|

市场调查报告书

商品编码

1699439

医用 X 光市场机会、成长动力、产业趋势分析及 2025-2034 年预测Medical X-ray Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

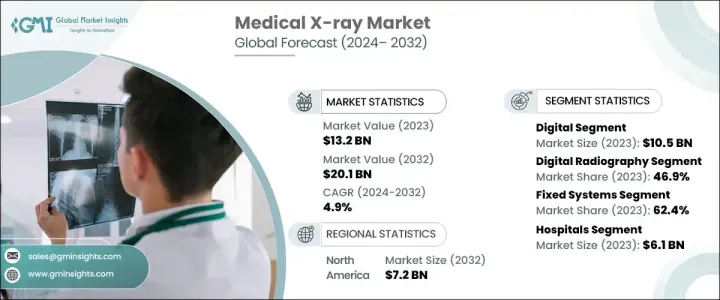

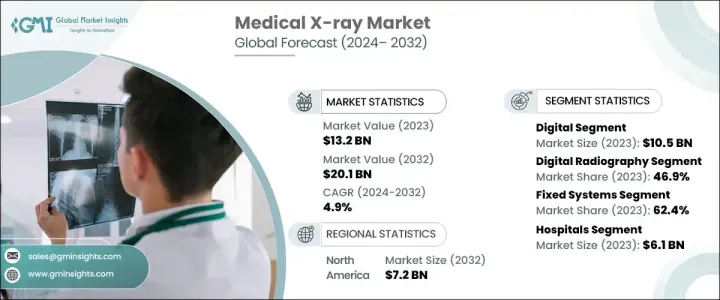

2023 年全球医用 X 光市场规模达到约 132 亿美元,预计 2024 年至 2032 年期间的复合年增长率为 4.9%。医用 X 光是必不可少的诊断影像工具,主要用于观察身体内部结构,包括骨骼、器官和组织。

医疗X射线市场的成长主要受到医疗设施扩张和诊断能力进步的推动,尤其是在新兴经济体。这些发展中地区正在大力投资现代化医疗保健基础设施,包括尖端的X射线系统,以满足日益增长的诊断影像服务需求。此外,人们对早期疾病检测重要性的认识不断提高,也促进了 X 光成像的更广泛应用。行动和便携式 X 光设备的进步也促进了市场的成长,因为这些创新使得诊断成像更容易获得。此外,人口老化增加了与年龄相关疾病的诊断服务的需求,进一步推动了市场扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 132亿美元 |

| 预测值 | 201亿美元 |

| 复合年增长率 | 4.9% |

市场分为数位和类比 X 光类型,其中数位领域处于领先地位,2023 年的收入约为 105 亿美元。数位 X 光系统与远距医疗平台的整合增强了其实用性,促进了远端咨询和诊断审查。无线和便携式数位X射线系统等技术创新正在扩大其在各种临床环境中的应用。此外,对法规遵循和品质保证的关注推动了数位 X 光系统的采用,符合严格的医疗保健标准。

按技术细分,医疗X光市场包括数位射线照相术、电脑射线照相术和基于胶片的射线照相术。数位放射成像领域占最大份额,2023 年营收将达到 62 亿美元,预计预测期内复合年增长率为 5.1%。该领域的成长主要归因于其能够产生具有卓越清晰度和准确性的高解析度影像,这对于有效的医学诊断至关重要。数位射线照相技术在捕捉和处理影像方面的效率可快速提高患者吞吐量并减少週转时间。此外,数位放射成像与现代医疗保健 IT 系统无缝集成,改善了资料管理和可存取性。

在北美,由于完善的医疗保健基础设施有利于先进技术的采用,预计到 2032 年医疗 X 光市场规模将达到 72 亿美元。美国占据北美市场的很大份额,2023 年的营收为 43 亿美元。慢性病盛行率的上升显着推动了对包括 X 光系统在内的诊断影像服务的需求,而事故和伤害的增加凸显了对准确诊断工具的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 已开发国家诊断影像技术的进步

- 全球慢性病盛行率不断上升

- 诊断成像程序的数量不断增加

- 医疗 X 光检查的报销情况

- 产业陷阱与挑战

- 高辐射暴露的风险

- 安装医学影像设备的成本高昂

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 监管格局

- 技术格局

- 2023年成交量分析(单位)

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 年至 2032 年

- 主要趋势

- 数位的

- 模拟

第六章:市场估计与预测:按技术,2021 年至 2032 年

- 主要趋势

- 底片放射照相术

- 电脑放射成像

- 数位射线照相术

第七章:市场估计与预测:按便携性,2021 年至 2032 年

- 主要趋势

- 固定係统

- 便携式系统

第 8 章:市场估计与预测:按应用,2021 年至 2032 年

- 主要趋势

- 牙科

- 口内成像

- 口外成像

- 兽医

- 肿瘤学

- 骨科

- 心臟病学

- 神经病学

- 其他兽医应用

- 乳房X光检查

- 胸部

- 心血管

- 骨科

- 其他应用

第九章:市场估计与预测:依最终用途,2021 年至 2032 年

- 主要趋势

- 医院

- 门诊手术中心

- 专科诊所

- 其他最终用途

第十章:市场估计与预测:按地区,2021 年至 2032 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 越南

- 韩国

- 泰国

- 大洋洲

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 埃及

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Agfa-Gevaert Group

- Allengers Medical Systems

- Canon

- Carestream Health

- Dentsply Sirona

- Fujifilm Holdings Corporation

- GE HealthCare Technologies

- Hologic

- Koninklijke Philips NV

- Konica Minolta

- Midmark

- Neusoft Medical Systems

- Perlong Medical Equipment

- Samsung Electronics

- Shimadzu

- Siemens Healthineers

- Trivitron Healthcare

The Global Medical X-Ray Market reached around USD 13.2 billion in 2023 and is projected to grow at 4.9% CAGR from 2024 to 2032. Medical X-rays are essential diagnostic imaging tools primarily used to visualize internal body structures, including bones, organs, and tissues.

