|

市场调查报告书

商品编码

1699374

粉丝参与平台市场机会、成长动力、产业趋势分析及 2025-2034 年预测Fan Engagement Platform Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

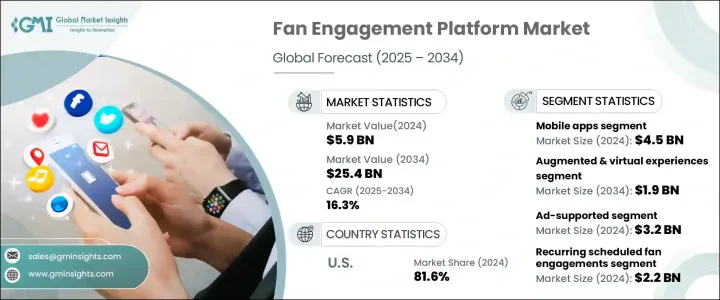

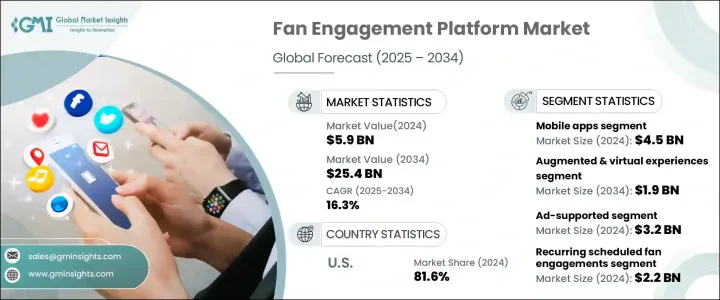

2024 年全球粉丝参与平台市场规模达到 59 亿美元,预计 2025 年至 2034 年的复合年增长率为 16.3%。随着数位转型继续重塑品牌、运动队伍和娱乐企业与观众互动的方式,该市场正在快速扩张。社群媒体在推动这一成长中发挥着至关重要的作用,越来越多的消费者依赖 Instagram、X(以前称为 Twitter)、TikTok 和 Facebook 等平台与他们最喜欢的球队、运动员和艺人保持联繫。这种转变导致对提供沉浸式互动体验的粉丝参与平台的需求增加。品牌和组织正在利用这些平台与受众建立更牢固、持久的关係,利用人工智慧驱动的洞察力、即时参与工具和游戏化功能来提高粉丝忠诚度和货币化机会。

市场分为两种主要平台类型:行动应用程式和网路平台。行动应用程式的价值在 2024 年将达到 45 亿美元,随着球迷越来越喜欢透过行动装置与他们最喜欢的球队和表演者互动,行动应用程式正在推动大部分市场的成长。企业正在透过开发提供无缝导航、即时更新和独家数位内容的用户友好型应用程式来应对这一趋势。这些行动平台透过推播通知、直播和人工智慧推荐增强了粉丝体验,让用户更容易与他们喜爱的内容保持互动。因此,对行动应用程式开发的投资持续激增,进一步加速了市场的扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 59亿美元 |

| 预测值 | 254亿美元 |

| 复合年增长率 | 16.3% |

粉丝参与平台涵盖一系列互动功能,包括增强和虚拟实境体验、即时视讯互动、电子商务整合、游戏化元素、忠诚度计划和个人化内容。其中,扩增实境和虚拟实境体验成长最快,预计到 2034 年市场价值将达到 19 亿美元。品牌越来越多地采用 AR 和 VR 技术来创造沉浸式体验,让粉丝更接近他们最喜欢的球队、音乐家和艺人。这些创新使用户能够参加虚拟见面会、享受 360 度游戏重播并参与互动直播活动。跨产业的策略伙伴关係正在加速这些技术的采用,进一步推动市场向前发展。

