|

市场调查报告书

商品编码

1699415

法布瑞氏症治疗市场机会、成长动力、产业趋势分析及 2025-2034 年预测Fabry Disease Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

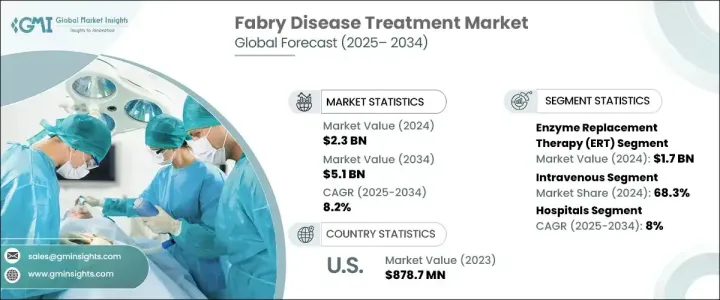

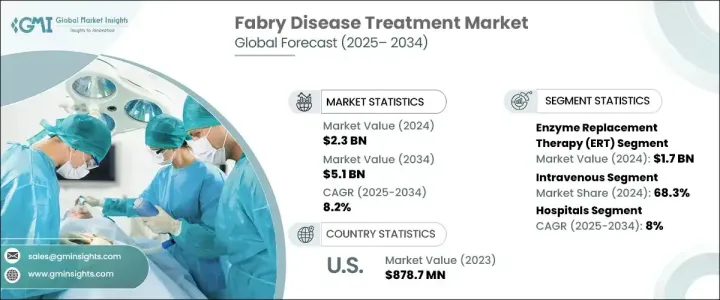

2024 年全球法布瑞氏症治疗市场价值为 23 亿美元,预计 2025-2034 年期间复合年增长率为 8.2%。对法布瑞氏症高效、有针对性和特异性治疗的需求不断增长,推动全球市场扩张。这种疾病是一种由 GLA 基因突变引起的罕见遗传性疾病,会导致有害脂肪物质在各个器官中积聚,引发影响肾臟、心臟和神经系统的严重併发症。随着人们对法布瑞氏症的认识不断提高,医疗保健提供者和製药公司正致力于开发针对症状和根本原因的创新疗法。随着研究的不断深入和临床的进步,新的治疗方案不断涌现,为患者带来了更好的治疗效果和更高的生活品质。公共和私营部门的资金增加以及生物製药公司之间的合作预计将加速该市场的创新。监管支持以及新疗法的快速通道指定进一步加快了药物审批,为行业参与者创造了有利可图的机会。竞争格局正在发生变化,各公司大力投资研发,将更有效、更容易取得的治疗方法推向市场。

市场分为几种治疗方案,其中酵素替代疗法 (ERT) 处于领先地位。 ERT 在 2024 年的价值为 17 亿美元,并且由于其作为法布瑞氏症标准治疗的既定地位而继续占据主导地位。这种疗法透过替代缺乏的酵素α-半乳糖苷酶A来发挥作用,该酵素是控制疾病和防止器官逐渐受损的重要组成部分。法布瑞氏症率的上升直接增加了对 ERT 的需求,随着诊断方法的改进,更多的患者获得了治疗。次世代定序和酵素测定彻底改变了法布瑞氏症的诊断,能够更早、更准确地检测,进一步推动了 ERT 的采用。正在进行的具有延长半衰期和提高疗效的下一代 ERT 配方研究预计将维持该领域的成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 23亿美元 |

| 预测值 | 51亿美元 |

| 复合年增长率 | 8.2% |

市场也根据给药途径区分治疗方法,包括静脉注射和口服。静脉注射治疗在 2024 年占据 68.3% 的份额,预计在 2025-2034 年期间将继续以 8.1% 的复合年增长率增长。人们对法布瑞氏症的认识不断提高以及基因筛检计画的改进导致了更多的诊断,这推动了对静脉治疗的需求。临床研究一致表明,静脉注射 ERT 在长期稳定症状方面更为有效,因此成为首选治疗方法。然而,口服疗法因其潜在的便利性和提高患者依从性而受到关注。

2024 年,北美法布瑞氏症治疗市场的收入为 9.458 亿美元,成为市场扩张的关键地区。成长的动力来自于政府的有利倡议、发病率的上升以及专门从事罕见疾病治疗的领先医疗保健公司的存在。美国治疗程序数量的不断增加,加上高昂的医疗支出和强有力的报销政策,大大促进了市场的成长。该地区在法布瑞氏症治疗领域的研发方面仍处于领先地位,多项临床试验和新药审批塑造了竞争格局。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 全球法布瑞氏症病例不断增加

