|

市场调查报告书

商品编码

1699379

软组织修復市场机会、成长动力、产业趋势分析及 2025-2034 年预测Soft Tissue Repair Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

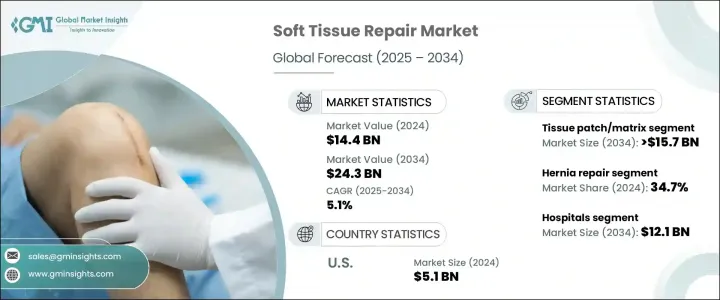

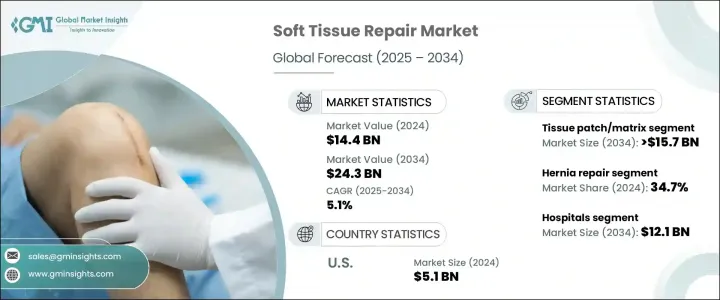

2024 年全球软组织修復市场规模达到 144 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.1%。运动伤害、创伤病例和与年龄相关的软组织损伤的增加正在推动对手术解决方案的需求。老年人口的增长和肥胖率的上升导致疝气和其他需要软组织修復的疾病的发生率上升。生物相容性产品和合成网片解决方案的进步正在改善患者的治疗效果,使手术介入更加有效。影像技术和微创手术的进步缩短了恢復时间并减少了术后併发症。

人们对创新修復技术的认识不断提高以及患者治疗效果的改善推动了市场的成长。运动医学的扩展和青少年体育运动参与度的提高导致受伤率上升,进一步推动了需求。此外,新兴市场政府对医疗保健的投资正在创造新的成长机会。再生医学的未来发展,包括富含血小板血浆 (PRP) 疗法和干细胞治疗,有望彻底改变该领域。医疗支出的增加和复杂手术的保险覆盖范围的扩大提高了人们获得先进修復方法的机会。门诊手术中心向门诊服务的转变凸显了成本效益高、便利的照护趋势,增强了市场扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 144亿美元 |

| 预测值 | 243亿美元 |

| 复合年增长率 | 5.1% |

软组织修復包括肌肉修復、筋膜缝合以及韧带、肌腱和皮肤组织损伤的治疗。这包括围手术期和术后干预,例如非手术缝合、生物解决方案和旨在缓解疼痛和恢復运动的再生干细胞疗法。市场分为组织贴片/基质和组织固定装置。组织补片/基质领域受手术对有效支架解决方案的需求推动,预计年复合成长率为 4.9%,到 2034 年将达到 157 亿美元以上。创伤、疝气和与年龄相关的组织退化病例的增加正在推动需求。材料科学的进步,特别是生物工程和合成贴片,由于具有优异的生物相容性和较低的排斥风险,改善了患者的治疗效果。

现代外科手术技术,例如腹腔镜手术,透过减少併发症和恢復期来支持组织贴片的采用。运动伤害发生率的上升和人口老化的加剧进一步要求有效的组织修復解决方案。再生医学的创新,包括与天然组织无缝结合的生物工程支架,扩大了其应用范围。医疗保健投资的增加和外科手术保险覆盖范围的扩大促进了先进组织修復解决方案的更广泛应用。门诊手术中心对门诊手术的关注加速了对具有成本效益和快速恢復材料的需求,使组织基质和贴片成为外科医生的首选。

