|

市场调查报告书

商品编码

1699434

柴油发电电信发电机市场机会、成长动力、产业趋势分析及 2025-2034 年预测Diesel Fired Telecom Generator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

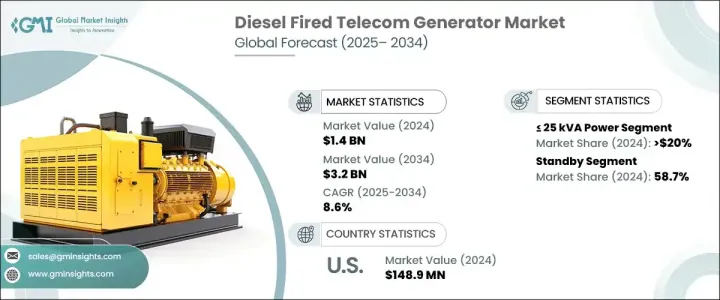

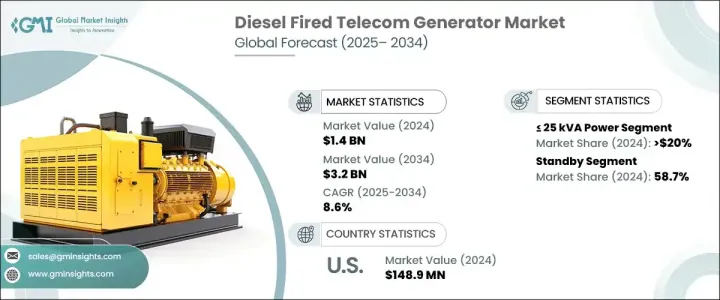

2024 年全球柴油发电电信发电机市场价值为 14 亿美元,预计 2025 年至 2034 年期间将以 8.6% 的复合年增长率大幅成长。随着 4G 和 5G 网路的快速普及,资料服务需求不断增长,这推动了整个电信基础设施对可靠电源解决方案的需求。随着全球电信业的不断扩张,电信塔数量的不断增加,加上对不间断供电的需求,促使电信业者投资柴油发电机以维持无缝服务。此外,发展中地区频繁停电和缺乏可靠的电力供应为电信业者部署备用电源解决方案提供了巨大的成长机会,确保持续的服务可用性。

随着城市化进程的加快,升级老化的电信基础设施和扩大服务欠缺地区的网路覆盖范围的需求正成为当务之急。柴油发电机在确保城市和偏远地区电信站的可靠电力方面发挥关键作用,在这些地区保持无缝连接至关重要。越来越依赖备用电源系统来支援不断增长的资料流量和自动化技术,进一步凸显了这些发电机在电信领域的重要性。此外,对提高能源效率的追求,加上先进监控系统的集成,提高了这些发电机的性能,使其成为现代电信营运中不可或缺的一部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 14亿美元 |

| 预测值 | 32亿美元 |

| 复合年增长率 | 8.6% |

柴油电信发电机市场按发电机容量和类型细分。 2024 年,额定功率 <= 25 kVA 的小型发电机占据了 20% 的市场。这些紧凑型发电机对于为基础设施仍在建设中的农村和欠发达地区的偏远电信站供电特别有价值。它们的效率使其成为小规模营运的理想选择,例如为基地台和小型蜂窝供电,这对于将网路覆盖范围扩大到服务不足的地区至关重要。随着电信网路不断扩展以满足日益增长的连接需求,对小型高效发电机的需求预计会增加。

就发电机类型而言,备用柴油电信发电机占据市场主导地位,到 2024 年将占据 58.7% 的份额。对不间断网路服务和最短停机时间的需求不断增长,推动了这一领域的成长。电信营运商越来越依赖这些发电机来维持持续运营,尤其是随着 5G 网路、行动资料服务和自动化技术的不断普及。这些发电机在电力中断期间提供可靠的备用电源,确保电信服务不间断地保持活跃。

2024 年美国柴油电信发电机市场价值为 1.489 亿美元,由于边缘运算和资料中心营运对持续电力的需求不断增长,需求激增。由于不间断高效电力对于维持高性能网路至关重要,柴油备用发电机的作用仍然至关重要。此外,减少排放和将先进的监控系统整合到电信基础设施的努力进一步推动了市场成长。随着电信业适应不断发展的技术需求,柴油备用发电机将继续在确保可靠且有效率的服务交付方面发挥关键作用。