- 专家和医生的意识不断增强

- 法布瑞氏症治疗疗法的进展

- 健康意识不断提高,早期诊断需求不断增加

- 产业陷阱与挑战

- 治疗费用高

- 治疗选择有限

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 定价分析

- 产品线分析

- 监管格局

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依治疗方式,2021 年至 2034 年

- 主要趋势

- 酵素替代疗法(ERT)

- 陪伴治疗

- 其他治疗类型

第六章:市场估计与预测:依管理路线,2021 年至 2034 年

- 主要趋势

- 静脉

- 口服

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 居家照护环境

- 其他最终用途

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Amicus Therapeutics

- Avrobio

- Freeline Therapeutics

- Idorsia Pharmaceuticals

- ISU Abxis

- JCR Pharmaceuticals

- Novartis

- Pfizer

- Protalix BioTherapeutics

- Sanofi

- Takeda Pharmaceuticals

- Viatris

The Global Fabry Disease Treatment Market was valued at USD 2.3 billion in 2024 and is projected to grow at a CAGR of 8.2% during 2025-2034. The increasing demand for highly effective, targeted, and specific treatments for Fabry disease is driving market expansion worldwide. The condition, a rare genetic disorder caused by mutations in the GLA gene, leads to the buildup of harmful fatty substances in various organs, resulting in severe complications affecting the kidneys, heart, and nervous system. As awareness of Fabry disease continues to grow, healthcare providers and pharmaceutical companies are focusing on developing innovative therapies that address both the symptoms and underlying causes. With ongoing research and clinical advancements, new treatment options are emerging, giving patients improved outcomes and an enhanced quality of life. Increased funding from both public and private sectors, along with collaborations among biopharmaceutical companies, is expected to accelerate innovation in this market. Regulatory support, along with fast-track designations for novel therapies, is further expediting drug approvals, creating lucrative opportunities for industry participants. The competitive landscape is evolving, with companies investing heavily in research and development to bring more effective and accessible treatments to market.

The market is categorized into several treatment options, with enzyme replacement therapy (ERT) leading the way. ERT was valued at USD 1.7 billion in 2024 and continues to dominate due to its established role as the standard treatment for Fabry disease. This therapy works by replacing the deficient enzyme alpha-galactosidase A, an essential component in managing the disease and preventing progressive organ damage. The rising prevalence of Fabry disease has directly increased the demand for ERT, with more patients gaining access to treatment due to improved diagnostic methods. Next-generation sequencing and enzyme assays have revolutionized Fabry disease diagnosis, enabling earlier and more accurate detection, which is further fueling the adoption of ERT. Ongoing research into next-generation ERT formulations with extended half-lives and improved efficacy is expected to sustain growth in this segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $5.1 Billion |

| CAGR | 8.2% |

The market also distinguishes treatments based on their route of administration, including intravenous and oral options. Intravenous treatments accounted for a 68.3% share in 2024 and are expected to continue growing at a CAGR of 8.1% during 2025-2034. The increasing awareness of Fabry disease and improvements in genetic screening programs have led to more diagnoses, which is driving demand for intravenous therapies. Clinical studies consistently show that intravenous ERT is more effective at stabilizing symptoms over the long term, making it the preferred treatment. However, oral therapies are gaining attention due to their potential convenience and improved patient adherence.

North America generated USD 945.8 million in revenue from the Fabry Disease Treatment Market in 2024, making it a key region for market expansion. Growth is driven by favorable government initiatives, rising incidence rates, and the presence of leading healthcare companies specializing in rare disease treatments. The increasing number of treatment procedures in the U.S., coupled with high healthcare expenditure and strong reimbursement policies, has significantly contributed to market growth. The region remains at the forefront of research and development in Fabry disease treatments, with multiple clinical trials and new drug approvals shaping the competitive landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising cases of fabry disease across the globe

- 3.2.1.2 Growing awareness among specialists and physicians

- 3.2.1.3 Advancements in fabry disease treatment therapies

- 3.2.1.4 Rising health awareness and demand for early-stage diagnosis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment cost

- 3.2.2.2 Limited treatment options

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Pricing analysis

- 3.6 Product pipeline analysis

- 3.7 Regulatory landscape

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Treatment, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Enzyme replacement therapy (ERT)

- 5.3 Chaperone treatment

- 5.4 Other treatment types

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Intravenous

- 6.3 Oral

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Homecare settings

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amicus Therapeutics

- 9.2 Avrobio

- 9.3 Freeline Therapeutics

- 9.4 Idorsia Pharmaceuticals

- 9.5 ISU Abxis

- 9.6 JCR Pharmaceuticals

- 9.7 Novartis

- 9.8 Pfizer

- 9.9 Protalix BioTherapeutics

- 9.10 Sanofi

- 9.11 Takeda Pharmaceuticals

- 9.12 Viatris