|

市场调查报告书

商品编码

1699438

内视镜市场机会、成长动力、产业趋势分析及 2025-2034 年预测Endoscopy Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

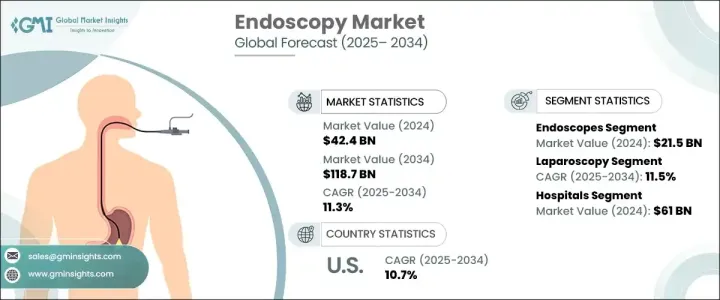

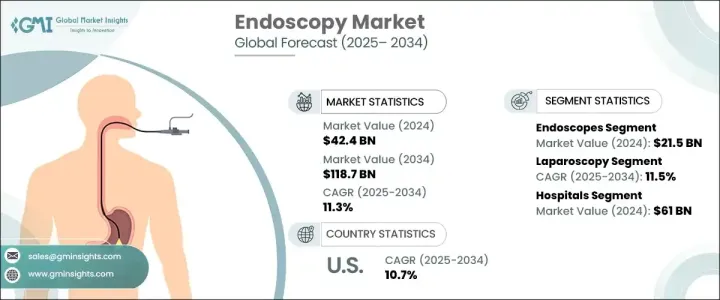

2024 年全球内视镜市场价值为 424 亿美元,预计 2025 年至 2034 年的复合年增长率为 11.3%。这一扩张是由医学影像的快速进步、报销框架的改善、慢性病患病率的上升以及对具有成本效益的诊断解决方案的需求不断增长所推动的。内视镜技术已经取得了显着的发展,高清 (HD) 成像、3D 视觉化和窄带成像 (NBI) 等创新技术提高了诊断的准确性。机器人、人工智慧(AI)和无线通讯的整合进一步提高了程式效率。此外,采用轻量、灵活和一次性使用的内视镜可降低感染风险,同时提高可及性和可负担性。多个医疗领域对微创技术的需求日益增长,使得内视镜检查成为首选的诊断和治疗方法。

产品范围包括内视镜、视觉化系统、内视镜超音波、充气器和其他设备。内视镜占据市场主导地位,2024 年市场规模达 215 亿美元。在应用方面,市场涵盖腹腔镜检查、胃肠 (GI) 内视镜检查、关节镜检查、耳鼻喉内视镜检查、肺内视镜检查、妇产科和其他程序。 2024 年腹腔镜手术市场规模将达到 112 亿美元,到 2034 年的复合年增长率将达到 11.5%。人们对微创手术的偏好日益增长,推动了这一领域的发展,因为透过小切口进行的手术可以减少恢復时间和术后併发症。腹腔镜手术的需求正在加速成长,特别是胆囊切除术、疝气修补术和减肥手术。随着肥胖人数的增加,越来越多的人选择减重手术,进一步推动了市场的成长。腹腔镜培训计画的日益普及确保了更多的外科医生能够采用这些技术,从而促进了更广泛的应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 424亿美元 |

| 预测值 | 1187亿美元 |

| 复合年增长率 | 11.3% |

医院仍然是最大的终端用户群体,预计到 2034 年市场价值将达到 610 亿美元。医疗机构依靠内视镜进行常规筛检、早期疾病检测和外科手术干预,尤其是在肿瘤学领域。优惠的报销政策和内视镜检查保险覆盖范围鼓励医院投资先进的设备和培训项目。透过扩展内视镜检查能力,医院可以改善病患的治疗效果,同时优化医疗成本。对高品质、高性价比程序的需求继续推动医疗机构的技术进步和基础设施投资。

北美占了相当大的市场份额,其中美国位居榜首,2024 年的市占率将达到 165 亿美元。慢性疾病(尤其是胃肠道疾病和肥胖症)的负担日益加重,增加了对内视镜手术的需求。先进的医疗保健基础设施和持续的技术创新(例如人工智慧辅助内视镜和机器人系统)增强了市场扩张。此外,支持诊断和治疗内视镜手术的报销政策改善了患者的就诊机会,进一步刺激了需求。对早期疾病检测和预防性医疗保健的持续重视巩固了该地区在全球内视镜市场的主导地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 全球老年人口不断增长

