|

市场调查报告书

商品编码

1699401

植入式医疗器材市场机会、成长动力、产业趋势分析及2025-2034年预测Implantable Medical Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

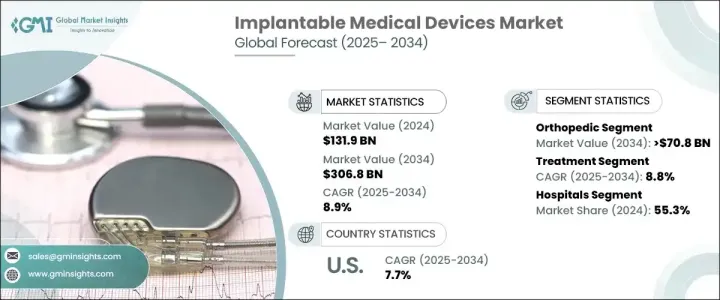

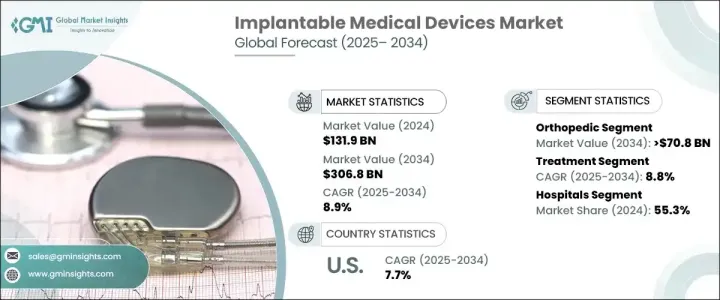

2024 年全球植入式医疗器材市场价值为 1,319 亿美元,预估 2025 年至 2034 年期间的复合年增长率为 8.9%。这一增长是由心血管疾病、神经系统疾病和骨科问题等慢性疾病的日益流行所推动的,所有这些疾病都需要先进的植入式解决方案。随着全球人口老化,对起搏器、神经刺激器、骨科植入物和其他改善生活品质的设备的需求持续激增。老年人口仍然是市场扩张的重要推动力,因为他们更容易患上与年龄相关的疾病和慢性病。

技术进步正在进一步重塑植入式医疗器材产业,生物相容性材料、无线技术和智慧植入物的创新增强了这些设备的功能和耐用性。微创手术的兴起和患者对持久解决方案的偏好也推动了该技术的采用。人工智慧 (AI) 与医疗物联网 (IoMT) 的融合正在创造新的成长途径,现在的设备能够即时健康监测和资料传输,从而更好地管理患者。市场上 3D 列印植入物的数量也在激增,从而实现了更高程度的客製化并改善了手术效果。随着全球医疗保健支出的增加以及下一代植入物的监管审批放宽,製造商正专注于研发,以推出更有效率、以患者为中心的设备。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1319亿美元 |

| 预测值 | 3068亿美元 |

| 复合年增长率 | 8.9% |

市场分为不同的类别,其中骨科器械预计将大幅成长。预计骨科领域将以 5.7% 的复合年增长率成长,到 2034 年将达到 708 亿美元。骨质疏鬆症、骨关节炎和骨折病例的增加导致对骨科植入物的需求增加。关节置换手术的数量不断增加,尤其是髋关节、膝关节和脊椎植入手术,进一步加速了市场扩张。此外,由于道路交通事故和运动相关事故造成的创伤发生率不断上升,推动了全球先进骨科解决方案的采用。

植入式医疗器材产业也分为治疗设备和诊断设备。治疗领域涵盖用于治疗目的的设备,预计将以 8.8% 的复合年增长率增长,到 2034 年达到 3032 亿美元。糖尿病和心血管疾病等生活方式相关疾病的盛行率日益上升,推动了对创新耐用的植入式解决方案的需求。这些设备显着改善了患者的治疗效果和生活质量,从而得到了广泛的应用。

