|

市场调查报告书

商品编码

1699388

燃料电池市场机会、成长动力、产业趋势分析及2025-2034年预测Fuel Cell Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

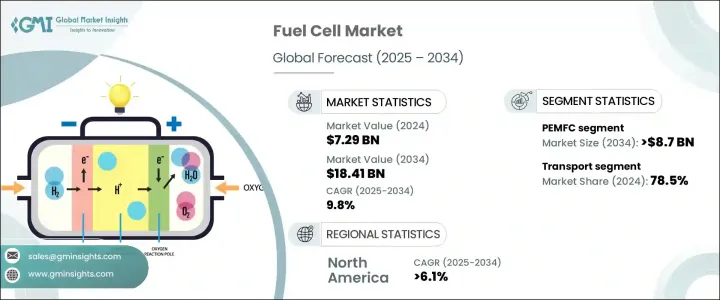

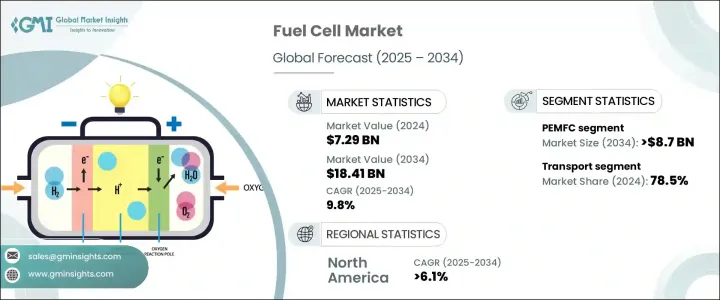

2024 年全球燃料电池市场价值为 72.9 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 9.8%。对永续能源的日益重视和氢经济的成长势头预计将推动市场扩张。旨在提高燃料电池相对于传统能源竞争力的技术突破,加上财政激励、税收抵免、补助和补贴等形式的强有力的监管支持,将有助于产业成长。减缓气候变迁和控制温室气体排放的努力将进一步加速燃料电池的采用,因为燃料电池具有清洁和低排放的特性。

世界各国政府都在实施严格的能源效率法规和减排政策,导致对多种应用的需求激增。全球和地区製造商燃料电池汽车部署的增加,以及发展中国家设定的目标,必将提振该产业前景。一些金融机构一直在燃料电池创新上投入大量资金,帮助推动该技术的发展以满足不断变化的能源需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 72.9亿美元 |

| 预测值 | 184.1亿美元 |

| 复合年增长率 | 9.8% |

燃料电池市场按产品类型细分为固态氧化物燃料电池 (SOFC)、直接甲醇燃料电池 (DMFC)、质子交换膜燃料电池 (PEMFC)、碱性燃料电池 (AFC)、磷酸燃料电池 (PAFC) 和熔融碳酸盐燃料电池 (MCFC)。其中,PEMFC由于能够在较低温度下运行,并根据能源需求调整功率输出,预计到2034年其市场价值将超过87亿美元。其高电气效率、宽功率范围和良好的功率面积比将继续支援广泛应用。燃料电池技术的进步使得 PEMFC 成为寻求清洁和适应性能源解决方案的各行各业的首选。

根据应用,市场分为固定式、便携式和运输式。 2024年,运输领域将占据市场主导地位,占总份额的78.5%。预计电气效率的提高和严格的区域标准的出台将推动大容量燃料电池的进一步商业化,特别是在交通运输领域。增加对永续移动解决方案的投资,加上政府对清洁能源转型的支持,将鼓励商用车、乘用车和重型运输更多地采用这种解决方案。

领先的产业参与者正在利用策略倡议来巩固其市场地位。公司正在扩大其技术能力、建立合作伙伴关係并采用无机成长策略来加强其影响力。美国燃料电池市场规模在 2022 年超过 15 亿美元,2023 年超过 15.1 亿美元,2024 年超过 15.4 亿美元。在强调能源效率和减少温室气体排放的政策支持下,预计到 2034 年北美的复合年增长率将超过 6.1%。政府对永续能源的措施和资金支持将继续增强该地区的产业潜力,推动燃料电池在关键领域的更广泛商业化。