受先进技术的采用和高度数位化的受众的推动,北美粉丝参与平台市场实现了 16.5% 的复合年增长率。人工智慧和机器学习在增强粉丝互动、提供个人化内容推荐、情绪分析和聊天机器人驱动的参与方面发挥着至关重要的作用。即时视讯互动已成为一项关键功能,推动了对数位粉丝参与解决方案的需求不断增长。随着数位体验的不断发展,品牌、运动联盟和娱乐公司越来越多地投资于下一代技术,以提供超个人化和沈浸式的体验,让粉丝保持参与。对即时互动内容日益增长的需求预计将在未来几年推动市场达到新的高度。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 社群媒体用户不断成长

- OTT消费量成长

- 球迷互动体验需求日益增长

- 日益增长的数位连接

- 产业陷阱与挑战

- 获利挑战

- 演算法依赖性

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依平台类型,2021 年至 2034 年

- 主要趋势

- 行动应用程式

- 网路平台

第六章:市场估计与预测:依参与类型,2021 年至 2034 年

- 主要趋势

- 增强和虚拟体验

- 即时视讯通话/大师班

- 电子商务与货币化

- 游戏化和忠诚度计划

- 个性化讯息

- 图片/照片

- 声音的

- 其他的

第七章:市场估计与预测:依货币化模型,2021 年至 2034 年

- 主要趋势

- 基于订阅

- 按互动付费

- 具有高级功能的免费增值版

- 广告支持

- 小费/捐款

- 商品销售

第八章:市场估计与预测:按互动频率,2021 年至 2034 年

- 主要趋势

- 一次性活动

- 定期安排的活动

- 始终在线的社群平台

第九章:市场估计与预测:按目标受众规模,2021 年至 2034 年

- 主要趋势

- 大众市场

- 小众社区

- 一对一个性化体验

第十章:市场估计与预测:按粉丝参与度,2021 年至 2034 年

- 主要趋势

- 被动消费

- 积极参与

- 共同创造机会

第 11 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 娱乐

- 艺术

- 社群媒体名人

- 音乐

- 运动的

- 游戏/电子竞技

- 政治/行动主义

- 其他的

第 12 章:市场估计与预测:按最终用户,2021 年至 2034 年

- 主要趋势

- 个人创作者/人物

- 品牌/公司

- 团队/团体

- 媒体组织

第 13 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 14 章:公司简介

- Baron App, Inc. dba Cameo

- Corite

- Edisn

- Fave for Fans

- fcQuiz

- GigaStar

- LiveLike Inc.

- OnlyFans

- Patreon

- Sport Buff

- Twitch

- Uscreen

- X Corp

- YouTube

The Global Fan Engagement Platform Market reached USD 5.9 billion in 2024 and is projected to grow at a CAGR of 16.3% from 2025 to 2034. This market is experiencing rapid expansion as digital transformation continues to reshape how brands, sports teams, and entertainment businesses interact with their audiences. Social media plays a crucial role in driving this growth, with an increasing number of consumers relying on platforms like Instagram, X (formerly Twitter), TikTok, and Facebook to stay connected with their favorite teams, athletes, and entertainers. This shift has resulted in a heightened demand for fan engagement platforms that offer immersive, interactive experiences. Brands and organizations are capitalizing on these platforms to foster stronger, lasting relationships with their audiences, leveraging AI-driven insights, real-time engagement tools, and gamification features to enhance fan loyalty and monetization opportunities.

The market is segmented into two primary platform types: mobile applications and web platforms. Mobile applications, valued at USD 4.5 billion in 2024, are driving much of the market's growth as fans increasingly prefer mobile-first interactions with their favorite teams and performers. Businesses are responding to this trend by developing user-friendly apps that offer seamless navigation, real-time updates, and exclusive digital content. These mobile platforms provide an enhanced fan experience through push notifications, live streaming, and AI-powered recommendations, making it easier for users to stay engaged with the content they love. As a result, investments in mobile app development continue to surge, further accelerating the market's expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.9 Billion |

| Forecast Value | $25.4 Billion |

| CAGR | 16.3% |

Fan engagement platforms encompass a range of interactive features, including augmented and virtual reality experiences, live video interactions, e-commerce integrations, gamification elements, loyalty programs, and personalized content. Among these, augmented and virtual reality experiences are witnessing the fastest growth, with a projected market value of USD 1.9 billion by 2034. Brands are increasingly adopting AR and VR technologies to create immersive experiences that bring fans closer to their favorite teams, musicians, and entertainers. These innovations allow users to participate in virtual meet-and-greets, enjoy 360-degree game replays, and engage in interactive live-streamed events. Strategic partnerships across industries are accelerating the adoption of these technologies, further driving the market forward.

