|

市场调查报告书

商品编码

1699354

伸缩臂叉装机市场机会、成长动力、产业趋势分析及 2025-2034 年预测Telehandler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

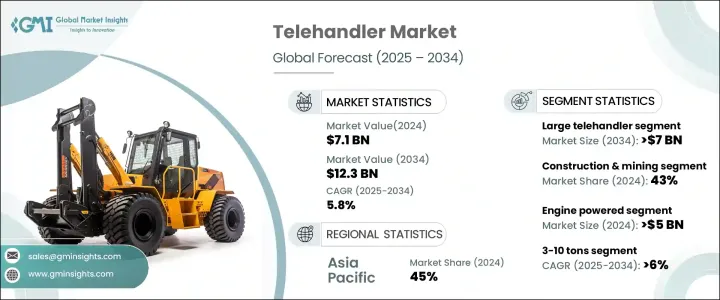

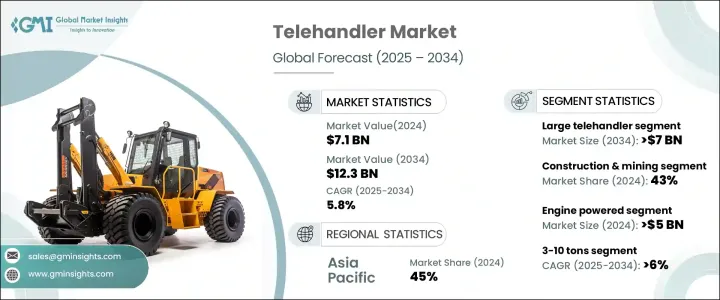

2024 年全球伸缩臂堆高机市场规模达到 71 亿美元,预估 2025 年至 2034 年期间的复合年增长率为 5.8%。政府对高速公路、公共交通系统、机场和智慧城市计画等基础设施项目的投资增加,正在推动需求成长。大规模开发通常需要国家资金,从而需要先进的建筑设备。伸缩臂叉装机正受益于这些趋势,因为它们对于基础设施项目中的物料搬运至关重要。农业机械化的兴起是推动市场成长的另一个关键因素,伸缩臂叉装机被广泛用于起重、装载和堆迭农业物资。与传统拖拉机不同,这些机器可以在崎岖的地形上行驶,同时承载更重的负载,这使得它们对于农业作业至关重要。它们能够在狭小空间和各种天气条件下正常工作,这增强了它们在各个行业的吸引力。

伸缩臂叉装机市场依产品分为大型和紧凑型。大型伸缩臂叉装机在 2024 年占据了 60% 以上的市场份额,预计到 2034 年将超过 70 亿美元。由于其伸展范围和起重能力强,这些机器在大型建筑、工业和采矿作业中需求量很大。紧凑型伸缩臂叉装机越来越受欢迎,特别是在城市环境中,因为空间限制,需要具有增强机动性的设备。承包商青睐这些型号,适用于住宅工程、室内应用和人口密集地区的建筑工地。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 71亿美元 |

| 预测值 | 123亿美元 |

| 复合年增长率 | 5.8% |

根据应用,市场分为租赁、建筑和采矿、农业、工业和其他。 2024 年,建筑和采矿业占据了 43% 的市场。桥樑、商业建筑和住宅区等不断增长的基础设施项目正在推动需求。伸缩臂叉装机因其能够吊运重物、在不平坦的地形上作业以及进入高架工作区域而广泛应用于这些行业。在采矿业中,这些机器对于运输重物、进行维护和穿越具有挑战性的地形至关重要。

就类型而言,市场分为引擎驱动和电动伸缩臂叉装机。 2024 年,引擎驱动领域的价值将超过 50 亿美元,广泛应用于建筑、采矿和大规模农业作业。这些机器因其强大的扭矩、较长的运行时间以及在苛刻环境下运行的能力而受到青睐。他们的柴油引擎无需充电,使其成为越野和远端应用的理想选择。由于营运成本较低、维护要求低以及电池技术进步(充电速度加快、电池寿命延长),电动伸缩臂叉装机预计将快速成长。

依起重能力,市场分为3吨以下、3-10吨及10吨以上。受建筑、仓储和物料搬运需求的推动,到 2034 年,3-10 吨类别的复合年增长率预计将超过 6%。这些模型在强度和灵活性之间取得了平衡,使其成为物流中心、製造工厂和城市项目不可或缺的一部分。它们也广泛用于农业领域,用于运输饲料、堆放干草和搬运谷物,而仓库则依靠它们进行库存管理和吊运重物。

2024 年,亚太地区将占全球市场的 45%,其中中国将位居首位。政府推动的基础设施发展、工业扩张和自动化趋势是需求的主要驱动力。推动大型建设项目和工业自动化的政策正在加速各行业对高性能物料搬运设备的应用。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 原料及零件供应商