市场按应用细分为疝气修復、整形外科手术、皮肤修復、硬膜修復和其他治疗。受肥胖率上升、人口老化和久坐不动的生活方式的影响,疝气修復手术将在 2024 年占据 34.7% 的市场份额。腹腔镜和开放式手术的普及推动了对先进修復材料的需求,包括减少復发和缩短恢復时间的合成和生物网片。患者和外科医生对疝气修復解决方案的信心增强,并继续推动市场扩张。

最终用途细分包括医院、门诊手术中心和诊所。 2024 年,医院占据市场主导地位,占有 48.3% 的份额,预计到 2034 年将达到 121 亿美元。大量复杂的外科手术病例、先进的医疗基础设施和专业的术后护理使医院成为主要的治疗中心。由于人口老化和生活方式相关因素导致的手术量不断增加,进一步巩固了医院在软组织修復领域的主导地位。

美国软组织修復市场价值在 2023 年为 47 亿美元,2024 年为 51 亿美元,预计成长强劲。慢性病、运动伤害和与年龄相关的组织退化病例的增加推动了对先进修復解决方案的需求。生物製剂和合成网片的日益普及提高了治疗的效果。微创腹腔镜技术可缩短恢復时间并减少併发症,越来越受到人们的关注。优惠的报销政策和高额的医疗支出使更多患者能够获得创新的修復方法。领先製造商的存在促进了产品的持续开发,并增强了市场的成长。向门诊手术中心和先进医院基础设施的转变支持更广泛的

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 肥胖人口不断增加

- 运动伤害发生率不断上升

- 软组织修復手术的最新进展

- 骨科疾病盛行率不断上升

- 产业陷阱与挑战

- 软组织修復手术费用过高

- 严格的监管框架

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 差距分析

- 波特的分析

- PESTEL分析

- 价值链分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 组织贴片/基质

- 合成网

- 生物网片

- 同种异体移植

- 异种移植

- 组织固定装置

- 缝合锚

- 缝合线

- 过盈螺丝

- 其他组织固定装置

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 疝气修补术

- 骨科

- 皮肤修復

- 硬脑膜修復

- 其他应用

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 诊所

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Anika Therapeutics

- Arthrex

- Baxter

- Becton, Dickinson and Company

- Collagen Matrix

- CONMED

- CryoLife

- Depuy Synthes (Johnson & Johnson)

- Integra LifeSciences

- Medprin

- Medtronic

- Smith & Nephew

- Stryker Corporation

- Zimmer Biomet

The Global Soft Tissue Repair Market reached USD 14.4 billion in 2024 and is projected to expand at a CAGR of 5.1% from 2025 to 2034. Rising sports injuries, trauma cases, and age-related soft tissue damage are driving demand for surgical solutions. A growing elderly population and increasing obesity rates contribute to higher incidences of hernias and other conditions requiring soft tissue repair. Advances in biocompatible products and synthetic mesh solutions are improving patient outcomes, making surgical interventions more effective. Progress in imaging techniques and minimally invasive procedures enhances recovery times and reduces post-operative complications.

Greater awareness of innovative repair techniques and improved patient outcomes fuel market growth. The expansion of sports medicine and increased youth participation in sports result in higher injury rates, further driving demand. Additionally, government investments in healthcare in emerging markets are creating new growth opportunities. Future developments in regenerative medicine, including platelet-rich plasma (PRP) therapy and stem cell treatments, are expected to revolutionize the field. Increased healthcare spending and insurance coverage for complex surgeries improve access to advanced repair methods. A shift towards outpatient services in ambulatory surgical centers highlights the trend of cost-effective, convenient care, reinforcing market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.4 Billion |

| Forecast Value | $24.3 Billion |

| CAGR | 5.1% |

Soft tissue repair encompasses muscle restoration, fascia suturing, and treatment of ligaments, tendons, and skin tissue damage. This includes perioperative and post-operative interventions such as non-surgical sutures, biological solutions, and regenerative stem cell therapies aimed at pain relief and motion recovery. The market is divided into tissue patch/matrix and tissue fixation devices. The tissue patch/matrix segment, driven by the need for effective scaffolding solutions in surgeries, is expected to grow at a CAGR of 4.9%, reaching over USD 15.7 billion by 2034. Increased cases of traumatic injuries, hernias, and age-related tissue degeneration are boosting demand. Advances in materials science, particularly bioengineered and synthetic patches, enhance patient outcomes due to superior biocompatibility and lower rejection risks.

