|

市场调查报告书

商品编码

1699435

电动工具市场机会、成长动力、产业趋势分析及 2025-2034 年预测Electric Power Tools Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

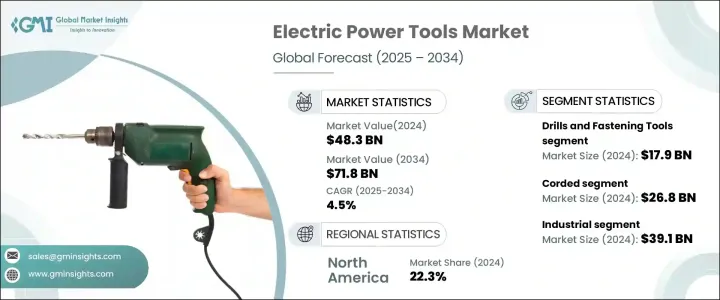

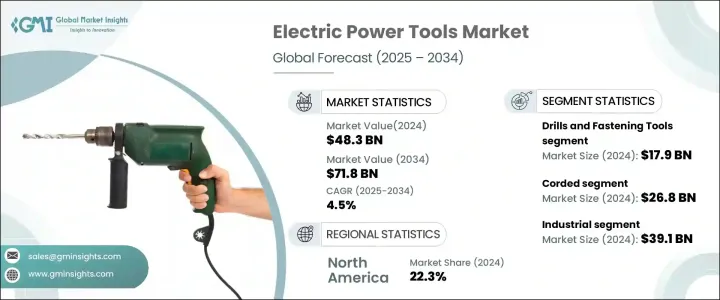

2024 年全球电动工具市场价值为 483 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 4.5%。这一增长是由建筑、製造和基础设施开发等各个领域对电动工具的日益普及所推动的。随着各行各业努力提高营运效率、减少体力劳动和简化流程,对高性能工具的需求也不断增加。持续向自动化转变以及对操作精确度的日益重视导致对电动工具的依赖性增加。

住宅、商业和工业部门正在增加对先进设备的投资,以提高生产力并确保营运的准确性。不断增加的改造项目、基础设施升级和工业扩张进一步推动了电动工具市场的成长。此外,包括智慧功能、人体工学设计和节能模型的整合在内的技术进步,使电动工具对最终用户更具吸引力。随着安全标准变得越来越严格,效率仍然是首要考虑因素,各行各业越来越多地转向可靠性和耐用性的电动工具。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 483亿美元 |

| 预测值 | 718亿美元 |

| 复合年增长率 | 4.5% |

钻头和紧固工具领域在 2024 年创造了 179 亿美元的产值,预计在 2025 年至 2034 年期间的复合年增长率为 4.8%。由于该领域广泛应用于建筑、工业应用和正在进行的基础设施项目,因此需求量很大。这些工具在拧螺丝、钻孔和紧固等任务中发挥关键作用,使其成为住宅、商业和工业环境中不可或缺的工具。对精密紧固和钻孔能力的需求不断增长,加上大规模改造项目,推动了这一领域的需求。随着各行各业不断现代化和采用自动化解决方案,电钻和紧固工具对于确保效率和多功能性仍然至关重要。

有线电动工具市场在 2024 年创造了 268 亿美元的收入。有线电动工具提供卓越的功率和扭矩,使其成为需要连续高性能设备的行业的首选。这些工具对于需要稳定电力供应的密集应用至关重要,特别是在製造和大型建筑项目中。锯子、磨床和钻头等重型工具在透过直接电气连接供电时可以达到最佳效率。虽然无线工具为在偏远或狭窄空间内工作提供了灵活性,但对于需要持续动力和耐用性的应用,有绳工具仍然是首选。

北美电动工具市场占有 22.3% 的份额,2024 年创造了 108 亿美元的产值。该地区的成长主要受到製造业需求不断增长的推动,其中钻头、锯子和紧固设备等工具对于生产活动、基础设施扩建和住宅建设项目至关重要。随着各行各业都注重优化效率和改善营运工作流程,对可靠、高效能工具的需求持续成长。该地区注重采用先进技术和提高生产力,进一步支持了电动工具在多个领域的广泛使用。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 定价分析

- 技术与创新格局

- 重要新闻和倡议

- 製造商

- 经销商

- 零售商

- 监管格局

- 衝击力

- 成长动力

- 建筑业和基础设施建设不断增长

- 不断扩大的DIY(自己动手做)市场

- 电池技术的进步

- 对高效能和专用工具的需求

- 产业陷阱与挑战

- 科技颠覆

- 供应链中断

- 成长动力

- 消费者购买行为分析

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品,2021-2034

- 主要趋势

- 钻头和紧固工具

- 锤子

- 锯子

- 割草机

- 吸尘器

- 其他的

第六章:市场估计与预测:按类型,2021-2034

- 主要趋势

- 有线

- 无线

第七章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 工业的

- 建造

- 汽车

- 航太

- 其他的

- DIY

- 其他

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Atlas Copco AB

- DeWalt

- Emerson Electric Co.

