|

市场调查报告书

商品编码

1699353

软胶囊市场机会、成长动力、产业趋势分析及 2025-2034 年预测Softgel Capsules Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

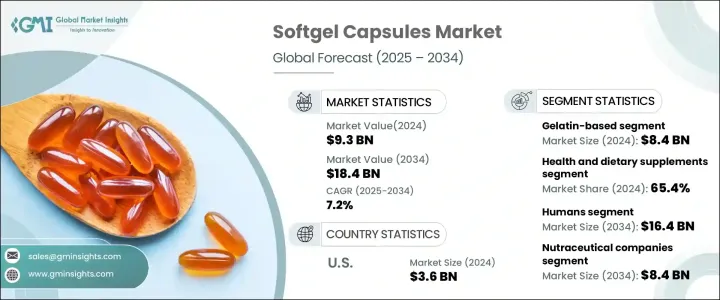

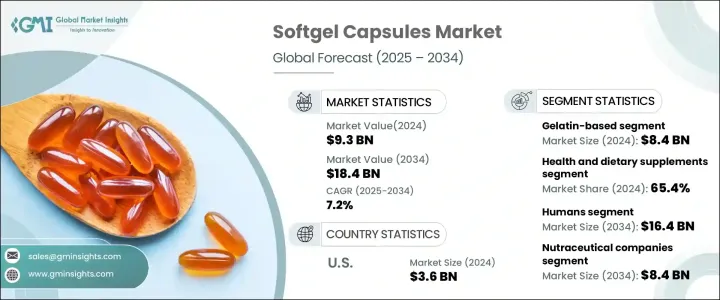

2024 年全球软胶囊市场规模达 93 亿美元,预估 2025 年至 2034 年复合年增长率为 7.2%。维生素、ω-3 脂肪酸补充剂和草药等营养保健品的消耗量增加是推动市场成长的主要因素。与传统药物相比,这些产品更容易服用、吸收更快,因此成为消费者的首选。此外,软胶囊製造技术的进步,例如引入马铃薯淀粉、羟丙基甲基纤维素 (HPMC) 和普鲁兰多醣等植物替代品,进一步推动了产业成长。随着人们对免疫系统增强剂和膳食补充剂的关注度不断提高,尤其是在疫情之后,对软胶囊的需求激增。人们对预防性医疗保健的认识不断提高以及向更健康生活方式的转变促进了膳食补充剂的采用,从而增加了市场的成长势头。

软胶囊,也称为软明胶胶囊,由单片外壳组成,其中填充有液体、半固体、凝胶或糊状形式的各种化合物。它们的优点包括易于吞嚥、提高生物利用度、掩盖味道和防篡改特性,使其成为溶解度和渗透性差的药物的理想选择。根据类型,市场分为素食胶囊和明胶胶囊,其中明胶胶囊占据市场主导地位,2024 年价值为 84 亿美元。这些胶囊具有更好的生物利用度、更快的起效速度,并能防止光、空气和湿气等环境因素的影响,因此比传统的药片和胶囊更受欢迎。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 93亿美元 |

| 预测值 | 184亿美元 |

| 复合年增长率 | 7.2% |

2024 年,健康和膳食补充剂领域占据了 65.4% 的市场份额,预计在预测期内的复合年增长率为 7.5%。人们对维生素、矿物质和 Omega-3 补充剂的需求不断增加,以增强免疫力并改善整体健康,推动了这一领域的发展。预防性医疗保健的趋势促使消费者在日常生活中加入补充剂,以预防心血管疾病和骨质疏鬆症等慢性疾病。不断上涨的医疗成本也促使人们采用补充剂作为管理长期健康的一种经济有效的措施,从而进一步刺激了对软胶囊的需求。技术进步简化了製造流程,使得软胶囊配方中可以包含更广泛的成分,从而促进了市场成长。

人类领域引领了市场,2024 年市场规模达 84 亿美元,预计到 2034 年将达到 164 亿美元。人口老化,尤其是在已开发国家,推动了对软胶囊等易于吞嚥和方便的药物形式的需求。注重健康的消费者对维生素、矿物质和草药补充剂的日益热爱进一步推动了市场的成长。製药公司继续采用软胶囊製剂,因为它们美观且符合消费者的喜好,从而加强了该行业的成长轨迹。

2024 年,营养保健品公司占据了相当大的市场份额,预计到 2034 年将达到 84 亿美元。消费者对健康和保健的意识不断提高,再加上直接面向消费者 (DTC) 模式和电子商务平台的激增,扩大了营养补充剂的覆盖范围,增加了对软胶囊的需求。不同地区的监管机构透过批准各种健康声明来支持营养保健品的使用,为创新软胶囊配方的开发铺平了道路。

在北美,美国占有突出的市场地位,2024 年市场价值为 36 亿美元。消费者对自我药疗和非处方 (OTC) 补充剂的倾向性增加,加上有利的监管框架和不断增长的研发资金,推动了市场的扩张。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 对营养保健品的需求不断增加

- 全球慢性病盛行率不断上升

- 软胶囊製造技术创新

- 越来越多转向无明胶胶囊

- 产业陷阱与挑战

- 来自替代剂型的竞争

- 严格的监管要求

- 成长动力

- 成长潜力分析

- 监管格局

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 明胶基

- 素食胶囊

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 健康和膳食补充剂

- 维生素

- 酵素

- 欧米茄

- 矿物质

- 其他健康和膳食补充剂

- 处方药

- 抗生素和抗病毒药物

- 抗发炎药物

- 咳嗽和感冒药

- 其他处方药

- 其他应用

第七章:市场估计与预测:按适应症,2021 年至 2034 年

- 主要趋势

- 人类

- 动物

第八章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 製药公司

- 营养保健品公司

- 兽医业

- 其他最终用途

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Aenova Group

- Capsugel (Lonza)