美国植入式医疗器材市场规模在 2024 年将达到 548 亿美元,预计 2025 年至 2034 年的复合年增长率将达到 7.7%。美国在技术进步方面仍然处于全球领先地位,无线充电、小型化和人工智慧驱动的植入物方面的创新正在彻底改变整个产业。提供即时资料和个人化治疗方案的智慧植入物正在受到医疗保健提供者的青睐。此外,3D列印技术正在改变个人化植入物的生产,并提高手术的精确度。凭藉持续的研发投入和强大的医疗保健基础设施,美国将继续处于植入式医疗设备创新的前沿。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 全球慢性病发生率不断上升

- 器官捐赠者稀缺

- 已开发国家的技术进步

- 已开发国家政府对植入式医疗器材的资助不断增加

- 越来越重视微电子和植入式感测器的发展

- 越来越多地采用生物材料来获得更好的生物相容性和疗效

- 产业陷阱与挑战

- 设备成本高

- 有源植入式医疗器材的严格规定

- 术后併发症发生率较高

- 大量植入式医疗器材召回

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 差距分析

- 波特的分析

- PESTEL分析

- 未来市场趋势

- 价值链分析

- 植入性医疗器材安全概述

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 骨科

- 关节重建

- 脊椎装置

- 创伤固定装置

- 其他骨科产品

- 心血管

- 支架

- 植入式心臟去颤器(ICD)

- 起搏器

- 心臟再同步治疗(CRT)

- 心室辅助装置

- 植入式心臟监测仪(ICM)

- 其他心血管产品

- 牙科

- 牙冠和基台

- 牙种植体

- 其他牙科产品

- 神经病学

- 深部脑部刺激器

- 其他神经病学产品

- 眼科

- 人工水晶体和青光眼植入物

- 其他眼科产品

- 整型手术

- 乳房植入物

- 臀肌植入物

- 其他产品

第六章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 治疗

- 诊断

第七章:市场估计与预测:依设备性质,2021 - 2034 年

- 主要趋势

- 静态/非主动/被动

- 积极的

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 多专科中心

- 诊所

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Abbott

- Advanced Bionics

- Alcon

- Allergan

- BAUSCH + LOMB

- BIOTRONIK

- Boston Scientific

- Cochlear

- Demant

- GORE

- HENRY SCHEIN

- Johnson & Johnson

- MED-EL

- Medtronic

- MicroPort

- mindray

- POLYTECH

- smith & nephew

- stryker

- ZIMMER BIOMET

The Global Implantable Medical Devices Market was valued at USD 131.9 billion in 2024 and is projected to grow at a CAGR of 8.9% between 2025 and 2034. This growth is fueled by the increasing prevalence of chronic conditions such as cardiovascular diseases, neurological disorders, and orthopedic issues, all of which require advanced implantable solutions. As the global population ages, the demand for pacemakers, neurostimulators, orthopedic implants, and other life-enhancing devices continues to surge. The elderly demographic remains a significant driver of market expansion, given their higher susceptibility to age-related ailments and chronic conditions.

Technological advancements are further reshaping the implantable medical devices industry, with innovations in biocompatible materials, wireless technology, and smart implants enhancing the functionality and durability of these devices. The rise of minimally invasive procedures and patient preference for long-lasting solutions are also propelling adoption. The integration of artificial intelligence (AI) and the Internet of Medical Things (IoMT) is creating new growth avenues, with devices now capable of real-time health monitoring and data transmission for better patient management. The market is also seeing a surge in 3D-printed implants, allowing for greater customization and improved surgical outcomes. With healthcare spending increasing globally and regulatory approvals easing for next-generation implants, manufacturers are focusing on research and development to introduce more efficient and patient-centric devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $131.9 Billion |

| Forecast Value | $ 306.8 Billion |

| CAGR | 8.9% |

The market is segmented into various categories, with orthopedic devices expected to witness substantial growth. The orthopedic segment is projected to grow at a CAGR of 5.7%, reaching USD 70.8 billion by 2034. Rising cases of osteoporosis, osteoarthritis, and fractures are contributing to the higher demand for orthopedic implants. The increasing number of joint replacement surgeries, particularly hip, knee, and spinal implants, is further accelerating market expansion. Additionally, the growing incidence of traumatic injuries due to road accidents and sports-related mishaps is driving the adoption of advanced orthopedic solutions worldwide.

