|

市场调查报告书

商品编码

1699411

厨房电器市场机会、成长动力、产业趋势分析及2025-2034年预测Kitchen Appliances Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

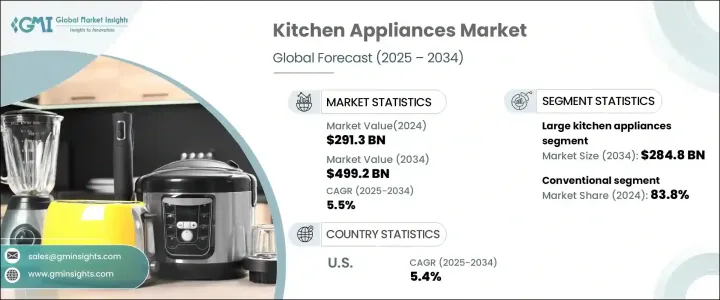

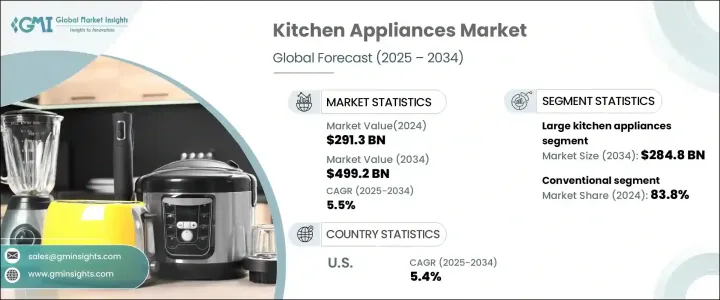

2024 年全球厨房电器市场规模达到 2,913 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.5%。对更有效率、技术更先进、用户友好的电器的需求激增推动了这一增长。消费者越来越追求厨房的便利性、速度和卓越的性能,这推动了向更智慧、更互联的解决方案的转变。大型和小型家电的创新正在改变家庭的运作方式,提供符合日益增长的可持续发展趋势的节能和直观的选择。随着人们对环境问题的认识不断提高,消费者开始有意识地选择投资节能产品,以减少电力消耗和降低碳足迹。此外,中产阶级人口的不断扩大、可支配收入的不断提高以及发展中经济体的快速城市化也促进了现代厨房用具的普及。这些因素,加上持续的技术进步,使得厨房电器市场成为全球经济的重要参与者。

市场分为大型和小型厨房电器,其中大型电器部分在 2024 年创造 1557 亿美元的产值,预计到 2034 年将达到 2848 亿美元。大型厨房电器,包括冰箱、烤箱和洗碗机,被认为是必不可少的长期投资,具有耐用性和先进的功能。消费者优先考虑这些高价商品,因为它们能够提高便利性、提高烹饪效率并降低能源消耗。现代大型家电融合了智慧感测器、触控控制和节能技术等功能,吸引了追求性能和永续性的技术买家。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2913亿美元 |

| 预测值 | 4992亿美元 |

| 复合年增长率 | 5.5% |

厨房电器也分为传统型和智慧型。 2024 年,传统家电占据了 83.8% 的市场份额,预计到 2034 年将以 5.2% 的稳定速度成长。儘管人们对智慧厨房技术的兴趣日益浓厚,但炉灶、烤箱和传统冰箱等传统家电以其可靠性、成熟的性能和易用性仍然广受欢迎。这些设备继续保持强大的吸引力,尤其是对于喜欢熟悉的、经过时间考验的解决方案的消费者而言。製造商正在将智慧功能融入传统设计中,提供将先进功能与传统模型的可靠性相结合的混合选项。

美国厨房电器市场正以每年 5.4% 的速度扩张,这得益于不断提升整体用户体验的智慧技术的普及。随着消费者追求便利性和省时的功能,製造商正在透过创新来简化烹饪、清洁和食物储存。语音控制、远端监控和基于人工智慧的功能的整合正在重塑厨房电器的未来,使其更加直观、更能响应用户偏好。随着消费者偏好的变化以及对智慧、永续解决方案的日益重视,厨房电器市场将在未来十年实现显着成长。

目录

第一章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测参数

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 零售商

- 衝击力

- 成长动力

- 可支配所得增加

- 家电技术进步

- 改变消费者的生活方式

- 产业陷阱与挑战

- 经济衰退

- 竞争激烈的市场

- 成长动力

- 消费者购买行为分析

- 人口趋势

- 影响购买决策的因素

- 消费者产品采用

- 首选配销通路

- 首选价格范围

- 成长潜力分析

- 监管格局

- 定价分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 大型厨房电器

- 烹饪用具

- 冰箱

- 洗碗机

- 烤箱

- 其他(抽油烟机等)

- 厨房小家电

- 咖啡机

- 搅拌机

- 食品加工机

- 烤麵包机

- 榨汁机

- 电热水壶

- 电炸锅

- 其他的

第六章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 聪明的

- 传统的

第七章:市场估计与预测:以价格,2021 年至 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第 8 章:市场估计与预测:按安装量 2021 年至 2034 年

- 主要趋势

- 室内的

- 户外的

第九章:市场估计与预测:依最终用途 2021 – 2034

- 主要趋势

- 住宅

- 商业的

- 餐厅

- 饭店

- 自助餐厅

- 餐饮服务

- 零售

- 其他(机构厨房等)

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 在线的

- 电子商务网站

- 公司网站

- 离线

- 专卖店

- 个别商店

- 其他的

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- BSH Home Appliances Group

- Electrolux AB

- Groupe SEB

- Haier Group Corporation

- HISENSE Group

- Hitachi Appliances Inc.