目录

第一章:方法论与范围

- 研究设计

- 基础估算与计算

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第二章:执行摘要

第三章:燃料电池产业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与技术格局

第五章:燃料电池市场:依产品划分,2021 年至 2034 年

- 主要产品趋势

- 质子交换膜燃料电池

- 直接甲醇燃料电池

- 固态氧化物燃料电池

- 平安金融中心及亚洲金融中心

- MCFC

第六章:燃料电池市场:依应用划分,2021 年至 2034 年

- 主要应用趋势

- 固定式

- < 200 千瓦

- 200千瓦-1兆瓦

- ≥1兆瓦

- 便携的

- 运输

- 海洋

- 铁路

- 电动车

- 其他的

第七章:燃料电池市场:按地区,2021 年至 2034 年

- 主要区域趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 奥地利

- 亚太地区

- 日本

- 韩国

- 中国

- 印度

- 菲律宾

- 越南

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 拉丁美洲

- 巴西

- 秘鲁

- 墨西哥

第八章:公司简介

- Cummins

- Ballard Power Systems

- Plug Power

- Nuvera Fuel Cells

- Nedstack Fuel Cell Technology

- Bloom Energy

- Panasonic Corporation

- Doosan Fuel Cell

- Aisin Corporation

- Ceres

- SFC Energy

- Toshiba Corporation

- Robert Bosch

- TW Horizon Fuel Cell Technologies

- AFC Energy

- FuelCell Energy

- Fuji Electric

- Hyundai Motor Company

The Global Fuel Cell Market was valued at USD 7.29 billion in 2024 and is projected to expand at a CAGR of 9.8% from 2025 to 2034. Increasing emphasis on sustainable energy and the growing momentum of the hydrogen economy are expected to drive market expansion. Technological breakthroughs aimed at enhancing fuel cell competitiveness against traditional energy sources, alongside strong regulatory support in the form of financial incentives, tax credits, grants, and subsidies, will contribute to industry growth. Efforts to mitigate climate change and curb greenhouse gas emissions will further accelerate the adoption of fuel cells due to their clean and low-emission characteristics.

Governments worldwide are implementing stringent energy efficiency regulations and emission reduction policies, leading to a surge in demand across multiple applications. The rise in fuel cell vehicle deployments from both global and regional manufacturers, along with targets set by developing nations, is set to boost industry prospects. Several financial institutions have been channeling significant investments into fuel cell innovation, helping advance the technology to meet evolving energy demands.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.29 Billion |

| Forecast Value | $18.41 Billion |

| CAGR | 9.8% |

The fuel cell market is segmented by product type into Solid Oxide Fuel Cells (SOFC), Direct Methanol Fuel Cells (DMFC), Proton Exchange Membrane Fuel Cells (PEMFC), Alkaline Fuel Cells (AFC), Phosphoric Acid Fuel Cells (PAFC), and Molten Carbonate Fuel Cells (MCFC). Among these, PEMFC is expected to surpass USD 8.7 billion by 2034 due to its ability to operate at lower temperatures and adjust power output based on energy needs. Its high electrical efficiency, wide power range, and favorable power-to-area ratio will continue to support widespread adoption. Advancements in fuel cell technology are making PEMFCs a preferred choice across industries looking for clean and adaptable energy solutions.

By application, the market is categorized into stationary, portable, and transport segments. In 2024, the transport segment dominated the market, accounting for 78.5% of the total share. Rising electrical efficiency and the introduction of stringent regional standards are expected to drive further commercialization of large-capacity fuel cells, particularly in the transportation sector. Increasing investments in sustainable mobility solutions, coupled with government support for clean energy transitions, will encourage greater adoption in commercial vehicles, passenger cars, and heavy-duty transport.

Leading industry participants are leveraging strategic initiatives to reinforce their market position. Companies are expanding their technological capabilities, forging partnerships, and adopting inorganic growth strategies to strengthen their presence. The U.S. fuel cell market exceeded USD 1.5 billion in 2022, USD 1.51 billion in 2023, and USD 1.54 billion in 2024. North America is anticipated to experience a CAGR of over 6.1% through 2034, supported by policies that emphasize energy efficiency and greenhouse gas reductions. Government initiatives and financial backing for sustainable energy will continue to enhance the region's industry potential, driving broader commercialization of fuel cells across key sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Fuel Cell Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Fuel Cell Market, By Product, 2021 – 2034 (USD Million & MW)

- 5.1 Key product trends

- 5.2 PEMFC

- 5.3 DMFC

- 5.4 SOFC

- 5.5 PAFC & AFC

- 5.6 MCFC

Chapter 6 Fuel Cell Market, By Application, 2021 – 2034 (USD Million & MW)

- 6.1 Key application trends

- 6.2 Stationary

- 6.2.1 < 200 kW

- 6.2.2 200 kW - 1 MW

- 6.2.3 ≥ 1 MW

- 6.3 Portable

- 6.4 Transport

- 6.4.1 Marine

- 6.4.2 Railways

- 6.4.3 EVs

- 6.4.4 Others

Chapter 7 Fuel Cell Market, By Region, 2021 – 2034 (USD Million & MW)

- 7.1 Key regional trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Austria

- 7.4 Asia Pacific

- 7.4.1 Japan

- 7.4.2 South Korea

- 7.4.3 China

- 7.4.4 India

- 7.4.5 Philippines

- 7.4.6 Vietnam

- 7.5 Middle East & Africa

- 7.5.1 South Africa

- 7.5.2 Saudi Arabia

- 7.5.3 UAE

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Peru

- 7.6.3 Mexico

Chapter 8 Company Profiles

- 8.1 Cummins

- 8.2 Ballard Power Systems

- 8.3 Plug Power

- 8.4 Nuvera Fuel Cells

- 8.5 Nedstack Fuel Cell Technology

- 8.6 Bloom Energy

- 8.7 Panasonic Corporation

- 8.8 Doosan Fuel Cell

- 8.9 Aisin Corporation

- 8.10 Ceres

- 8.11 SFC Energy

- 8.12 Toshiba Corporation

- 8.13 Robert Bosch

- 8.14 TW Horizon Fuel Cell Technologies

- 8.15 AFC Energy

- 8.16 FuelCell Energy

- 8.17 Fuji Electric

- 8.18 Hyundai Motor Company