|

市场调查报告书

商品编码

1699431

液体冷却系统市场机会、成长动力、产业趋势分析及 2025-2034 年预测Liquid Cooling Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

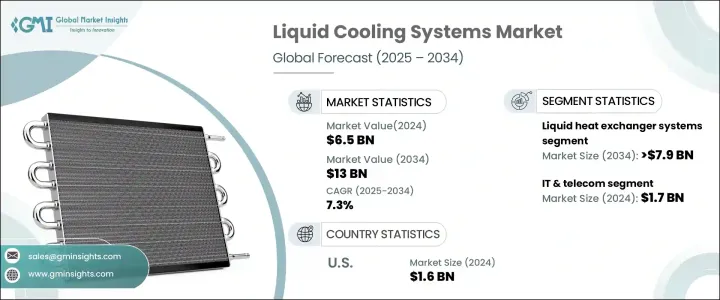

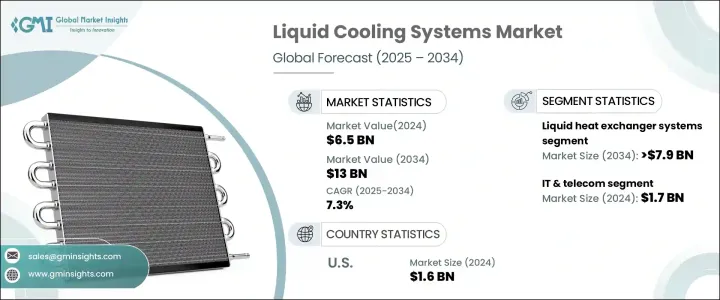

2024 年全球液体冷却系统市场价值为 65 亿美元,预计 2025 年至 2034 年的复合年增长率为 7.3%。高效能运算、人工智慧和机器学习的需求激增,正在加速从传统空气冷却到更高效的液体冷却解决方案的转变。伺服器功率密度的快速增加暴露了空气冷却方法的局限性,导致资料中心采用液体冷却作为更好的替代方案。增强的热管理能力使得液体冷却对于处理高密度伺服器环境不可或缺。根据行业研究,液体冷却具有更高的散热效率,可确保提高性能并节省能源。随着企业优先考虑现代 IT 基础架构的节能解决方案,市场正在稳步扩张。

市场按产品类型细分为液体热交换器系统和基于压缩机的系统。液体热交换器系统在 2024 年的收入为 40 亿美元,预计到 2034 年将超过 79 亿美元。这些系统透过液体介质传递热量,从而提供卓越的能源效率,减少对机械压缩的依赖。人们对更安静、高性能的冷却解决方案的日益青睐推动了多个行业对液体热交换器系统的巨大需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 65亿美元 |

| 预测值 | 130亿美元 |

| 复合年增长率 | 7.3% |

根据最终用户细分,市场涵盖各个行业,包括 BFSI、医疗保健、分析设备、工业、IT 和电信、汽车、政府和国防等。 2024 年,IT 和电信成为主导领域,创造 17 亿美元的收入并占据约 56% 的市场份额。对先进热管理解决方案日益增长的需求正在推动 IT 和电信业的采用。随着云端运算、人工智慧和边缘运算导致资料处理工作量不断增加,传统的冷却技术已被证明效率低。液体冷却因其能够在高功率运算环境中有效管理热量、降低能耗并提高整体系统效能而越来越受到青睐。产业报告显示,液体冷却系统的传热效率可比空气冷却方法高出 1,000 倍,使其成为大型 IT 基础架构的首选。

2024 年,美国液体冷却系统市场规模接近 16 亿美元,预计 2025 年至 2034 年期间的复合年增长率将达到 8%。美国在高效能运算、超大规模资料中心和先进技术基础设施方面的强大实力为其市场领导地位做出了贡献。公司正在迅速投资液体冷却解决方案,以提高营运效率和永续性。随着人工智慧、机器学习和边缘运算不断推动资料处理要求,传统的冷却方法正在变得过时。对创新冷却技术的需求不断增长,支持了美国液体冷却系统市场的扩张。领先科技公司的存在进一步加强了该地区在行业中的地位。

目录

第一章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 资料中心热密度不断上升

- 能源效率和永续发展倡议

- 技术进步和行业采用

- 产业陷阱与挑战

- 初始资本支出高

- 缺乏标准化和相容性问题

- 成长动力

- 技术格局

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021-2032

- 主要趋势

- 液体热交换器系统

- 基于压缩机的系统

第六章:市场估计与预测:依组件,2021 年至 2034 年

- 主要趋势

- 解决方案

- 服务

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- BFSI(银行、金融服务和保险)

- 卫生保健

- 分析设备

- 工业的

- IT和电信

- 汽车

- 政府和国防

- 其他(能源、零售、製造等)