- 製造商

- 技术提供者

- 分销商和经销商

- 最终用途

- 供应商格局

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 价格趋势

- 成本細項分析

- 衝击力

- 成长动力

- 建筑和基础设施建设对伸缩臂叉装机的需求不断增长

- 伸缩臂叉装机的技术进步与创新

- 租赁伸缩臂叉装机日益普及

- 农业对重型设备的需求不断成长

- 产业陷阱与挑战

- 初期投资及维护成本高

- 操作复杂性和训练要求

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 大型伸缩臂叉装机

- 紧凑型伸缩臂叉装机

第六章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 引擎驱动

- 电的

第七章:市场估计与预测:按起重能力,2021 - 2034 年

- 主要趋势

- 3吨以下

- 3-10吨

- 10吨以上

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 租赁

- 建筑和采矿

- 农业

- 工业的

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Bobcat

- Caterpillar

- CNH Industrial

- CTE Company

- Dieci Srl

- Faresin Industries

- Haulotte Group

- JCB

- JLG Industries

- Liebherr

- Manitou

- Merlo

- Sany

- Skyjack

- Snorkel

- Terex

- Teupen

- Wacker Neuson

- XCMG

- Zoomlion

The Global Telehandler Market reached USD 7.1 billion in 2024 and is projected to grow at a CAGR of 5.8% between 2025 and 2034. Increased government investments in infrastructure projects, including highways, public transit systems, airports, and smart city initiatives, are driving demand. Large-scale developments often require state funding, leading to the adoption of advanced construction equipment. Telehandlers are benefiting from these trends, as they are crucial for material handling in infrastructure projects. The rise in agricultural mechanization is another key factor boosting market growth, with telehandlers being widely used for lifting, loading, and stacking farming materials. Unlike conventional tractors, these machines can navigate rough terrains while handling heavier loads, making them essential for farming operations. Their ability to function in tight spaces and under all weather conditions enhances their appeal across industries.

The telehandler market is segmented by product into large and compact models. Large telehandlers accounted for over 60% of the market share in 2024 and are expected to surpass USD 7 billion by 2034. These machines are in high demand for major construction, industrial, and mining operations due to their extended reach and lifting capacity. Compact telehandlers are gaining traction, particularly in urban settings where space constraints require equipment with enhanced maneuverability. Contractors favor these models for residential projects, indoor applications, and construction sites in densely populated areas.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.1 Billion |

| Forecast Value | $12.3 Billion |

| CAGR | 5.8% |

By application, the market is categorized into rental, construction & mining, agriculture, industrial, and others. The construction & mining segment held a significant 43% market share in 2024. Growing infrastructure projects, including bridges, commercial buildings, and residential complexes, are fueling demand. Telehandlers are widely used in these industries due to their ability to lift heavy materials, operate on uneven terrains, and access elevated work areas. In the mining sector, these machines are essential for transporting heavy loads, performing maintenance, and navigating challenging landscapes.

In terms of type, the market is divided into engine-powered and electric telehandlers. The engine-powered segment was valued at over USD 5 billion in 2024, with widespread usage in construction, mining, and large-scale agricultural operations. These machines are favored for their strong torque, long operational hours, and ability to perform in demanding environments. Their diesel engines eliminate the need for recharging, making them ideal for off-road and remote applications. Electric telehandlers are expected to witness rapid growth due to lower operational costs, minimal maintenance requirements, and advancements in battery technology that improve charging speeds and battery longevity.

By lifting capacity, the market is segmented into below 3 tons, 3-10 tons, and above 10 tons. The 3-10 tons category is set to grow at a CAGR of over 6% through 2034, driven by demand in construction, warehousing, and material handling. These models strike a balance between strength and agility, making them indispensable for logistics centers, manufacturing plants, and urban projects. They are also widely used in agriculture for transporting feed, stacking hay, and moving grain, while warehouses rely on them for inventory management and lifting heavy goods.

Asia Pacific dominated the global market with a 45% share in 2024, with China leading the region. Government-driven infrastructure developments, industrial expansion, and automation trends are key drivers of demand. Policies promoting large-scale construction projects and industrial automation are accelerating the adoption of high-performance material handling equipment across various sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material & component suppliers

- 3.1.2 Manufacturers

- 3.1.3 Technology providers

- 3.1.4 Distributors & dealers

- 3.1.5 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Price trends

- 3.9 Cost breakdown analysis

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising demand for telehandlers in construction and infrastructure development

- 3.10.1.2 Technological advancements and innovations in telehandlers

- 3.10.1.3 Rising popularity of rental telehandlers

- 3.10.1.4 Growing demand for heavy equipment in agriculture

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High initial investment and maintenance costs

- 3.10.2.2 Operational complexity and training requirements

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Large telehandler

- 5.3 Compact telehandler

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034($Bn, Units)

- 6.1 Key trends

- 6.2 Engine-powered

- 6.3 Electric

Chapter 7 Market Estimates & Forecast, By Lifting Capacity, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Below 3 tons

- 7.3 3-10 tons

- 7.4 Above 10 tons

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Rental

- 8.3 Construction & mining

- 8.4 Agriculture

- 8.5 Industrial

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Bobcat

- 10.2 Caterpillar

- 10.3 CNH Industrial

- 10.4 CTE Company

- 10.5 Dieci Srl

- 10.6 Faresin Industries

- 10.7 Haulotte Group

- 10.8 JCB

- 10.9 JLG Industries

- 10.10 Liebherr

- 10.11 Manitou

- 10.12 Merlo

- 10.13 Sany

- 10.14 Skyjack

- 10.15 Snorkel

- 10.16 Terex

- 10.17 Teupen

- 10.18 Wacker Neuson

- 10.19 XCMG

- 10.20 Zoomlion