|

市场调查报告书

商品编码

1699356

自主船舶市场机会、成长动力、产业趋势分析及 2025-2034 年预测Autonomous Ships Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

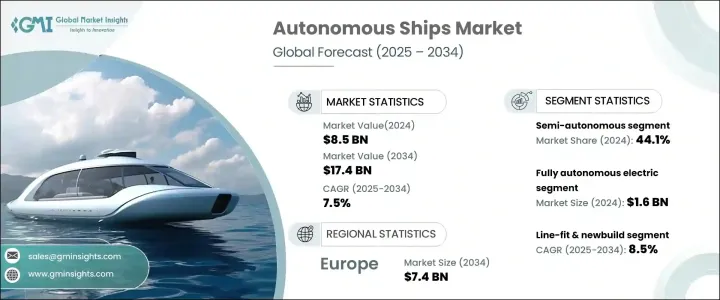

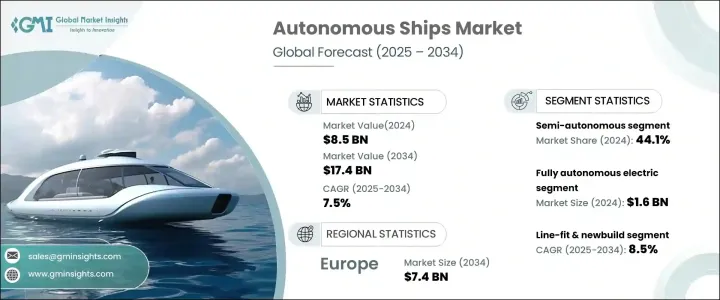

2024 年全球自主船舶市场规模达到 85 亿美元,预计 2025 年至 2034 年的复合年增长率为 7.5%。人工智慧 (AI) 和机器学习 (ML) 技术的日益普及正在推动市场扩张,彻底改变自主船舶的运作方式。製造商正在大力投资开发全自动船舶,整合 GPS、感测器和物联网 (IoT) 等尖端组件。这些进步显着提高了自主船舶的营运效率,最大限度地减少了人为干预,并确保了更好的安全标准。

在对更具成本效益和环保的解决方案的需求的推动下,自主航运业正在迅速发展。随着全球贸易的成长,航运公司越来越多地寻求优化营运成本、改善安全措施和减少排放的方法。自主船舶透过简化海上作业和最大限度地减少人为错误,提供了一种有前景的替代方案。人工智慧导航系统使船舶能够即时回应环境和导航变化,从而降低与人为误判相关的风险。此外,监管机构正在支持向自动化转变,例如增加对智慧港口基础设施和数位海事解决方案的投资。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 85亿美元 |

| 预测值 | 174亿美元 |

| 复合年增长率 | 7.5% |

根据船舶类型,市场分为半自动船舶、全自动船舶和遥控船舶。半自主船舶在 2024 年占据 44.1% 的市场份额,需求持续稳定。这些船隻可以在特定条件下自主运行,提供灵活性,同时减少对人类操作员的依赖。製造商正在透过简化设计、消除甲板室和供暖等昂贵的子系统以及减少资本投资来提高半自主船舶的成本效益。该行业对半自动化解决方案的关注凸显了对逐步自动化日益增长的偏好,这使得航运公司无需对现有船队进行彻底改造即可采用该技术。

市场的另一个关键部分是推进技术,包括全电动、混合动力和传统系统。到 2024 年,全电动自主船舶的价值将达到 16 亿美元,这代表着朝着实现零排放迈出了重要一步。随着永续性成为航运业的焦点,电力推进可望推动进一步的创新。全电动船舶为传统燃料驱动船舶提供了更清洁、更节能的替代方案,符合全球减碳目标。混合动力系统也越来越受到关注,因为它们在燃油效率和运行范围之间实现了平衡,使其成为长途航线的首选。

德国自主船舶市场预计将大幅成长,预计到 2034 年将以 10.1% 的复合年增长率扩张。该国处于自主航运技术的前沿,多家公司率先推出增强船舶自主性的技术进步。随着产业的成熟,自动驾驶船舶有望降低营运成本、减少排放并提高海上安全。人们越来越关注永续性和效率,这使得自主船舶成为全球航运业的变革者,确保企业和环境的长期利益。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 人工智慧和机器学习的进步

- 降低劳动力和营运成本

- 绿色航运解决方案需求不断成长

- 支持性政府和海事政策

- 产业陷阱与挑战

- 原材料供应链中断

- 消费者对自动驾驶船舶的信任问题

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 半自主

- 完全自主

- 远端操作

第六章:市场估计与预测:按推进技术,2021 年至 2034 年

- 主要趋势

- 全电动

- 杂交种

- 传统的

第七章:市场估计与预测:依适用性,2021 年至 2034 年

- 主要趋势

- 线路安装和新建

- 改造

第八章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- >8.2 商业

- 客船

- 货柜船

- 油轮

- 其他的

- 军事与国防

- 潜水艇

- 航空母舰

- 驱逐舰

- 护卫舰

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- ABB Ltd.

- Aselsan AS

- BAE Systems

- DNV GL

- Fugro

- General Electric

- Hyundai Heavy Industries Inc.