Growth in the medical X-ray market is largely driven by the expansion of healthcare facilities and advancements in diagnostic capabilities, particularly in emerging economies. These developing regions are investing heavily in modern healthcare infrastructure, which includes cutting-edge X-ray systems, to meet the rising demand for diagnostic imaging services. Additionally, increased awareness of the importance of early disease detection is encouraging broader adoption of X-ray imaging. The advancement of mobile and portable X-ray devices is also contributing to market growth, as these innovations make diagnostic imaging more accessible. Moreover, the aging population is increasing the demand for diagnostic services related to age-associated conditions, further propelling market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.2 Billion |

| Forecast Value | $20.1 Billion |

| CAGR | 4.9% |

The market is categorized into digital and analog X-ray types, with the digital segment leading the way, generating revenues of approximately USD 10.5 billion in 2023. The integration of digital X-ray systems with telemedicine platforms enhances their utility, facilitating remote consultations and diagnostic reviews. Technological innovations, such as wireless and portable digital X-ray systems, are expanding their application across various clinical environments. Additionally, the focus on regulatory compliance and quality assurance drives the adoption of digital X-ray systems, aligning with rigorous healthcare standards.

When segmented by technology, the medical X-ray market includes digital radiography, computed radiography, and film-based radiography. The digital radiography segment captured the largest share, with revenues reaching USD 6.2 billion in 2023 and is expected to grow at a CAGR of 5.1% during the forecast period. This segment's growth is primarily attributed to its capacity to produce high-resolution images with superior clarity and accuracy, crucial for effective medical diagnoses. The efficiency of digital radiography in capturing and processing images swiftly enhances patient throughput and reduces turnaround times. Furthermore, digital radiography seamlessly integrates with modern healthcare IT systems, improving data management and accessibility.

In North America, the medical X-ray market is anticipated to reach USD 7.2 billion by 2032, supported by a well-established healthcare infrastructure that facilitates the adoption of advanced technologies. The U.S. holds a significant portion of the North American market, with revenues of USD 4.3 billion in 2023. The rising prevalence of chronic diseases is notably driving demand for diagnostic imaging services, including X-ray systems, while an increase in accidents and injuries emphasizes the need for accurate diagnostic tools.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancements in diagnostic imaging in developed countries

- 3.2.1.2 Rising prevalence of chronic diseases worldwide

- 3.2.1.3 Growing number of diagnostic imaging procedures

- 3.2.1.4 Presence of reimbursement for medical x-ray procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk of high radiation exposure

- 3.2.2.2 High cost associated with installation of medical imaging modalities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Regulatory landscape

- 3.6 Technological landscape

- 3.7 Volume analysis, 2023 (Units)

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2032 ($ Mn)

- 5.1 Key trends

- 5.2 Digital

- 5.3 Analog

Chapter 6 Market Estimates and Forecast, By Technology, 2021 – 2032 ($ Mn)

- 6.1 Key trends

- 6.2 Film-based radiography

- 6.3 Computed radiography

- 6.4 Digital radiography

Chapter 7 Market Estimates and Forecast, By Portability, 2021 – 2032 ($ Mn)

- 7.1 Key trends

- 7.2 Fixed systems

- 7.3 Portable systems

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2032 ($ Mn)

- 8.1 Key trends

- 8.2 Dental

- 8.2.1 Intraoral imaging

- 8.2.2 Extraoral imaging

- 8.3 Veterinary

- 8.3.1 Oncology

- 8.3.2 Orthopedics

- 8.3.3 Cardiology

- 8.3.4 Neurology

- 8.3.5 Other veterinary applications

- 8.4 Mammography

- 8.5 Chest

- 8.6 Cardiovascular

- 8.7 Orthopedics

- 8.8 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2032 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Ambulatory surgical centers

- 9.4 Specialty clinics

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2032 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Vietnam

- 10.4.5 South Korea

- 10.4.6 Thailand

- 10.4.7 Oceania

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Egypt

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Agfa-Gevaert Group

- 11.2 Allengers Medical Systems

- 11.3 Canon

- 11.4 Carestream Health

- 11.5 Dentsply Sirona

- 11.6 Fujifilm Holdings Corporation

- 11.7 GE HealthCare Technologies

- 11.8 Hologic

- 11.9 Koninklijke Philips N.V.

- 11.10 Konica Minolta

- 11.11 Midmark

- 11.12 Neusoft Medical Systems

- 11.13 Perlong Medical Equipment

- 11.14 Samsung Electronics

- 11.15 Shimadzu

- 11.16 Siemens Healthineers

- 11.17 Trivitron Healthcare