|

市场调查报告书

商品编码

1699420

印表机市场机会、成长动力、产业趋势分析及 2025-2034 年预测Printer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

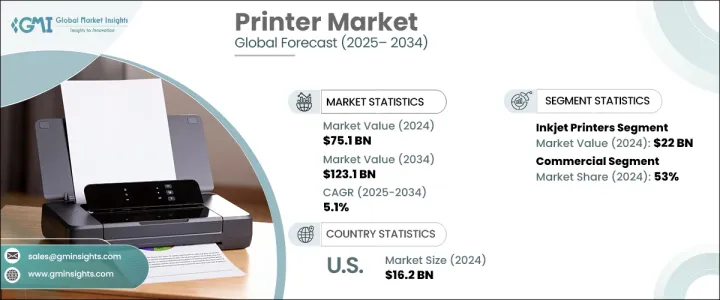

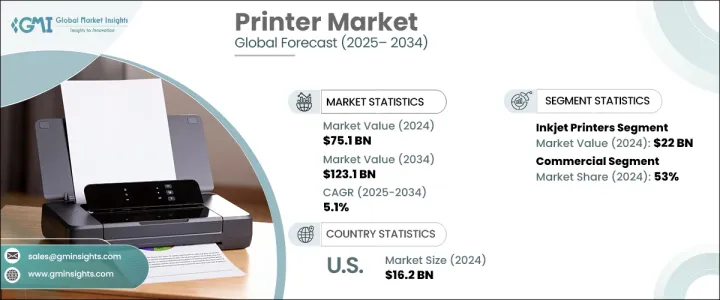

2024 年全球印表机市场价值为 751 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.1%。这一成长主要得益于数位印刷技术的日益普及,数位印刷技术正迅速取代传统方法。随着企业和消费者对更个人化和高品质的印刷解决方案的需求,数位印表机已被证明是各行业必不可少的工具。向效率和永续性的持续转变进一步加速了商业和工业领域对先进印刷解决方案的需求。

数位印刷格局的不断发展正在改变整个产业,其中喷墨和 3D 列印技术处于领先地位。高速喷墨印表机对于大量生产来说已变得不可或缺,它能提供卓越的列印品质、更快的周转时间和更大的灵活性。这些进步迎合了寻求经济高效、环保和客製化印刷选项的企业的需求。此外,按需印刷的兴起趋势正在透过减少浪费和提高供应链效率来重塑市场。工业应用、包装和纺织品印刷的需求也在激增,各大品牌优先考虑采用数位解决方案来实现鲜艳耐用的印刷效果。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 751亿美元 |

| 预测值 | 1231亿美元 |

| 复合年增长率 | 5.1% |

印表机市场按类型细分,包括喷墨印表机、雷射印表机、点阵印表机、3D印表机等。预计 2024 年 3D 列印领域将在预测期内实现 5.9% 的强劲成长率。 3D 列印在医疗保健、航太和製造业中的应用日益广泛,这正在彻底改变生产流程,实现快速成型并减少材料浪费。随着印刷技术的不断创新,企业正在利用自动化解决方案来提高生产力和精确度。

根据最终用途,市场分为工业、住宅和商业部分。 2024 年,商业领域将占据市场主导地位,占有 53% 的份额,这得益于医疗保健、教育和酒店等行业广泛部署先进的列印解决方案。企业越来越多地采用网路印刷服务,这种服务可以提供无缝客製化、更短的印刷週期和更高的效率。商业领域也正在转向永续的印刷方法,利用环保油墨和节能印表机来满足监管和环境标准。

2024 年,北美占据印表机市场的 72% 份额,估值达 162 亿美元。由于技术的快速进步以及商业和工业应用对混合印表机的日益青睐,美国市场持续扩大。企业正在用现代数位解决方案取代传统的胶印机,以提供更快的输出速度、更低的营运成本和更少的环境影响。这种转变正在重塑商业印刷产业,使公司能够以更高的效率和创新来满足不断变化的消费者偏好。

目录

第一章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 技术格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 家庭和办公室列印需求增加

- 商业和工业印刷行业的成长

- 产业陷阱与挑战

- 采用无纸化技术

- 不受控制的印刷成本

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依类型,2021-2034

- 主要趋势

- 喷墨印表机

- 雷射印表机

- 点阵印表机

- 3D印表机

- 胶印机

- 柔版印刷

- 其他(Grauvre等)

第六章:市场估计与预测:依功能,2021-2034

- 主要趋势

- 单功能印表机

- 多功能印表机

第七章:市场估计与预测:依连结性,2021-2034

- 主要趋势

- 绳索

- 无线

第八章:市场估计与预测:按价格,2021-2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第九章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 工业的