- Kongsberg Maritime

- L3Harris Technologies, Inc.

- Mitsui E&S Shipbuilding Co., Ltd.

- Northrop Grumman Corporation

- Praxis Automation Technology BV

- RH Marine

- Rolls-Royce Holdings plc

- Samsung Heavy Industries Co., Ltd.

- Sea Machines Robotics, Inc

- Siemens AG

- Ulstein Group ASA

- Valmet

- Vigor Industrial LLC

- Wartsila

The Global Autonomous Ships Market reached USD 8.5 billion in 2024 and is anticipated to grow at a CAGR of 7.5% from 2025 to 2034. The increasing adoption of artificial intelligence (AI) and machine learning (ML) technologies is driving market expansion, revolutionizing the way autonomous vessels operate. Manufacturers are heavily investing in the development of fully autonomous ships by integrating cutting-edge components such as GPS, sensors, and the Internet of Things (IoT). These advancements are significantly enhancing the operational efficiency of autonomous ships, minimizing human intervention, and ensuring better safety standards.

The autonomous shipping industry is evolving rapidly, driven by the need for more cost-efficient and environmentally friendly solutions. With global trade rising, shipping companies are increasingly looking for ways to optimize operational costs, improve safety measures, and reduce emissions. Autonomous vessels offer a promising alternative by streamlining maritime operations and minimizing human error. AI-powered navigation systems enable ships to respond to environmental and navigational changes in real time, reducing the risks associated with human miscalculations. Additionally, regulatory bodies are supporting the shift towards automation, as seen in increasing investments in smart port infrastructures and digital maritime solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.5 Billion |

| Forecast Value | $17.4 Billion |

| CAGR | 7.5% |

The market is segmented based on vessel type into semi-autonomous, fully autonomous, and remotely operated ships. Semi-autonomous ships accounted for 44.1% market share in 2024 and continue to see steady demand. These vessels can function autonomously under specific conditions, providing flexibility while reducing reliance on human operators. Manufacturers are making semi-autonomous ships more cost-effective by simplifying design, eliminating costly subsystems like deck houses and heating, and reducing capital investment. The industry's focus on semi-autonomous solutions highlights the growing preference for gradual automation, allowing shipping companies to adopt technology without a complete overhaul of their existing fleets.

Another key segment of the market is propulsion technology, which includes fully electric, hybrid, and conventional systems. Fully electric autonomous ships, valued at USD 1.6 billion in 2024, represent a major step toward achieving zero emissions. With sustainability taking center stage in the maritime industry, electric propulsion is expected to drive further innovation. Fully electric vessels offer a cleaner and more energy-efficient alternative to conventional fuel-powered ships, aligning with global carbon reduction goals. Hybrid systems are also gaining traction as they offer a balance between fuel efficiency and operational range, making them a preferred choice for long-haul shipping routes.

Germany Autonomous Ship Market is poised for substantial growth, projected to expand at a CAGR of 10.1% through 2034. The country is at the forefront of autonomous shipping technology, with multiple companies pioneering advancements that enhance vessel autonomy. As the industry matures, autonomous ships are expected to reduce operational costs, lower emissions, and improve maritime safety. The increasing focus on sustainability and efficiency is positioning autonomous vessels as a game-changer for the global shipping industry, ensuring long-term benefits for both businesses and the environment.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancement in AI & Machine learning

- 3.2.1.2 Cost reduction in labour and operations

- 3.2.1.3 Growing demand for green shipping solutions

- 3.2.1.4 Supportive government & maritime policies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain disruption of raw materials

- 3.2.2.2 Consumers trust issues in autonomous ship

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Semi-Autonomous

- 5.3 Fully autonomous

- 5.4 Remotely operated

Chapter 6 Market Estimates and Forecast, By Propulsion Technology, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Fully electric

- 6.3 Hybrid

- 6.4 Conventional

Chapter 7 Market Estimates and Forecast, By Fit, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Line-fit & newbuild

- 7.3 Retrofit

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- >8.2 Commercial

- 8.2.1 Passenger ship

- 8.2.2 Container ship

- 8.1.3 Tankers

- 8.2.4 Others

- 8.3 Military & defense

- 8.3.1 Submarines

- 8.3.2 Aircraft carriers

- 8.3.3 Destroyers

- 8.3.4 Frigates

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ABB Ltd.

- 10.2 Aselsan A.S.

- 10.3 BAE Systems

- 10.4 DNV GL

- 10.5 Fugro

- 10.6 General Electric

- 10.7 Hyundai Heavy Industries Inc.

- 10.8 Kongsberg Maritime

- 10.9 L3Harris Technologies, Inc.

- 10.10 Mitsui E&S Shipbuilding Co., Ltd.

- 10.11 Northrop Grumman Corporation

- 10.12 Praxis Automation Technology B.V.

- 10.13 RH Marine

- 10.14 Rolls-Royce Holdings plc

- 10.15 Samsung Heavy Industries Co., Ltd.

- 10.16 Sea Machines Robotics, Inc

- 10.17 Siemens AG

- 10.18 Ulstein Group ASA

- 10.19 Valmet

- 10.20 Vigor Industrial LLC

- 10.21 Wartsila