Modern surgical techniques, such as laparoscopic procedures, support the adoption of tissue patches by reducing complications and recovery periods. The rising incidence of sports injuries and a growing aging population further necessitate efficient tissue repair solutions. Innovations in regenerative medicine, including bioengineered scaffolds that integrate seamlessly with native tissues, expand their applications. Increased healthcare investments and improved insurance coverage for surgical procedures facilitate wider adoption of advanced tissue repair solutions. The focus on outpatient procedures in ambulatory surgical centers accelerates the demand for cost-effective and rapid recovery materials, positioning tissue matrices and patches as preferred options among surgeons.

The market is segmented by application into hernia repair, orthopedic procedures, skin repair, dural repair, and other treatments. Hernia repair accounted for 34.7% of the market in 2024, driven by rising obesity rates, an aging population, and sedentary lifestyles. Increased adoption of laparoscopic and open surgical procedures boosts demand for advanced repair materials, including synthetic and biological meshes that reduce recurrence and improve recovery times. Enhanced patient and surgeon confidence in hernia repair solutions continues to drive market expansion.

End-use segmentation includes hospitals, ambulatory surgical centers, and clinics. Hospitals led the market in 2024, holding a 48.3% share and projected to reach USD 12.1 billion by 2034. The high volume of complex surgical cases, advanced medical infrastructure, and specialized post-operative care make hospitals the primary treatment centers. Rising surgical volumes due to aging populations and lifestyle-related conditions further reinforce hospital dominance in soft tissue repair.

The U.S. soft tissue repair market was valued at USD 4.7 billion in 2023 and USD 5.1 billion in 2024, with strong growth projections. Increased cases of chronic diseases, sports injuries, and age-related tissue degeneration drive demand for advanced repair solutions. The growing adoption of biologics and synthetic meshes enhances the effectiveness of treatments. Minimally invasive laparoscopic techniques, which shorten recovery times and reduce complications, are gaining traction. Favorable reimbursement policies and high healthcare spending enable greater patient access to innovative repair methods. The presence of leading manufacturers fosters continuous product development, strengthening market growth. The shift toward outpatient surgical centers and advanced hospital infrastructure supports broader ado

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising obese population

- 3.2.1.2 Increasing incidence of sports injuries

- 3.2.1.3 Recent advancements in soft tissue repair procedures

- 3.2.1.4 Increasing prevalence of orthopedic conditions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Excessive cost of soft tissue repair procedures

- 3.2.2.2 Stringent regulatory framework

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Tissue patch/Matrix

- 5.2.1 Synthetic mesh

- 5.2.2 Biologic mesh

- 5.2.2.1 Allograft

- 5.2.2.2 Xenograft

- 5.3 Tissue fixation devices

- 5.3.1 Suture anchors

- 5.3.2 Sutures

- 5.3.3 Interference screws

- 5.3.4 Other tissue fixation devices

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hernia repair

- 6.3 Orthopedic

- 6.4 Skin repair

- 6.5 Dural repair

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Clinics

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Anika Therapeutics

- 9.2 Arthrex

- 9.3 Baxter

- 9.4 Becton, Dickinson and Company

- 9.5 Collagen Matrix

- 9.6 CONMED

- 9.7 CryoLife

- 9.8 Depuy Synthes (Johnson & Johnson)

- 9.9 Integra LifeSciences

- 9.10 Medprin

- 9.11 Medtronic

- 9.12 Smith & Nephew

- 9.13 Stryker Corporation

- 9.14 Zimmer Biomet