- 引进技术先进的内视镜

- 胃肠道疾病、癌症和其他慢性疾病发生率上升

- 微创手术的需求不断增加

- 产业陷阱与挑战

- 发展中国家缺乏熟练的医生和内视镜医师

- 成长动力

- 成长潜力分析

- 监管格局

- 我们

- 欧洲

- 技术格局

- 报销场景

- 波特的分析

- PESTEL分析

- 差距分析

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 内视镜

- 硬内视镜

- 柔性内视镜

- 机器人辅助内视镜

- 胶囊内视镜

- 可视化系统

- 内视镜超音波

- 气腹机

- 其他产品

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 腹腔镜检查

- 胃肠内视镜检查

- 胃镜

- 大肠镜检查

- 乙状结肠镜检查

- 十二指肠镜检查

- 其他胃肠内视镜检查

- 关节镜检查

- 耳鼻喉内视镜检查

- 肺内视镜检查

- 妇产科

- 其他应用

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- B Braun

- Boston Scientific

- CONMED

- COOK MEDICAL

- FUJIFILM

- HOYA

- INTUITIVE

- Johnson & Johnson

- KARL STORZ

- Medtronic

- OLYMPUS

- RICHARD WOLF

- Smith & Nephew

- Stryker

The Global Endoscopy Market, valued at USD 42.4 billion in 2024, is projected to grow at a CAGR of 11.3% from 2025 to 2034. This expansion is driven by rapid advancements in medical imaging, improved reimbursement frameworks, a rising prevalence of chronic diseases, and an increasing demand for cost-effective diagnostic solutions. Endoscopic technology has evolved significantly with innovations like high-definition (HD) imaging, 3D visualization, and Narrow-Band Imaging (NBI), enhancing diagnostic accuracy. The integration of robotics, artificial intelligence (AI), and wireless communication further improves procedural efficiency. Additionally, the adoption of lightweight, flexible, and single-use endoscopes reduces infection risks while improving accessibility and affordability. The growing need for minimally invasive techniques across multiple medical fields has solidified endoscopy as a preferred diagnostic and treatment method.

The product landscape includes endoscopes, visualization systems, endoscopic ultrasound, insufflators, and other devices. Endoscopes dominated the market, generating USD 21.5 billion in 2024. On the application front, the market spans laparoscopy, gastrointestinal (GI) endoscopy, arthroscopy, ENT endoscopy, pulmonary endoscopy, obstetrics/gynecology, and other procedures. Laparoscopy accounted for USD 11.2 billion in 2024, expanding at an 11.5% CAGR through 2034. The rising preference for minimally invasive surgeries has fueled this segment, as procedures performed through small incisions reduce recovery time and postoperative complications. Demand for laparoscopic surgeries is accelerating, particularly for gallbladder removal, hernia repair, and bariatric procedures. With obesity on the rise, more individuals are opting for weight-loss surgeries, further propelling market growth. The increasing availability of laparoscopic training programs ensures more surgeons can adopt these techniques, promoting wider adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $42.4 Billion |

| Forecast Value | $118.7 Billion |

| CAGR | 11.3% |

Hospitals remain the largest end-user segment, with projections indicating a market value of USD 61 billion by 2034. Healthcare institutions rely on endoscopy for routine screenings, early disease detection, and surgical interventions, particularly in oncology. Favorable reimbursement policies and insurance coverage for endoscopic procedures encourage hospitals to invest in advanced equipment and training programs. By expanding their endoscopic capabilities, hospitals improve patient outcomes while optimizing healthcare costs. The demand for high-quality, cost-effective procedures continues to drive technological advancements and infrastructure investments in healthcare facilities.

North America holds a significant share of the market, with the US leading at USD 16.5 billion in 2024. The rising burden of chronic diseases, particularly gastrointestinal disorders and obesity, has heightened the demand for endoscopic procedures. The presence of advanced healthcare infrastructure and ongoing technological innovations, such as AI-assisted endoscopy and robotic systems, strengthens market expansion. Additionally, reimbursement policies supporting diagnostic and therapeutic endoscopic procedures have improved patient access, further fueling demand. The continued emphasis on early disease detection and preventive healthcare solidifies the region's dominance in the global endoscopy market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing geriatric population globally

- 3.2.1.2 Introduction of technologically advanced endoscopes

- 3.2.1.3 Rising incidences of gastrointestinal disorders, cancer, and other chronic conditions

- 3.2.1.4 Increasing demand for minimally invasive procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Dearth of skilled physicians and endoscopists in developing countries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Gap analysis

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Endoscopes

- 5.2.1 Rigid endoscopes

- 5.2.2 Flexible endoscopes

- 5.2.3 Robot-assisted endoscopes

- 5.2.4 Capsule endoscopes

- 5.3 Visualization systems

- 5.4 Endoscopic ultrasound

- 5.5 Insufflator

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Laparoscopy

- 6.3 GI endoscopy

- 6.3.1 Gastroscopy

- 6.3.2 Colonoscopy

- 6.3.3 Sigmoidoscopy

- 6.3.4 Duodenoscopy

- 6.3.5 Other GI endoscopies

- 6.4 Arthroscopy

- 6.5 ENT endoscopy

- 6.6 Pulmonary endoscopy

- 6.7 Obstetrics/Gynecology

- 6.8 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 B Braun

- 9.2 Boston Scientific

- 9.3 CONMED

- 9.4 COOK MEDICAL

- 9.5 FUJIFILM

- 9.6 HOYA

- 9.7 INTUITIVE

- 9.8 Johnson & Johnson

- 9.9 KARL STORZ

- 9.10 Medtronic

- 9.11 OLYMPUS

- 9.12 RICHARD WOLF

- 9.13 Smith & Nephew

- 9.14 Stryker