The implantable medical devices industry is also divided into treatment and diagnostic devices. The treatment segment, which encompasses devices used for therapeutic purposes, is anticipated to grow at a CAGR of 8.8%, reaching USD 303.2 billion by 2034. The increasing prevalence of lifestyle-related diseases, such as diabetes and cardiovascular disorders, is driving demand for innovative and durable implantable solutions. These devices significantly enhance patient outcomes and quality of life, leading to widespread adoption.

U.S. Implantable Medical Devices Market, valued at USD 54.8 billion in 2024, is expected to expand at a CAGR of 7.7% from 2025 to 2034. The country remains a global leader in technological advancements, with innovations in wireless charging, miniaturization, and AI-driven implants revolutionizing the industry. Smart implants that provide real-time data and personalized treatment options are gaining traction among healthcare providers. Furthermore, 3D printing technology is transforming the production of personalized implants, improving precision in surgical procedures. With continuous R&D investments and a robust healthcare infrastructure, the U.S. is poised to remain at the forefront of implantable medical device innovations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of chronic diseases across the globe

- 3.2.1.2 Scarcity of organ donors

- 3.2.1.3 Technological advancement in developed nations

- 3.2.1.4 Rising government funding for implantable medical devices in developed countries

- 3.2.1.5 Increasing focus on the development of microelectronics and implantable sensors

- 3.2.1.6 Growing adoption of biomaterials for better biocompatibility and outcomes

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of devices

- 3.2.2.2 Stringent regulations for active implantable medical devices

- 3.2.2.3 Considerable rate of post-procedural complications

- 3.2.2.4 High number of recalls of implantable medical devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.10 Value chain analysis

- 3.11 Overview on implantable medical device security

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Orthopedic

- 5.2.1 Joint reconstruction

- 5.2.2 Spinal devices

- 5.2.3 Trauma fixation devices

- 5.2.4 Other orthopedic products

- 5.3 Cardiovascular

- 5.3.1 Stents

- 5.3.2 Implantable cardiac defibrillators (ICDs)

- 5.3.3 Pacemaker

- 5.3.4 Cardiac resynchronization therapy (CRT)

- 5.3.5 Ventricular assist devices

- 5.3.6 Implantable cardiac monitors (ICM)

- 5.3.7 Other cardiovascular products

- 5.4 Dental

- 5.4.1 Dental crowns and abutment

- 5.4.2 Dental implants

- 5.4.3 Other dental products

- 5.5 Neurology

- 5.5.1 Deep brain stimulators

- 5.5.2 Other neurology products

- 5.6 Ophthalmology

- 5.6.1 Intraocular lenses and glaucoma implants

- 5.6.2 Other ophthalmology products

- 5.7 Plastic surgery

- 5.7.1 Breast implants

- 5.7.2 Gluteal implants

- 5.8 Other products

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Treatment

- 6.3 Diagnostic

Chapter 7 Market Estimates and Forecast, By Nature of Device, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Static/Non-active/Passive

- 7.3 Active

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Multi-specialty centers

- 8.5 Clinics

- 8.6 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott

- 10.2 Advanced Bionics

- 10.3 Alcon

- 10.4 Allergan

- 10.5 BAUSCH + LOMB

- 10.6 BIOTRONIK

- 10.7 Boston Scientific

- 10.8 Cochlear

- 10.9 Demant

- 10.10 GORE

- 10.11 HENRY SCHEIN

- 10.12 Johnson & Johnson

- 10.13 MED-EL

- 10.14 Medtronic

- 10.15 MicroPort

- 10.16 mindray

- 10.17 POLYTECH

- 10.18 smith & nephew

- 10.19 stryker

- 10.20 ZIMMER BIOMET