- 住宅

- 商业的

- 公司办公室

- 卫生保健

- 教育

- 饭店业

- 其他(活动策划者等)

第 10 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 电子产品商店

- 品牌店

- 其他(百货公司等)

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十二章:公司简介

- Brother

- Canon

- Dell

- Epson

- Fujifilm

- HP

- Konica Minolta

- Kyocera

- Lexmark

- Oki

- Ricoh

- Roland

- Sharp

- Toshiba

- Xerox

The Global Printer Market was valued at USD 75.1 billion in 2024 and is projected to grow at a CAGR of 5.1% between 2025 and 2034. This growth is largely driven by the increasing adoption of digital printing technologies, which are rapidly replacing traditional methods. As businesses and consumers demand more personalized and high-quality printing solutions, digital printers are proving to be essential tools across various industries. The ongoing shift toward efficiency and sustainability is further accelerating the demand for advanced printing solutions in commercial and industrial sectors.

The evolving landscape of digital printing is transforming the industry, with inkjet and 3D printing technologies leading the way. High-speed inkjet printers are becoming indispensable for high-volume production, offering superior print quality, faster turnaround times, and greater flexibility. These advancements cater to businesses seeking cost-effective, eco-friendly, and customized printing options. Additionally, the rising trend of on-demand printing is reshaping the market by minimizing waste and enhancing supply chain efficiency. Industrial applications, packaging, and textile printing are also experiencing a surge in demand, with brands prioritizing digital solutions for vibrant and durable prints.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $75.1 Billion |

| Forecast Value | $123.1 Billion |

| CAGR | 5.1% |

The printer market is segmented by type, including inkjet, laser, dot matrix, 3D printers, and others. In 2024, the 3D printing segment is anticipated to witness a robust growth rate of 5.9% during the forecast period. The increasing adoption of 3D printing in healthcare, aerospace, and manufacturing is revolutionizing production processes, enabling rapid prototyping and reducing material wastage. With continuous innovations in printing technologies, businesses are leveraging automated solutions to enhance productivity and precision.

By end-use, the market is categorized into industrial, residential, and commercial segments. In 2024, the commercial segment dominated the market with a 53% share, driven by the widespread deployment of advanced printing solutions in industries such as healthcare, education, and hospitality. Businesses are increasingly adopting web-to-print services, which provide seamless customization, shorter print runs, and improved efficiency. The commercial sector is also shifting toward sustainable printing methods, utilizing eco-friendly inks and energy-efficient printers to meet regulatory and environmental standards.

North America held a commanding 72% share of the printer market in 2024, with a valuation of USD 16.2 billion. The U.S. market continues to expand due to rapid technological advancements and the growing preference for hybrid printers across commercial and industrial applications. Businesses are replacing traditional offset printing presses with modern digital solutions that offer faster output, lower operational costs, and reduced environmental impact. This transition is reshaping the commercial printing industry, enabling companies to meet evolving consumer preferences with greater efficiency and innovation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Technological landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increased demand for home and office printing

- 3.6.1.2 Growth in the commercial and industrial printing sector

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Adoption of paperless technology

- 3.6.2.2 Uncontrolled printing costs

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Inkjet printers

- 5.3 Laser printers

- 5.4 Dot matrix printers

- 5.5 3D printers

- 5.6 Offset printers

- 5.7 Flexographic

- 5.8 Others (Grauvre, etc.)

Chapter 6 Market Estimates & Forecast, By Functionality, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Single function printers

- 6.3 Multifunction printers

Chapter 7 Market Estimates & Forecast, By Connectivity, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Cord

- 7.3 Cordless

Chapter 8 Market Estimates & Forecast, By Price, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Industrial

- 9.3 Residential

- 9.4 Commercial

- 9.4.1 Corporate offices

- 9.4.2 Healthcare

- 9.4.3 Educational

- 9.4.4 Hospitality

- 9.4.5 others (events planners etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Company websites

- 10.3 Offline

- 10.3.1 Electronics stores

- 10.3.2 Brand stores

- 10.3.3 Others (department stores etc.)

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Brother

- 12.2 Canon

- 12.3 Dell

- 12.4 Epson

- 12.5 Fujifilm

- 12.6 HP

- 12.7 Konica Minolta

- 12.8 Kyocera

- 12.9 Lexmark

- 12.10 Oki

- 12.11 Ricoh

- 12.12 Roland

- 12.13 Sharp

- 12.14 Toshiba

- 12.15 Xerox