- Fein Power Tools Inc.

- Festool Group

- Hilti Corporation

- Hitachi Koki Co., Ltd.

- Makita Corporation

- Milwaukee Electric Tool Corporation

- Panasonic Corporation

- Robert Bosch GmbH

- Ryobi Limited

- Snap-on Incorporated

- Stanley Black & Decker, Inc.

- Techtronic Industries Co. Ltd.

The Global Electric Power Tools Market was valued at USD 48.3 billion in 2024 and is projected to grow at a CAGR of 4.5% between 2025 and 2034. This growth is driven by the increasing adoption of electric power tools across various sectors, including construction, manufacturing, and infrastructure development. As industries strive to improve operational efficiency, reduce manual labor, and streamline processes, the demand for high-performance tools is rising. The ongoing shift toward automation and the growing emphasis on precision in operations are contributing to the increased reliance on power tools.

Residential, commercial, and industrial sectors are increasingly investing in advanced equipment to enhance productivity and ensure accuracy in their operations. The rising number of renovation projects, infrastructure upgrades, and industrial expansions is further fueling the growth of the electric power tools market. Additionally, advancements in technology, including the integration of smart features, ergonomic designs, and energy-efficient models, are making electric power tools more appealing to end users. As safety standards become more stringent and efficiency remains a top priority, industries are increasingly turning to electric power tools that offer reliability and durability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $48.3 Billion |

| Forecast Value | $71.8 Billion |

| CAGR | 4.5% |

The drills and fastening tools segment generated USD 17.9 billion in 2024 and is expected to grow at a CAGR of 4.8% between 2025 and 2034. This segment is experiencing high demand due to its widespread use in construction, industrial applications, and ongoing infrastructure projects. These tools play a critical role in tasks such as screwing, drilling, and fastening, making them indispensable across residential, commercial, and industrial environments. The growing need for precision fastening and drilling capabilities, coupled with large-scale renovation projects, is driving demand in this segment. As industries continue to modernize and adopt automated solutions, power drills and fastening tools remain essential for ensuring efficiency and versatility.

The corded electric tools segment generated USD 26.8 billion in 2024. Corded electric tools provide superior power and torque, making them the preferred choice for industries that require continuous and high-performance equipment. These tools are essential for intensive applications where a consistent power supply is necessary, particularly in manufacturing and large-scale construction projects. Heavy-duty tools such as saws, grinders, and drills operate at peak efficiency when powered through direct electrical connections. While cordless tools offer flexibility for work in remote or confined spaces, corded versions remain the go-to option for applications demanding sustained power and durability.

North America electric power tools market held a 22.3% share and generated USD 10.8 billion in 2024. Growth in this region is primarily driven by increasing demand in the manufacturing sector, where tools such as drills, saws, and fastening equipment are critical for production activities, infrastructure expansion, and residential construction projects. As industries focus on optimizing efficiency and improving operational workflows, the need for reliable, high-performance tools continues to grow. The region's emphasis on adopting advanced technologies and enhancing productivity further supports the expanding use of electric power tools across multiple sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.4.2.1 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Manufacturers

- 3.7 Distributors

- 3.8 Retailers

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Growing construction and infrastructure development

- 3.10.1.2 Expanding DIY (Do-It-Yourself) market

- 3.10.1.3 Advancements in battery technology

- 3.10.1.4 Demand for high-performance and specialty tools

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Technological disruption

- 3.10.2.2 Supply chain disruptions

- 3.10.1 Growth drivers

- 3.11 Consumer buying behavior analysis

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Drills and fastening tools

- 5.3 Hammers

- 5.4 Saws

- 5.5 Lawn mowers

- 5.6 Vacuum cleaners

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Corded

- 6.3 Cordless

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Industrial

- 7.2.1 Construction

- 7.2.2 Automotive

- 7.2.3 Aerospace

- 7.2.4 Others

- 7.3 DIY

- 7.4 Other

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Atlas Copco AB

- 9.2 DeWalt

- 9.3 Emerson Electric Co.

- 9.4 Fein Power Tools Inc.

- 9.5 Festool Group

- 9.6 Hilti Corporation

- 9.7 Hitachi Koki Co., Ltd.

- 9.8 Makita Corporation

- 9.9 Milwaukee Electric Tool Corporation

- 9.10 Panasonic Corporation

- 9.11 Robert Bosch GmbH

- 9.12 Ryobi Limited

- 9.13 Snap-on Incorporated

- 9.14 Stanley Black & Decker, Inc.

- 9.15 Techtronic Industries Co. Ltd.