第八章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直接的

- 间接

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 马来西亚

- 印尼

- 新加坡

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地区

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

- MEA 其余地区

第十章:公司简介

- Asetek Inc

- Boyd Corporation

- CoolIT Systems

- Emerson Electric Co

- Fujitsu

- Green Revolution Cooling Inc

- HUBER+SUHNER

- Koolance

- Lytron Inc

- MillerWelds

- Newegg

- Parker NA

- Rittal GmbH & Co

- Schneider Electric SE

- Watteredge

The Global Liquid Cooling Systems Market was valued at USD 6.5 billion in 2024 and is projected to expand at a CAGR of 7.3% from 2025 to 2034. The surge in demand for high-performance computing, artificial intelligence, and machine learning is accelerating the shift from traditional air cooling to more efficient liquid cooling solutions. The rapid increase in server power densities has exposed the limitations of air-based cooling methods, leading data centers to adopt liquid cooling as a superior alternative. Enhanced thermal management capabilities make liquid cooling indispensable for handling high-density server environments. According to industry research, liquid cooling delivers greater heat dissipation efficiency, ensuring improved performance and energy savings. The market is witnessing steady expansion as businesses prioritize energy-efficient solutions for modern IT infrastructure.

The market is segmented by product type into liquid heat exchanger systems and compressor-based systems. Liquid heat exchanger systems accounted for USD 4 billion in revenue in 2024 and are expected to exceed USD 7.9 billion by 2034. These systems provide superior energy efficiency by transferring heat through a liquid medium, reducing the reliance on mechanical compression. The increasing preference for quieter, high-performance cooling solutions is driving significant demand for liquid heat exchanger systems across multiple industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $13 Billion |

| CAGR | 7.3% |

By end-user segmentation, the market encompasses various industries, including BFSI, healthcare, analytical equipment, industrial, IT & telecom, automotive, government & defense, and others. IT & telecom emerged as the dominant segment in 2024, generating USD 1.7 billion in revenue and capturing approximately 56% of the market share. The growing need for advanced thermal management solutions is propelling adoption in IT and telecom industries. With data processing workloads intensifying due to cloud computing, AI, and edge computing, traditional cooling techniques are proving inefficient. Liquid cooling is increasingly favored for its ability to manage heat effectively in high-power computing environments, lower energy consumption, and enhance overall system performance. Industry reports suggest that liquid cooling systems can achieve heat transfer efficiency up to 1,000 times greater than air-based methods, making them a preferred choice for large-scale IT infrastructure.

The US market for liquid cooling systems stood at nearly USD 1.6 billion in 2024 and is set to grow at a CAGR of 8% between 2025 and 2034. The country's strong presence in high-performance computing, hyperscale data centers, and advanced technological infrastructure contributes to its market leadership. Companies are rapidly investing in liquid cooling solutions to enhance operational efficiency and sustainability. As AI, machine learning, and edge computing continue to push data processing requirements, traditional cooling approaches are becoming obsolete. The demand for innovative cooling technologies is growing, supporting the expansion of the liquid cooling systems market in the US. The presence of leading technology firms further strengthens the region's position in the industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Key news & initiatives

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Escalating heat densities in data centers

- 3.5.1.2 Energy efficiency and sustainability Initiatives

- 3.5.1.3 Technological advancements and industry adoption

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 High initial capital expenditure

- 3.5.2.2 Lack of standardization and compatibility Issues

- 3.5.1 Growth drivers

- 3.6 Technology landscape

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2032 (USD Billion) (Units)

- 5.1 Key Trends

- 5.2 Liquid heat exchanger systems

- 5.3 Compressor-Based systems

Chapter 6 Market Estimates & Forecast, By Component, 2021 – 2034, (USD Billion) (Units)

- 6.1 Key trends

- 6.2 Solution

- 6.3 Services

Chapter 7 Market Estimates & Forecast, By End Use, 2021 – 2034, (USD Billion) (Units)

- 7.1 Key trends

- 7.2 BFSI (banking, financial services, and insurance)

- 7.3 Healthcare

- 7.4 Analytical equipment

- 7.5 Industrial

- 7.6 IT & telecom

- 7.7 Automotive

- 7.8 Government & defense

- 7.9 Others (Energy, Retail, Manufacturing, etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 U.K.

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Malaysia

- 9.4.7 Indonesia

- 9.4.8 Singapore

- 9.4.9 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

- 9.6.4 Rest of MEA

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 Asetek Inc

- 10.2 Boyd Corporation

- 10.3 CoolIT Systems

- 10.4 Emerson Electric Co

- 10.5 Fujitsu

- 10.6 Green Revolution Cooling Inc

- 10.7 HUBER+SUHNER

- 10.8 Koolance

- 10.9 Lytron Inc

- 10.10 MillerWelds

- 10.11 Newegg

- 10.12 Parker NA

- 10.13 Rittal GmbH & Co

- 10.14 Schneider Electric SE

- 10.15 Watteredge