|

市场调查报告书

商品编码

1708126

柔性中型散货货柜 (FIBC) 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Flexible Intermediate Bulk Container (FIBC) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

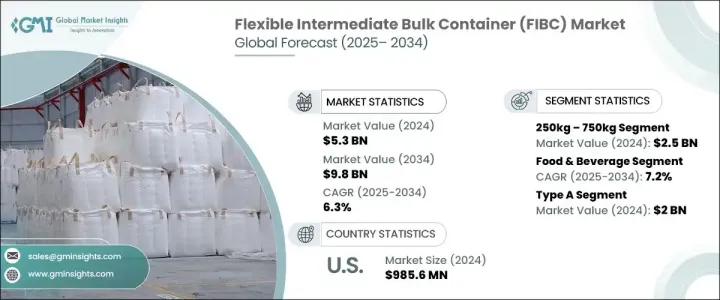

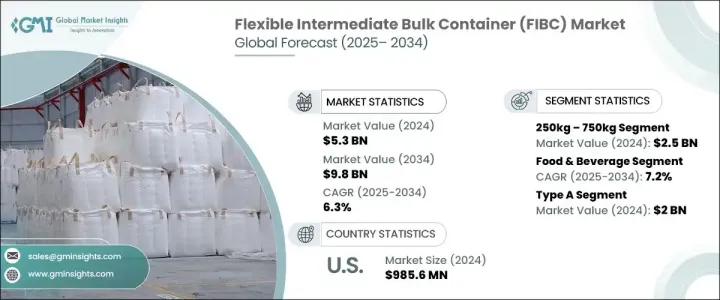

2024 年全球柔性中型散装货柜市场价值为 53 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 6.3%。製药、食品和饮料、化学品、农业和建筑等行业日益增长的需求正在推动这一扩张。这些货柜为散装物料处理提供了经济高效、耐用且轻巧的解决方案,使其成为多个行业的首选。此外,全球贸易的激增、工业化程度的提高以及严格的包装法规也极大地促进了市场的成长。

随着全球企业不断强调效率和永续性,FIBC 因其环保特性、可重复使用性和符合国际包装标准而越来越受到关注。人们对永续散装包装的偏好日益增长,尤其是在已开发地区,这进一步支持了市场扩张。随着线上零售商和物流公司越来越多地采用 FIBC 进行经济高效且安全的散装运输,电子商务的兴起也发挥了关键作用。在製药和食品加工等领域,这些容器可确保无污染的储存和运输,并遵守严格的卫生和安全规定。此外,FIBC 技术的不断创新,包括防潮、防紫外线和防静电袋,使其更能适应多样化的工业需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 53亿美元 |

| 预测值 | 98亿美元 |

| 复合年增长率 | 6.3% |

250 公斤至 750 公斤细分市场在 2024 年创造了 25 亿美元的收入,主要满足农业、食品加工和建筑等中型产业的需求。这些货柜为处理大量货物提供了一种经济高效的解决方案,同时降低了劳动力成本并提高了营运效率。各行各业对卫生和无污染包装的需求日益增长,尤其是食品、化学品和药品行业,这些行业对安全和法规遵循至关重要。这些行业越来越多地采用先进的散装包装解决方案,预计将在未来十年维持该行业的上升趋势。

在主要应用领域中,食品和饮料行业是成长最快的领域,预计从 2025 年到 2034 年的复合年增长率将达到 7.2%。政府对食品卫生包装的监管愈加严格,加上全球谷物、豆类和其他食品贸易的不断增长,推动了这一增长。对可靠、大容量散装包装解决方案的需求导致食品业对 FIBC 的需求增加。此外,FIBC 材料和设计的进步,包括防篡改、防潮和防紫外线选项,正在增强其吸引力,确保长途运输过程中产品的完整性。

受製药、食品和化学工业强劲需求的推动,美国柔性中型散装容器 (FIBC) 市场在 2024 年创造了 9.856 亿美元的收入。更严格的永续法规,加上日益转向具有成本效益和环保的包装解决方案,正在推动市场成长。美国各地的企业都优先考虑高效的物料处理,而 FIBC 成为降低营运成本和提高生产力的首选。食品加工、製药和化学品等行业对永续和卫生包装的高度重视进一步加强了对这些散装容器的需求,为未来几年市场稳步扩张奠定了基础。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 扩大国际贸易

- 可持续且环保的包装

- 蓬勃发展的电子商务产业

- 成本效益和营运效率

- 食品和製药业的成长

- 产业陷阱与挑战

- 供应链中断

- 原物料价格波动

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- A型(非导电、非静电)

- B 型(非导电、有限静电)

- C 型(导电 FIBC,接地)

- D型(静电耗散,无接地)

第六章:市场估计与预测:按产能,2021 - 2034 年

- 主要趋势

- 最多 250 公斤

- 250公斤 – 750公斤

- 750公斤以上

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 食品和饮料

- 化学品

- 製药

- 矿业

- 建造

- 其他的

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Bag Corp

- Berry Global Group, Inc.