North America Fan Engagement Platform Market recorded a CAGR of 16.5%, driven by advanced technology adoption and a highly digital-savvy audience. AI and machine learning are playing a crucial role in enhancing fan interactions, providing personalized content recommendations, sentiment analysis, and chatbot-driven engagement. Live video interactions have emerged as a key feature, fueling increased demand for digital fan engagement solutions. As digital experiences continue to evolve, brands, sports leagues, and entertainment companies are increasingly investing in next-generation technologies to deliver hyper-personalized and immersive experiences that keep fans engaged. This growing demand for real-time, interactive content is expected to propel the market to new heights in the coming years.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing social media users

- 3.2.1.2 Rise in OTT consumption

- 3.2.1.3 Increasing demand for interactive experience of fans

- 3.2.1.4 Growing digital connectivity

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Monetization challenges

- 3.2.2.2 Algorithm dependency

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Platform Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Mobile apps

- 5.3 Web platforms

Chapter 6 Market Estimates and Forecast, By Engagement Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Augmented & virtual experiences

- 6.3 Live video calls/master class

- 6.4 E-commerce & monetization

- 6.5 Gamification & loyalty programs

- 6.6 Personalized Messages

- 6.7 Images/photos

- 6.8 Audio

- 6.9 Others

Chapter 7 Market Estimates and Forecast, By Monetization Model, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Subscription-based

- 7.3 Pay-per-interaction

- 7.4 Freemium with premium features

- 7.5 Ad-supported

- 7.6 Tipping/donations

- 7.7 Merchandize Sales

Chapter 8 Market Estimates and Forecast, By Interaction Frequency, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 One-time events

- 8.3 Recurring scheduled engagements

- 8.4 Always-on community platforms

Chapter 9 Market Estimates and Forecast, By Target Audience Size, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Mass market

- 9.3 Niche communities

- 9.4 One-to-one personalized experiences

Chapter 10 Market Estimates and Forecast, By Fan Involvement Level, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Passive consumption

- 10.3 Active participation

- 10.4 Co-creation opportunities

Chapter 11 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 Entertainment

- 11.3 Art

- 11.4 Social media personalities

- 11.5 Music

- 11.6 Sports

- 11.7 Gaming/e-sports

- 11.8 Politics/activism

- 11.9 Others

Chapter 12 Market Estimates and Forecast, By End-user, 2021 – 2034 ($ Mn)

- 12.1 Key trends

- 12.2 Individual creators/personalities

- 12.3 Brands/companies

- 12.4 Teams/groups

- 12.5 Media organizations

Chapter 13 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 Germany

- 13.3.2 UK

- 13.3.3 France

- 13.3.4 Spain

- 13.3.5 Italy

- 13.3.6 Netherlands

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 Australia

- 13.4.5 South Korea

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.5.3 Argentina

- 13.6 Middle East and Africa

- 13.6.1 Saudi Arabia

- 13.6.2 South Africa

- 13.6.3 UAE

Chapter 14 Company Profiles

- 14.1 Baron App, Inc. dba Cameo

- 14.2 Corite

- 14.3 Edisn

- 14.4 Facebook

- 14.5 Fave for Fans

- 14.6 fcQuiz

- 14.7 GigaStar

- 14.8 LiveLike Inc.

- 14.9 OnlyFans

- 14.10 Patreon

- 14.11 Sport Buff

- 14.12 Twitch

- 14.13 Uscreen

- 14.14 X Corp

- 14.15 YouTube