目录

第一章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:依功率等级,2021 年至 2034 年

- 主要趋势

- ≤25千伏安

- > 25千伏安 - 50千伏安

- > 50千伏安 - 125千伏安

- > 125 千伏安 - 200 千伏安

- > 200 千伏安 - 330 千伏安

- > 330千伏安

第六章:市场规模及预测:依应用,2021 年至 2034 年

- 主要趋势

- 支援

- 主/连续

第七章:市场规模及预测:依地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 俄罗斯

- 英国

- 德国

- 法国

- 西班牙

- 奥地利

- 义大利

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 印尼

- 马来西亚

- 泰国

- 越南

- 菲律宾

- 缅甸

- 孟加拉

- 中东

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 土耳其

- 伊朗

- 阿曼

- 非洲

- 埃及

- 奈及利亚

- 阿尔及利亚

- 南非

- 安哥拉

- 肯亚

- 莫三比克

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 智利

第八章:公司简介

- AGG POWER TECHNOLOGY

- Aggreko

- Atlas Copco

- Caterpillar

- Cummins

- Deere & Company

- FG Wilson

- Generac Power Systems

- HIMOINSA

- Kirloskar Electric

- Kohler

- MAHINDRA POWEROL

- Perkins Engines Company

- SUPERNOVA GENSET

- Tractors and Farm Equipment

- Wärtsilä

The Global Diesel Fired Telecom Generator Market was valued at USD 1.4 billion in 2024 and is projected to grow significantly at a CAGR of 8.6% between 2025 and 2034. The increasing demand for data services, driven by the rapid adoption of 4G and 5G networks, is fueling the need for reliable power solutions across telecom infrastructure. As the global telecom industry continues to expand, the rising number of telecom towers, coupled with the need for uninterrupted power supply, is pushing telecom operators to invest in diesel-fired generators to maintain seamless service. Furthermore, frequent power outages and the lack of reliable electricity supply in developing regions present significant growth opportunities for telecom operators to deploy backup power solutions, ensuring consistent service availability.

As urbanization accelerates, the need to upgrade aging telecom infrastructure and expand network coverage in underserved regions is becoming a priority. Diesel-fired generators play a critical role in ensuring reliable power for telecom stations in both urban and remote areas, where maintaining seamless connectivity is essential. The growing reliance on backup power systems to support the growing data traffic and automation technologies further highlights the importance of these generators in the telecom sector. Additionally, the push for increased energy efficiency, coupled with the integration of advanced monitoring systems, is enhancing the performance of these generators, making them indispensable in modern telecom operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 8.6% |

The diesel-fired telecom generator market is segmented by generator capacity and type. Smaller units with a power rating of <= 25 kVA accounted for 20% of the market share in 2024. These compact generators are particularly valuable for powering remote telecom stations in rural and underdeveloped regions where infrastructure development is still ongoing. Their efficiency makes them ideal for smaller-scale operations such as powering base stations and small cells, which are essential for extending network coverage to underserved areas. As telecom networks continue to expand to meet the growing demand for connectivity, the need for smaller, highly efficient generators is expected to rise.

In terms of generator type, standby diesel-fired telecom generators dominated the market, holding 58.7% of the share in 2024. The rising need for uninterrupted network service and minimal downtime is driving the growth of this segment. Telecom operators increasingly depend on these generators to maintain continuous operations, especially as 5G networks, mobile data services, and automation technologies continue to proliferate. These generators provide a reliable backup during power disruptions, ensuring that telecom services remain active without interruption.

The U.S. diesel-fired telecom generator market was valued at USD 148.9 million in 2024, with demand surging due to the growing need for continuous power in edge computing and data center operations. As uninterrupted and efficient power becomes critical for maintaining high-performance networks, the role of diesel-powered backup generators remains vital. Additionally, the push to reduce emissions and integrate advanced monitoring systems into telecom infrastructure is further propelling market growth. As the telecom industry adapts to evolving technological needs, diesel-powered backup generators will continue to play a crucial role in ensuring reliable and efficient service delivery.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 – 2034 (Units & USD Million)

- 5.1 Key trends

- 5.2 ≤ 25 kVA

- 5.3 > 25 kVA - 50 kVA

- 5.4 > 50 kVA - 125 kVA

- 5.5 > 125 kVA - 200 kVA

- 5.6 > 200 kVA - 330 kVA

- 5.7 > 330 kVA

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (Units & USD Million)

- 6.1 Key trends

- 6.2 Standby

- 6.3 Prime/continuous

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (Units & USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Russia

- 7.3.2 UK

- 7.3.3 Germany

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Austria

- 7.3.7 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.4.6 Indonesia

- 7.4.7 Malaysia

- 7.4.8 Thailand

- 7.4.9 Vietnam

- 7.4.10 Philippines

- 7.4.11 Myanmar

- 7.4.12 Bangladesh

- 7.5 Middle East

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Turkey

- 7.5.5 Iran

- 7.5.6 Oman

- 7.6 Africa

- 7.6.1 Egypt

- 7.6.2 Nigeria

- 7.6.3 Algeria

- 7.6.4 South Africa

- 7.6.5 Angola

- 7.6.6 Kenya

- 7.6.7 Mozambique

- 7.7 Latin America

- 7.7.1 Brazil

- 7.7.2 Mexico

- 7.7.3 Argentina

- 7.7.4 Chile

Chapter 8 Company Profiles

- 8.1 AGG POWER TECHNOLOGY

- 8.2 Aggreko

- 8.3 Atlas Copco

- 8.4 Caterpillar

- 8.5 Cummins

- 8.6 Deere & Company

- 8.7 FG Wilson

- 8.8 Generac Power Systems

- 8.9 HIMOINSA

- 8.10 Kirloskar Electric

- 8.11 Kohler

- 8.12 MAHINDRA POWEROL

- 8.13 Perkins Engines Company

- 8.14 SUPERNOVA GENSET

- 8.15 Tractors and Farm Equipment

- 8.16 Wärtsilä