- LG Electronics

- Midea Group Co., Ltd.

- Panasonic Corporation

- Robert Bosch Gmbh

- Samsung electronics

- Sharp Corporation

- Toshiba Corporation

- Voltas

- Whirlpool corporation

The Global Kitchen Appliances Market reached USD 291.3 billion in 2024 and is projected to grow at a CAGR of 5.5% between 2025 and 2034. The surge in demand for more efficient, technologically advanced, and user-friendly appliances is driving this growth. Consumers are increasingly seeking convenience, speed, and superior performance in the kitchen, which has fueled the shift toward smarter, more connected solutions. Innovations in both large and small appliances are transforming the way households function, providing energy-efficient and intuitive options that align with growing sustainability trends. As awareness around environmental concerns increases, consumers are making conscious choices to invest in energy-efficient products that reduce electricity consumption and lower carbon footprints. Furthermore, the expanding middle-class population, rising disposable incomes, and rapid urbanization across developing economies are contributing to the increased adoption of modern kitchen appliances. These factors, combined with ongoing technological advancements, are making the kitchen appliances market a key player in the global economy.

The market is segmented into large and small kitchen appliances, with the large appliances segment generating USD 155.7 billion in 2024 and expected to reach USD 284.8 billion by 2034. Large kitchen appliances, including refrigerators, ovens, and dishwashers, are considered essential, long-term investments that offer durability and advanced functionality. Consumers prioritize these high-ticket items due to their ability to enhance convenience, improve cooking efficiency, and reduce energy consumption. Modern large appliances incorporate features such as smart sensors, touch controls, and energy-saving technologies that appeal to tech-savvy buyers seeking performance and sustainability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $291.3 Billion |

| Forecast Value | $499.2 Billion |

| CAGR | 5.5% |

Kitchen appliances are also categorized into conventional and smart segments. In 2024, conventional appliances dominated the market with an 83.8% share and are expected to grow at a steady rate of 5.2% through 2034. Despite the rising interest in smart kitchen technology, conventional appliances such as stoves, ovens, and traditional refrigerators remain widely popular due to their reliability, proven performance, and ease of use. These appliances continue to hold strong appeal, especially among consumers who prefer familiar, time-tested solutions. Manufacturers are integrating smart capabilities into conventional designs, offering hybrid options that combine advanced functionality with the reliability of traditional models.

The US kitchen appliances market is expanding at an annual rate of 5.4%, driven by the growing adoption of smart technologies that enhance the overall user experience. As consumers seek convenience and time-saving features, manufacturers are responding with innovations that streamline cooking, cleaning, and food storage. The integration of voice control, remote monitoring, and AI-based functionalities is reshaping the future of kitchen appliances, making them more intuitive and responsive to user preferences. With changing consumer preferences and an increasing emphasis on smart, sustainable solutions, the kitchen appliances market is poised for significant growth over the next decade.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.5 Secondary

- 1.5.1.1 Paid sources

- 1.5.1.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising disposable income

- 3.2.1.2 Technological advancement in appliances

- 3.2.1.3 Changing consumers lifestyles

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Economic downturn

- 3.2.2.2 Highly competitive market

- 3.2.1 Growth drivers

- 3.3 Consumer buying behavior analysis

- 3.3.1 Demographic trends

- 3.3.2 Factors Affecting Buying Decision

- 3.3.3 Consumer Product Adoption

- 3.3.4 Preferred Distribution Channel

- 3.3.5 Preferred Price Range

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Pricing analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Large kitchen appliances

- 5.2.1 Cooking appliances

- 5.2.2 Refrigerator

- 5.2.3 Dishwasher

- 5.2.4 Ovens

- 5.2.5 Others (Range hood, etc.)

- 5.3 Small kitchen appliances

- 5.3.1 Coffee makers

- 5.3.2 Blenders

- 5.3.3 Food processors

- 5.3.4 Toasters

- 5.3.5 Juicers

- 5.3.6 Electric kettles

- 5.3.7 Electric deep fryers

- 5.3.8 Others

Chapter 6 Market Estimates & Forecast, By Type, 2021 – 2034, (USD Billion) (Million units)

- 6.1 Key trends

- 6.2 Smart

- 6.3 Conventional

Chapter 7 Market Estimates & Forecast, By Price, 2021 – 2034, (USD Billion) (Million units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Installation 2021 – 2034, (USD Billion) (Million units)

- 8.1 Key trends

- 8.2 Indoor

- 8.3 Outdoor

Chapter 9 Market Estimates & Forecast, By End Use 2021 – 2034, (USD Billion) (Million units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.3.1 Restaurants

- 9.3.2 Hotels

- 9.3.3 Cafeterias

- 9.3.4 Catering services

- 9.3.5 Retail

- 9.3.6 Others (Institutional kitchens, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution channel, 2021 – 2034, (USD Billion) (Million units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-Commerce Site

- 10.2.2 Company website

- 10.3 Offline

- 10.3.1 Specialty stores

- 10.3.2 Individual stores

- 10.3.3 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 12.1 BSH Home Appliances Group

- 12.2 Electrolux AB

- 12.3 Groupe SEB

- 12.4 Haier Group Corporation

- 12.5 HISENSE Group

- 12.6 Hitachi Appliances Inc.

- 12.7 LG Electronics

- 12.8 Midea Group Co., Ltd.

- 12.9 Panasonic Corporation

- 12.10 Robert Bosch Gmbh

- 12.11 Samsung electronics

- 12.12 Sharp Corporation

- 12.13 Toshiba Corporation

- 12.14 Voltas

- 12.15 Whirlpool corporation