, vaccinations, insulin administration, and more. The drug delivery segment is projected to experience notable growth, reaching USD 4.8 billion by 2034 at a CAGR of 2.8%. As the number of individuals managing chronic diseases rises, there is a greater need for effective medication administration solutions. The industry is witnessing advancements in needle-free injection systems, smart syringes, and prefilled syringe technology, all of which are playing a crucial role in enhancing drug delivery efficiency and patient compliance.

The U.S. Hypodermic Syringes and Needles Market was valued at USD 2.13 billion in 2024 and is set to grow at a rate of 1.8% between 2025 and 2034. The country's well-established healthcare infrastructure, combined with a high prevalence of chronic diseases, continues to drive demand for these devices. With a significant portion of the population requiring injectable treatments, the need for precise and high-quality syringes and needles remains strong. Moreover, increasing investments in healthcare innovation and stringent regulatory policies ensuring product safety and efficiency are further shaping the market dynamics in the United States. As the demand for injectable solutions grows, manufacturers are focusing on sustainable and user-friendly syringe and needle technologies to cater to evolving healthcare needs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of chronic disorders

- 3.2.1.2 Increase in the number of surgeries

- 3.2.1.3 Technological advancements and product innovation

- 3.2.1.4 Surged adoption of syringes and needles for blood collection

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk of needlestick injuries and infection

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Emerging alternatives

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Syringes

- 5.3 Needles

Chapter 6 Market Estimates and Forecast, By Usability, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Disposable

- 6.3 Reusable

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Blood collection

- 7.3 Drug delivery

- 7.4 Vaccination

- 7.5 Insulin administration

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Diagnostic centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott

- 10.2 B. Braun

- 10.3 BD (Becton, Dickinson and Company)

- 10.4 Cardinal Health

- 10.5 Catalent

- 10.6 Connecticut Hypodermics

- 10.7 DeRoyal

- 10.8 EXEl

- 10.9 HI-TECH MEDICS

- 10.10 ICU medical

- 10.11 Lifelong MEDITECH

- 10.12 McKESSON

- 10.13 Medline

- 10.14 NIPRO

- 10.15 RETRACTABLE TECHNOLOGIES

- 10.16 TERUMO

- 10.17 VITA NEEDLE

- 10.18 VMG