- Bulk Container Europe BV

- Bulk Lift International

- CL Smith

- FlexiblePackagingSolutions.com

- Global-Pak

- Halsted

- Intertape Polymer Group

- Isbir Sentetik

- Jumbo Bag Limited

- Langston Companies Inc.

- LC Packaging International BV

- Masterpack Group

- Palmetto Industries International Inc.

- Rishi FIBC Solutions

- Taihua Group

The Global Flexible Intermediate Bulk Container Market was valued at USD 5.3 billion in 2024 and is projected to grow at a CAGR of 6.3% between 2025 and 2034. The increasing demand from industries such as pharmaceuticals, food and beverage, chemicals, agriculture, and construction is fueling this expansion. These containers offer cost-effective, durable, and lightweight solutions for bulk material handling, making them a preferred choice across multiple sectors. Additionally, the surge in global trade, rising industrialization, and stringent packaging regulations have significantly contributed to the market's growth.

As businesses worldwide continue to emphasize efficiency and sustainability, FIBCs are gaining traction due to their eco-friendly properties, reusability, and compliance with international packaging standards. The growing preference for sustainable bulk packaging, particularly in developed regions, is further supporting market expansion. The rise of e-commerce has also played a pivotal role as online retailers and logistics companies increasingly adopt FIBCs for cost-effective and secure bulk transportation. In sectors such as pharmaceuticals and food processing, these containers ensure contamination-free storage and transit, adhering to strict hygiene and safety regulations. Moreover, continuous innovations in FIBC technology, including moisture-resistant, UV-protected, and anti-static bags, are making them more adaptable to diverse industrial needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.3 Billion |

| Forecast Value | $9.8 Billion |

| CAGR | 6.3% |

The 250kg-750kg segment generated USD 2.5 billion in 2024, primarily catering to medium-sized industries such as agriculture, food processing, and construction. These containers provide a cost-efficient solution for handling large volumes of goods while reducing labor costs and improving operational efficiency. The demand for hygienic and contamination-free packaging is growing across various industries, particularly in food, chemicals, and pharmaceuticals, where safety and regulatory compliance are paramount. The increasing adoption of advanced bulk packaging solutions in these sectors is expected to sustain the segment's upward trajectory over the coming decade.

Among the key application areas, the food and beverage industry stands out as the fastest-growing segment, anticipated to expand at a CAGR of 7.2% from 2025 to 2034. Stricter government regulations regarding hygienic food packaging, coupled with the rising global trade of grains, pulses, and other food commodities, are driving this growth. The need for reliable and large-capacity bulk packaging solutions has led to an increased demand for FIBCs in the food sector. Furthermore, advancements in FIBC materials and designs, including tamper-proof, moisture-resistant, and UV-shielded options, are enhancing their appeal, ensuring product integrity during long-distance transportation.

The United States Flexible Intermediate Bulk Container (FIBC) Market generated USD 985.6 million in 2024, driven by robust demand from the pharmaceutical, food, and chemical industries. Stricter sustainability regulations, coupled with an increasing shift toward cost-effective and environmentally friendly packaging solutions, are propelling market growth. Businesses across the U.S. are prioritizing efficient material handling, with FIBCs emerging as a preferred choice for reducing operational costs and improving productivity. The heightened focus on sustainable and hygienic packaging in industries such as food processing, pharmaceuticals, and chemicals has further strengthened the demand for these bulk containers, positioning the market for steady expansion in the years ahead.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of international trade

- 3.2.1.2 Sustainable and eco-friendly packaging

- 3.2.1.3 Booming e-commerce industry

- 3.2.1.4 Cost effectiveness and operational efficiency

- 3.2.1.5 Growth in food and pharmaceutical industries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain disruption

- 3.2.2.2 Fluctuating price of raw materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion & Units)

- 5.1 Key trends

- 5.2 Type A (Non-conductive, Non-static)

- 5.3 Type B (Non-conductive, Limited-static)

- 5.4 Type C (Conductive FIBCs, Grounded)

- 5.5 Type D (Static dissipative, No Grounding)

Chapter 6 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Billion & Units)

- 6.1 Key trends

- 6.2 Upto 250 kg

- 6.3 250kg – 750 kg

- 6.4 Above 750 kg

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion & Units)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.3 Chemicals

- 7.4 Pharmaceuticals

- 7.5 Mining

- 7.6 Construction

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion & Units)

- 9.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Bag Corp

- 9.2 Berry Global Group, Inc.

- 9.3 Bulk Container Europe BV

- 9.4 Bulk Lift International

- 9.5 C.L. Smith

- 9.6 FlexiblePackagingSolutions.com

- 9.7 Global-Pak

- 9.8 Halsted

- 9.9 Intertape Polymer Group

- 9.10 Isbir Sentetik

- 9.11 Jumbo Bag Limited

- 9.12 Langston Companies Inc.

- 9.13 LC Packaging International BV

- 9.14 Masterpack Group

- 9.15 Palmetto Industries International Inc.

- 9.16 Rishi FIBC Solutions

- 9.17 Taihua Group