- Captek Softgel International

- Catalent

- Curtis Health Caps

- Delpharm Evreux

- Estrellas

- Eurocaps

- Fuji Capsules

- Guangdong Yichao Biological

- Nutramax Laboratories

- Patheon

- Procaps Group

- Sirio Pharma

The Global Softgel Capsules Market reached USD 9.3 billion in 2024 and is expected to exhibit a CAGR of 7.2% from 2025 to 2034. Increasing consumption of nutraceuticals such as vitamins, omega-3 fatty acid supplements, and herbal medicines is a primary factor driving market growth. These products offer easier consumption and faster absorption compared to traditional medicines, making them a preferred choice among consumers. Additionally, advancements in softgel capsule manufacturing, such as the introduction of plant-based alternatives like potato starch, hydroxypropyl methylcellulose (HPMC), and pullulan, are further boosting industry growth. With a heightened focus on immune system boosters and dietary supplements, particularly after the pandemic, there has been a surge in demand for softgel capsules. Growing awareness about preventive healthcare and a shift toward healthier lifestyles have contributed to the increased adoption of dietary supplements, adding to the market's growth momentum.

Softgel capsules, also known as soft gelatin capsules, consist of a single-piece shell filled with various compounds in liquid, semi-solid, gel, or paste form. Their advantages include ease of swallowing, improved bioavailability, taste masking, and tamper-proof features, making them ideal for drugs with poor solubility and permeability. Based on type, the market is segmented into vegetarian and gelatin-based capsules, with the gelatin-based segment dominating the market, valued at USD 8.4 billion in 2024. These capsules provide better bioavailability, faster onset of action, and protection against environmental factors like light, air, and moisture, making them preferable over traditional tablets and capsules.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.3 Billion |

| Forecast Value | $18.4 Billion |

| CAGR | 7.2% |

The health and dietary supplements segment accounted for 65.4% of the market in 2024 and is projected to grow at a CAGR of 7.5% during the forecast period. Increasing demand for vitamins, minerals, and omega-3 supplements to boost immunity and improve overall health is driving this segment. The trend toward preventive healthcare has led consumers to include supplements in their daily routines to prevent chronic conditions such as cardiovascular diseases and osteoporosis. Rising healthcare costs have also encouraged the adoption of supplements as a cost-effective measure to manage long-term health, further fueling the demand for softgel capsules. Technological advancements have streamlined the manufacturing process, enabling the inclusion of a wider range of ingredients in softgel formulations, contributing to market growth.

The human segment led the market, generating USD 8.4 billion in 2024, and is projected to reach USD 16.4 billion by 2034. An aging population, particularly in developed nations, has fueled demand for easy-to-swallow and convenient medication forms like softgel capsules. The growing popularity of vitamins, minerals, and herbal supplements among health-conscious consumers has further boosted market growth. Pharmaceutical companies continue to embrace softgel formulations for their aesthetic appeal and consumer preference, strengthening the industry's growth trajectory.

Nutraceutical companies held a significant share of the market in 2024 and are expected to reach USD 8.4 billion by 2034. Rising consumer awareness about health and wellness, coupled with the proliferation of direct-to-consumer (DTC) models and e-commerce platforms, has expanded the reach of nutritional supplements, increasing demand for softgel capsules. Regulatory agencies in different regions have supported the use of nutraceuticals by approving various health claims, paving the way for the development of innovative softgel formulations.

In North America, the U.S. held a prominent position in the market, valued at USD 3.6 billion in 2024. Increased consumer inclination toward self-medication and over-the-counter (OTC) supplements, combined with favorable regulatory frameworks and growing research and development funding, has fueled the market's expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for nutraceuticals

- 3.2.1.2 Growing prevalence of chronic ailments globally

- 3.2.1.3 Technological innovation in softgel manufacturing

- 3.2.1.4 Increasing shift towards gelatin free capsules

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Competition from alternative dosage forms

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Gelatin based

- 5.3 Vegetarian capsules

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Health and dietary supplements

- 6.2.1 Vitamins

- 6.2.2 Enzymes

- 6.2.3 Omega

- 6.2.4 Minerals

- 6.2.5 Other health and dietary supplements

- 6.3 Prescription medicine

- 6.3.1 Antibiotics and antivirals

- 6.3.2 Anti-inflammatory drugs

- 6.3.3 Cough and cold drugs

- 6.3.4 Other prescription medicines

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By Indication, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Humans

- 7.3 Animals

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical companies

- 8.3 Nutraceutical companies

- 8.4 Veterinary industry

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Aenova Group

- 10.2 Capsugel (Lonza)

- 10.3 Captek Softgel International

- 10.4 Catalent

- 10.5 Curtis Health Caps

- 10.6 Delpharm Evreux

- 10.7 Estrellas

- 10.8 Eurocaps

- 10.9 Fuji Capsules

- 10.10 Guangdong Yichao Biological

- 10.11 Nutramax Laboratories

- 10.12 Patheon

- 10.13 Procaps Group

- 10.14 Sirio Pharma